Idaho Executive Change in Control Agreement for The First National Bank of Litchfield provides a detailed framework for managing executive transitions in the event of a change in control at the bank. This agreement outlines the terms and conditions under which executives will be compensated and protected during such critical events. It ensures that the bank can retain key talent, maintains stability during times of uncertainty, and addresses potential concerns related to leadership changes. With a focus on the First National Bank of Litchfield, this agreement safeguards the interests of both the executives and the bank, making sure that all parties are treated fairly and have appropriate protections in place. By naming specific executives involved, this agreement can vary based on the individuals covered and their positions within the bank. Key provisions of the Idaho Executive Change in Control Agreement typically include: 1. Definitions: Clearly defines important terms used throughout the agreement, such as "change in control," "executive," and "bank," ensuring a common understanding among the parties involved. 2. Change in Control Compensation: Outlines the compensation package that executives will receive in the event of a change in control. Includes details on salary continuation, bonuses, stock options, insurance benefits, and pension plans, among others. These provisions are designed to incentivize executives to remain committed during the transition period and address potential financial uncertainties. 3. Termination Provisions: Describes the circumstances under which an executive's employment may be terminated, whether voluntarily or involuntarily, during a change in control. It outlines the severance package and any post-termination benefits that will be provided. 4. Non-Compete and Non-Disclosure Agreements: Generally, this agreement includes provisions to restrict executives from engaging in competitive activities or disclosing confidential information about the bank, ensuring the protection of the bank's assets and interests even after they have left the organization. 5. Dispute Resolution: Specifies the procedures for resolving any disputes or conflicts that may arise between the bank and the executive regarding the agreement. It may lay out the steps for negotiation, mediation, and arbitration, ultimately ensuring a fair resolution. While the specific Idaho Executive Change in Control Agreement for The First National Bank of Litchfield may have variations tailored to different executives, the underlying purpose remains the same — preserving stability, protecting the interests of both executives and the bank, and providing a structured process for managing leadership transitions during times of change.

Idaho Executive Change in Control Agreement for The First National Bank of Litchfield

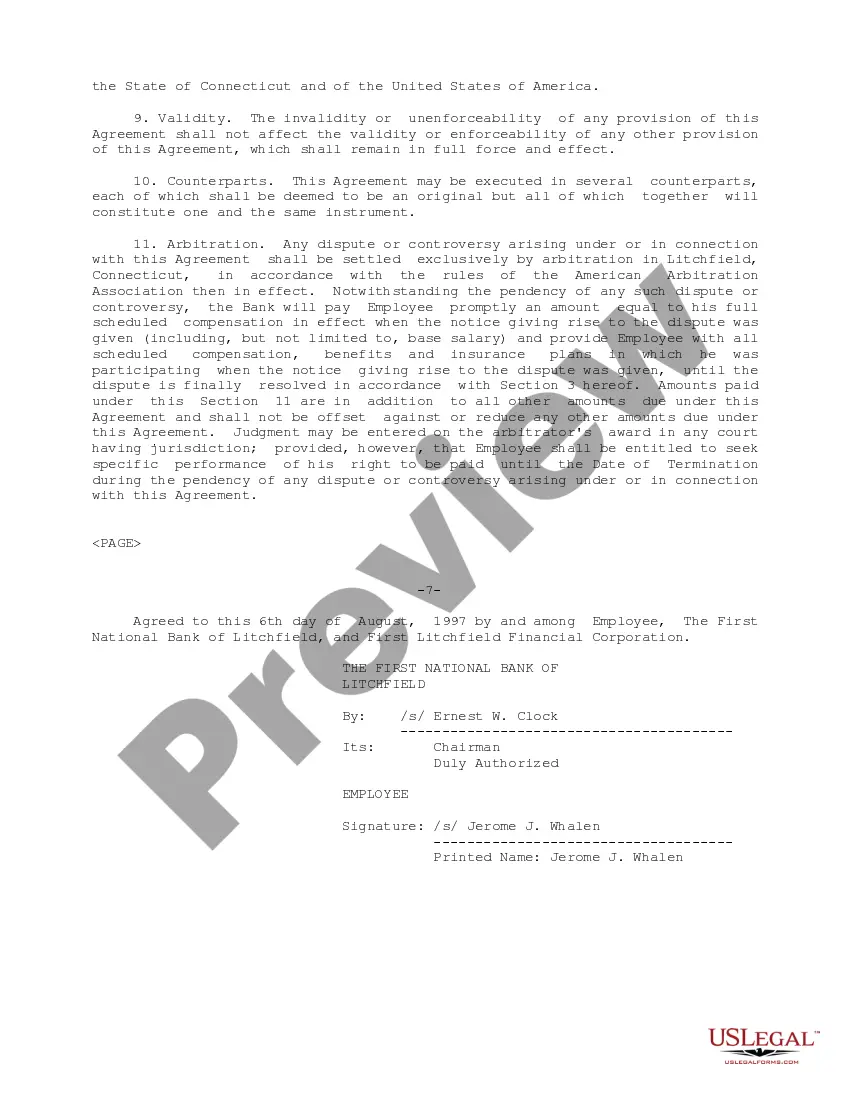

Description

How to fill out Idaho Executive Change In Control Agreement For The First National Bank Of Litchfield?

Are you currently in a place that you will need papers for sometimes organization or personal functions just about every day? There are tons of lawful file themes accessible on the Internet, but finding kinds you can depend on isn`t effortless. US Legal Forms gives a large number of develop themes, just like the Idaho Executive Change in Control Agreement for The First National Bank of Litchfield, that happen to be written to fulfill state and federal demands.

If you are currently knowledgeable about US Legal Forms internet site and get a free account, basically log in. Next, it is possible to obtain the Idaho Executive Change in Control Agreement for The First National Bank of Litchfield format.

Should you not offer an bank account and would like to begin using US Legal Forms, abide by these steps:

- Get the develop you require and make sure it is for the appropriate city/region.

- Utilize the Review button to examine the form.

- See the information to actually have selected the proper develop.

- When the develop isn`t what you are seeking, take advantage of the Search discipline to discover the develop that meets your needs and demands.

- Whenever you find the appropriate develop, simply click Get now.

- Choose the pricing strategy you desire, fill out the necessary details to generate your bank account, and buy the transaction making use of your PayPal or Visa or Mastercard.

- Decide on a hassle-free data file format and obtain your backup.

Find all of the file themes you possess bought in the My Forms menus. You can obtain a more backup of Idaho Executive Change in Control Agreement for The First National Bank of Litchfield anytime, if required. Just select the required develop to obtain or print the file format.

Use US Legal Forms, one of the most comprehensive collection of lawful kinds, in order to save time and stay away from mistakes. The service gives appropriately made lawful file themes that you can use for a variety of functions. Create a free account on US Legal Forms and initiate making your daily life easier.