Idaho Angel Fund Promissory Note Term Sheet

Description

Term sheet is a non-binding agreement setting forth the basic terms and conditions under which an investment will be made."

How to fill out Angel Fund Promissory Note Term Sheet?

Are you in a placement in which you need to have papers for sometimes business or person purposes nearly every working day? There are a variety of lawful record layouts available on the net, but locating versions you can trust is not straightforward. US Legal Forms offers a large number of kind layouts, like the Idaho Angel Fund Promissory Note Term Sheet, which are created in order to meet state and federal demands.

If you are presently informed about US Legal Forms site and also have an account, merely log in. After that, it is possible to obtain the Idaho Angel Fund Promissory Note Term Sheet template.

If you do not provide an bank account and want to begin using US Legal Forms, follow these steps:

- Obtain the kind you want and make sure it is for your proper city/county.

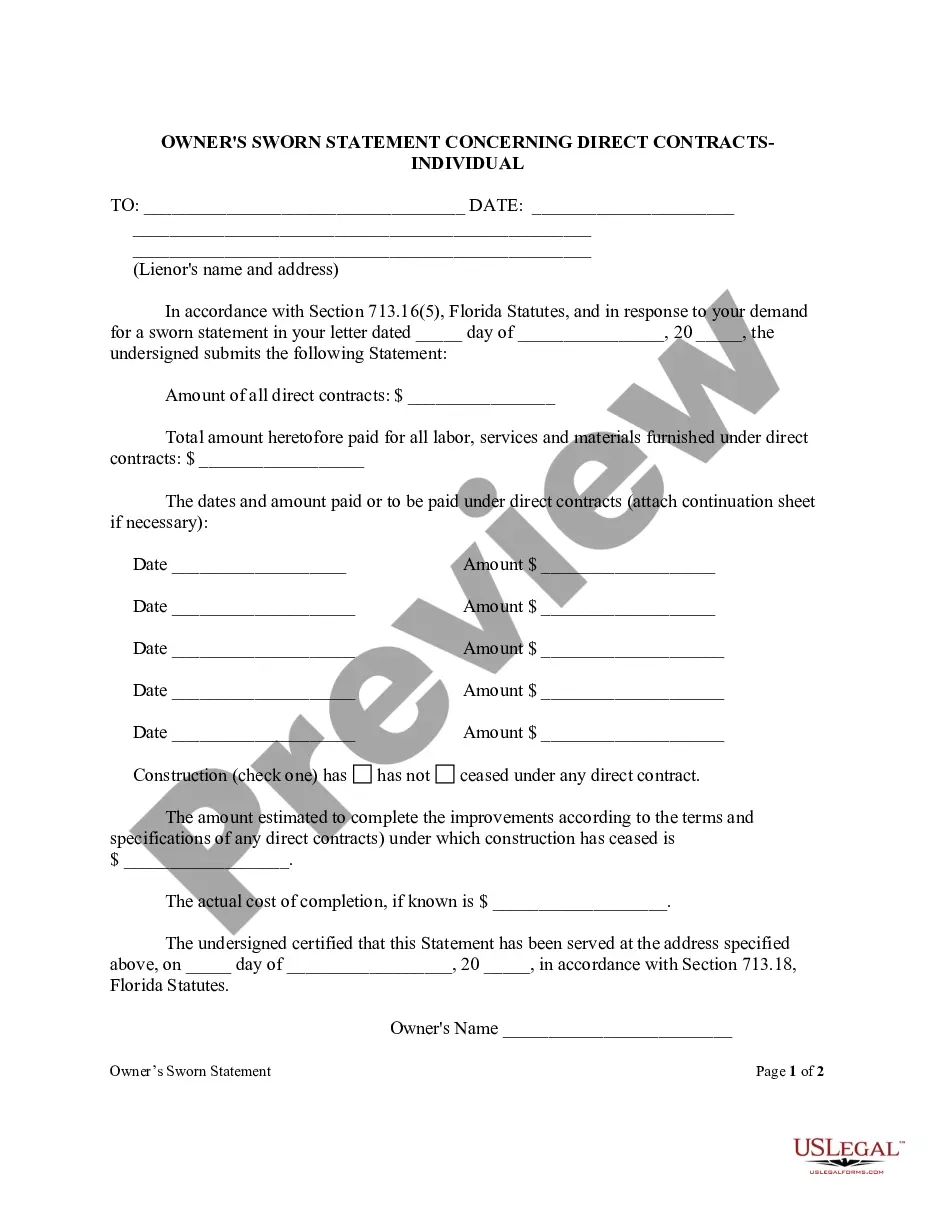

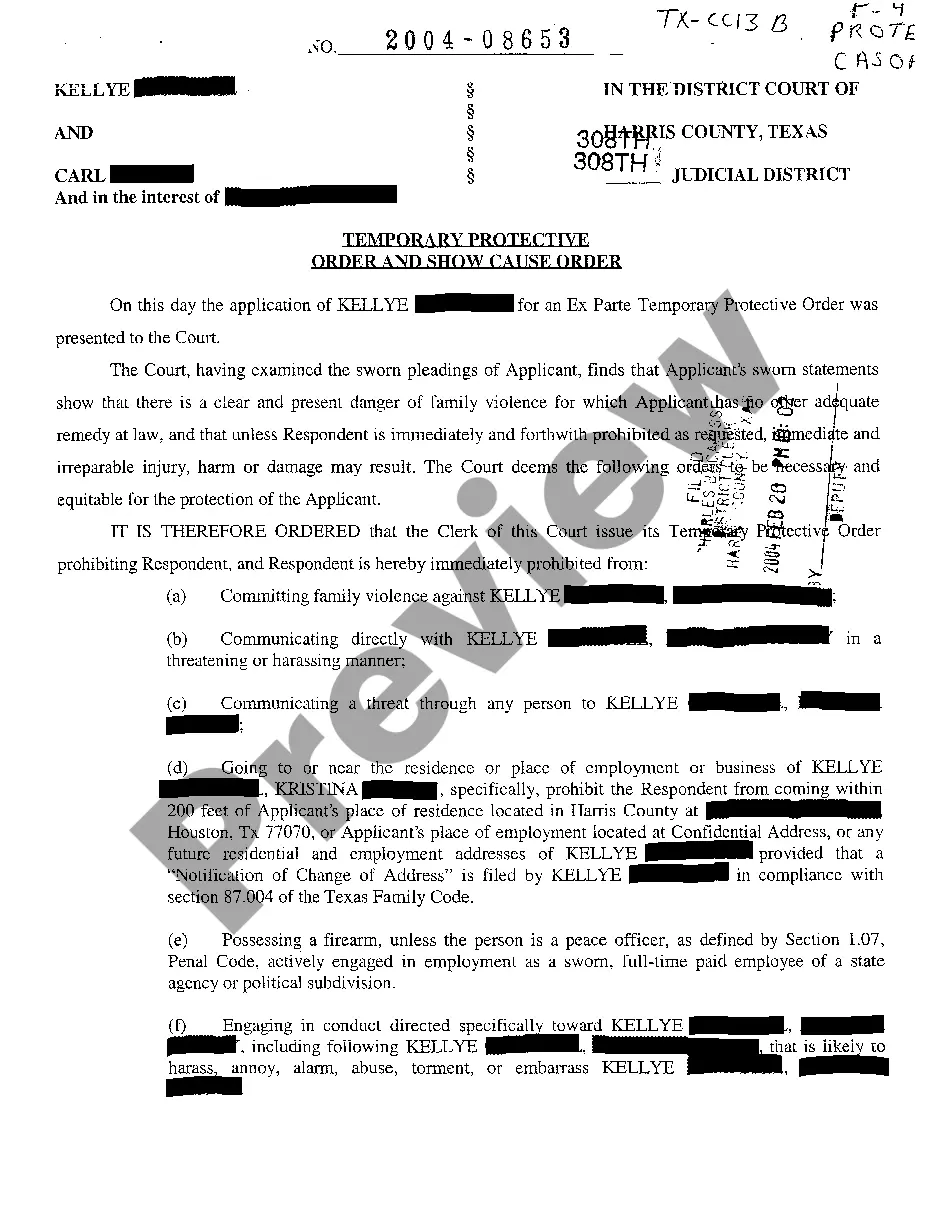

- Take advantage of the Preview button to check the form.

- Look at the outline to ensure that you have selected the correct kind.

- If the kind is not what you are seeking, take advantage of the Look for area to discover the kind that fits your needs and demands.

- When you obtain the proper kind, click on Get now.

- Opt for the pricing prepare you want, submit the required information to create your account, and buy the order utilizing your PayPal or charge card.

- Decide on a handy paper format and obtain your copy.

Find every one of the record layouts you have purchased in the My Forms food list. You may get a more copy of Idaho Angel Fund Promissory Note Term Sheet anytime, if required. Just select the needed kind to obtain or printing the record template.

Use US Legal Forms, probably the most extensive selection of lawful types, in order to save efforts and prevent mistakes. The service offers expertly produced lawful record layouts which you can use for a range of purposes. Generate an account on US Legal Forms and begin making your way of life easier.

Form popularity

FAQ

A term sheet is usually a non-binding agreement outlining the basic terms and conditions of the investment. It serves as a template for the convertible note for both parties.

A promissory note is a form of debt that companies and individuals sometimes use, like loans, to raise money. The issuer, through the notes, promises to return the buyer's funds (principal) and to make fixed interest payments to the buyer in exchange for borrowing the money.

SAFEs vs. convertible notes NotesSAFEsValuation cap??Conversion discount??Maturity date??Accrues interest??1 more row ?

Convertible notes are promissory notes that serve an additional business purpose other than merely representing debt. Convertible notes include all of the terms of a vanilla promissory note, such as an interest rate and the pledge of underlying security (if applicable).

A convertible note is a debt instrument often used by angel or seed investors looking to fund an early-stage startup that has not been valued explicitly. After more information becomes available to establish a reasonable value for the company, convertible note investors can convert the note into equity.

The SAFE is legally a contract of the issuer, constituting an agreement to issue equity in the future at a purchase price paid in advance. It is not debt and, unlike a convertible promissory note, accrues no interest and has no maturity date.