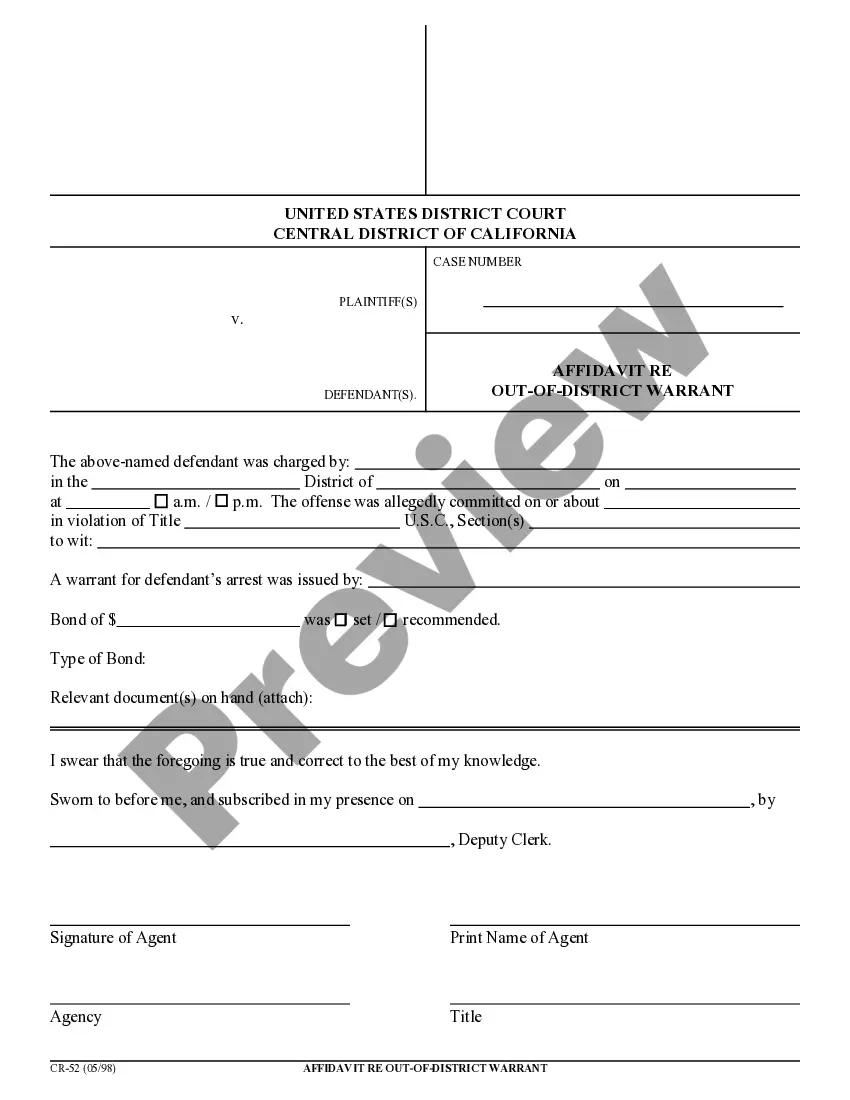

The Idaho Voluntary Petition — Form 1 is a legal document used in the state of Idaho for individuals or businesses seeking bankruptcy protection through Chapter 7 bankruptcy. This petition initiates the bankruptcy process and provides the necessary information to the court about the debtor's financial situation. The Idaho Voluntary Petition — Form 1 is divided into different sections, each requiring specific information to be filled out accurately. Some important keywords to be aware of when describing this form include Idaho, voluntary petition, bankruptcy, Chapter 7, legal document, financial situation, debtor, and court. The form begins with general information about the debtor, including their name, address, contact details, and identification information. It also requires detailed information about the debtor's employment, income, and monthly expenses. This section is crucial for the court to evaluate the debtor's financial situation and determine their eligibility for Chapter 7 bankruptcy. The Idaho Voluntary Petition — Form 1 also asks for details about the debtor's assets, liabilities, and any pending lawsuits or claims against them. This section helps the court understand the debtor's overall financial picture and the extent of their debts. Additionally, the form includes a statement of the debtor's financial affairs, where they must disclose their recent financial history, including any transfers of property, repaying of debts, or significant financial transactions made within a specified period of time. This statement is essential to ensure transparency in the bankruptcy process and prevent any fraudulent activities. It is important to note that there are no different types of Idaho Voluntary Petition — Form 1. However, there are additional schedules and forms that need to be submitted alongside this petition, such as Schedule A (Real Property), Schedule B (Personal Property), Schedule C (Exempt Property), and Schedule D (Creditors Holding Secured Claims). These schedules provide more specific information about the debtor's assets, exemptions, and creditors. Overall, the Idaho Voluntary Petition — Form 1 serves as a comprehensive document that captures vital financial information about the debtor seeking Chapter 7 bankruptcy in Idaho. It enables the court to assess the debtor's eligibility, understand their financial situation, and facilitate the bankruptcy process in a fair and transparent manner.

Idaho Voluntary Petition - Form 1

Description

How to fill out Idaho Voluntary Petition - Form 1?

Are you currently in the position where you require paperwork for either organization or person purposes nearly every day time? There are plenty of authorized document themes available on the Internet, but discovering kinds you can rely is not effortless. US Legal Forms offers a large number of kind themes, like the Idaho Voluntary Petition - Form 1, which can be published in order to meet state and federal demands.

Should you be already acquainted with US Legal Forms site and also have an account, merely log in. Afterward, it is possible to acquire the Idaho Voluntary Petition - Form 1 design.

Should you not offer an bank account and wish to start using US Legal Forms, adopt these measures:

- Obtain the kind you will need and ensure it is for your right metropolis/region.

- Make use of the Preview option to review the form.

- Browse the outline to ensure that you have chosen the right kind.

- If the kind is not what you are looking for, take advantage of the Research area to obtain the kind that suits you and demands.

- Whenever you discover the right kind, simply click Buy now.

- Select the rates prepare you desire, fill in the desired information and facts to produce your account, and purchase the order making use of your PayPal or charge card.

- Select a convenient data file structure and acquire your duplicate.

Locate each of the document themes you might have bought in the My Forms food list. You can aquire a extra duplicate of Idaho Voluntary Petition - Form 1 whenever, if possible. Just go through the needed kind to acquire or print out the document design.

Use US Legal Forms, by far the most substantial collection of authorized kinds, in order to save time as well as avoid faults. The support offers appropriately manufactured authorized document themes that you can use for an array of purposes. Create an account on US Legal Forms and begin creating your lifestyle a little easier.

Form popularity

FAQ

A voluntary bankruptcy is the most common type of bankruptcy proceeding. It is initiated by a debtor who wishes to seek relief from their debt burden. Involuntary bankruptcies are very rare. They are initiated by creditors who want to receive payment for what they are owed from a debtor.

A bankruptcy petition filed by creditors, usually to force a debtor to enter a liquidation proceeding under Chapter 7. The debtor can contest the petition and can choose to convert it into a case under Chapter 11.

Key Takeaways Voluntary bankruptcy is a bankruptcy proceeding that a debtor initiates because they cannot satisfy the debt. This type of bankruptcy is different than an involuntary bankruptcy, which is a process originating from creditors.

Voluntary bankruptcy is a bankruptcy proceeding commenced by the debtor; bankruptcy instituted by an adjudication upon a debtor's petition. Involuntary bankruptcy, on the other hand, is a bankruptcy case initiated by a debtor's creditors.

A petition may be a voluntary petition, which is filed by the debtor, or it may be an involuntary petition, which is filed by creditors that meet certain requirements.