Idaho Loan Modification Agreement - Multistate

Description

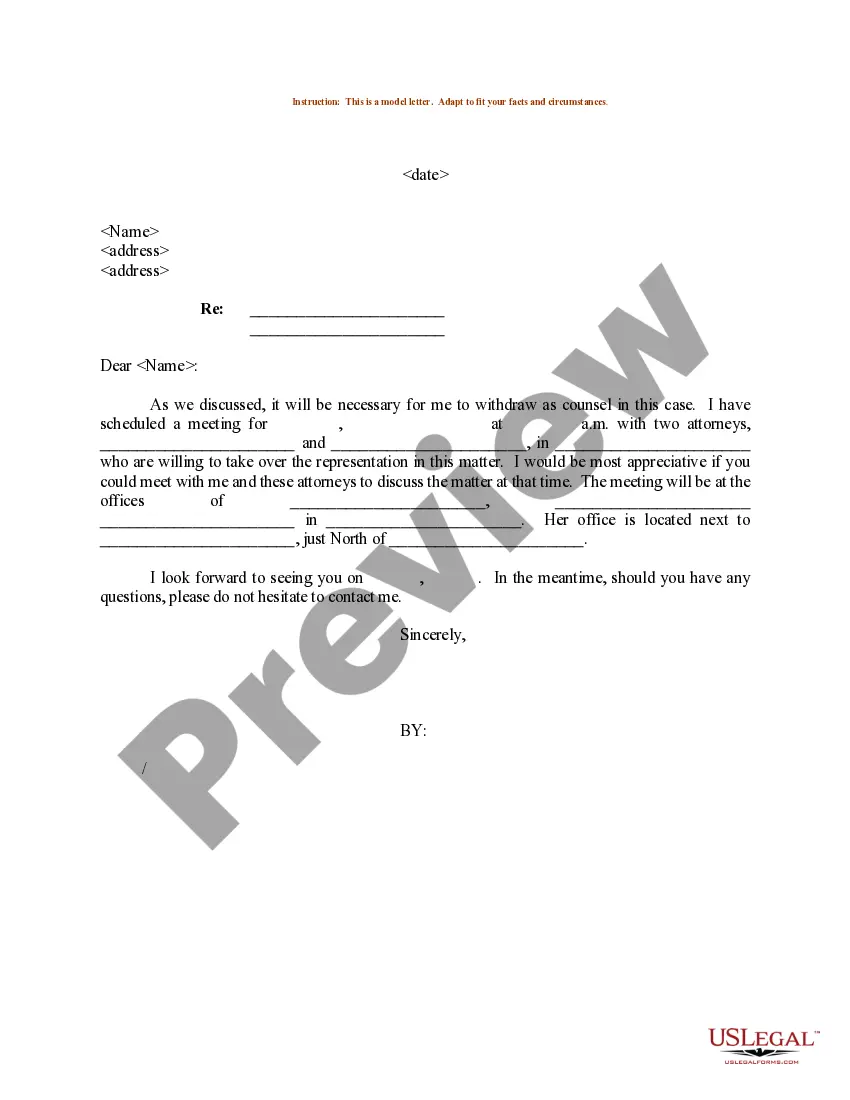

How to fill out Loan Modification Agreement - Multistate?

Discovering the right lawful papers web template might be a have a problem. Of course, there are plenty of themes accessible on the Internet, but how would you get the lawful form you want? Use the US Legal Forms internet site. The assistance delivers thousands of themes, such as the Idaho Loan Modification Agreement - Multistate, which you can use for business and personal demands. Every one of the types are inspected by professionals and meet up with federal and state specifications.

When you are already authorized, log in in your accounts and click the Obtain button to have the Idaho Loan Modification Agreement - Multistate. Make use of your accounts to look from the lawful types you may have purchased formerly. Proceed to the My Forms tab of your respective accounts and get another version in the papers you want.

When you are a new user of US Legal Forms, here are straightforward recommendations that you can stick to:

- Initially, ensure you have selected the right form for your town/region. It is possible to look through the form utilizing the Preview button and browse the form description to ensure this is basically the best for you.

- If the form does not meet up with your needs, use the Seach field to get the right form.

- When you are certain the form is suitable, select the Acquire now button to have the form.

- Pick the prices strategy you need and enter the essential info. Design your accounts and pay money for your order using your PayPal accounts or charge card.

- Select the document structure and acquire the lawful papers web template in your gadget.

- Comprehensive, edit and produce and sign the received Idaho Loan Modification Agreement - Multistate.

US Legal Forms may be the largest local library of lawful types that you can find different papers themes. Use the company to acquire expertly-produced paperwork that stick to condition specifications.

Form popularity

FAQ

Could be reported as a settlement: Because you're changing the terms of your loan, some lenders may report your loan modification to the credit bureaus (Experian, TransUnion and Equifax) as a settlement, which can wreak havoc on your credit scores and remain on your credit reports for several years.

This is a document that changes the terms of the original mortgage, which is a document that is recorded in the county clerk's office in order to protect a lender's right to foreclose if you don't pay as agreed. That's why it's essential that a loan modification be recorded, as well.

During meetings with your lender, you can negotiate the interest rate, the term of the loan, late fees, and any good faith payment you are prepared to make. Remember that you may not be able to negotiate the principal or any amount that you still owe from before you applied for the loan modification.

The loan modification process can vary from lender to lender, but in general most programs will require similar steps: Step 1 Gather information about your financial situation. ... Step 2 Reach out to your lender. ... Step 3 Check the qualifications for loan modification. ... Step 4 Complete an application.

Modifications may involve extending the number of years you have to repay the loan, reducing your interest rate, and/or forbearing or reducing your principal balance.

Required documentation for a loan modification usually includes a formal application, pay stubs, financial statements, proof of income, bank statements, and tax returns, as well as a hardship statement.

What Is A Loan Modification? A loan modification is a change to the original terms of your mortgage loan. Unlike a refinance, a loan modification doesn't pay off your current mortgage and replace it with a new one. Instead, it directly changes the conditions of your loan.

Because these represent mutual agreements, they should be signed by both the borrowers and the plaintiff (who may or may not be the lender or servicer but may be an assignee of the mortgage). There is no doubt that foreclosing plaintiffs understand that they need to sign those mortgage modification agreements.