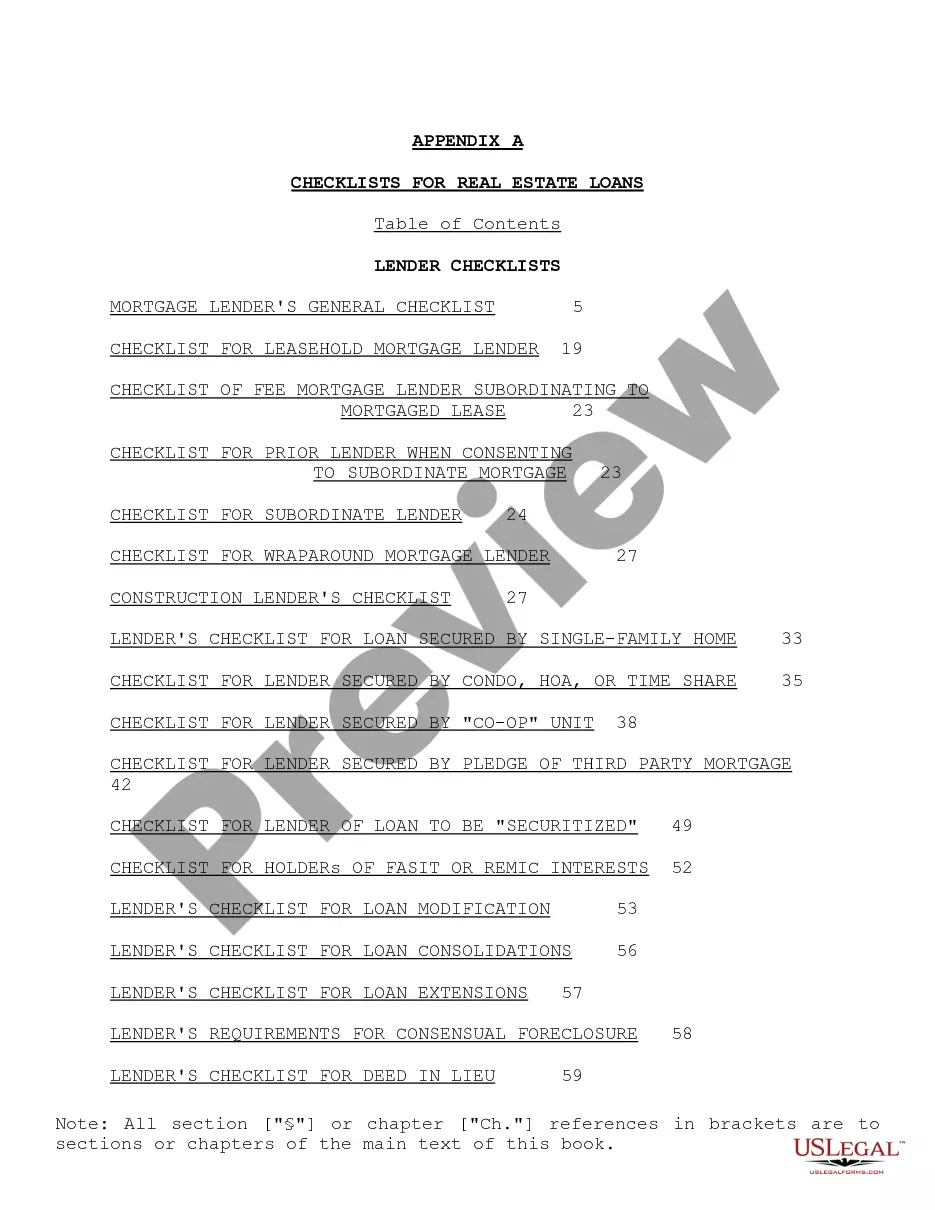

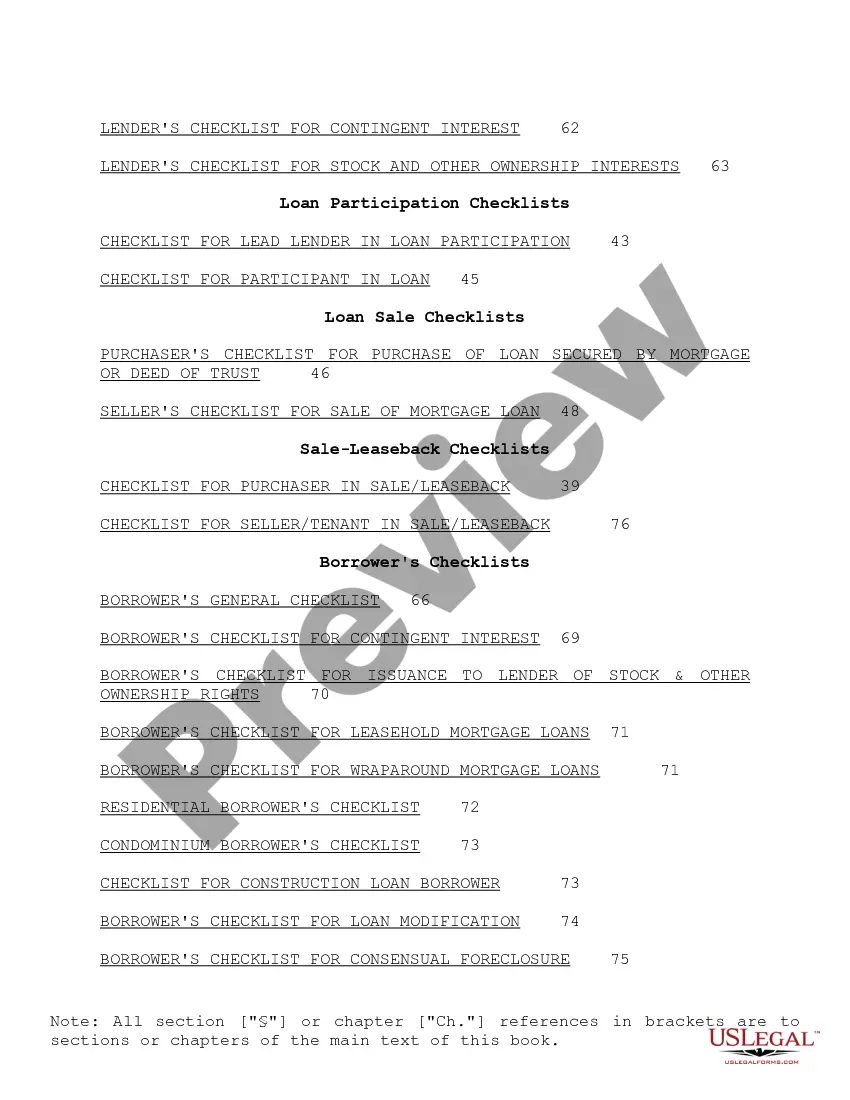

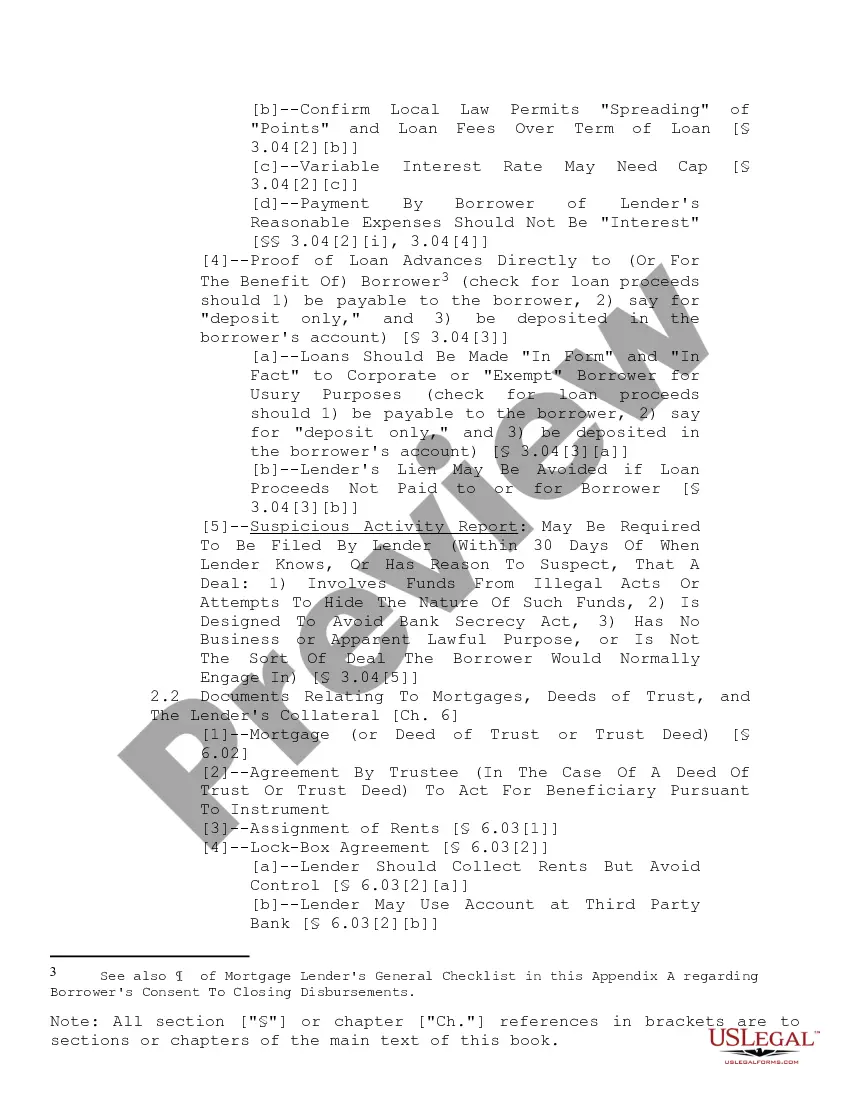

"Checklist for Real Estate Loans" is a American Lawyer Media form. This consist of many checklist that can be used for real estate loans.

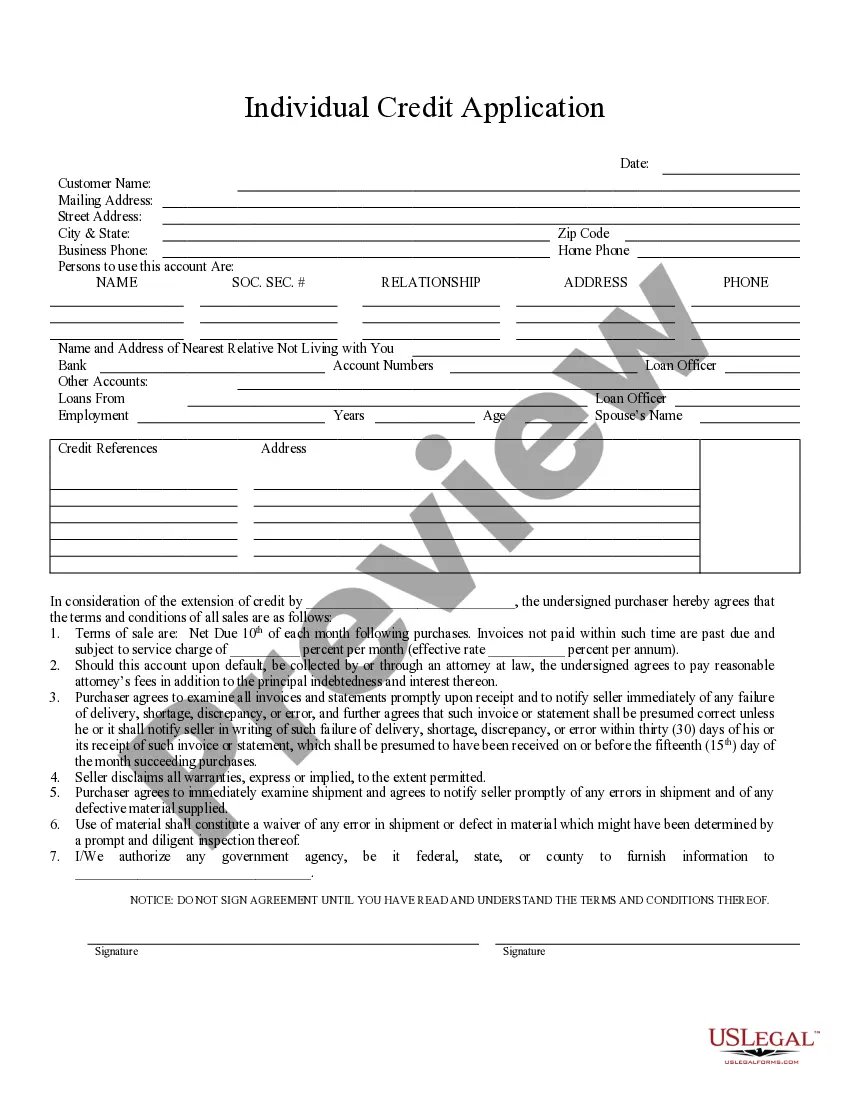

Idaho Checklist for Real Estate Loans: When applying for a real estate loan in Idaho, it is crucial to be aware of the required checklist to ensure a smooth and successful process. Below is a detailed description of the essential elements that should be considered when applying for Idaho real estate loans: 1. Credit Score: A good credit score is essential for loan approval. Lenders in Idaho generally prefer borrowers with higher credit scores, as it indicates financial responsibility and a lower risk for default. 2. Income Documentation: Providing proof of stable income is crucial for securing a real estate loan. In Idaho, lenders usually require recent pay stubs, W-2 forms, and tax returns to evaluate the borrower's income and ability to repay the loan. 3. Employment Verification: Lenders may contact employers to verify the applicant's employment status and stability. Having a steady job is an important factor in the loan approval process. 4. Down Payment: Idaho real estate loans typically require a down payment ranging from 3% to 20% of the property's value. The amount may vary depending on the borrower's creditworthiness and the loan program selected. 5. Property Appraisal: Before approving a loan, lenders will require an appraisal of the property to determine its market value. This valuation ensures that the loan amount aligns with the property's worth. 6. Title search and Insurance: Prior to loan approval, a title search must be conducted to ensure there are no liens or legal issues associated with the property. Obtaining title insurance protects both the lender and the borrower in case of any undiscovered claims on the property. 7. Hazard Insurance: Lenders in Idaho typically require borrowers to acquire hazard insurance for the property. This insurance safeguards against damages caused by natural disasters, accidents, or other unforeseen events. 8. Real Estate Loan Application: Completing the loan application accurately and thoroughly is crucial. It includes providing personal information, financial details, and consent for credit checks necessary for the lender's evaluation process. Types of Idaho Checklist for Real Estate Loans: 1. Conventional Real Estate Loans: These loans are not insured or guaranteed by any government agency and typically require a higher credit score and a larger down payment. 2. Federal Housing Administration (FHA) Loans: Backed by the FHA, these loans are designed to assist borrowers with lower credit scores and offer more flexible down payment options. 3. Department of Veterans Affairs (VA) Loans: These loans are available to eligible veterans, active-duty military members, and surviving spouses. They provide attractive terms, including zero down payment options for qualifying borrowers. 4. Idaho Housing and Finance Association (IFA) Loans: The IFA offers several loan programs to help Idaho residents, including first-time homebuyers and low to moderate-income individuals, achieve homeownership. Each program has specific eligibility requirements. In conclusion, when applying for real estate loans in Idaho, understanding and preparing the necessary checklist items is crucial. Lenders and loan programs may have additional requirements or variations, so it is essential to consult with a mortgage professional to provide accurate and up-to-date information.