Idaho Approval of Employee Stock Ownership Plan of Franklin Co.

Description

How to fill out Approval Of Employee Stock Ownership Plan Of Franklin Co.?

If you need to total, obtain, or produce authorized record templates, use US Legal Forms, the largest collection of authorized kinds, that can be found on the web. Make use of the site`s basic and convenient lookup to get the documents you want. Different templates for business and person functions are categorized by categories and states, or keywords and phrases. Use US Legal Forms to get the Idaho Approval of Employee Stock Ownership Plan of Franklin Co. in a number of clicks.

Should you be previously a US Legal Forms customer, log in to your accounts and click the Down load key to find the Idaho Approval of Employee Stock Ownership Plan of Franklin Co.. You can even accessibility kinds you in the past delivered electronically within the My Forms tab of your own accounts.

If you use US Legal Forms the first time, follow the instructions beneath:

- Step 1. Ensure you have selected the form for your correct area/region.

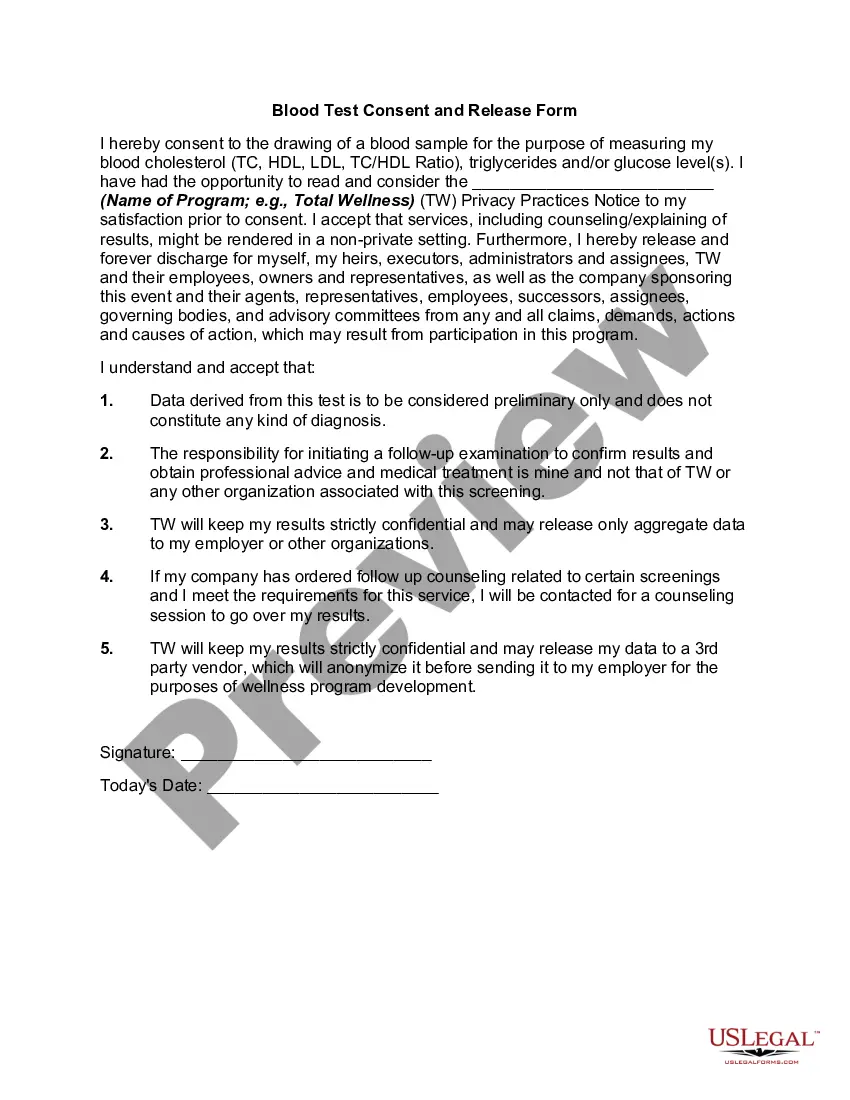

- Step 2. Use the Review solution to look through the form`s content material. Never overlook to read the description.

- Step 3. Should you be not satisfied together with the kind, make use of the Lookup field at the top of the display screen to locate other types in the authorized kind format.

- Step 4. Upon having located the form you want, click on the Get now key. Pick the costs plan you favor and add your qualifications to sign up on an accounts.

- Step 5. Method the transaction. You can utilize your credit card or PayPal accounts to accomplish the transaction.

- Step 6. Find the structure in the authorized kind and obtain it in your device.

- Step 7. Total, modify and produce or sign the Idaho Approval of Employee Stock Ownership Plan of Franklin Co..

Every single authorized record format you get is your own eternally. You might have acces to each kind you delivered electronically in your acccount. Click on the My Forms section and select a kind to produce or obtain yet again.

Remain competitive and obtain, and produce the Idaho Approval of Employee Stock Ownership Plan of Franklin Co. with US Legal Forms. There are many professional and condition-distinct kinds you may use to your business or person demands.

Form popularity

FAQ

Risks associated with Stock Options. Rules of an ESOP can be complicated. It is subject to fluctuations. It may create a succession problem. ESOPs may risk company finance. ESOP may be incompatible with shareholders. Corporate Governance Considerations with Stock Option Scheme. Conclusion.

How Do You Start an ESOP? To set up an ESOP, you'll have to establish a trust to buy your stock. Then, each year you'll make tax-deductible contributions of company shares, cash for the ESOP to buy company shares, or both. The ESOP trust will own the stock and allocate shares to individual employee's accounts.

You'll not only be looking at the prospect of losing your job, but also losing money on the company stock. It's an example of putting too many eggs in one basket. Remember if a company with an ESOP is struggling financially and has to lay off workers, it may have to cash out workers' shares in the ESOP.

These ESOPs are normally created when a retiring owner wants to transfer the ownership to the employees in the company. On the other hand, an ESPP permits employees to use after-tax wages to purchase the stock in their company, normally at a discounted price.

An Employee Stock Ownership Plan (ESOP) is a tax- qualified retirement plan authorized and encouraged by federal tax and pension laws.