Idaho Form of Revolving Promissory Note

Description

How to fill out Form Of Revolving Promissory Note?

Are you in the placement that you need to have papers for possibly enterprise or person uses almost every time? There are plenty of lawful file layouts accessible on the Internet, but discovering kinds you can depend on is not effortless. US Legal Forms delivers 1000s of develop layouts, much like the Idaho Form of Revolving Promissory Note, which can be composed to satisfy federal and state requirements.

In case you are previously acquainted with US Legal Forms site and have an account, merely log in. Following that, it is possible to obtain the Idaho Form of Revolving Promissory Note web template.

Should you not have an accounts and want to begin using US Legal Forms, abide by these steps:

- Obtain the develop you want and make sure it is to the correct area/area.

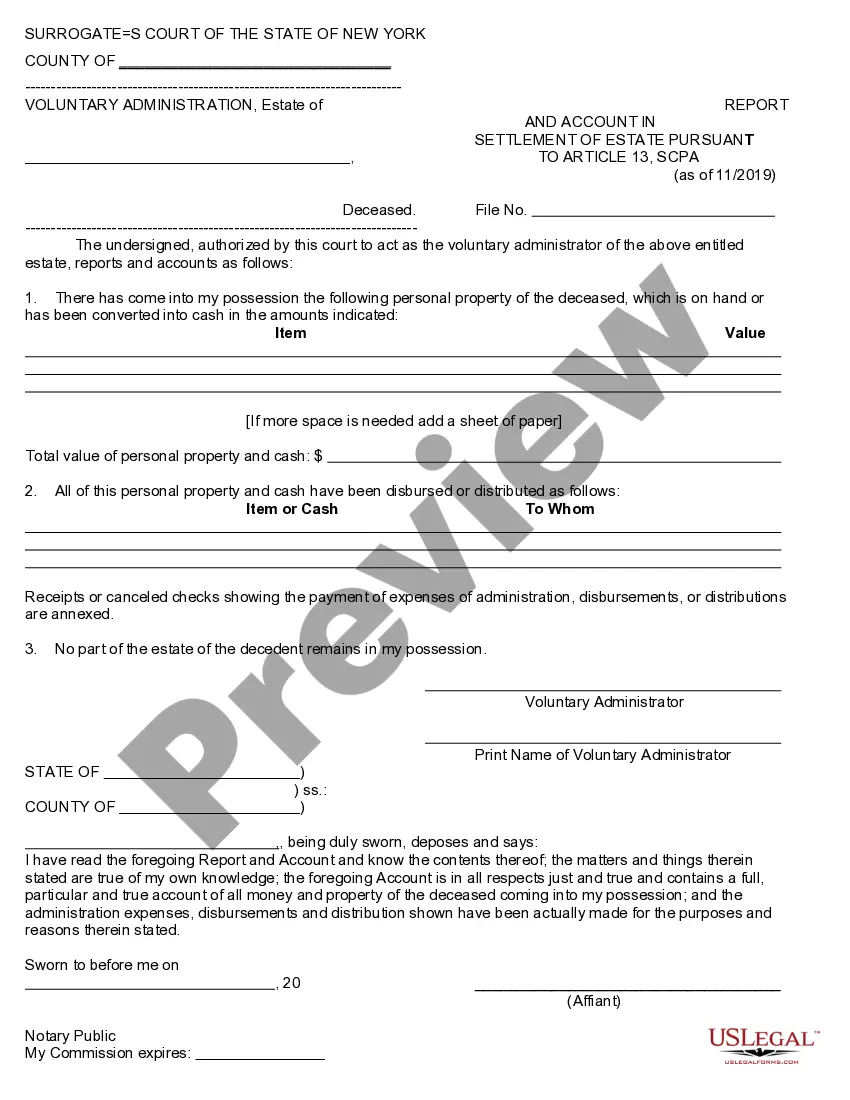

- Take advantage of the Review switch to examine the shape.

- Browse the description to ensure that you have chosen the correct develop.

- In the event the develop is not what you`re looking for, take advantage of the Look for area to find the develop that suits you and requirements.

- If you obtain the correct develop, simply click Acquire now.

- Opt for the costs strategy you would like, complete the necessary information to generate your bank account, and pay money for the transaction with your PayPal or credit card.

- Decide on a convenient paper structure and obtain your version.

Discover every one of the file layouts you may have bought in the My Forms food list. You can get a further version of Idaho Form of Revolving Promissory Note at any time, if needed. Just select the needed develop to obtain or print out the file web template.

Use US Legal Forms, the most substantial selection of lawful types, in order to save some time and steer clear of faults. The services delivers expertly made lawful file layouts which can be used for an array of uses. Generate an account on US Legal Forms and start producing your daily life a little easier.

Form popularity

FAQ

A revolving line of credit promissory note (RLOCPN) is a secured loan that allows businesses to borrow money against an established limit. These loans are generally used to cover short-term liquidity needs, such as working capital or inventory financing.

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

Types of Promissory Notes Simple Promissory Note. ... Student Loan Promissory Note. ... Real Estate Promissory Note. ... Personal Loan Promissory Notes. ... Car Promissory Note. ... Commercial Promissory note. ... Investment Promissory Note. ... Installment Payments.

Credit cards and lines of credit are both examples of revolving credit. Instalment loans are non-revolving, because you must pay off the loan over a specific period with fixed monthly instalments. There's far more flexibility involved with revolving credit in comparison to paying off a non-revolving credit balance.

A revolving promissory note is a form of business financing that allows the company to borrow more money when needed. The process starts with an initial loan and then can be used as collateral for future loans that are paid back over time.

A revolving loan facility, also called a revolving credit facility or simply revolver, is a form of credit issued by a financial institution that provides the borrower with the ability to draw down or withdraw, repay, and withdraw again.

There are three types of promissory notes: unsecured, secured and demand.

Promissory notes are quite simple and can be prepared by anyone. They do not need to be prepared by a lawyer or be notarized. It isn't even particularly significant whether a promissory note is handwritten or typed and printed.