Title: Exploring the Idaho Investment Advisory Agreement between First American Insurance Portfolios, Inc. and U.S. Bank National Assoc. Keywords: Idaho Investment Advisory Agreement, First American Insurance Portfolios, Inc., U.S. Bank National Assoc., detailed description, types Introduction: The Idaho Investment Advisory Agreement, often referred to as the Investment Management Agreement (IMA), is a legal contract negotiated between First American Insurance Portfolios, Inc. (FAIR) and U.S. Bank National Association (U.S. Bank). This agreement outlines the terms and conditions under which U.S. Bank will act as an investment advisor for FAIR, managing various investment portfolios and providing related services. Detailed Description: 1. Scope of the Agreement: The Idaho Investment Advisory Agreement details the scope of the arrangement between FAIR and U.S. Bank. It defines the specific investment portfolios that U.S. Bank will oversee and the responsibilities of both parties. 2. Investment Objectives and Strategies: The agreement outlines FAIR's investment objectives, such as maximizing returns, capital appreciation, income generation, or a combination thereof. Additionally, it delves into the investment strategies U.S. Bank will employ to achieve these objectives, potentially covering asset allocation, risk management, portfolio diversification, and more. 3. Portfolio Reporting and Performance Evaluation: This section highlights the reporting requirements that U.S. Bank must fulfill, including the frequency and method of reporting. It may include information on investment performance evaluation, benchmarking against industry standards, and the delivery of detailed portfolio statements to FAIR. 4. Fees and Compensation: The Idaho Investment Advisory Agreement specifies the fee structure for U.S. Bank's services. It may outline the management fees, performance-based fees, expense reimbursements, or other forms of compensation that FAIR agrees to pay U.S. Bank. 5. Termination and Amendment: Terms related to the termination or amendment of the agreement are covered in this section. It may explain the conditions under which either party can terminate the agreement and any associated penalties or procedures that must be followed. Types of Idaho Investment Advisory Agreements: While the specific types of Idaho IMA agreements between FAIR and U.S. Bank may vary based on individual circumstances, they typically fall under: 1. General Investment Advisory Agreement: This agreement encompasses a broad range of investment portfolios managed by U.S. Bank on behalf of FAIR. 2. Specific Portfolio Advisory Agreement: In some cases, FAIR may establish separate agreements for specific portfolios or investment vehicles, allowing for tailored management and strategies. Conclusion: The Idaho Investment Advisory Agreement between First American Insurance Portfolios, Inc., and U.S. Bank National Association sets the foundation and guidelines for the provision of investment management services. It ensures both parties have a clear understanding of their roles, responsibilities, and compensation. By adhering to this formal agreement, FAIR and U.S. Bank can work collaboratively to maximize investment returns and achieve FAIR's financial goals.

Idaho Investment Advisory Agreement between First American Insurance Portfolios, Inc. and U.S. Bank National Assoc.

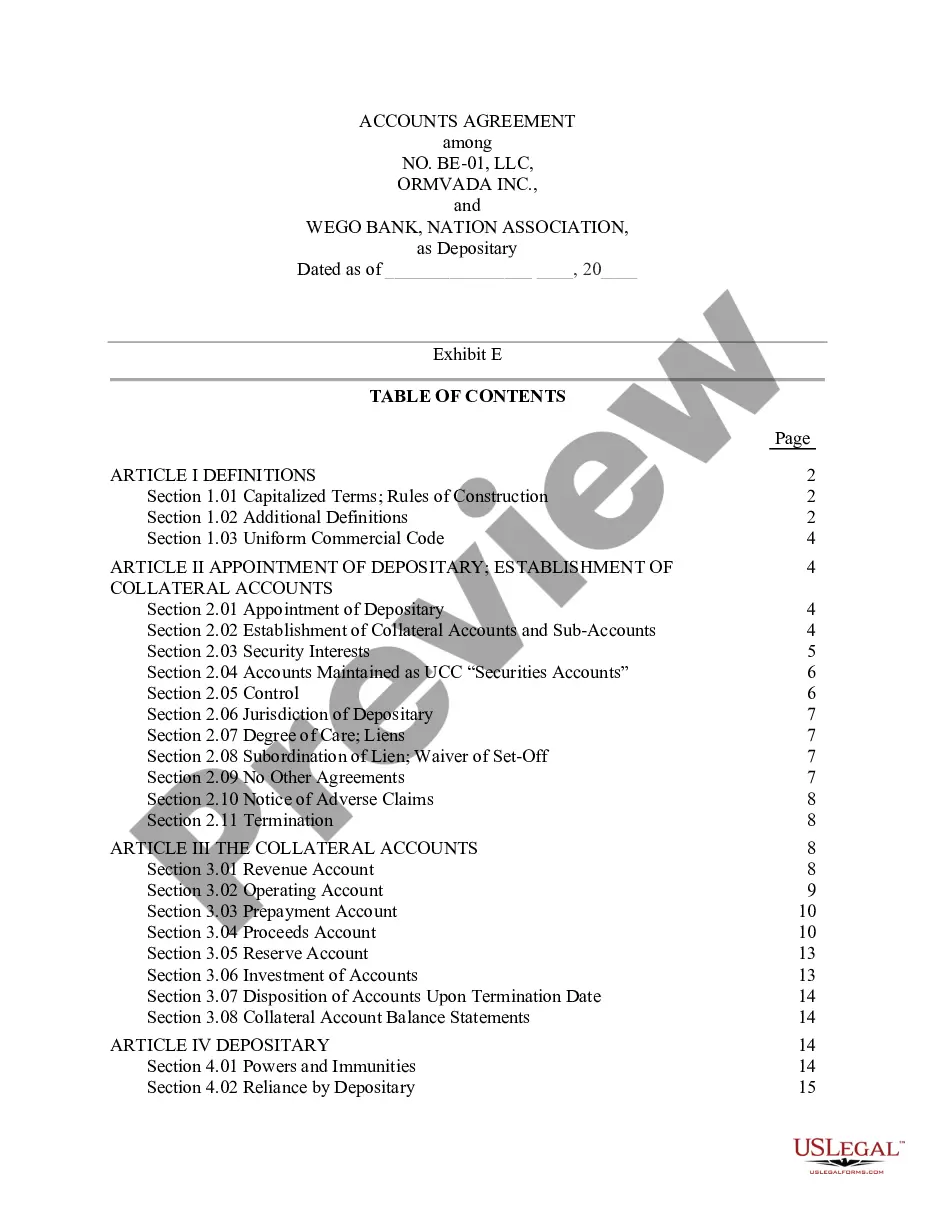

Description

How to fill out Idaho Investment Advisory Agreement Between First American Insurance Portfolios, Inc. And U.S. Bank National Assoc.?

You may invest hours on the web looking for the legal file design that suits the federal and state demands you require. US Legal Forms provides a large number of legal forms which can be evaluated by pros. You can easily obtain or print the Idaho Investment Advisory Agreement between First American Insurance Portfolios, Inc. and U.S. Bank National Assoc. from our service.

If you currently have a US Legal Forms account, it is possible to log in and click on the Download key. After that, it is possible to comprehensive, edit, print, or indicator the Idaho Investment Advisory Agreement between First American Insurance Portfolios, Inc. and U.S. Bank National Assoc.. Every legal file design you acquire is your own property for a long time. To have an additional duplicate associated with a obtained form, visit the My Forms tab and click on the corresponding key.

If you use the US Legal Forms website initially, stick to the simple recommendations beneath:

- Initially, make sure that you have selected the right file design for the state/town of your choosing. Look at the form description to make sure you have chosen the proper form. If offered, utilize the Preview key to appear through the file design too.

- If you wish to find an additional variation from the form, utilize the Look for industry to find the design that meets your requirements and demands.

- After you have located the design you need, simply click Acquire now to proceed.

- Pick the pricing prepare you need, type your accreditations, and register for a merchant account on US Legal Forms.

- Comprehensive the transaction. You may use your credit card or PayPal account to fund the legal form.

- Pick the formatting from the file and obtain it for your device.

- Make adjustments for your file if necessary. You may comprehensive, edit and indicator and print Idaho Investment Advisory Agreement between First American Insurance Portfolios, Inc. and U.S. Bank National Assoc..

Download and print a large number of file templates while using US Legal Forms website, that provides the greatest variety of legal forms. Use specialist and express-distinct templates to tackle your company or person demands.