Title: Idaho Registration Rights Agreement for Sale and Purchase of 6% Series G Convertible Preferred Stocks: A Comprehensive Guide Keywords: Idaho Registration Rights Agreement, Object Soft Corp., Investors, sale and purchase, 6% Series G convertible preferred stocks Introduction: The Idaho Registration Rights Agreement plays a vital role in governing the sale and purchase of 6% Series G convertible preferred stocks between Object Soft Corp. and its investors. This detailed description aims to provide a comprehensive understanding of this agreement and the different types that may exist. Understanding the Idaho Registration Rights Agreement: The Idaho Registration Rights Agreement is a contractual document that outlines the rights, responsibilities, and obligations of Object Soft Corp. and its investors concerning the sale and purchase of 6% Series G convertible preferred stocks. The agreement ensures compliance with Idaho state laws and regulations while facilitating a transparent and fair transaction process. Key Features and Clauses: 1. Registration Obligations: The agreement specifies the registration obligations of Object Soft Corp. with the Idaho state authorities, ensuring the timely registration of the preferred stocks for sale and listing on the market. 2. Restriction Period: The agreement may define a specified period during which the investors are restricted from selling or transferring their 6% Series G convertible preferred stocks to maintain stability in the market. 3. Piggyback Rights: Object Soft Corp. may grant investors piggyback rights, allowing them to include their converted preferred stocks in registration statements filed by the company for securities offerings. 4. Demand Registration: Investors may have the right to request registration of their preferred stocks for sale when certain conditions, as defined in the agreement, are met. Object Soft Corp. is obligated to comply within a reasonable time frame. 5. Expenses and Indemnification: The agreement outlines the allocation of expenses related to the registration process between Object Soft Corp. and the investors. It also defines indemnification clauses to protect both parties in case of any legal disputes or damages. Types of Idaho Registration Rights Agreement: 1. Standard Agreement: This type of agreement outlines the basic registration rights granted to the investors, including piggyback rights and a restriction period for selling preferred stocks. 2. Demand Registration Agreement: This agreement includes additional provisions enabling investors to request registration of their 6% Series G convertible preferred stocks under certain circumstances, such as a significant liquidity event or when a specific number of shares are held. 3. Enhanced Agreement: This type of agreement may include tailor-made clauses and provisions to accommodate specific requirements of Object Soft Corp. or its investors, offering more flexibility and customization options. Conclusion: The Idaho Registration Rights Agreement between Object Soft Corp. and its investors regarding the sale and purchase of 6% Series G convertible preferred stocks forms a crucial foundation for a transparent and regulated transaction process. By understanding the key features and types of this agreement, Object Soft Corp. and its investors can ensure a smooth and compliant buying and selling experience.

Idaho Registration Rights Agreement between ObjectSoft Corp. and Investors regarding sale and purchase of 6% Series G convertible preferred stocks

Description

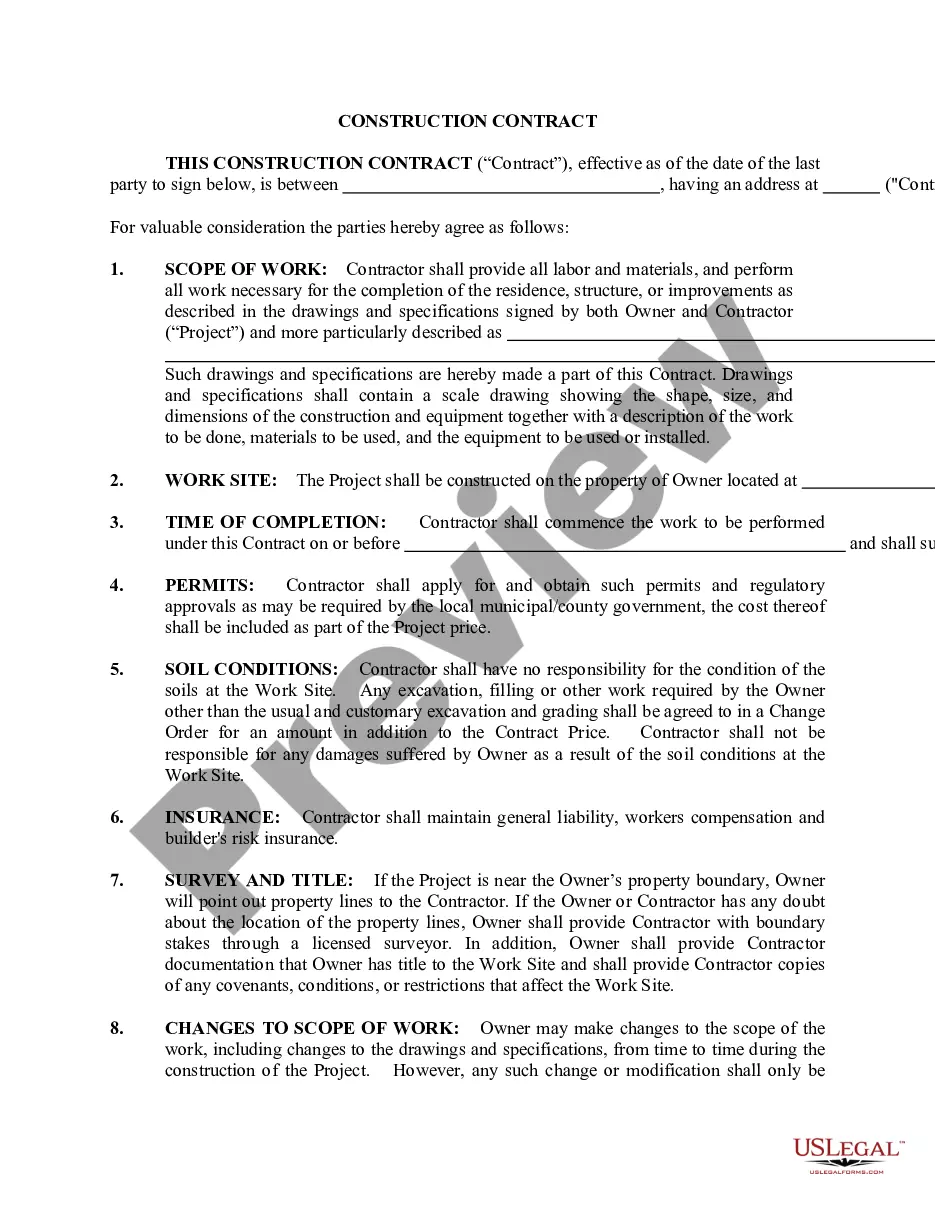

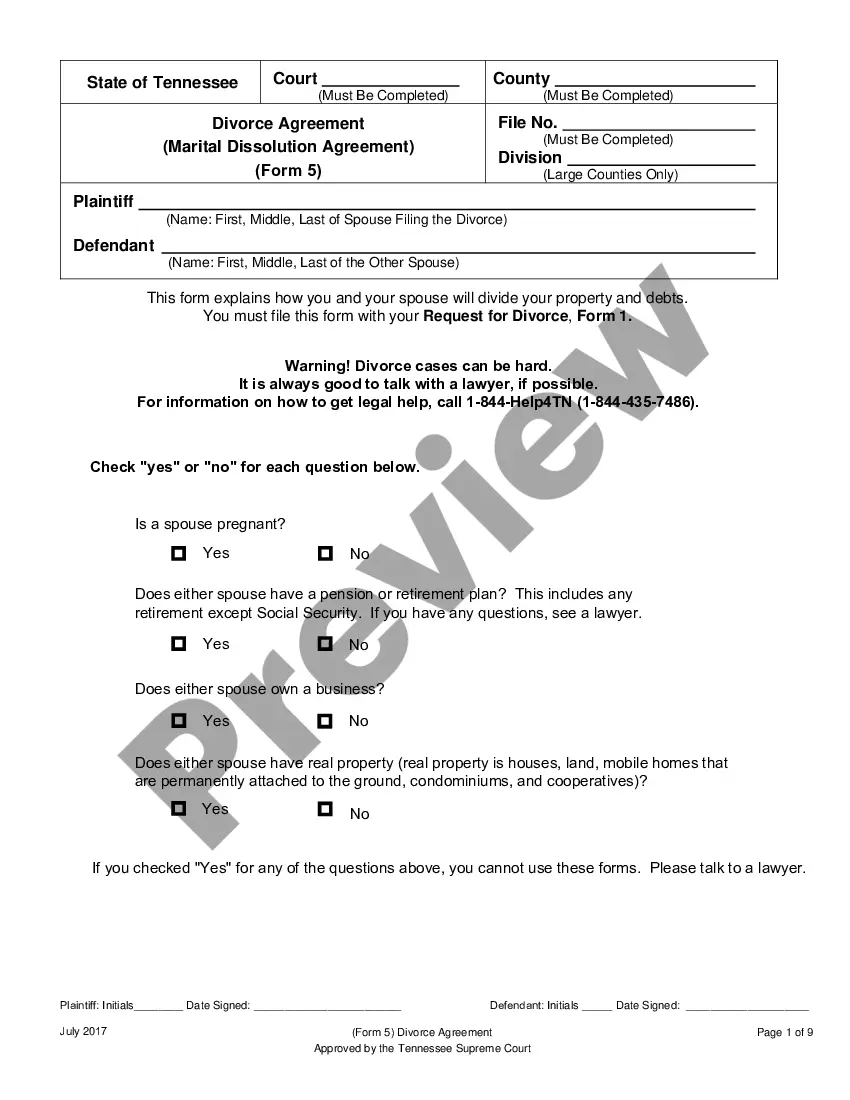

How to fill out Idaho Registration Rights Agreement Between ObjectSoft Corp. And Investors Regarding Sale And Purchase Of 6% Series G Convertible Preferred Stocks?

If you wish to comprehensive, down load, or produce authorized file layouts, use US Legal Forms, the largest collection of authorized forms, which can be found on the Internet. Use the site`s basic and handy lookup to find the documents you require. Different layouts for enterprise and personal functions are categorized by groups and claims, or keywords and phrases. Use US Legal Forms to find the Idaho Registration Rights Agreement between ObjectSoft Corp. and Investors regarding sale and purchase of 6% Series G convertible preferred stocks within a handful of click throughs.

If you are previously a US Legal Forms consumer, log in in your accounts and click on the Down load key to obtain the Idaho Registration Rights Agreement between ObjectSoft Corp. and Investors regarding sale and purchase of 6% Series G convertible preferred stocks. You may also entry forms you previously delivered electronically in the My Forms tab of the accounts.

If you use US Legal Forms the first time, follow the instructions under:

- Step 1. Make sure you have chosen the shape for the correct metropolis/land.

- Step 2. Utilize the Preview solution to check out the form`s content. Don`t overlook to read through the description.

- Step 3. If you are not happy with the develop, take advantage of the Search field near the top of the screen to find other versions in the authorized develop template.

- Step 4. Upon having found the shape you require, select the Get now key. Pick the rates program you favor and include your qualifications to register for an accounts.

- Step 5. Procedure the financial transaction. You can use your credit card or PayPal accounts to finish the financial transaction.

- Step 6. Find the formatting in the authorized develop and down load it on the system.

- Step 7. Complete, revise and produce or sign the Idaho Registration Rights Agreement between ObjectSoft Corp. and Investors regarding sale and purchase of 6% Series G convertible preferred stocks.

Every authorized file template you buy is your own forever. You might have acces to each and every develop you delivered electronically in your acccount. Click on the My Forms area and pick a develop to produce or down load once more.

Be competitive and down load, and produce the Idaho Registration Rights Agreement between ObjectSoft Corp. and Investors regarding sale and purchase of 6% Series G convertible preferred stocks with US Legal Forms. There are millions of skilled and state-particular forms you may use to your enterprise or personal needs.

Form popularity

FAQ

?Definition? A registration rights provision in a term sheet allows an investor to require a company to register the investor's shares with the SEC when certain conditions are met, ensuring that the investor has the opportunity to sell their shares in the public market.

In an unregistered securities offering, an agreement between the issuer and the purchasers of the security that creates an obligation for the issuer to register the re-offer and resale of the securities being offered at some time in the future (usually within six months).

An Investor Rights Agreement (IRA) is an agreement between an investor and a company that contractually guarantees the investor certain rights including, but not limited to, voting rights, inspection rights, rights of first refusal, and observer rights.

Demand registration rights, where an investor can force a company to file a registration statement to register the holder's securities so the investor can sell them in the public market without restriction.

Related Content. In an unregistered securities offering, an agreement between the issuer and the purchasers of the security that creates an obligation for the issuer to register the re-offer and resale of the securities being offered at some time in the future (usually within six months).