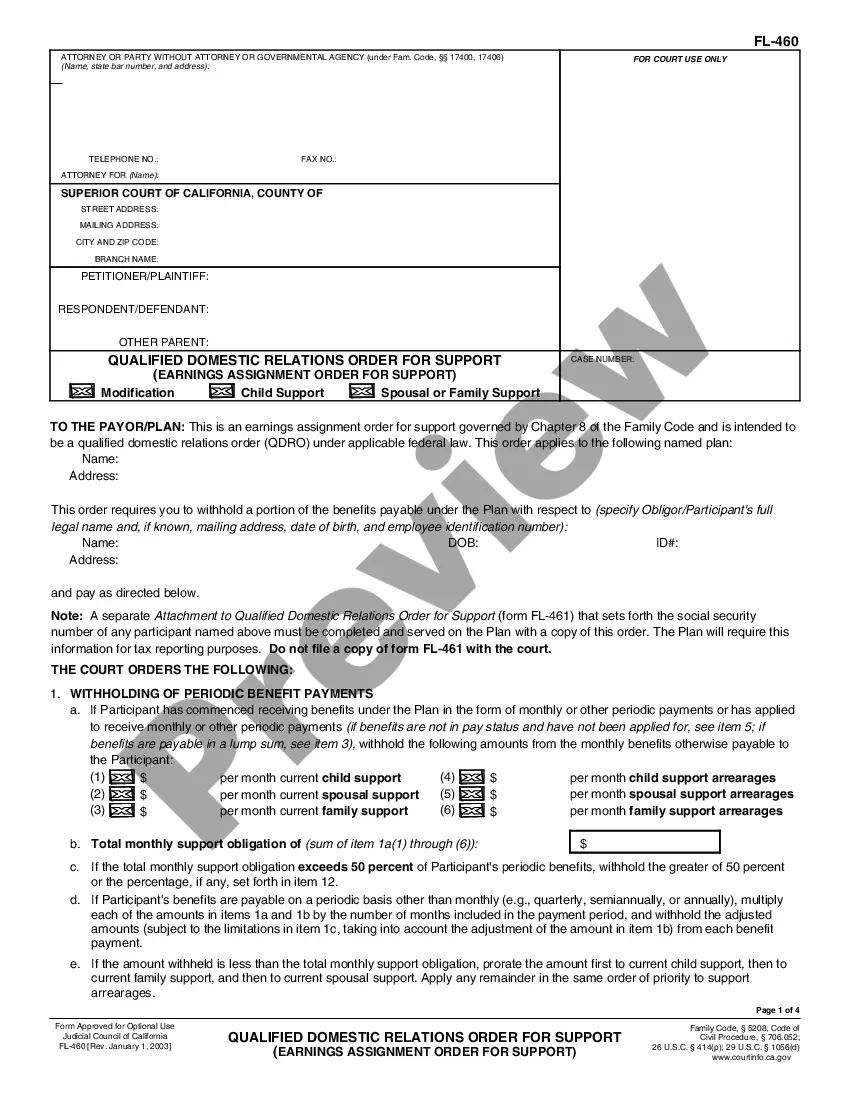

Idaho Stock Option Plan of Hayes Wheels International, Inc., which provides for grant of Incentive Stock Options and Nonqualified Stock Options

Description

How to fill out Stock Option Plan Of Hayes Wheels International, Inc., Which Provides For Grant Of Incentive Stock Options And Nonqualified Stock Options?

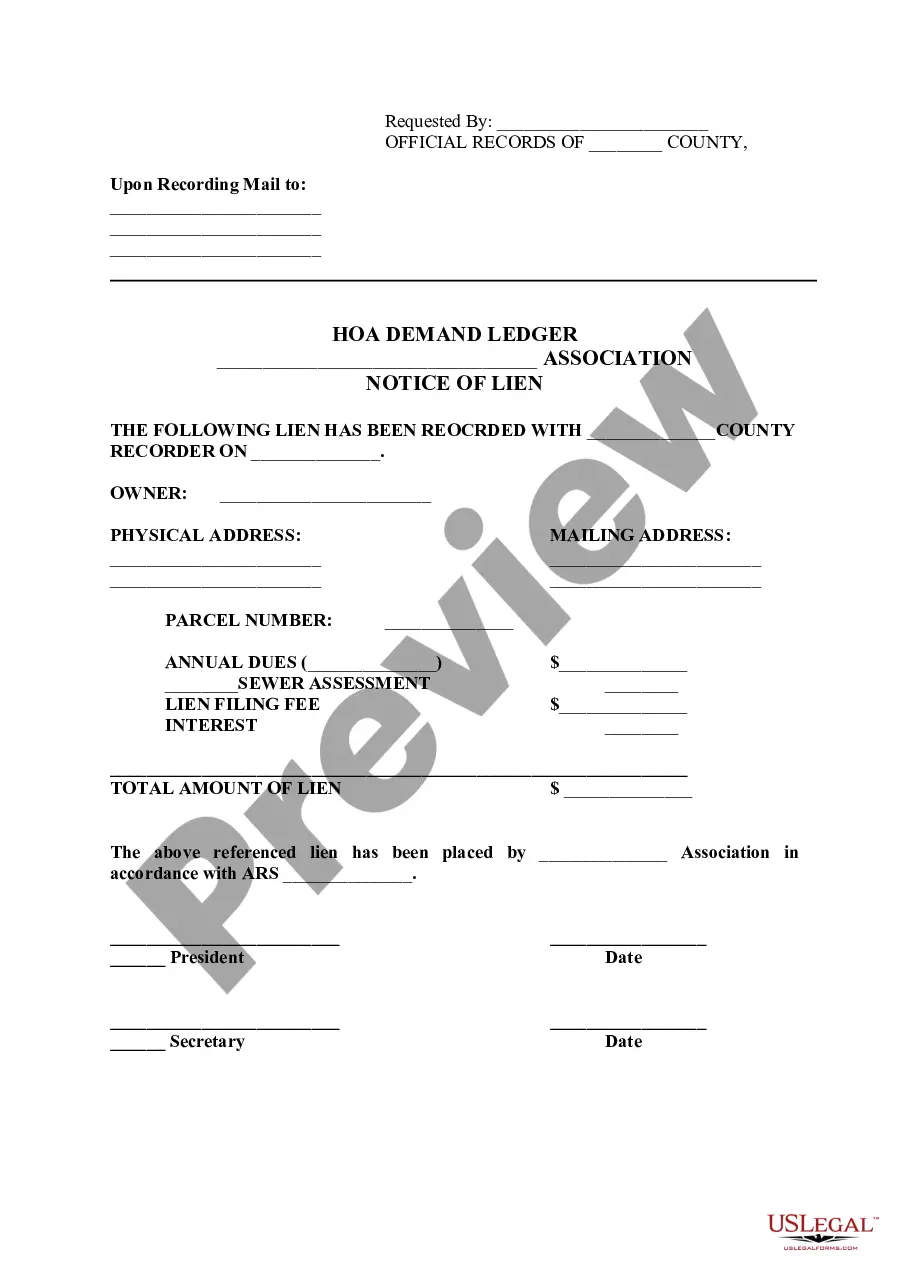

US Legal Forms - among the biggest libraries of legal types in the United States - offers a wide array of legal document templates you may obtain or print out. Utilizing the web site, you can get a large number of types for organization and specific purposes, sorted by types, claims, or keywords.You can get the newest versions of types much like the Idaho Stock Option Plan of Hayes Wheels International, Inc., which provides for grant of Incentive Stock Options and Nonqualified Stock Options within minutes.

If you have a subscription, log in and obtain Idaho Stock Option Plan of Hayes Wheels International, Inc., which provides for grant of Incentive Stock Options and Nonqualified Stock Options through the US Legal Forms collection. The Obtain key will show up on each and every develop you view. You gain access to all earlier acquired types from the My Forms tab of the bank account.

If you wish to use US Legal Forms the very first time, listed here are simple instructions to get you began:

- Ensure you have selected the right develop to your city/area. Go through the Preview key to review the form`s articles. Browse the develop information to actually have selected the proper develop.

- In the event the develop doesn`t match your demands, use the Search field near the top of the screen to find the one who does.

- In case you are happy with the form, affirm your selection by visiting the Purchase now key. Then, opt for the rates plan you like and give your accreditations to sign up on an bank account.

- Method the deal. Utilize your credit card or PayPal bank account to finish the deal.

- Choose the format and obtain the form in your gadget.

- Make changes. Fill out, change and print out and indicator the acquired Idaho Stock Option Plan of Hayes Wheels International, Inc., which provides for grant of Incentive Stock Options and Nonqualified Stock Options.

Each design you included in your account does not have an expiration particular date and is your own eternally. So, if you want to obtain or print out another duplicate, just visit the My Forms segment and then click about the develop you want.

Gain access to the Idaho Stock Option Plan of Hayes Wheels International, Inc., which provides for grant of Incentive Stock Options and Nonqualified Stock Options with US Legal Forms, probably the most substantial collection of legal document templates. Use a large number of skilled and condition-certain templates that fulfill your small business or specific requirements and demands.

Form popularity

FAQ

An incentive stock option (ISO) is a corporate benefit that gives an employee the right to buy shares of company stock at a discounted price with the added benefit of possible tax breaks on the profit. The profit on qualified ISOs is usually taxed at the capital gains rate, not the higher rate for ordinary income.

An option grant is a right to acquire a set number of shares of stock of a company at a set price.

If the stock value increases, you could make significant financial gains?but only if you've exercised (purchased) your options. And you can only do that if you've accepted your grant. The earlier you understand your options and the financial implications of exercising, the sooner you can make smart financial decisions.

Non-qualified stock options are issued at a grant price. The grant price is the price at which you can buy the company stock. Your options come with a vesting schedule. During the time between the grant date of your options and the day they vest, you can't exercise your option.

A stock grant provides the recipient with value?the corporate stock. By contrast, stock options only offer employees the opportunity to purchase something of value. They can acquire the corporate stock at a set price, but the employees receiving stock options still have to pay for those stocks if they want them.

Nonqualified: Employees generally don't owe tax when these options are granted. When exercising, tax is paid on the difference between the exercise price and the stock's market value. They may be transferable. Qualified or Incentive: For employees, these options may qualify for special tax treatment on gains.

Non-qualified Stock Options (NSOs) are stock options that, when exercised, result in ordinary income under US tax laws on the difference, calculated on the exercise date, between the exercise price and the fair market value of the underlying shares.

An incentive stock option (ISO) is a corporate benefit that gives an employee the right to buy shares of company stock at a discounted price with the added benefit of possible tax breaks on the profit. The profit on qualified ISOs is usually taxed at the capital gains rate, not the higher rate for ordinary income.