Idaho Stock Option Agreement of Hayes Wheels International, Inc. - general form

Description

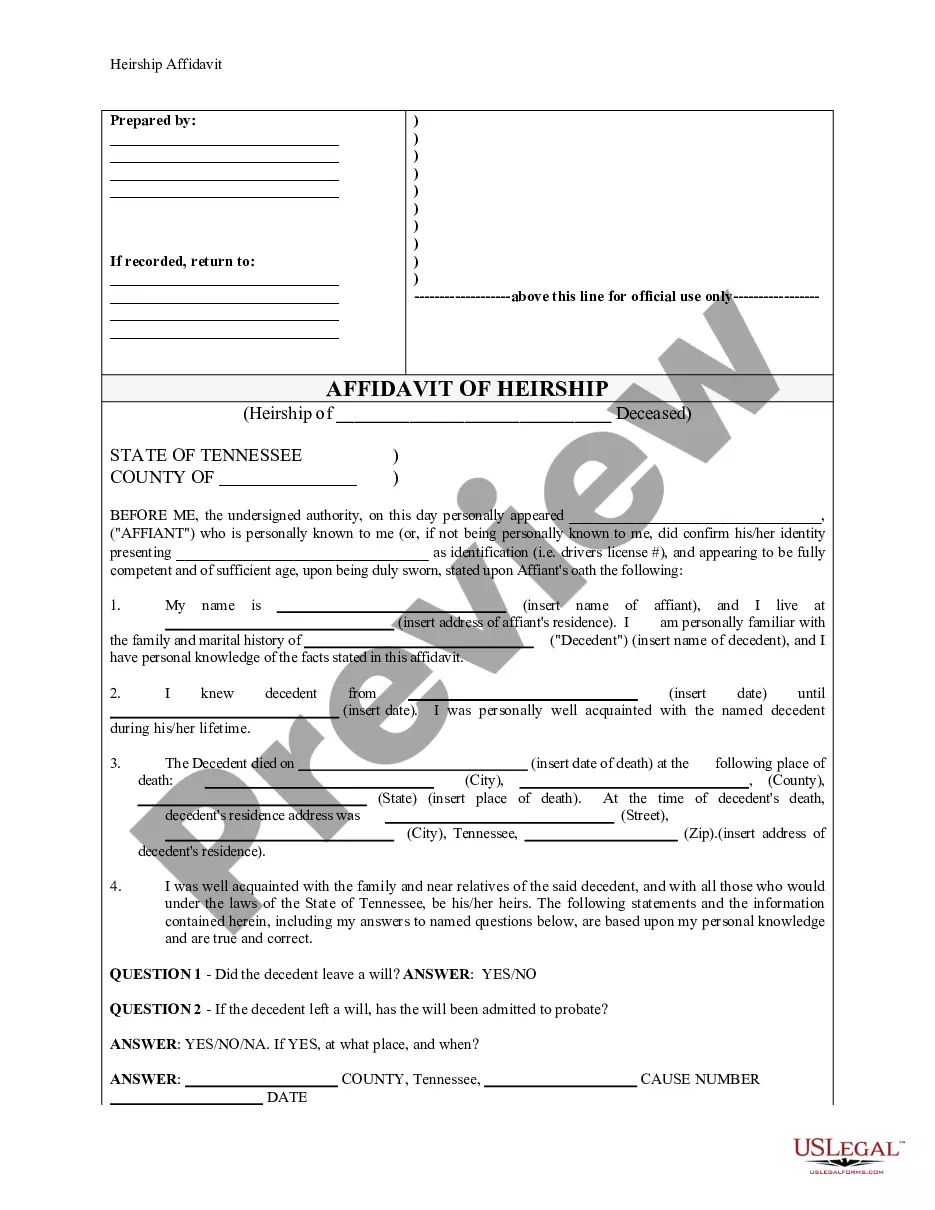

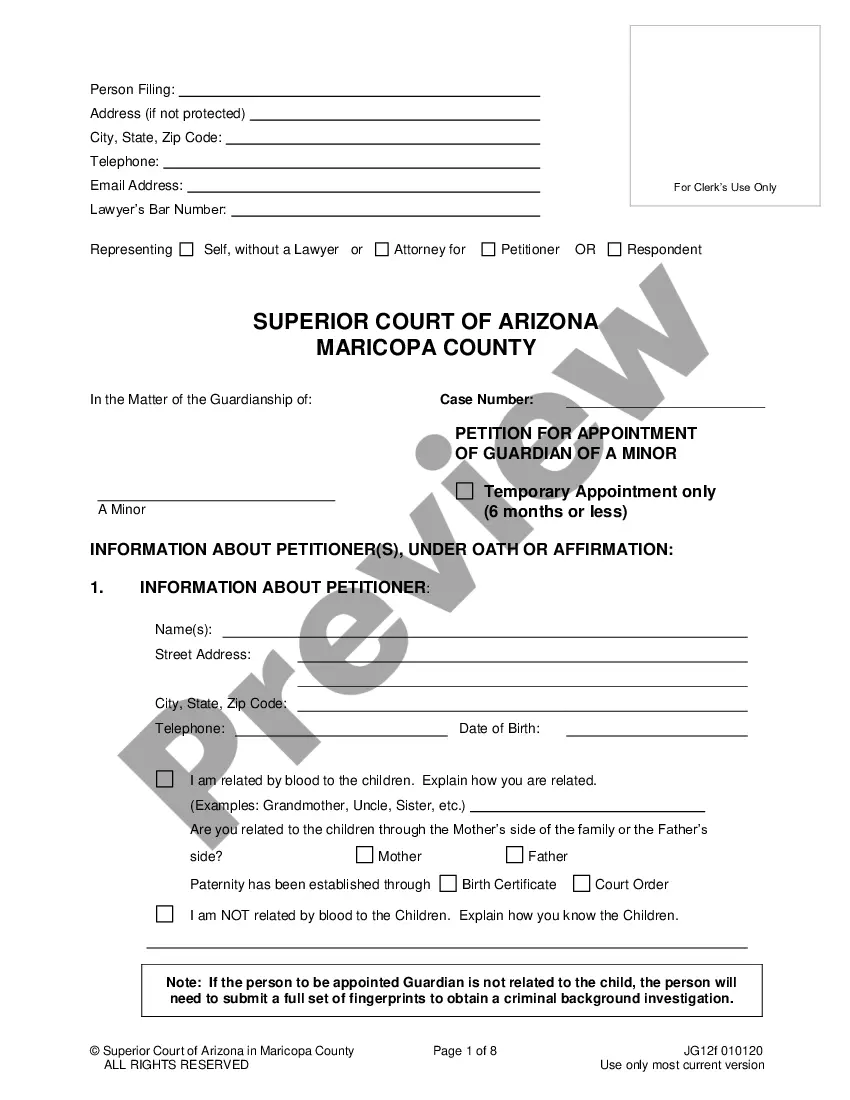

How to fill out Stock Option Agreement Of Hayes Wheels International, Inc. - General Form?

If you want to total, download, or print authorized document layouts, use US Legal Forms, the most important assortment of authorized kinds, that can be found on-line. Take advantage of the site`s easy and hassle-free lookup to get the files you need. Different layouts for company and personal functions are categorized by groups and claims, or search phrases. Use US Legal Forms to get the Idaho Stock Option Agreement of Hayes Wheels International, Inc. - general form in just a couple of clicks.

In case you are currently a US Legal Forms customer, log in for your bank account and click the Down load switch to have the Idaho Stock Option Agreement of Hayes Wheels International, Inc. - general form. You may also entry kinds you in the past delivered electronically inside the My Forms tab of your own bank account.

If you are using US Legal Forms for the first time, refer to the instructions under:

- Step 1. Ensure you have selected the shape to the right town/nation.

- Step 2. Take advantage of the Preview choice to check out the form`s content. Do not overlook to read the outline.

- Step 3. In case you are unhappy with all the type, take advantage of the Search discipline near the top of the screen to discover other variations from the authorized type design.

- Step 4. Once you have discovered the shape you need, click the Buy now switch. Opt for the rates plan you prefer and put your qualifications to register to have an bank account.

- Step 5. Approach the transaction. You may use your charge card or PayPal bank account to complete the transaction.

- Step 6. Find the structure from the authorized type and download it on the device.

- Step 7. Full, modify and print or indicator the Idaho Stock Option Agreement of Hayes Wheels International, Inc. - general form.

Every single authorized document design you get is your own property for a long time. You possess acces to each and every type you delivered electronically with your acccount. Go through the My Forms segment and pick a type to print or download again.

Compete and download, and print the Idaho Stock Option Agreement of Hayes Wheels International, Inc. - general form with US Legal Forms. There are many expert and express-particular kinds you can utilize for your personal company or personal requirements.