Idaho Employee Stock Option Plan of Vivigen, Inc.

Description

How to fill out Employee Stock Option Plan Of Vivigen, Inc.?

Choosing the right lawful document format can be quite a battle. Obviously, there are a variety of web templates available online, but how can you discover the lawful type you want? Utilize the US Legal Forms web site. The support delivers a large number of web templates, including the Idaho Employee Stock Option Plan of Vivigen, Inc., which can be used for company and private needs. Every one of the types are inspected by experts and meet state and federal demands.

When you are already signed up, log in in your profile and click on the Download key to obtain the Idaho Employee Stock Option Plan of Vivigen, Inc.. Make use of your profile to check with the lawful types you have purchased formerly. Go to the My Forms tab of the profile and obtain an additional duplicate in the document you want.

When you are a new consumer of US Legal Forms, listed here are simple directions for you to comply with:

- Initial, make certain you have selected the proper type for your personal city/region. You are able to look through the form making use of the Review key and read the form outline to ensure this is basically the best for you.

- In case the type fails to meet your preferences, use the Seach field to find the right type.

- When you are certain that the form is proper, click the Purchase now key to obtain the type.

- Opt for the prices prepare you want and enter in the essential information. Create your profile and pay money for the transaction utilizing your PayPal profile or credit card.

- Select the submit formatting and acquire the lawful document format in your system.

- Comprehensive, revise and print out and indication the obtained Idaho Employee Stock Option Plan of Vivigen, Inc..

US Legal Forms is the largest library of lawful types where you can find numerous document web templates. Utilize the company to acquire expertly-made files that comply with condition demands.

Form popularity

FAQ

To offer ESOPs, founders are required to dilute a part of their equity and carve the ESOP pool. From this pool, ESOPs or equity options are granted to employees. If the pool gets exhausted, founders and investors may dilute further equity to replenish the pool in successive fundraising rounds.

An employee stock purchase plan allows you to buy company stock at a bargain price. Discounts usually range from 5% to 15%. For example, if you work and participate in Hilton's ESPP, you can buy Hilton stock at a 15% discount. If Hilton's stock is trading at $130/share, they'll buy it at $110.50/share for you.

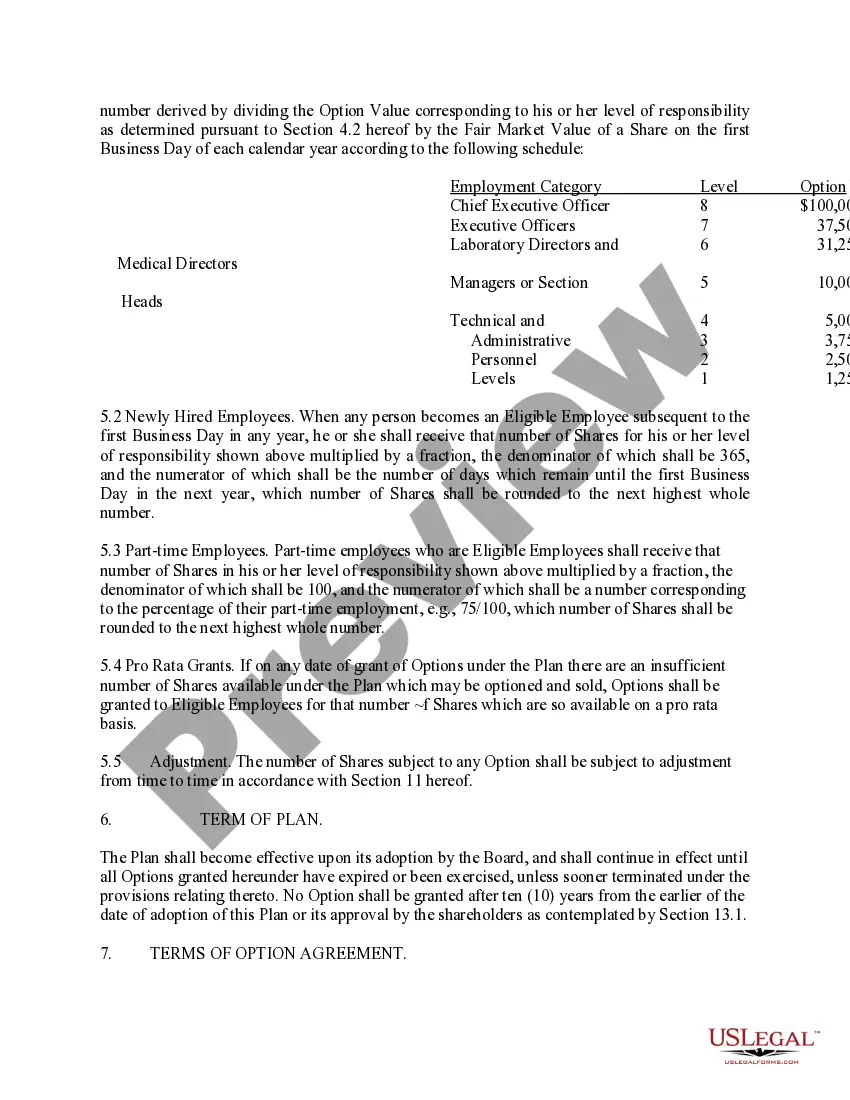

Stock options are a form of equity compensation that allows an employee to buy a specific number of shares at a pre-set price. Many startups, private companies, and corporations will include them as part of a compensation plan for prospective employees.

Employee Stock option plan or Employee Stock Ownership Plan (ESOP) is an employee benefit scheme that enables employees to own shares in the company. These shares are purchased by employees at price below market price, or in other words, a discounted price.

Below are our 10 key steps for creating, building and maintaining an ESPP: Determine the plan's purpose. ... Conduct external and internal research. ... Establish a budget. ... Pick the right components for the company. ... Seek stakeholder buy-in. ... Prepare early for shareholder approval. ... Select a provider. ... Create a robust implementation plan.

Making ESO Offers Declare the type of stock options employees will receive (ISOs or NSOs). Explain the value in terms of the number of shares rather than the percentage of the company. State that the board must approve all stock option grant amounts before the offer letter becomes valid.

With stock-based compensation, employees in an early-stage business are offered stock options in addition to their salaries. The percentage of a company's shares reserved for stock options will typically vary from 5% to 15% and sometimes go up as high as 20%, depending on the development stage of the company.