Idaho Restricted Stock Plan of Sundstrand Corp.

Description

How to fill out Restricted Stock Plan Of Sundstrand Corp.?

If you need to full, down load, or print out authorized file themes, use US Legal Forms, the biggest selection of authorized varieties, that can be found on the web. Utilize the site`s simple and handy search to obtain the files you will need. Different themes for company and person uses are sorted by groups and claims, or keywords. Use US Legal Forms to obtain the Idaho Restricted Stock Plan of Sundstrand Corp. within a handful of click throughs.

In case you are presently a US Legal Forms client, log in to the bank account and click on the Download button to obtain the Idaho Restricted Stock Plan of Sundstrand Corp.. Also you can entry varieties you earlier acquired from the My Forms tab of your bank account.

If you use US Legal Forms initially, refer to the instructions under:

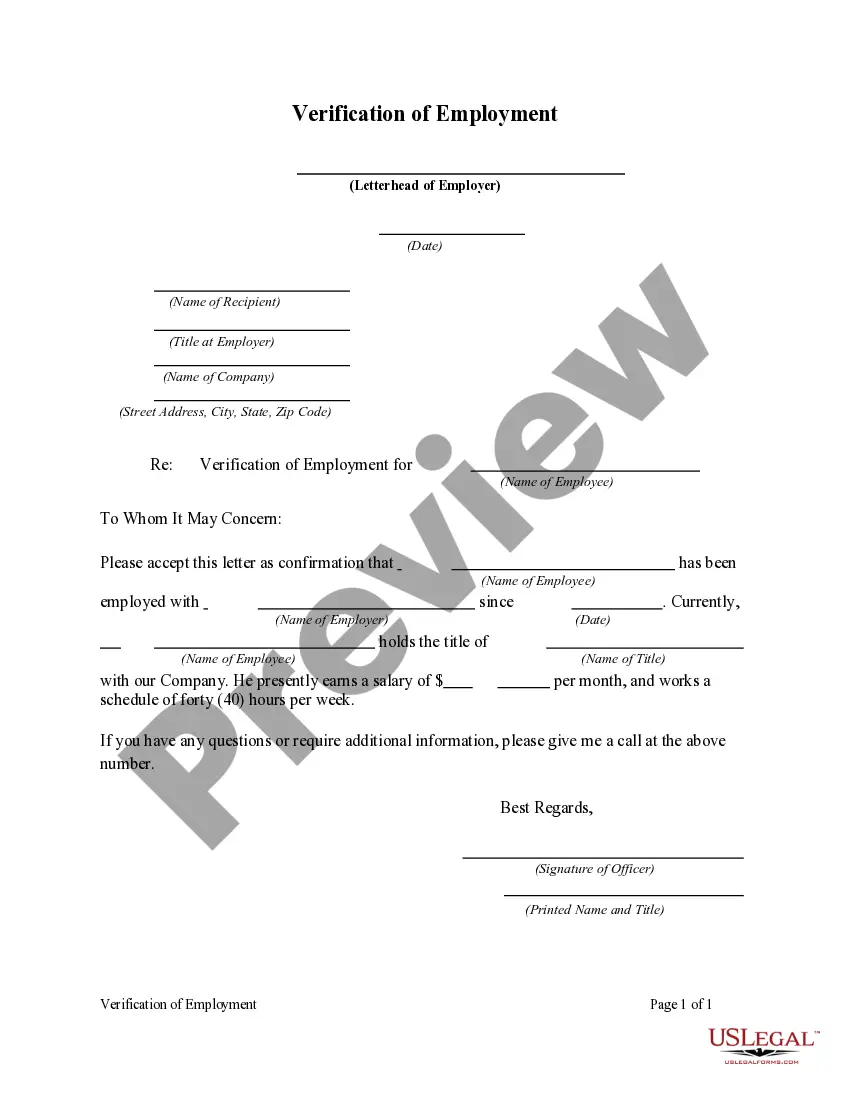

- Step 1. Ensure you have selected the shape for the correct metropolis/region.

- Step 2. Take advantage of the Preview choice to check out the form`s content material. Never forget to read the explanation.

- Step 3. In case you are not satisfied with all the develop, take advantage of the Search industry towards the top of the screen to find other types in the authorized develop design.

- Step 4. After you have identified the shape you will need, select the Acquire now button. Choose the rates prepare you like and include your references to register to have an bank account.

- Step 5. Approach the deal. You can utilize your credit card or PayPal bank account to perform the deal.

- Step 6. Pick the formatting in the authorized develop and down load it on your own device.

- Step 7. Comprehensive, change and print out or indicator the Idaho Restricted Stock Plan of Sundstrand Corp..

Every single authorized file design you buy is the one you have forever. You may have acces to each and every develop you acquired inside your acccount. Go through the My Forms portion and decide on a develop to print out or down load once again.

Be competitive and down load, and print out the Idaho Restricted Stock Plan of Sundstrand Corp. with US Legal Forms. There are millions of skilled and express-certain varieties you can utilize to your company or person needs.

Form popularity

FAQ

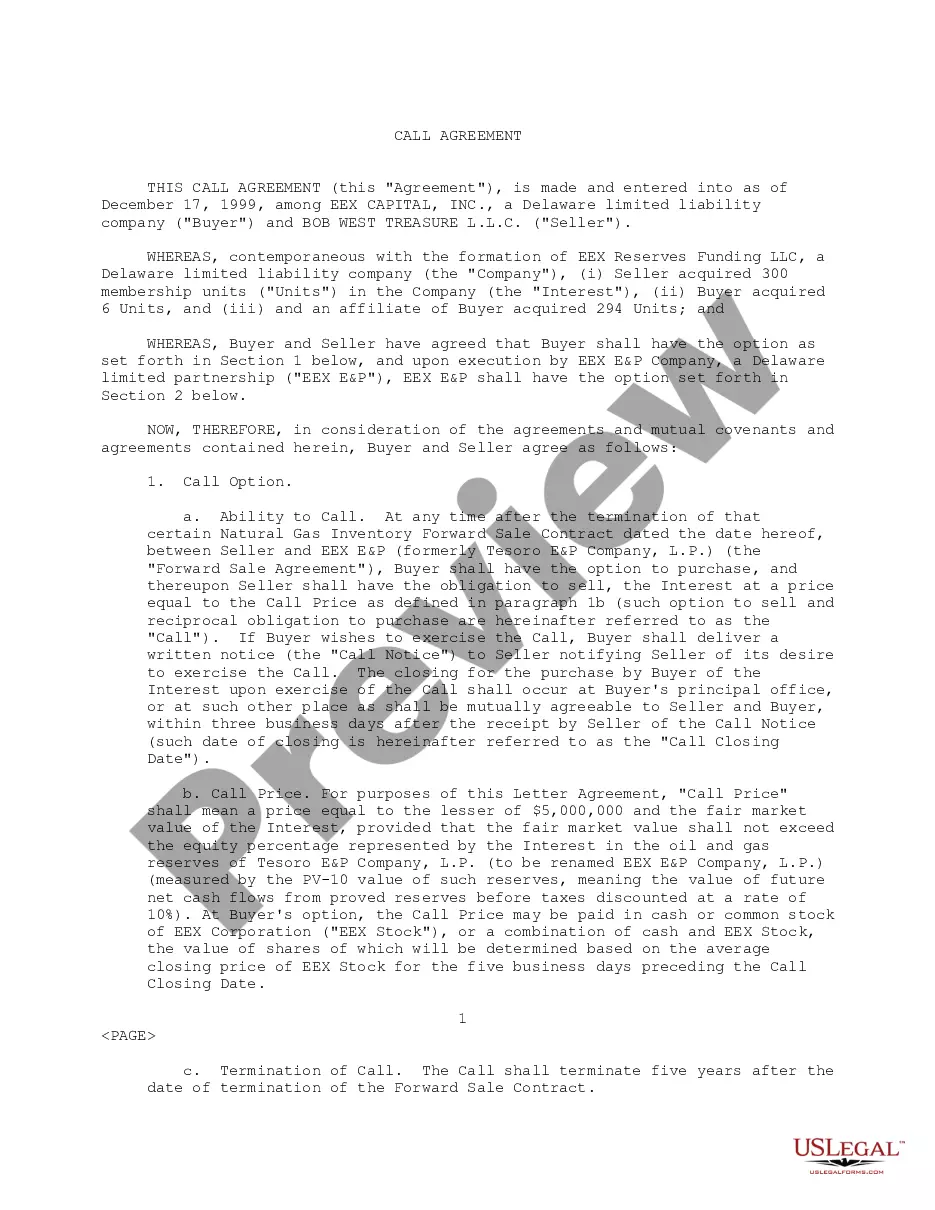

Each RSU will correspond to a certain number and value of employer stock. For example, suppose your RSU agreement states that one RSU corresponds to one share of company stock, which currently trades for $20 per share. If you're offered 100 RSUs, then your units are worth 100 shares of stock with a value of $2,000.

A restricted stock unit (RSU) is an award of stock shares, usually given as a form of employee compensation. The recipient must meet certain conditions before the restricted stock units are transferred to the owner.

RSUs are appealing because if the company performs well and the share price takes off, employees can receive a significant financial benefit. This can motivate employees to take ownership. Since employees need to satisfy vesting requirements, RSUs encourage them to stay for the long term and can improve retention.

A restricted stock unit (RSU) is stock-based compensation issued by an employer. A vesting period exists before the RSU converts to actual common stock. Until then, it has no monetary worth. Once the RSU converts to stock, the stockholder may pay taxes on its value.

At their core, RSUs are retention tools publicly traded companies use to attract and keep their top talent. As an employee, you are awarded a certain number of shares of company stock after meeting specific requirements. Once these conditions are met, your shares become vested, and you are then the owner of them.