The Idaho Plan of Merger refers to a legal document detailing the specific terms and conditions regarding the merger between WIT Capital Group, Inc., WIS Merger Corporation, and Sound view Technology Group, Inc. Merger agreements are commonly utilized to streamline and combine businesses to create a more efficient and competitive entity in the marketplace. The Idaho Plan of Merger outlines the step-by-step procedures involved in the consolidation, including the timeline, the roles and responsibilities of each party, and the legal requirements to be fulfilled. It sets forth the terms of the merger, including the exchange of shares, assets, and liabilities between the involved corporations. There are typically different types or variations of merger transactions, each catering to specific circumstances and objectives. Examples include: 1. Horizontal Merger: This occurs when two or more companies in the same industry merge to create a more dominant player by expanding market presence, cutting costs, or enhancing competitiveness. 2. Vertical Merger: In this type of merger, two companies operating in different stages of the same industry's supply chain combine their efforts. This allows for streamlined operations, cost reductions, and increased control over the production and distribution process. 3. Conglomerate Merger: Conglomerate mergers involve the consolidation of companies that operate in unrelated industries. This type of merger diversifies the business portfolio, mitigating risks by venturing into different markets and product lines. The Idaho Plan of Merger between WIT Capital Group, Inc., WIS Merger Corporation, and Sound view Technology Group, Inc. may fall into one of these categories depending on the nature of the companies involved and the rationale behind the merger. It is important to note that the specific details and terms of the Idaho Plan of Merger between WIT Capital Group, Inc., WIS Merger Corporation, and Sound view Technology Group, Inc. can only be determined by reviewing the actual legal document filed with the appropriate governmental authorities. This description provides a general understanding of what a plan of merger entails and the potential types of merger transactions relevant to this case.

Idaho Plan of Merger between WIT Capital Group, Inc., WIS Merger Corporation and Soundview Technology Group, Inc.

Description

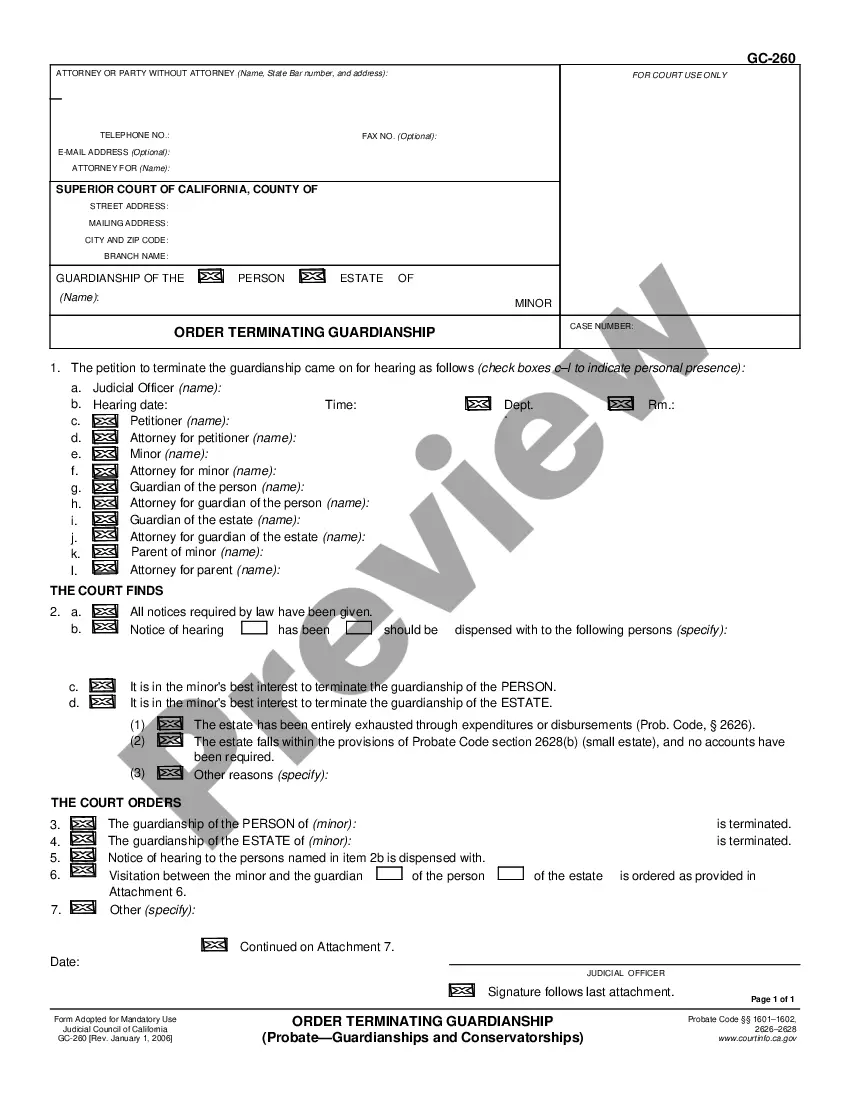

How to fill out Idaho Plan Of Merger Between WIT Capital Group, Inc., WIS Merger Corporation And Soundview Technology Group, Inc.?

If you wish to full, download, or print out legal papers themes, use US Legal Forms, the biggest selection of legal varieties, which can be found on the web. Utilize the site`s simple and easy convenient research to discover the papers you will need. Various themes for enterprise and personal uses are sorted by types and suggests, or keywords and phrases. Use US Legal Forms to discover the Idaho Plan of Merger between WIT Capital Group, Inc., WIS Merger Corporation and Soundview Technology Group, Inc. with a number of clicks.

Should you be presently a US Legal Forms customer, log in to your bank account and then click the Down load button to get the Idaho Plan of Merger between WIT Capital Group, Inc., WIS Merger Corporation and Soundview Technology Group, Inc.. You can even entry varieties you previously delivered electronically within the My Forms tab of the bank account.

Should you use US Legal Forms the first time, follow the instructions under:

- Step 1. Make sure you have chosen the form for that appropriate area/region.

- Step 2. Utilize the Preview solution to examine the form`s content material. Never forget about to read through the description.

- Step 3. Should you be not happy together with the develop, make use of the Research industry near the top of the monitor to find other variations from the legal develop web template.

- Step 4. When you have found the form you will need, go through the Get now button. Select the prices strategy you prefer and add your credentials to sign up for an bank account.

- Step 5. Approach the transaction. You can utilize your Мisa or Ьastercard or PayPal bank account to accomplish the transaction.

- Step 6. Find the format from the legal develop and download it on your own system.

- Step 7. Full, edit and print out or sign the Idaho Plan of Merger between WIT Capital Group, Inc., WIS Merger Corporation and Soundview Technology Group, Inc..

Every legal papers web template you purchase is your own forever. You might have acces to every develop you delivered electronically inside your acccount. Click on the My Forms segment and pick a develop to print out or download once again.

Be competitive and download, and print out the Idaho Plan of Merger between WIT Capital Group, Inc., WIS Merger Corporation and Soundview Technology Group, Inc. with US Legal Forms. There are thousands of expert and express-certain varieties you can utilize to your enterprise or personal requirements.