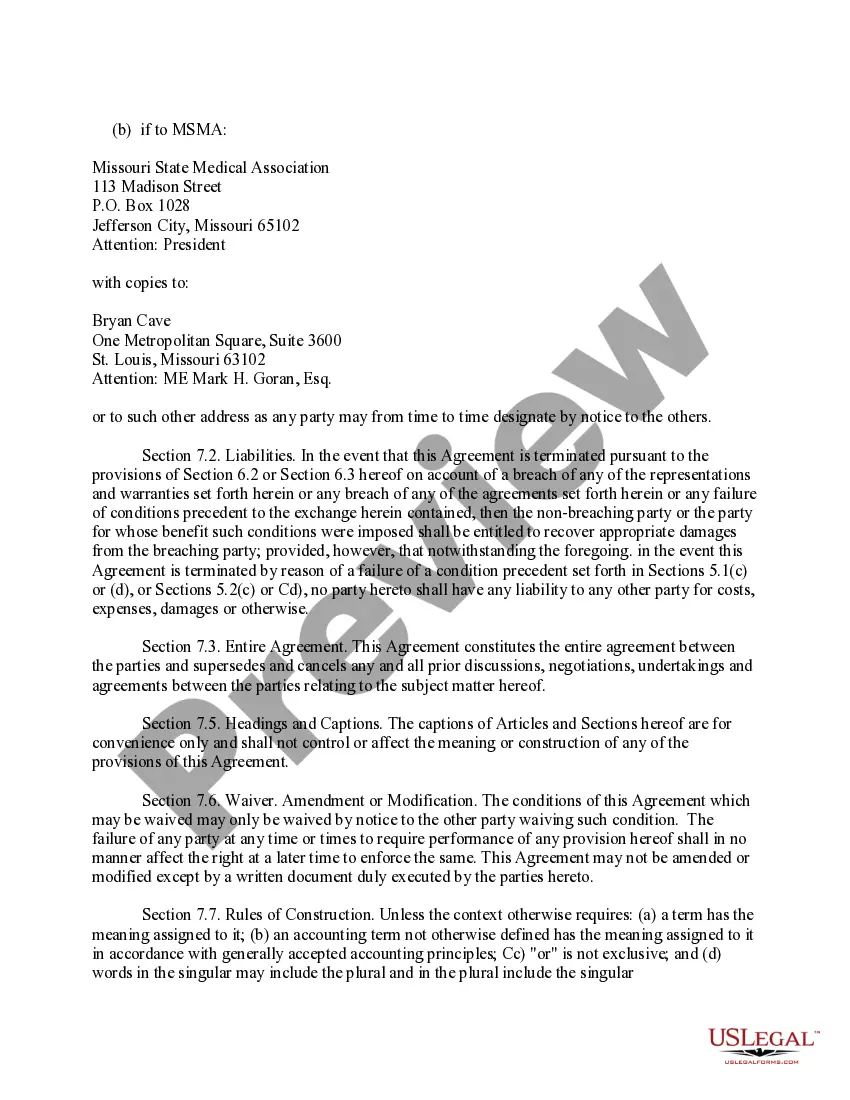

Idaho Share Exchange Agreement with exhibits between Momed Holding Co. and Missouri State Medical Assoc.

Description

How to fill out Share Exchange Agreement With Exhibits Between Momed Holding Co. And Missouri State Medical Assoc.?

US Legal Forms - one of many largest libraries of legitimate kinds in the United States - provides an array of legitimate papers web templates you can acquire or print. Using the site, you will get a large number of kinds for business and individual uses, categorized by classes, suggests, or keywords.You will find the latest types of kinds just like the Idaho Share Exchange Agreement with exhibits between Momed Holding Co. and Missouri State Medical Assoc. in seconds.

If you already possess a registration, log in and acquire Idaho Share Exchange Agreement with exhibits between Momed Holding Co. and Missouri State Medical Assoc. in the US Legal Forms catalogue. The Down load switch can look on each type you see. You gain access to all in the past saved kinds within the My Forms tab of your respective accounts.

If you want to use US Legal Forms the very first time, listed here are basic directions to obtain started off:

- Make sure you have chosen the proper type for your metropolis/area. Click on the Preview switch to review the form`s content. See the type information to actually have chosen the appropriate type.

- When the type doesn`t fit your demands, take advantage of the Research discipline at the top of the screen to find the one which does.

- Should you be content with the shape, validate your decision by clicking on the Purchase now switch. Then, opt for the prices program you favor and give your accreditations to register for the accounts.

- Approach the transaction. Make use of your bank card or PayPal accounts to finish the transaction.

- Select the file format and acquire the shape in your system.

- Make modifications. Load, change and print and indicator the saved Idaho Share Exchange Agreement with exhibits between Momed Holding Co. and Missouri State Medical Assoc..

Every web template you put into your bank account does not have an expiration day and is your own permanently. So, if you want to acquire or print one more copy, just proceed to the My Forms portion and click on on the type you will need.

Obtain access to the Idaho Share Exchange Agreement with exhibits between Momed Holding Co. and Missouri State Medical Assoc. with US Legal Forms, probably the most comprehensive catalogue of legitimate papers web templates. Use a large number of expert and state-specific web templates that satisfy your small business or individual requirements and demands.

Form popularity

FAQ

By Practical Law Corporate. This standard document is a short form agreement intended for use in an intra-group share purchase transaction where the consideration is to be satisfied by an issue of shares by the buyer to the seller.

A share for share exchange is where one or more shareholders exchange shares they hold in one company for shares in another company. A common example of this is where a new holding company B is put on top of existing company A.

A Share Exchange is a type of share transaction where the shares of one class are exchanged for shares of another class. Unlike a share conversion, shares are not simply converted from one class to another directly.

The advantages of a share exchange to target shareholders include: Capital gains tax is delayed. The shareholders of the target company will participate in the control and profits of the combined entity.