Idaho Notice of Violation of Fair Debt Act — Improper Document Appearance: A Comprehensive Overview A Notice of Violation of Fair Debt Act related to improper document appearance in the state of Idaho brings attention to unlawful practices committed by debt collectors regarding the presentation and formatting of debt-related documents. Such violations pertain to the Fair Debt Collection Practices Act (FD CPA), a federal law established to protect consumers from unfair and deceptive debt collection practices. Debt collectors are required to adhere to specific guidelines outlined by the FD CPA when it comes to document appearance. The purpose of these guidelines is to ensure transparency, accuracy, and clarity in the information provided to consumers. Some common issues surrounding document appearance violations include illegible font, improper formatting, lack of disclosure, and misleading or confusing language. Different Types of Idaho Notice of Violation of Fair Debt Act — Improper Document Appearance: 1. Illegible or Incomprehensible Font: Debt collectors are obligated to provide documents using a legible font, ensuring that consumers can easily read and understand the terms and conditions, payment details, and any other relevant information. Employing excessively small, distorted, or unclear fonts can be considered a violation of the FD CPA. 2. Improper Formatting: Debt collectors must take substantial care in presenting debt-related documents in a professional and organized format. Inconsistent or disorganized information, misplaced paragraphs, jumbled sections, or any formatting that creates confusion or impairs the clarity of the document can be deemed a violation. 3. Lack of Disclosure: The FD CPA requires transparent disclosure of certain information in debt-related documents. Failure to disclose key details, such as the creditor's name, amount owed, interest rates, fees, or the consumer's rights, can constitute a violation. Consumers must be fully informed about their debt and their rights before making any payment arrangements. 4. Misleading or Confusing Language: Debt collectors are prohibited from using language that may mislead or confuse consumers about their debt-related rights, obligations, or the consequences of non-payment. Documents containing misleading statements, deceptive language, or false threats can be seen as a violation of the FD CPA. It is essential for consumers to be aware of their rights when dealing with debt collectors. If they receive a Notice of Violation of Fair Debt Act — Improper Document Appearance, they may have grounds for legal action against the debt collector responsible. Seeking legal advice from an attorney experienced in handling FD CPA cases is advisable to determine the appropriate steps to take. In summary, a Notice of Violation of Fair Debt Act — Improper Document Appearance in Idaho sheds light on violations committed by debt collectors regarding the presentation and formatting of debt-related documents. Proper document appearance is crucial to ensure transparency, accuracy, and clarity for consumers, and any violations of these requirements may warrant legal action.

Idaho Notice of Violation of Fair Debt Act - Improper Document Appearance

Description

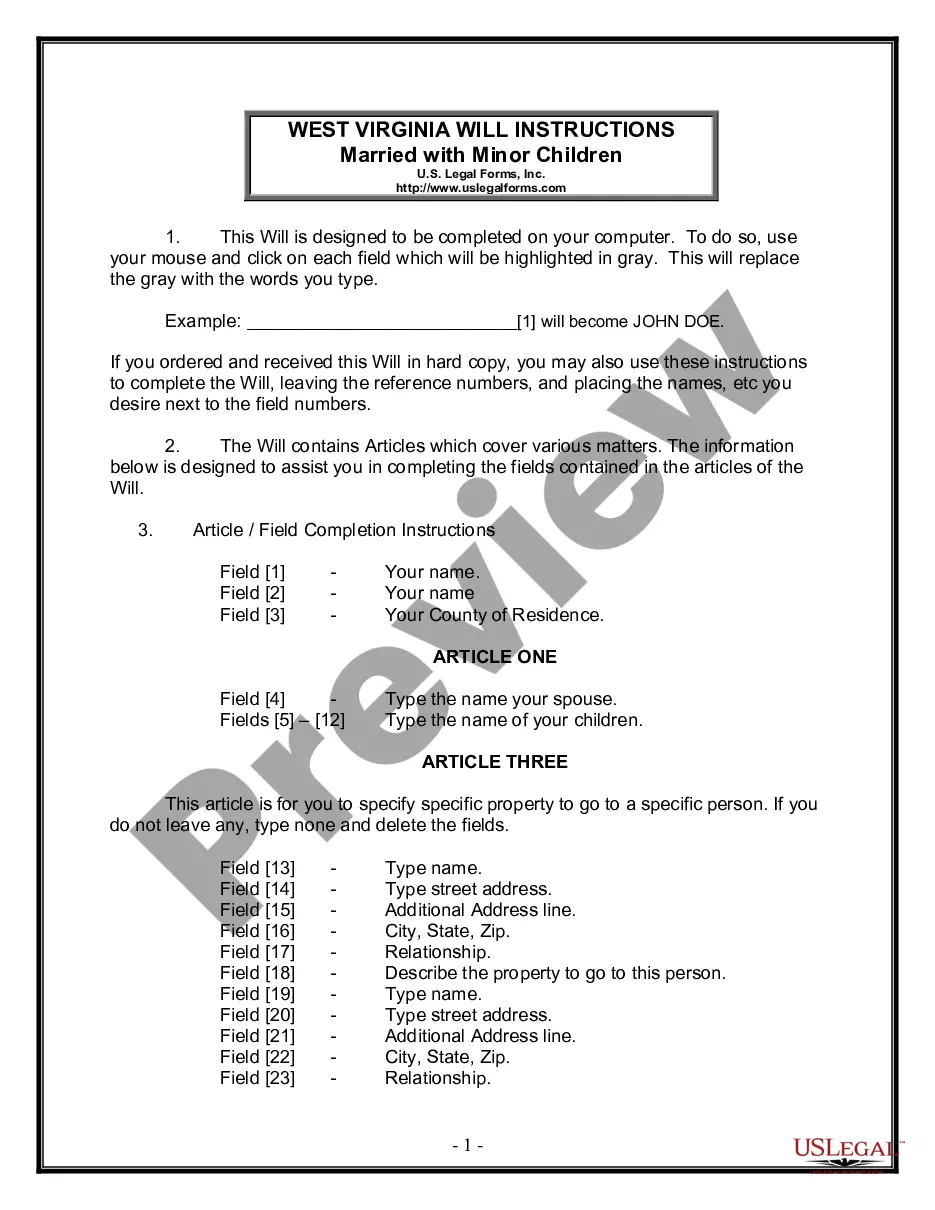

How to fill out Idaho Notice Of Violation Of Fair Debt Act - Improper Document Appearance?

US Legal Forms - among the greatest libraries of legitimate types in the USA - delivers a wide range of legitimate document templates you are able to download or print out. While using web site, you may get thousands of types for enterprise and specific functions, sorted by groups, says, or keywords and phrases.You will discover the most recent types of types like the Idaho Notice of Violation of Fair Debt Act - Improper Document Appearance in seconds.

If you currently have a membership, log in and download Idaho Notice of Violation of Fair Debt Act - Improper Document Appearance from your US Legal Forms collection. The Down load switch will appear on each develop you view. You have access to all earlier delivered electronically types in the My Forms tab of your own profile.

If you want to use US Legal Forms for the first time, allow me to share simple instructions to get you started out:

- Be sure you have picked the correct develop for the metropolis/county. Click on the Preview switch to analyze the form`s content. Read the develop explanation to ensure that you have selected the proper develop.

- When the develop doesn`t satisfy your specifications, utilize the Research field towards the top of the monitor to discover the one that does.

- Should you be content with the shape, validate your selection by clicking the Purchase now switch. Then, pick the costs strategy you favor and provide your references to sign up on an profile.

- Process the financial transaction. Use your credit card or PayPal profile to finish the financial transaction.

- Find the formatting and download the shape on the system.

- Make alterations. Fill out, revise and print out and indication the delivered electronically Idaho Notice of Violation of Fair Debt Act - Improper Document Appearance.

Every format you put into your money does not have an expiry time and is also your own property permanently. So, if you want to download or print out another version, just go to the My Forms section and click around the develop you require.

Gain access to the Idaho Notice of Violation of Fair Debt Act - Improper Document Appearance with US Legal Forms, the most extensive collection of legitimate document templates. Use thousands of skilled and status-particular templates that satisfy your organization or specific requires and specifications.

Form popularity

FAQ

If you feel you've been contacted in error, send a letter disputing a debt in writing. Ask the agency to stop contacting you. If the agency can't provide proof, you owe the money, by law, they must stop collection efforts. If you don't owe the bill, don't pay anything ? ever.

If you are struggling with debt and debt collectors, Farmer & Morris Law, PLLC can help. As soon as you use the 11-word phrase ?please cease and desist all calls and contact with me immediately? to stop the harassment, call us for a free consultation about what you can do to resolve your debt problems for good.

Don't provide personal or sensitive financial information Never give out or confirm personal or sensitive financial information ? such as your bank account, credit card, or full Social Security number ? unless you know the company or person you are talking with is a real debt collector. Should I share personal information with a debt collector? consumerfinance.gov ? ask-cfpb ? should-i-... consumerfinance.gov ? ask-cfpb ? should-i-...

Harassment of the debtor by the creditor ? More than 40 percent of all reported FDCPA violations involved incessant phone calls in an attempt to harass the debtor. Most Common Violations of the Fair Debt Collection Practices Act | ABI abi.org ? feed-item ? most-common-violatio... abi.org ? feed-item ? most-common-violatio...

Here are three steps to follow when you Answer a debt collection lawsuit in Idaho: Answer each claim listed in the Complaint. Assert your affirmative defenses. File the Answer with the court and serve the plaintiff. How to Answer a Summons for Debt Collection in Idaho (2023 Guide) solosuit.com ? posts ? answer-summons-deb... solosuit.com ? posts ? answer-summons-deb...

You must fill out an Answer, serve the other side's attorney, and file your Answer form with the court within 30 days. If you don't, the creditor can ask for a default. If there's a default, the court won't let you file an Answer and can decide the case without you. Respond to a debt lawsuit | California Courts | Self Help Guide ca.gov ? debt-lawsuits ? respond ca.gov ? debt-lawsuits ? respond

(1) The use or threat of use of violence or other criminal means to harm the physical person, reputation, or property of any person. (2) The use of obscene or profane language or language the natural consequence of which is to abuse the hearer or reader.