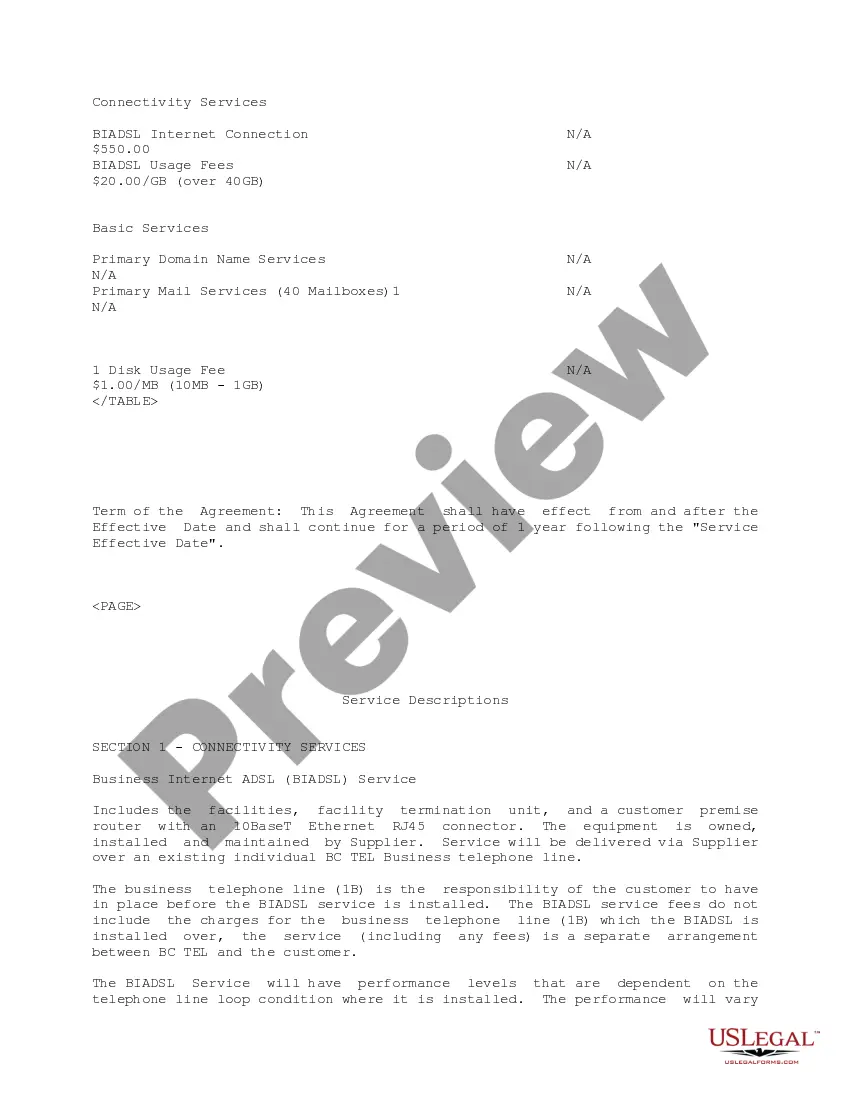

Idaho Internet Business Services Agreement

Description

How to fill out Internet Business Services Agreement?

US Legal Forms - one of the most significant libraries of legitimate forms in the States - provides a variety of legitimate record layouts you may obtain or print out. While using site, you will get a large number of forms for company and personal reasons, categorized by types, says, or search phrases.You can find the latest variations of forms such as the Idaho Internet Business Services Agreement within minutes.

If you already have a subscription, log in and obtain Idaho Internet Business Services Agreement in the US Legal Forms library. The Download switch can look on every kind you view. You gain access to all formerly saved forms inside the My Forms tab of your respective profile.

If you want to use US Legal Forms the very first time, listed below are basic guidelines to help you get started:

- Ensure you have picked the right kind for your personal metropolis/area. Select the Preview switch to analyze the form`s articles. Look at the kind outline to ensure that you have selected the appropriate kind.

- In the event the kind doesn`t fit your requirements, make use of the Search discipline at the top of the screen to discover the one who does.

- When you are content with the form, confirm your choice by simply clicking the Purchase now switch. Then, choose the prices prepare you prefer and provide your references to register for the profile.

- Method the financial transaction. Make use of your charge card or PayPal profile to finish the financial transaction.

- Find the formatting and obtain the form on your own product.

- Make changes. Complete, revise and print out and sign the saved Idaho Internet Business Services Agreement.

Each design you included with your money does not have an expiry particular date and is your own property permanently. So, in order to obtain or print out yet another version, just visit the My Forms section and click on in the kind you need.

Obtain access to the Idaho Internet Business Services Agreement with US Legal Forms, the most substantial library of legitimate record layouts. Use a large number of skilled and express-distinct layouts that meet up with your organization or personal requirements and requirements.

Form popularity

FAQ

New businesses Register your business (and any of its assumed business names) with the Idaho Secretary of State. Apply with the IRS for a federal Employer Identification Number (EIN), if necessary. You must have an EIN if you have employees, if you're a single-member LLC, and in certain other situations.

Ask the IRS to search for your EIN by calling the Business & Specialty Tax Line at 800-829-4933. The hours of operation are a.m. - p.m. local time, Monday through Friday.

The EIN can be obtained by calling (800) 829-4933 or by visiting the IRS website at . If you are interested in attending a Business Basics class in your area, sign up today at .

Services in Idaho are generally not taxable. However ? if the service you provide includes creating or manufacturing a product, you may have to deal with the sales tax on products. Tangible products are taxable in Idaho, with a few exceptions such as prescription drugs.

You need a regular seller's permit if all of these are true: You make any Idaho sales of taxable goods or services (see Who needs a permit). You sell anywhere other than registered marketplace facilitators or short-term rental marketplaces that collect and send in Idaho taxes for all your sales.

You can look up another business's EIN using the SEC's Edgar system, as long as the business is a public company. To verify a charitable organization's EIN, you could check the IRS Tax Exempt Organization Search tool. You may also be able to hire an online company to do the research on your behalf.

Every LLC in the U.S. should obtain a unique Employer Identification Number (EIN) from the Internal Revenue Service. You'll use it when you open a business bank account, file taxes and pay employees. It's available at no cost from the IRS, or have Incfile obtain one for you.

Your account number can be found on your quarterly tax form, by logging in to send a secure message to the Tax Department, or by calling Employer Accounts at (208) 332-3576 or (800) 448-2977.