Idaho Trust Indenture and Agreement between John Nuveen and Co., Inc. and Chase Manhattan Bank regarding terms and conditions for Nuveen Tax Free Unit Trust, Series 1140

Description

How to fill out Trust Indenture And Agreement Between John Nuveen And Co., Inc. And Chase Manhattan Bank Regarding Terms And Conditions For Nuveen Tax Free Unit Trust, Series 1140?

Have you been within a position that you need to have documents for both business or specific uses just about every day? There are tons of authorized file templates available on the net, but finding ones you can rely isn`t effortless. US Legal Forms offers 1000s of kind templates, just like the Idaho Trust Indenture and Agreement between John Nuveen and Co., Inc. and Chase Manhattan Bank regarding terms and conditions for Nuveen Tax Free Unit Trust, Series 1140, which can be composed to fulfill federal and state needs.

In case you are previously informed about US Legal Forms internet site and possess an account, just log in. Next, you may obtain the Idaho Trust Indenture and Agreement between John Nuveen and Co., Inc. and Chase Manhattan Bank regarding terms and conditions for Nuveen Tax Free Unit Trust, Series 1140 web template.

Unless you offer an profile and wish to begin using US Legal Forms, follow these steps:

- Find the kind you require and ensure it is to the appropriate metropolis/state.

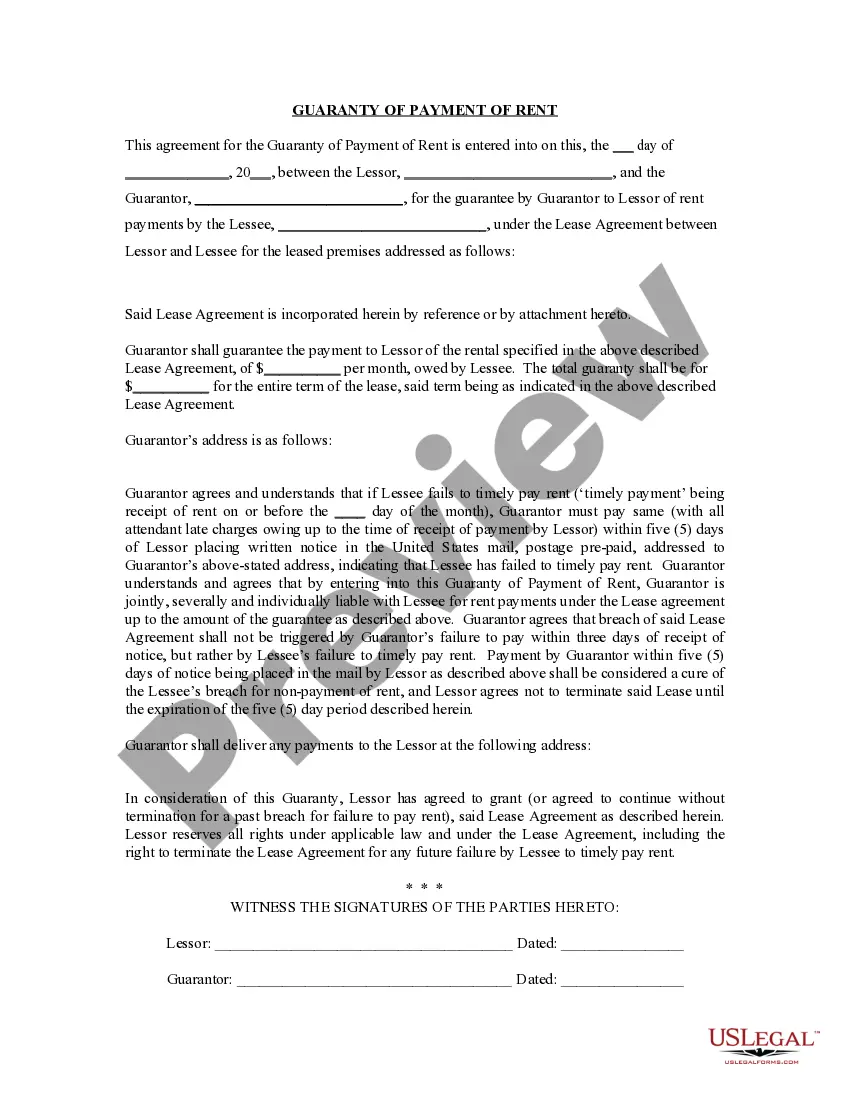

- Utilize the Review key to review the shape.

- Browse the explanation to ensure that you have selected the proper kind.

- When the kind isn`t what you`re searching for, make use of the Lookup area to find the kind that suits you and needs.

- Once you get the appropriate kind, simply click Get now.

- Pick the prices program you want, complete the desired information and facts to create your money, and buy an order with your PayPal or credit card.

- Pick a practical file formatting and obtain your copy.

Locate each of the file templates you possess bought in the My Forms food list. You can aquire a additional copy of Idaho Trust Indenture and Agreement between John Nuveen and Co., Inc. and Chase Manhattan Bank regarding terms and conditions for Nuveen Tax Free Unit Trust, Series 1140 at any time, if possible. Just select the essential kind to obtain or print the file web template.

Use US Legal Forms, one of the most considerable variety of authorized kinds, to save lots of time as well as prevent mistakes. The assistance offers professionally manufactured authorized file templates which you can use for a range of uses. Create an account on US Legal Forms and begin creating your way of life easier.