The Idaho Voting Trust and Divestiture Agreement is a legal arrangement that applies to various situations involving the transfer of voting rights and ownership interests in Idaho-based companies. It aims to ensure transparency, fairness, and compliance when divesting or acquiring assets within the state of Idaho. This agreement is commonly utilized in corporate transactions, mergers and acquisitions, and other strategic business activities. The Idaho Voting Trust and Divestiture Agreement consists of several types, each tailored to specific circumstances and requirements: 1. Corporate Voting Trust: This type of agreement can be established when shareholders of an Idaho corporation desire to delegate their voting rights to a trustee. It safeguards the interests of the shareholders by ensuring that their votes are cast in accordance with their predetermined instructions. The trustee acts as a fiduciary, making informed decisions based on the shareholders' best interests. 2. Asset Divestiture Agreement: When an Idaho-based company intends to divest its assets, particularly in scenarios such as a business sale, restructuring, or voluntary liquidation, an asset divestiture agreement is utilized. This agreement outlines the terms and conditions of the asset transfer, including the allocation of voting rights associated with those assets during and after the divestiture process. 3. Trust and Divestiture Agreement for Public Entities: In situations where a public entity in Idaho intends to divest its ownership interests or voting rights, a specific agreement can be used. This ensures compliance with state regulations and guarantees that the divestiture process is conducted transparently and in the best interest of the constituents or stakeholders. 4. Nonprofit Voting Trust and Divestiture Agreement: For nonprofit organizations in Idaho, this type of agreement permits the responsible delegation of voting rights and handling of ownership interests when divestiture is required. It ensures that the interests of donors, members, or stakeholders are adequately protected during the divestiture or restructuring process. The Idaho Voting Trust and Divestiture Agreement aims to bring coherence, legality, and transparency to the transfer of voting rights and ownership interests within the state's business landscape. It provides a framework for businesses and individuals to navigate complex transactions while adhering to Idaho's legal requirements and ensuring fairness for all parties involved.

Idaho Voting Trust and Divestiture Agreement

Description

How to fill out Idaho Voting Trust And Divestiture Agreement?

Discovering the right authorized file design might be a have difficulties. Naturally, there are a variety of themes accessible on the Internet, but how do you obtain the authorized develop you need? Make use of the US Legal Forms web site. The service offers thousands of themes, including the Idaho Voting Trust and Divestiture Agreement, that can be used for business and personal requirements. All of the forms are checked by experts and meet state and federal requirements.

In case you are currently authorized, log in to your accounts and click on the Download switch to have the Idaho Voting Trust and Divestiture Agreement. Make use of your accounts to check from the authorized forms you possess ordered in the past. Check out the My Forms tab of your own accounts and acquire yet another backup in the file you need.

In case you are a whole new end user of US Legal Forms, listed below are simple recommendations that you should stick to:

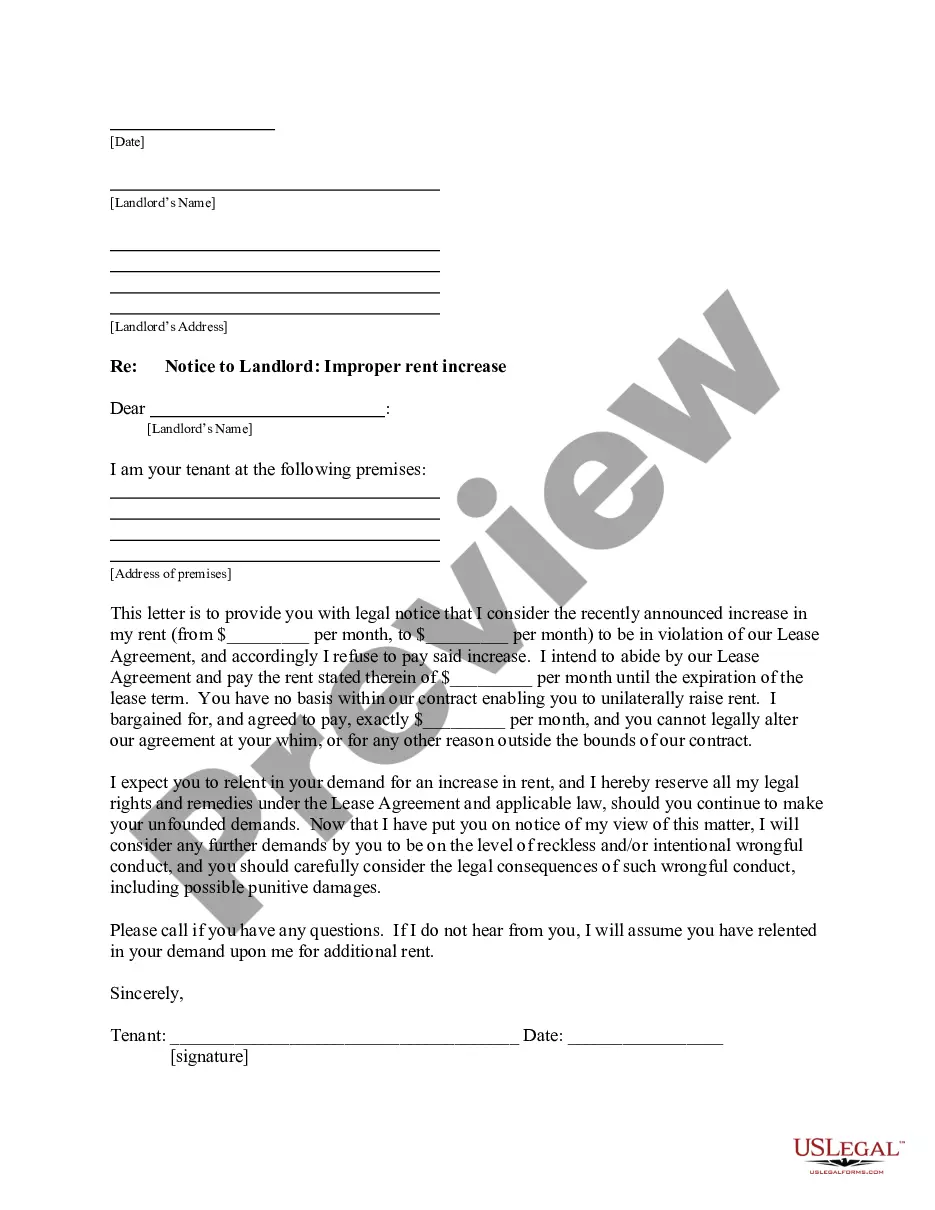

- Initial, make certain you have selected the correct develop for your metropolis/county. You are able to look through the form using the Review switch and read the form information to ensure it will be the best for you.

- In case the develop is not going to meet your needs, utilize the Seach discipline to obtain the correct develop.

- When you are sure that the form is proper, select the Acquire now switch to have the develop.

- Pick the pricing prepare you need and enter in the required info. Make your accounts and buy the order using your PayPal accounts or bank card.

- Choose the data file file format and down load the authorized file design to your system.

- Complete, revise and printing and indication the attained Idaho Voting Trust and Divestiture Agreement.

US Legal Forms will be the largest local library of authorized forms that you can discover different file themes. Make use of the service to down load appropriately-made papers that stick to status requirements.