Idaho Power of Attorney by Trustee of Trust, also known as Trustee's Power of Attorney in Idaho, is a legally binding document that allows a trustee of a trust to appoint an agent or attorney-in-fact to act on their behalf in managing and making decisions regarding trust assets and affairs. This power of attorney grants specific powers and authority to the appointed agent, granting them the ability to handle various financial, legal, and administrative matters related to the trust. The Idaho Power of Attorney by Trustee of Trust is an important tool for trustees who may need assistance or may be unable to personally handle the responsibilities of managing a trust due to various reasons such as illness, absence, or lack of expertise in certain areas. It provides a mechanism for the smooth administration of the trust by empowering a trusted individual to act and make decisions on the trustee's behalf. The specific powers granted through the Idaho Power of Attorney by Trustee of Trust may vary depending on the provisions included within the document. However, they typically encompass a broad range of powers, including but not limited to: 1. Managing and investing trust assets: The agent may have the authority to buy, sell, and manage trust assets such as real estate, stocks, bonds, and bank accounts. They may also have the power to make investment decisions and handle financial transactions on behalf of the trustee. 2. Paying bills and debts: The agent can handle the payment of bills, debts, and any other financial obligations related to the trust. This includes making mortgage payments, settling outstanding debts, and handling tax-related matters. 3. Banking and financial management: The appointed agent may have access to the trust's bank accounts, allowing them to deposit, withdraw, and manage funds as necessary. They can also handle financial transactions, establish new accounts, and manage investments. 4. Legal representation: The power of attorney may grant the agent the authority to retain legal counsel and represent the trustee's interests in legal proceedings related to the trust. 5. Acquiring, selling, or leasing property: The agent may be empowered to acquire, sell, lease, or otherwise deal with real estate or other assets held by the trust. By granting an Idaho Power of Attorney by Trustee of Trust, the trustee can have peace of mind knowing that a trusted individual is legally authorized to handle various aspects of the trust administration. This document helps ensure the efficient management and protection of trust assets while allowing the trustee to delegate responsibilities to a capable agent. It is essential to note that each Power of Attorney by Trustee of Trust in Idaho may have specific terms and limitations, and it is crucial to consult with a qualified attorney to ensure that the document is drafted in accordance with the trustee's specific needs and intentions.

Idaho Power Of Attorney

Description

How to fill out Idaho Power Of Attorney By Trustee Of Trust?

Discovering the right lawful papers design can be a struggle. Naturally, there are a lot of templates available online, but how will you obtain the lawful kind you require? Make use of the US Legal Forms web site. The support gives thousands of templates, including the Idaho Power of Attorney by Trustee of Trust, that you can use for enterprise and personal demands. All the kinds are inspected by specialists and meet state and federal needs.

Should you be previously listed, log in to your profile and click the Down load option to find the Idaho Power of Attorney by Trustee of Trust. Use your profile to check from the lawful kinds you may have acquired earlier. Proceed to the My Forms tab of the profile and get yet another backup in the papers you require.

Should you be a brand new end user of US Legal Forms, listed here are basic recommendations for you to follow:

- First, be sure you have selected the correct kind for your personal area/state. You can examine the shape using the Review option and read the shape explanation to make certain this is the right one for you.

- In the event the kind will not meet your needs, take advantage of the Seach field to find the right kind.

- Once you are sure that the shape is acceptable, select the Acquire now option to find the kind.

- Pick the costs program you need and enter in the required information. Create your profile and pay money for the transaction with your PayPal profile or charge card.

- Pick the document file format and download the lawful papers design to your gadget.

- Complete, revise and produce and indicator the acquired Idaho Power of Attorney by Trustee of Trust.

US Legal Forms is definitely the largest collection of lawful kinds in which you can discover various papers templates. Make use of the company to download skillfully-produced documents that follow condition needs.

Form popularity

FAQ

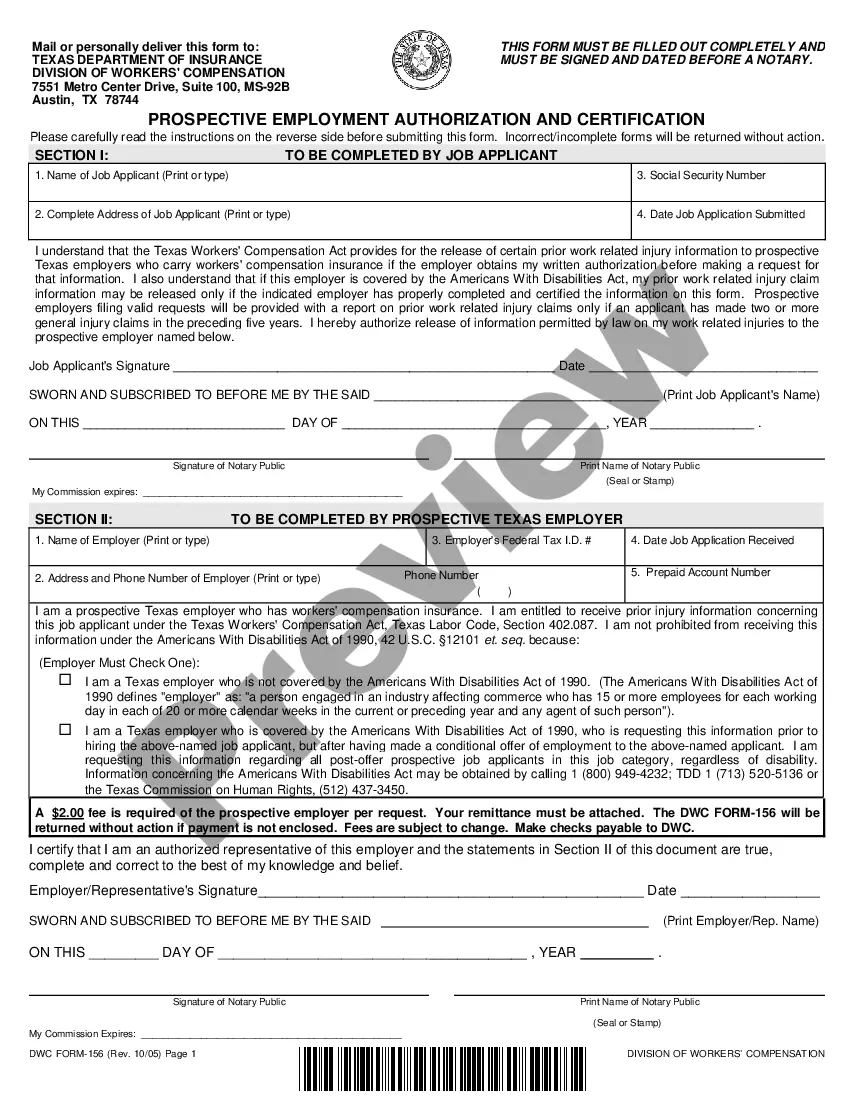

In Idaho, a durable power of attorney may not necessarily need to be signed in front of a notary public when executed by the principal. A power of attorney does not need to be recorded unless it is being used in connection with a real estate transaction.

If a person wants to authorise someone to act as a power of attorney on his behalf, it must be signed and notarised by a certified notary advocate, who is able to declare that you are competent at the time of signing the document to issue the said power of attorney.

Here are the basic steps to help a parent or loved one make their power of attorney, and name you as their agent:Help the grantor decide which type of POA to create.Decide on a durable or non-durable POA.Discuss what authority the grantor wants to give the agent.Get the correct power of attorney form.More items...?

Steps for Making a Financial Power of Attorney in IdahoCreate the POA Using a Statutory Form, Software, or Attorney.Sign the POA in the Presence of a Notary Public.Store the Original POA in a Safe Place.Give a Copy to Your Agent or Attorney-in-Fact.File a Copy With the Recorder's Office.More items...

Can a Trustee appoint a Power of Attorney? Generally speaking, a Trustee (who is not also the Grantor) cannot appoint a Power of Attorney to take over the Trustee's duties or responsibilities, unless this is something that is directly permitted by the Trust Deed or a court order.

Name documents:biometric residence card. national identity card. travel document. birth or adoption certificate or certificate of registry of birth.

The agent's authority will continue until your death unless you revoke the power of attorney or the agent resigns. Your agent is entitled to reasonable compensation unless you state otherwise in the Special Instructions. This form provides for designation of one (1) agent.

In Idaho, a durable power of attorney may not necessarily need to be signed in front of a notary public when executed by the principal. A power of attorney does not need to be recorded unless it is being used in connection with a real estate transaction.

In Idaho, a durable power of attorney may not necessarily need to be signed in front of a notary public when executed by the principal. A power of attorney does not need to be recorded unless it is being used in connection with a real estate transaction.