Idaho Checklist — Certificate of Status as an Accredited Investor: A Comprehensive Guide Introduction: The Idaho Checklist — Certificate of Status as an Accredited Investor is a crucial document that verifies an individual's qualification as an accredited investor within the state of Idaho. Being recognized as an accredited investor grants individuals exclusive access to certain investment opportunities that are only available to high-net-worth and sophisticated investors. In this article, we will provide a detailed description of the Idaho Checklist — Certificate of Status as an Accredited Investor and discuss its significance. Additionally, we will outline different types of certificates available under this checklist. Idaho Checklist — Certificate of Status as an Accredited Investor Explained: The Idaho Checklist — Certificate of Status as an Accredited Investor is primarily used to confirm an individual's eligibility to participate in certain private investment opportunities, such as hedge funds, venture capital funds, private equity investments, and other offerings exempted from extensive regulatory disclosures. Accredited investors are deemed to possess the necessary financial knowledge and ability to withstand potential risks associated with these investments better than non-accredited investors. Key Requirements for Certificate of Status as an Accredited Investor in Idaho: To obtain the Certificate of Status as an Accredited Investor in Idaho, individuals are required to meet specific criteria established by the state's regulatory authorities. These criteria typically include the following elements: 1. Net Worth Requirement: An individual should have a net worth exceeding at least $1 million, either individually or jointly with their spouse. 2. Income Requirement: The individual must demonstrate an annual income of at least $200,000 individually or $300,000 jointly with their spouse for the past two years. 3. Expertise/Experience: Alternatively, an individual can qualify as an accredited investor by proving their experience and expertise in financial and business matters. This typically includes holding certain professional certifications, educational degrees, or relevant work experience in the financial industry. Types of Idaho Checklist — Certificate of Status as an Accredited Investor: 1. Individual Accredited Investor Certificate: This type of certificate is issued to individuals who meet the net worth or income requirements outlined in the Idaho regulations. 2. Joint Accredited Investor Certificate: Couples who satisfy the joint net worth or income requirements can obtain this certificate, allowing them to jointly access accredited investor opportunities. 3. Expertise-Based Accredited Investor Certificate: Individuals who may not meet the income or net worth criteria but possess substantial financial knowledge, professional certifications, or relevant experience can obtain this certificate. 4. Renewal Certificates: These certificates are issued upon the expiration of an existing certificate. To maintain accredited investor status, individuals must periodically renew their certificates as required by Idaho's regulatory authorities. Conclusion: The Idaho Checklist — Certificate of Status as an Accredited Investor serves as a vital tool for individuals seeking entrance into exclusive investment opportunities. By meeting the established requirements, investors can obtain various types of certificates, including individual, joint, or expertise-based certificates. It is important to note that maintaining accredited investor status often necessitates certificate renewal. As always, it is advisable to consult with legal and financial professionals well-versed in Idaho securities laws to ensure compliance and maximize investment opportunities.

Idaho Checklist - Certificate of Status as an Accredited Investor

Description

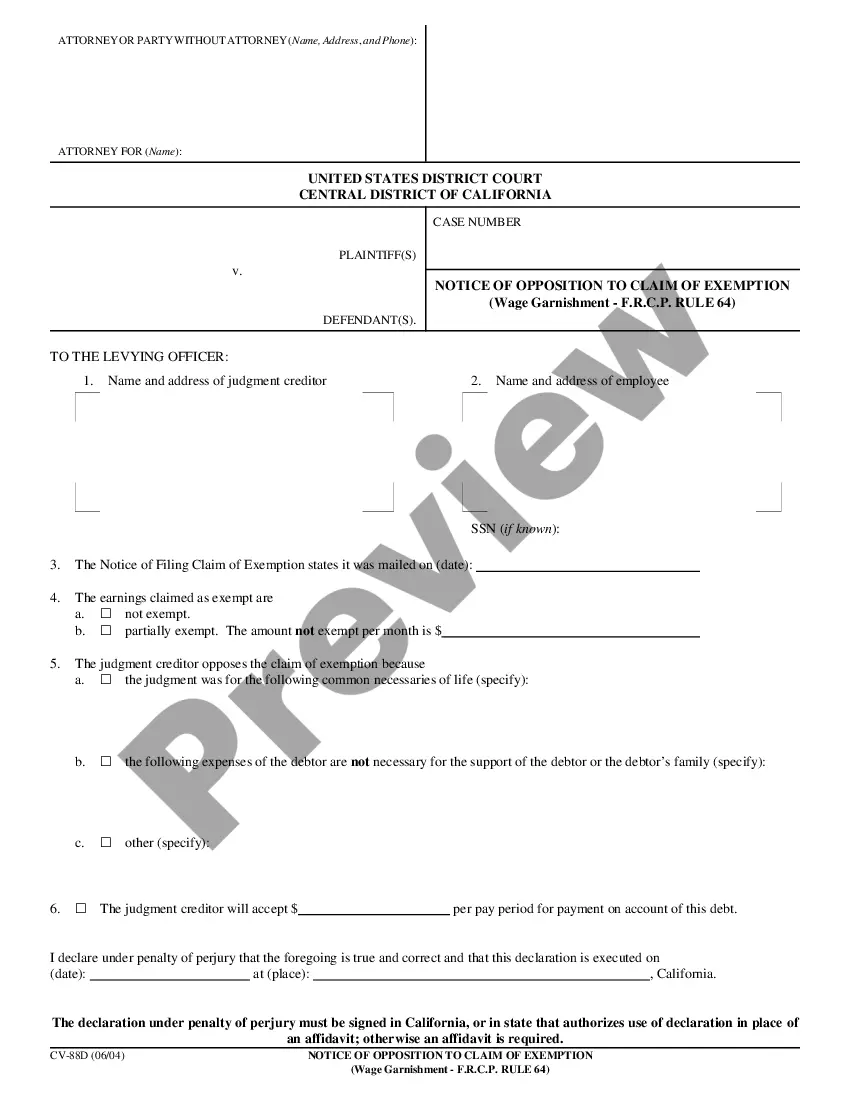

How to fill out Idaho Checklist - Certificate Of Status As An Accredited Investor?

You can invest time on the Internet attempting to find the legal file design that meets the state and federal demands you will need. US Legal Forms gives a large number of legal kinds which can be analyzed by professionals. You can easily down load or printing the Idaho Checklist - Certificate of Status as an Accredited Investor from my support.

If you have a US Legal Forms bank account, it is possible to log in and then click the Download key. Afterward, it is possible to complete, modify, printing, or sign the Idaho Checklist - Certificate of Status as an Accredited Investor. Each and every legal file design you acquire is the one you have eternally. To obtain yet another duplicate of any obtained develop, go to the My Forms tab and then click the corresponding key.

If you work with the US Legal Forms website the first time, adhere to the easy guidelines listed below:

- Initial, be sure that you have selected the right file design for the state/town of your liking. Browse the develop description to ensure you have picked out the proper develop. If readily available, make use of the Preview key to search from the file design too.

- If you would like discover yet another version of your develop, make use of the Lookup industry to discover the design that suits you and demands.

- Upon having identified the design you desire, simply click Purchase now to carry on.

- Pick the pricing strategy you desire, type in your credentials, and register for an account on US Legal Forms.

- Comprehensive the purchase. You can utilize your credit card or PayPal bank account to cover the legal develop.

- Pick the format of your file and down load it for your product.

- Make changes for your file if required. You can complete, modify and sign and printing Idaho Checklist - Certificate of Status as an Accredited Investor.

Download and printing a large number of file templates utilizing the US Legal Forms Internet site, which provides the most important variety of legal kinds. Use specialist and condition-distinct templates to take on your business or individual demands.