Idaho Private Placement of Common Stock: What You Need to Know Idaho private placement of common stock refers to the process through which a company in Idaho sells its equity shares to a select group of private investors, rather than making them available to the public through a public offering. This kind of offering is commonly pursued by startups, small businesses, or companies looking to raise capital without incurring the expenses and regulations associated with a public offering. Private placement of common stock offers numerous advantages to both companies and investors. For businesses, it provides a flexible and efficient way to raise capital, bypassing the rigorous registration requirements imposed by the Securities and Exchange Commission (SEC) for public offerings. Furthermore, it can often be completed in a shorter timeframe, allowing companies to access funds quickly. On the other hand, private investors gain the opportunity to invest in promising companies at an early stage and potentially reap significant returns if the business succeeds. There are various types of private placements of common stock available in Idaho. Some popular variations include: 1. Regulation D Private Placements: This type of private placement offering is conducted under the SEC's Regulation D exemption, which allows companies to raise capital from an unlimited number of accredited investors and a limited number of non-accredited investors. Regulation D offerings are typically divided into three categories (Rule 504, Rule 505, and Rule 506), each with its own set of requirements relating to the amount of capital raised, the number of investors, and general solicitation rules. 2. Intrastate Private Placements: These offerings are conducted solely within Idaho, allowing businesses to raise capital exclusively from in-state investors without the need for federal registration or compliance with SEC regulations. To qualify, the offering must meet the requirements defined under the Idaho Securities Act, including limitations on the number of non-accredited investors and a genuine connection to the state. 3. Rule 147 Offerings: Also known as the "Intrastate Exemption," Rule 147 permits companies to raise capital from investors residing within Idaho by ensuring that the offering and the company's operations are primarily conducted within the state. Under this exemption, the company must demonstrate that at least 80% of its revenues, assets, and proceeds from the offering will be utilized within Idaho. Overall, private placement of common stock in Idaho offers businesses an efficient and flexible method to raise capital while providing investors with an opportunity to support local companies and potentially earn significant returns on their investments. However, it is vital to consult with legal and financial advisors to ensure compliance with applicable state and federal securities laws, as private placement offerings involve specific regulations and requirements to protect investors and maintain market integrity.

Idaho Private placement of Common Stock

Description

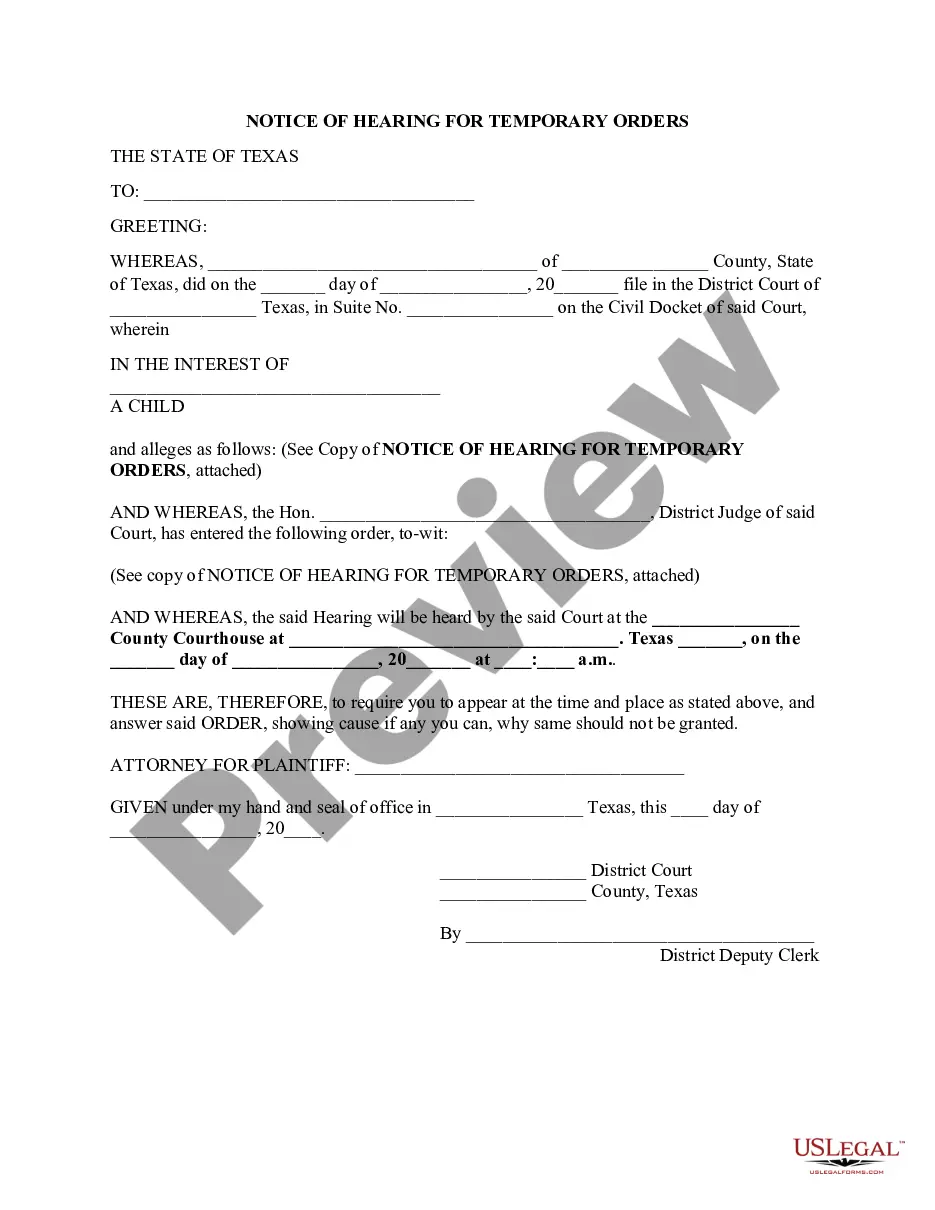

How to fill out Idaho Private Placement Of Common Stock?

Finding the right lawful record template might be a have difficulties. Of course, there are tons of themes available on the Internet, but how would you find the lawful develop you need? Use the US Legal Forms web site. The assistance gives a huge number of themes, for example the Idaho Private placement of Common Stock, which can be used for enterprise and personal requires. Each of the varieties are inspected by professionals and meet federal and state demands.

If you are already listed, log in to your profile and click the Acquire switch to get the Idaho Private placement of Common Stock. Make use of profile to look with the lawful varieties you have purchased formerly. Proceed to the My Forms tab of your own profile and obtain another duplicate from the record you need.

If you are a new end user of US Legal Forms, listed below are straightforward recommendations that you should comply with:

- Initial, be sure you have selected the appropriate develop for your personal metropolis/county. You can look through the form making use of the Review switch and browse the form description to make certain this is the right one for you.

- In the event the develop is not going to meet your expectations, make use of the Seach industry to discover the correct develop.

- Once you are sure that the form is suitable, click on the Get now switch to get the develop.

- Pick the rates program you desire and type in the necessary details. Make your profile and pay money for the transaction making use of your PayPal profile or credit card.

- Choose the file structure and acquire the lawful record template to your system.

- Total, edit and printing and indication the obtained Idaho Private placement of Common Stock.

US Legal Forms will be the greatest catalogue of lawful varieties in which you will find a variety of record themes. Use the service to acquire appropriately-created files that comply with condition demands.