Idaho Leased Personal Property Workform

Description

How to fill out Idaho Leased Personal Property Workform?

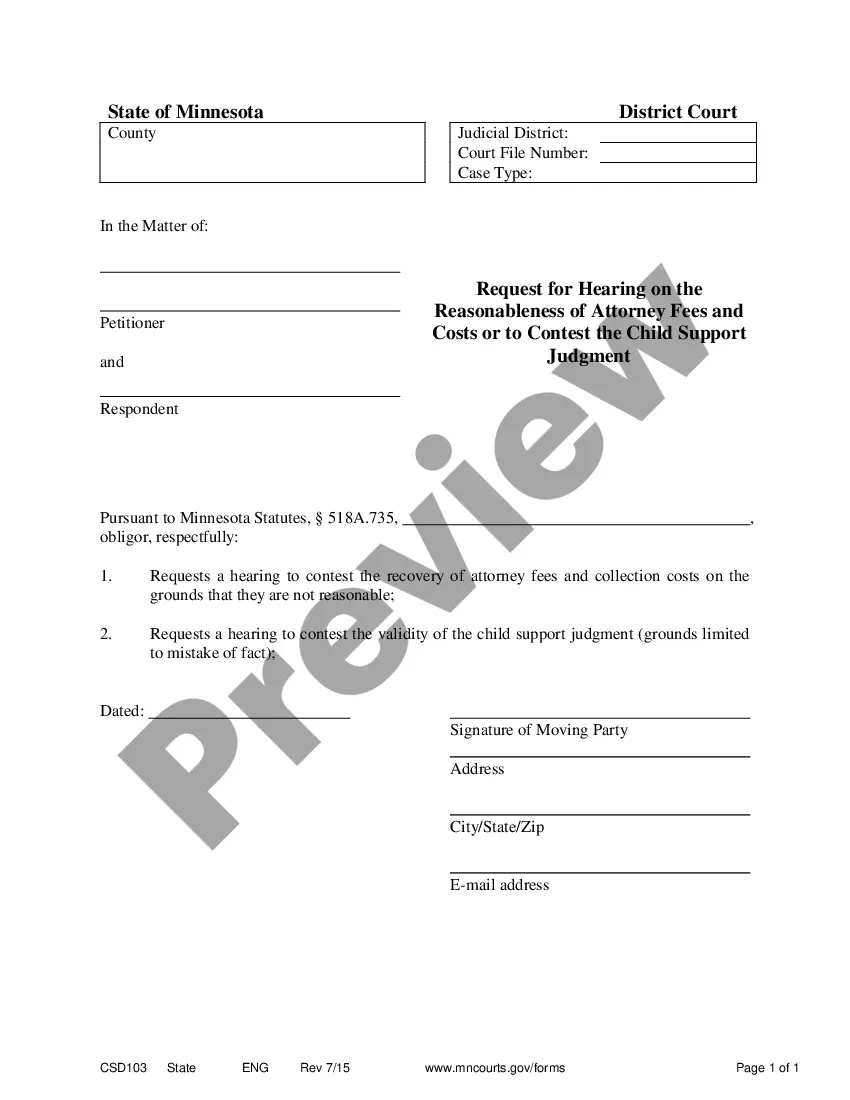

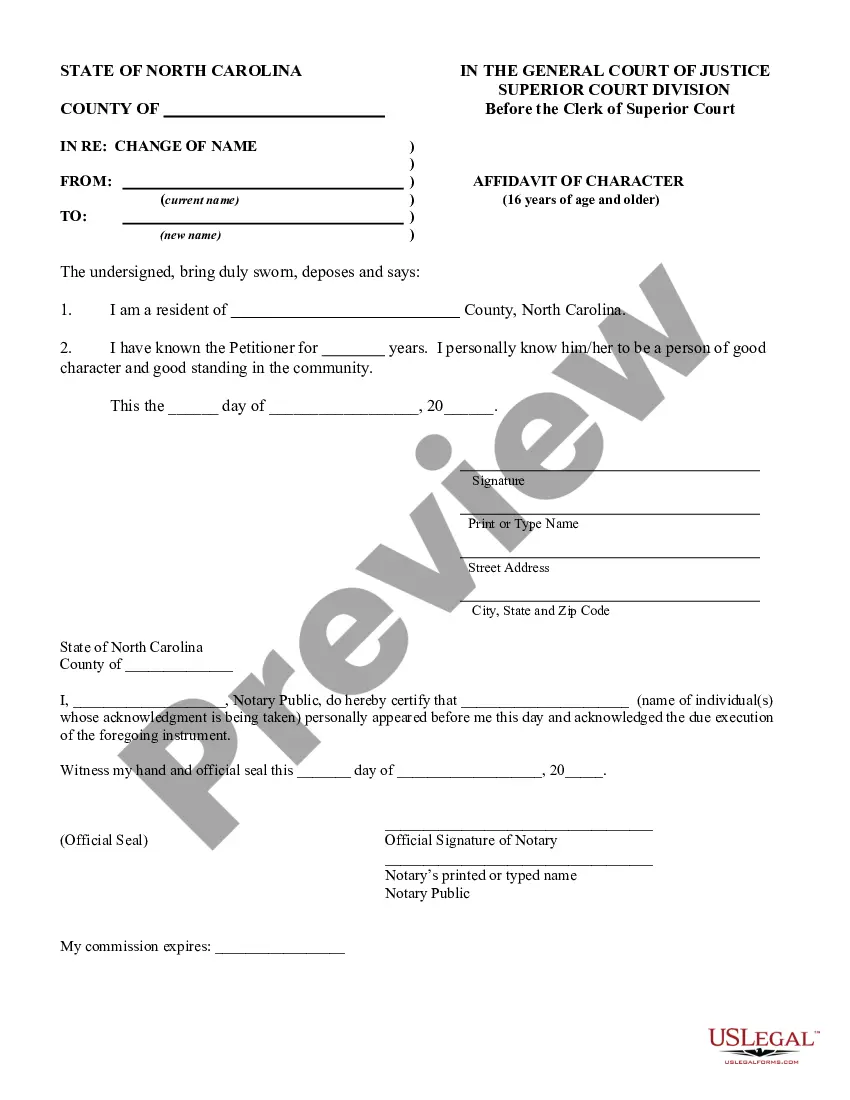

Choosing the right legal file format could be a battle. Needless to say, there are a variety of layouts available on the net, but how would you get the legal type you will need? Make use of the US Legal Forms web site. The assistance gives a large number of layouts, like the Idaho Leased Personal Property Workform, that can be used for business and private requires. All the varieties are inspected by professionals and meet up with federal and state specifications.

In case you are presently signed up, log in in your bank account and click the Acquire key to have the Idaho Leased Personal Property Workform. Make use of bank account to search through the legal varieties you might have ordered formerly. Check out the My Forms tab of your respective bank account and obtain an additional version from the file you will need.

In case you are a fresh customer of US Legal Forms, listed here are straightforward guidelines so that you can stick to:

- Initially, make sure you have selected the proper type to your city/state. You are able to look over the form using the Preview key and read the form information to ensure it is the right one for you.

- In the event the type does not meet up with your expectations, make use of the Seach industry to find the right type.

- Once you are certain that the form is suitable, go through the Acquire now key to have the type.

- Select the costs plan you desire and enter in the essential information and facts. Make your bank account and pay money for your order with your PayPal bank account or bank card.

- Opt for the document structure and obtain the legal file format in your device.

- Full, revise and produce and indicator the obtained Idaho Leased Personal Property Workform.

US Legal Forms will be the most significant catalogue of legal varieties for which you can see various file layouts. Make use of the company to obtain expertly-made paperwork that stick to status specifications.

Form popularity

FAQ

All car sales in Idaho are subject to a state sales tax rate of 6%. However, the total tax rate is dependent on your county and local taxes, which can be up to 9%. On average, the total Idaho car sales tax is 6.074%.

Leases will either be treated as a true tax lease or a non-tax lease. Under a true tax lease, the lessor maintains ownership of the asset and the related deductions such as depreciation, while the lessee would deduct rental payments. A non-tax lease assumes that the risks and rewards of ownership are with the lessee.

Tax Benefits of Equipment Leasing Not all tax savings are limited to equipment financing. Leased equipment can also be eligible for Section 179. You can write off the entire lease payment as a business expense by deducting the monthly lease payments on your taxes, as long as your lease meets the qualifications.

Personal property tax in Idaho is assessed by the county assessor's office of the county where it's located. This page doesn't cover information on personal property owned by operating property companies, such as public utilities and railroads, which is assessed by the Idaho State Tax Commission.

In general, payments for the lease of tangible personal property are subject to tax unless the lessor paid tax on the purchase of the property. Payments for the lease of tangible personal property are exempt from tax if the sale of the tangible personal property would be exempt.

A state tax commission guide describes it this way: Taxable personal property consists of items used commercially, such as furniture, libraries, art, coin collections, machinery, tools, equipment, signs, unregistered vehicles, and watercraft.

You don't have to pay sales tax because you didn't buy the car. However, you must fill out Idaho Sales Tax Exemption Certificate, Form ST-133, Section II, and give the completed form to the clerk when you title and register the car.

All personal property in Idaho, unless exempt, is subject to assessment and taxation. You must report all of your taxable personal property to your county assessor using a personal property declaration form available from the assessor.

Do I have to file an Idaho State Tax return? Thus, if you collected more than $2,500 in rent (gross income, not net income, which is income after deductions) on your Idaho rental property, then the answer to your question would be yes, you are legally required to file an Idaho state tax return.

If your business leases equipment under a typical lease, you generally are entitled to currently deduct your rental payments as long as you are using the leased property in your business.