Idaho Approval of Executive Director Loan Plan: A Comprehensive Guide The Idaho Approval of Executive Director Loan Plan is a specialized program designed to address the financial needs of executive directors in various industries across the state. This plan aims to provide executives with the necessary funds to enhance their leadership capabilities, facilitate professional growth, and support their strategic initiatives. By offering favorable loan terms and conditions, the program intends to attract and retain top-level executives in Idaho. The Idaho Approval of Executive Director Loan Plan encompasses different types of loans catering to unique requirements and circumstances. These include: 1. Personal Development Loan: This loan type is specifically designed to assist executive directors in pursuing educational programs, certifications, and expert-level training courses. The loan covers tuition fees, study materials, and related expenses, empowering executives to acquire new skills and knowledge essential for personal and professional growth. The loan provides flexibility in terms of repayment schedules and interest rates. 2. Technology Investment Loan: Executives often require access to advanced technology to streamline operations, improve productivity, and stay competitive. The Technology Investment Loan aims to facilitate executive directors in procuring state-of-the-art equipment, software, and digital infrastructure necessary to enhance organizational effectiveness. This loan type is known for its low-interest rates and extended repayment periods. 3. Expansion Capital Loan: As executive directors capitalize on growth opportunities, they may require additional funds to expand their businesses or organizations. The Expansion Capital Loan offers financial support for activities like market expansion, infrastructure development, and talent acquisition. This loan type provides customizable repayment terms, such as grace periods and flexible interest rates, to suit the unique needs of executive directors. 4. Sustainability Loan: Executive directors with a focus on sustainable practices and environmental stewardship can avail themselves of the Sustainability Loan. This loan type supports initiatives like implementing green technologies, reducing carbon footprint, and adopting environmentally friendly practices. The Sustainability Loan offers favorable interest rates and extended repayment periods, encouraging executives to incorporate sustainable strategies into their leadership roles. To obtain approval for the Idaho Approval of Executive Director Loan Plan, executives must meet specific eligibility criteria and successfully fulfill the application process. Eligibility requirements may include demonstrating strong leadership skills, submitting financial statements, providing a comprehensive business plan, and showcasing a proven track record of successful executive-level management. Additionally, executives must present a detailed proposal outlining the purpose of the loan and its expected impact on their professional development or organizational growth. The Idaho Approval of Executive Director Loan Plan aims to foster innovation, growth, and strategic decision-making among executive directors within the state. By offering tailored loan options and facilitating access to much-needed capital, this program aims to elevate the success of both individual executives and the organizations they lead.

Part 3 Of The Irmpa Which Applies To Mortgage Loan Originators Is Also Known As The Idaho

Description

How to fill out Idaho Approval Of Executive Director Loan Plan?

If you wish to full, obtain, or print out authorized document layouts, use US Legal Forms, the most important collection of authorized varieties, that can be found on the web. Take advantage of the site`s basic and practical research to obtain the documents you will need. Various layouts for business and specific reasons are categorized by types and claims, or search phrases. Use US Legal Forms to obtain the Idaho Approval of executive director loan plan with a couple of clicks.

Should you be previously a US Legal Forms client, log in in your profile and then click the Down load button to have the Idaho Approval of executive director loan plan. You can also access varieties you in the past downloaded inside the My Forms tab of your profile.

If you use US Legal Forms the very first time, follow the instructions under:

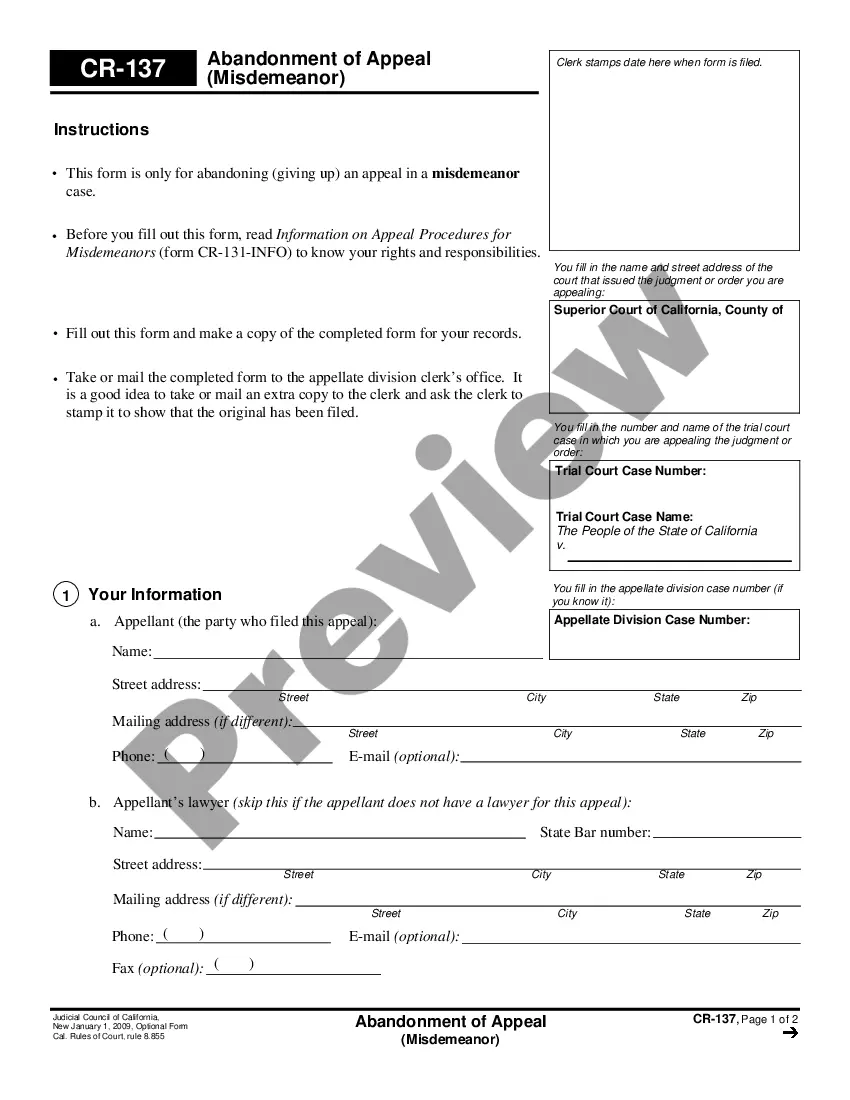

- Step 1. Be sure you have chosen the form for that appropriate metropolis/nation.

- Step 2. Use the Review solution to check out the form`s articles. Do not neglect to see the information.

- Step 3. Should you be not satisfied with the type, utilize the Lookup discipline near the top of the display screen to discover other types of your authorized type format.

- Step 4. Upon having identified the form you will need, go through the Buy now button. Select the prices strategy you prefer and add your references to sign up for an profile.

- Step 5. Process the purchase. You can utilize your Мisa or Ьastercard or PayPal profile to perform the purchase.

- Step 6. Select the formatting of your authorized type and obtain it on the product.

- Step 7. Comprehensive, revise and print out or signal the Idaho Approval of executive director loan plan.

Each and every authorized document format you acquire is the one you have for a long time. You might have acces to every single type you downloaded inside your acccount. Select the My Forms segment and pick a type to print out or obtain yet again.

Remain competitive and obtain, and print out the Idaho Approval of executive director loan plan with US Legal Forms. There are millions of skilled and express-specific varieties you can use to your business or specific demands.