Idaho Credit Agreement regarding extension of credit

Description

How to fill out Credit Agreement Regarding Extension Of Credit?

Discovering the right legitimate papers web template could be a have a problem. Naturally, there are tons of web templates available on the Internet, but how do you discover the legitimate type you will need? Use the US Legal Forms site. The services delivers 1000s of web templates, for example the Idaho Credit Agreement regarding extension of credit, which can be used for organization and private needs. All of the kinds are checked out by pros and satisfy state and federal needs.

If you are previously listed, log in for your accounts and then click the Obtain option to obtain the Idaho Credit Agreement regarding extension of credit. Utilize your accounts to look through the legitimate kinds you may have acquired in the past. Check out the My Forms tab of your accounts and acquire an additional backup of your papers you will need.

If you are a whole new user of US Legal Forms, allow me to share simple guidelines that you should follow:

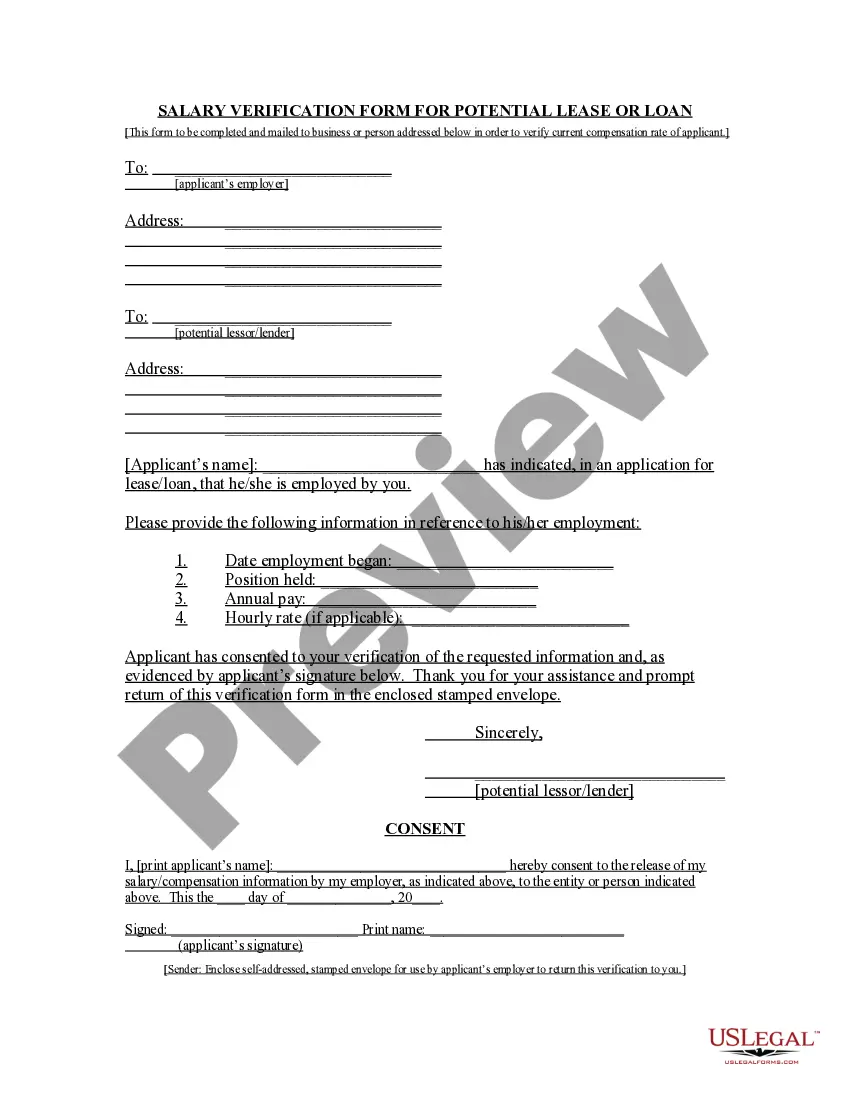

- Initial, make certain you have chosen the right type for your personal city/region. You can look over the form utilizing the Review option and study the form explanation to guarantee this is basically the right one for you.

- In the event the type is not going to satisfy your expectations, make use of the Seach field to find the correct type.

- Once you are sure that the form is suitable, click on the Get now option to obtain the type.

- Select the rates program you need and enter the needed details. Make your accounts and pay money for an order making use of your PayPal accounts or credit card.

- Pick the file file format and down load the legitimate papers web template for your device.

- Full, change and printing and indicator the obtained Idaho Credit Agreement regarding extension of credit.

US Legal Forms will be the largest library of legitimate kinds where you can discover various papers web templates. Use the service to down load expertly-produced papers that follow condition needs.

Form popularity

FAQ

Loan agreements typically include covenants, value of collateral involved, guarantees, interest rate terms and the duration over which it must be repaid. Default terms should be clearly detailed to avoid confusion or potential legal court action.

A credit agreement is a legally binding agreement entered into between a lender and a borrower. It outlines all of the terms of the borrowing relationship, such as the interest rate, costs of originating the loan, and other borrower and lender rights and obligations.

A credit facility agreement details the borrower's responsibilities, loan warranties, lending amounts, interest rates, loan duration, default penalties, and repayment terms and conditions.

Lenders must provide a full disclosure of all of the loan's terms in the credit agreement. That can include the annual interest rate (APR), how the interest is applied to outstanding balances, any fees associated with the account, the duration of the loan, the payment terms, and any consequences for late payments.

(1) With respect to a precomputed regulated consumer credit transaction, the parties may contract for a delinquency charge on any installment not paid in full within ten (10) days after its due date, as originally scheduled or as deferred, in an amount which is not more than five percent (5%) of the unpaid amount of ...

Lenders must provide a full disclosure of all of the loan's terms in the credit agreement. That can include the annual interest rate (APR), how the interest is applied to outstanding balances, any fees associated with the account, the duration of the loan, the payment terms, and any consequences for late payments.