Idaho Sample Asset Purchase Agreement between Centennial Technologies, Inc. and Intel Corporation - Sample

Description

How to fill out Sample Asset Purchase Agreement Between Centennial Technologies, Inc. And Intel Corporation - Sample?

US Legal Forms - one of the biggest libraries of lawful varieties in the USA - delivers a variety of lawful file web templates you are able to obtain or print out. While using web site, you can find 1000s of varieties for enterprise and personal reasons, sorted by types, claims, or keywords and phrases.You can find the newest versions of varieties much like the Idaho Sample Asset Purchase Agreement between Centennial Technologies, Inc. and Intel Corporation - Sample in seconds.

If you already possess a subscription, log in and obtain Idaho Sample Asset Purchase Agreement between Centennial Technologies, Inc. and Intel Corporation - Sample from your US Legal Forms library. The Download switch will appear on each type you see. You gain access to all formerly delivered electronically varieties in the My Forms tab of your accounts.

If you would like use US Legal Forms initially, listed below are basic recommendations to help you get started:

- Make sure you have picked the best type for the city/state. Select the Preview switch to review the form`s content material. See the type explanation to actually have chosen the right type.

- In case the type doesn`t satisfy your demands, utilize the Look for industry near the top of the display screen to discover the one that does.

- When you are pleased with the shape, verify your option by clicking the Purchase now switch. Then, choose the rates strategy you like and give your credentials to sign up to have an accounts.

- Procedure the deal. Use your bank card or PayPal accounts to accomplish the deal.

- Select the structure and obtain the shape on the product.

- Make adjustments. Load, edit and print out and indication the delivered electronically Idaho Sample Asset Purchase Agreement between Centennial Technologies, Inc. and Intel Corporation - Sample.

Each and every design you included with your money does not have an expiry particular date and is the one you have permanently. So, if you wish to obtain or print out another backup, just go to the My Forms portion and then click around the type you will need.

Get access to the Idaho Sample Asset Purchase Agreement between Centennial Technologies, Inc. and Intel Corporation - Sample with US Legal Forms, one of the most extensive library of lawful file web templates. Use 1000s of expert and state-specific web templates that meet up with your small business or personal requires and demands.

Form popularity

FAQ

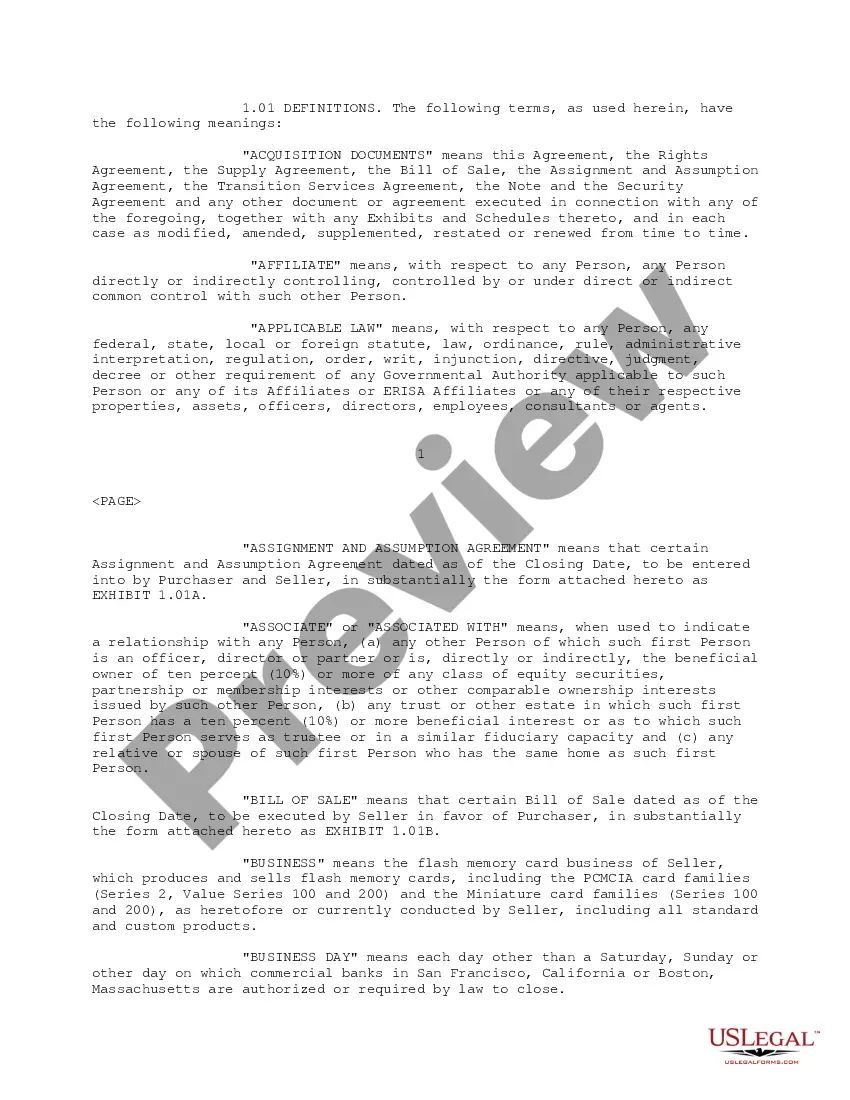

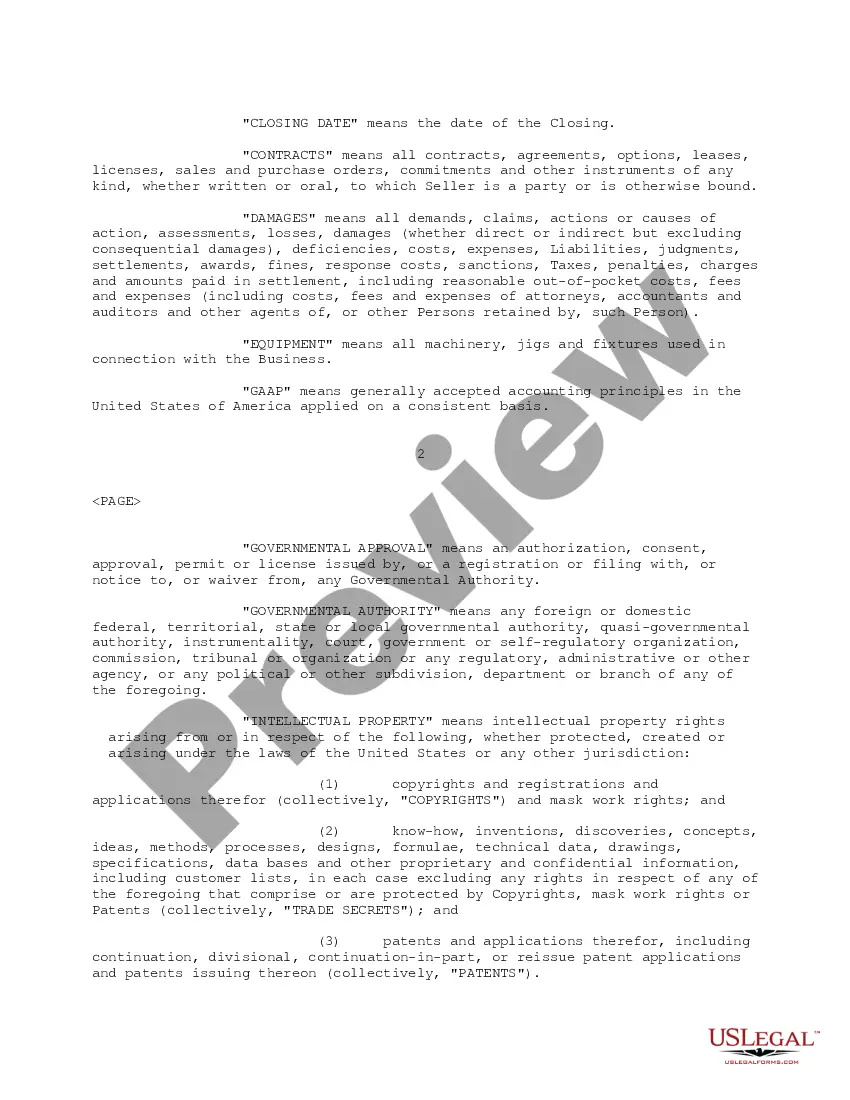

An asset acquisition is the purchase of a company by buying its assets instead of its stock. In most jurisdictions, an asset acquisition typically also involves an assumption of certain liabilities.

In an asset purchase, the buyer agrees to purchase specific assets and liabilities. This means that they only take on the risks of those specific assets. This could include equipment, fixtures, furniture, licenses, trade secrets, trade names, accounts payable and receivable, and more.

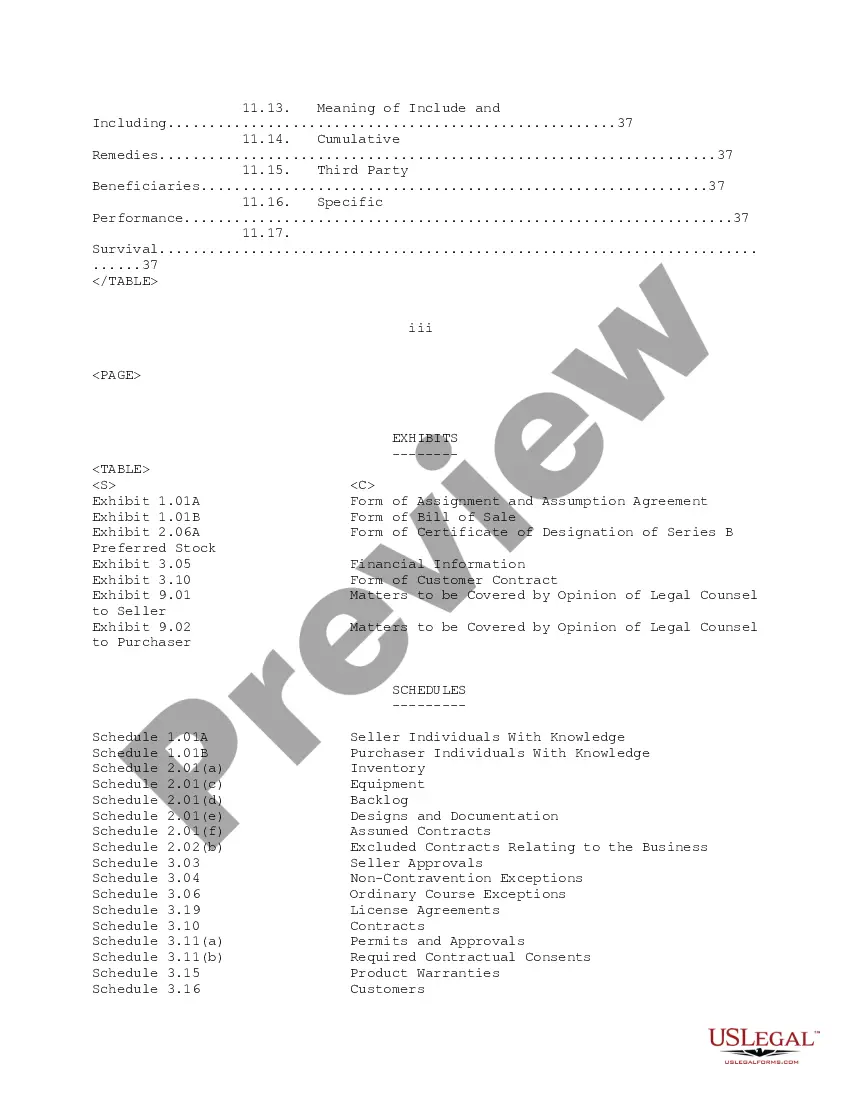

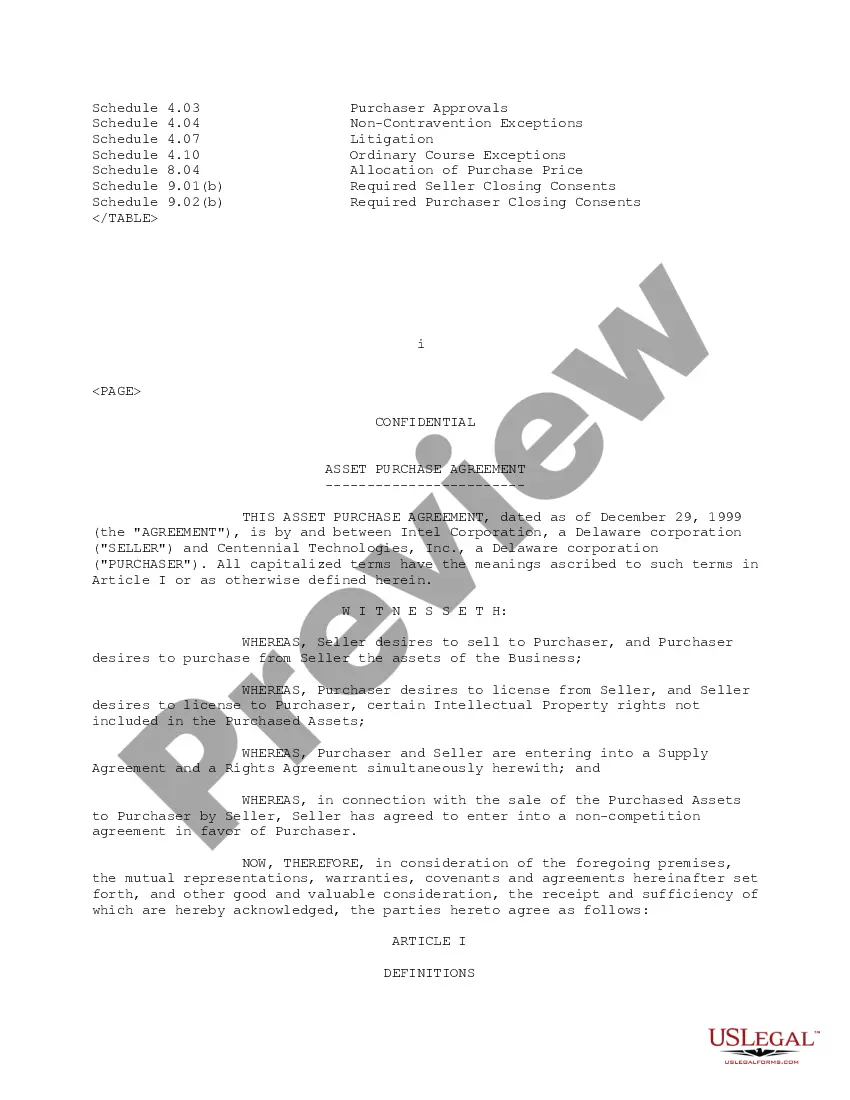

Definitions of the words and terms to be used in the legal instrument. Terms and conditions of the sale and purchase of the assets, including purchase price and terms of the purchase (full payment at close, down payment, subsequent payments, etc.) Terms and conditions of the closing of the agreement, if any.

The terms and conditions for the sale and purchase of the assets, including the purchase price and the terms and conditions for its payment. The terms and conditions for the closing of the transaction, if any.

At its most basic, a purchase agreement should include the following: Name and contact information for buyer and seller. The address of the property being sold. The price to be paid for the property. The date of transfer. Disclosures. Contingencies. Signatures.