Idaho Merger Plan and Agreement between Ichargeit.Com, Inc. and Para-Link, Inc.

Description

How to fill out Merger Plan And Agreement Between Ichargeit.Com, Inc. And Para-Link, Inc.?

US Legal Forms - one of many largest libraries of legal kinds in America - delivers a wide array of legal document layouts you are able to download or print. Utilizing the site, you will get a huge number of kinds for company and specific functions, categorized by types, says, or key phrases.You will discover the newest variations of kinds such as the Idaho Merger Plan and Agreement between Ichargeit.Com, Inc. and Para-Link, Inc. within minutes.

If you have a subscription, log in and download Idaho Merger Plan and Agreement between Ichargeit.Com, Inc. and Para-Link, Inc. from your US Legal Forms library. The Acquire switch will show up on each type you perspective. You have access to all previously saved kinds from the My Forms tab of the account.

If you want to use US Legal Forms for the first time, listed here are simple recommendations to get you started off:

- Ensure you have picked the proper type for your personal area/area. Go through the Preview switch to analyze the form`s articles. Browse the type explanation to ensure that you have selected the proper type.

- When the type doesn`t fit your demands, use the Lookup area towards the top of the screen to obtain the one that does.

- When you are pleased with the shape, verify your decision by clicking on the Acquire now switch. Then, choose the prices plan you favor and give your qualifications to register for an account.

- Approach the financial transaction. Make use of Visa or Mastercard or PayPal account to perform the financial transaction.

- Find the format and download the shape in your gadget.

- Make changes. Complete, revise and print and indication the saved Idaho Merger Plan and Agreement between Ichargeit.Com, Inc. and Para-Link, Inc..

Each and every template you added to your bank account does not have an expiry day and is yours forever. So, if you want to download or print another duplicate, just check out the My Forms section and then click on the type you need.

Obtain access to the Idaho Merger Plan and Agreement between Ichargeit.Com, Inc. and Para-Link, Inc. with US Legal Forms, by far the most extensive library of legal document layouts. Use a huge number of skilled and state-distinct layouts that satisfy your organization or specific needs and demands.

Form popularity

FAQ

Use SEC filings to find details about a company's merger or acquisition. Both the target and acquirer will file reports. The actual report type (8-K, 10-K, or proxy) will vary.

The Institute for Mergers, Acquisitions and Alliances has the world's largest free-of-charge M&A Statistics database. Our faculty are the authors of many leading M&A books.

Use SEC filings to find details about a company's merger or acquisition. Both the target and acquirer will file reports.

Business Source Complete, ABI/INFORM, Mergent Online, and Nexis Uni (formerly LexisNexis) will provide news articles on recent mergers and acquisitions, as well as industry reports. These industry reports may indicate whether an industry is consolidating or growing industry.

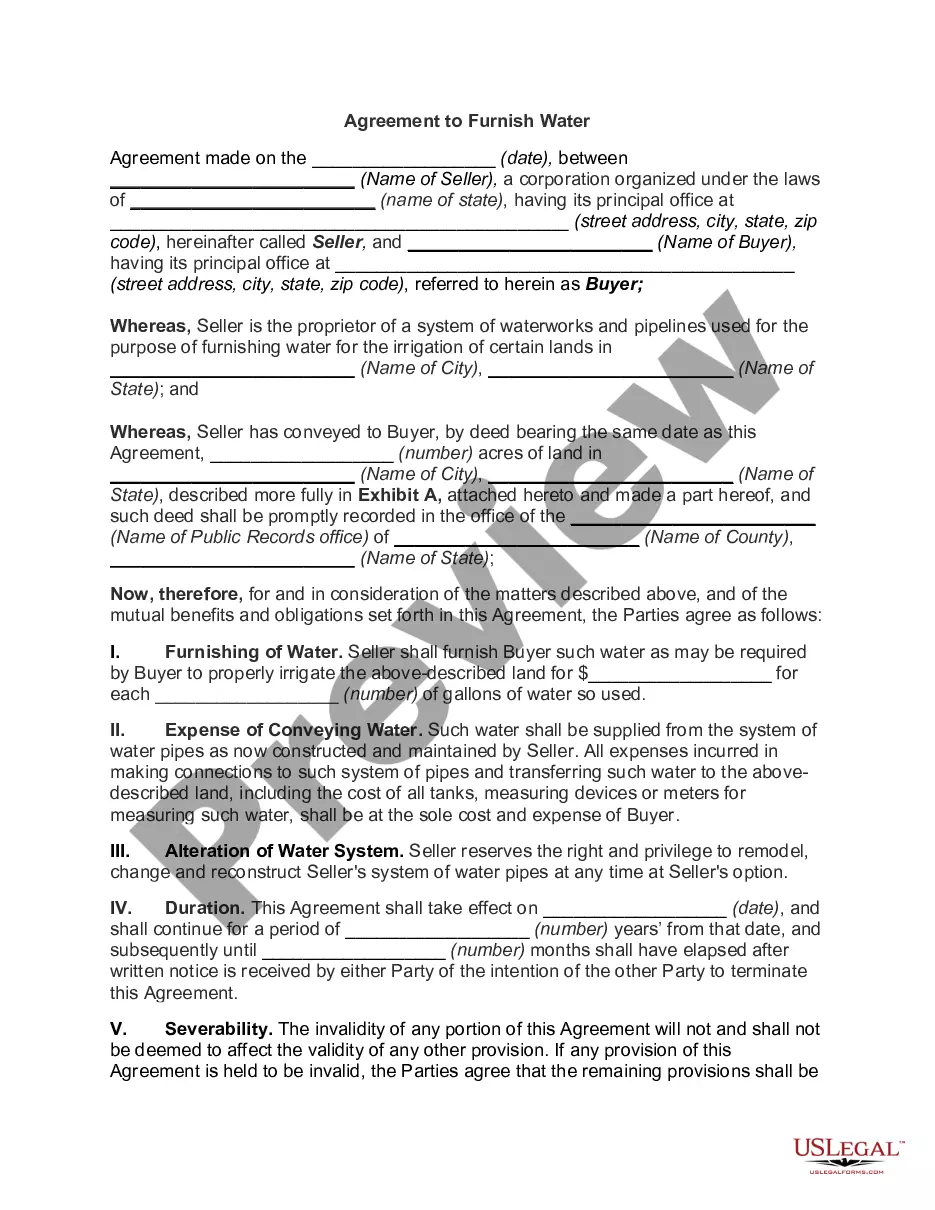

An agreement setting out steps of a merger of two or more entities including the terms and conditions of the merger, parties, the consideration, conversion of equity, and information about the surviving entity (such as its governing documents).

Merger Documents means the collective reference to the Merger Agreement, all material exhibits and schedules thereto and all agreements expressly contemplated thereby.

The Company and each of its subsidiaries is duly organized, validly existing and in good standing (with respect to jurisdictions that recognize the concept of good standing) under the laws of the jurisdiction of its organization and has all requisite corporate or similar power and authority to own, lease and operate ...