Idaho Property Claimed as Exempt - Schedule C - Form 6C - Post 2005

Description

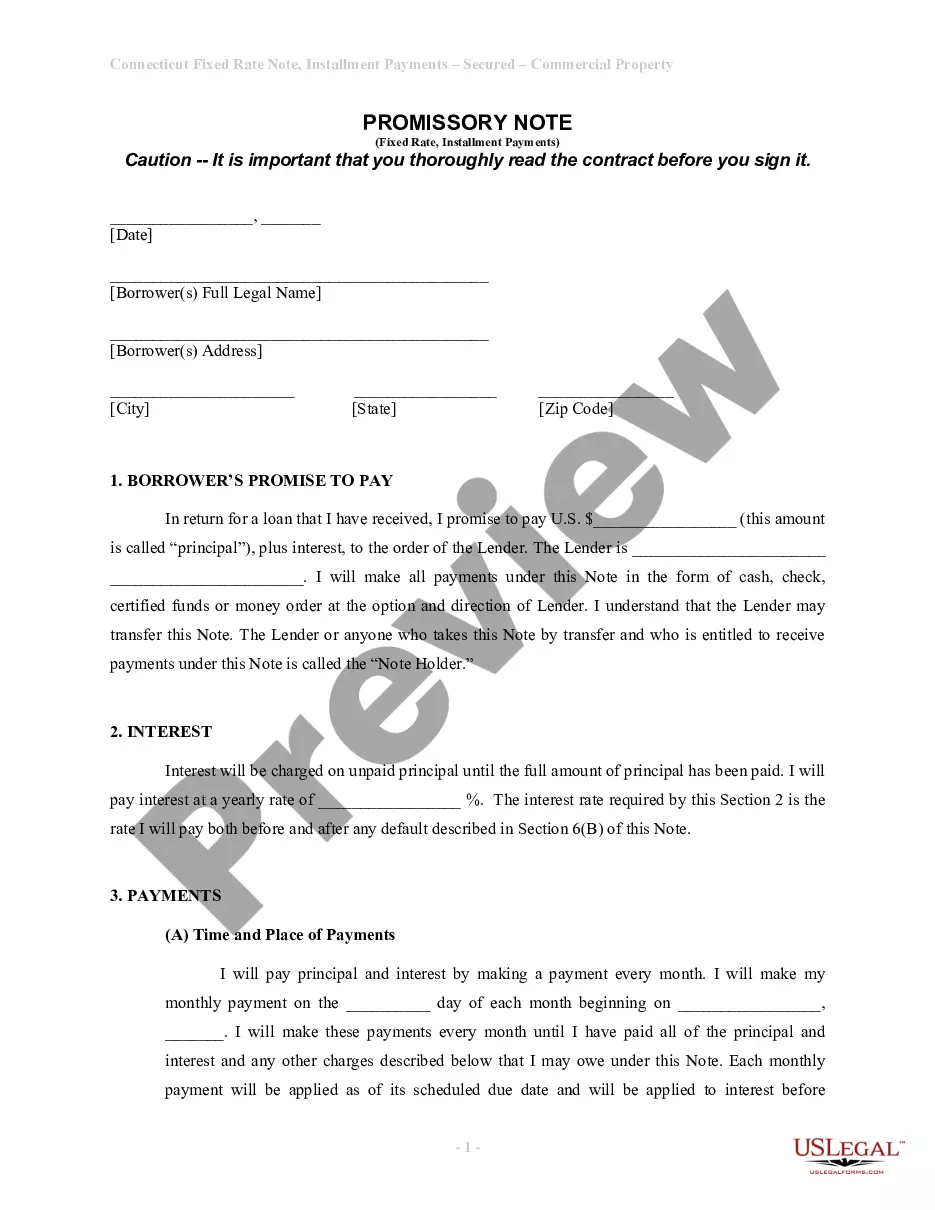

How to fill out Property Claimed As Exempt - Schedule C - Form 6C - Post 2005?

You are able to commit several hours on the web looking for the legitimate document template that meets the state and federal needs you want. US Legal Forms gives a large number of legitimate types which are evaluated by specialists. It is simple to download or print out the Idaho Property Claimed as Exempt - Schedule C - Form 6C - Post 2005 from your assistance.

If you already have a US Legal Forms account, it is possible to log in and click on the Acquire key. Afterward, it is possible to full, change, print out, or indication the Idaho Property Claimed as Exempt - Schedule C - Form 6C - Post 2005. Every legitimate document template you buy is your own for a long time. To get yet another duplicate of the obtained form, check out the My Forms tab and click on the corresponding key.

If you are using the US Legal Forms web site the very first time, follow the straightforward directions under:

- Initial, make sure that you have selected the correct document template for your state/area of your choosing. See the form explanation to ensure you have chosen the correct form. If readily available, take advantage of the Review key to check throughout the document template too.

- In order to locate yet another variation from the form, take advantage of the Lookup area to discover the template that meets your requirements and needs.

- Upon having located the template you desire, just click Buy now to continue.

- Pick the rates program you desire, type your qualifications, and register for a free account on US Legal Forms.

- Total the transaction. You can utilize your credit card or PayPal account to purchase the legitimate form.

- Pick the structure from the document and download it to the product.

- Make alterations to the document if necessary. You are able to full, change and indication and print out Idaho Property Claimed as Exempt - Schedule C - Form 6C - Post 2005.

Acquire and print out a large number of document templates utilizing the US Legal Forms site, which offers the largest variety of legitimate types. Use specialist and condition-specific templates to deal with your business or personal demands.

Form popularity

FAQ

If your total monthly income over the course of the next 60 months is less than $7,475 then you pass the means test and you may file a Chapter 7 bankruptcy. If it is over $12,475 then you fail the means test and don't have the option of filing Chapter 7.

(Official Form 106C) lists the property that you believe you are entitled to keep. If you do not claim the property on this form, it will not be exempted, despite your rights under the law. Before filling out this form, you have to decide whether you will use your state exemptions or the federal exemptions. Understanding Bankruptcy Forms: The Schedules A, B, and C bayarea-bankruptcy-lawyers.com ? understanding... bayarea-bankruptcy-lawyers.com ? understanding...

Chapter 7 bankruptcy is a type of bankruptcy filing commonly referred to as liquidation because it involves selling the debtor's assets in bankruptcy. Assets, like real estate, vehicles, and business-related property, are included in a Chapter 7 filing.

Rights to exempt property have priority over all claims against the estate. These rights are in addition to any benefit or share passing to the surviving spouse or children by the will of the decedent, unless otherwise provided in the will, or by intestate succession, or by way of elective share.

Search Idaho Statutes 55-1003. Homestead exemption limited. A homestead may consist of lands, as described in section 55-1001, Idaho Code, regardless of area, but the homestead exemption amount shall not exceed the sum of one hundred seventy-five thousand dollars ($175,000).

Personal property: up to $7,500 of household appliances and up to $750 per item. Motor vehicles: up to $7,000. Wildcard: up to $800 of any property you own. Chapter 7 Exemptions in Idaho - Avery Law averybankruptcylaw.com ? bankruptcy ? ch... averybankruptcylaw.com ? bankruptcy ? ch...