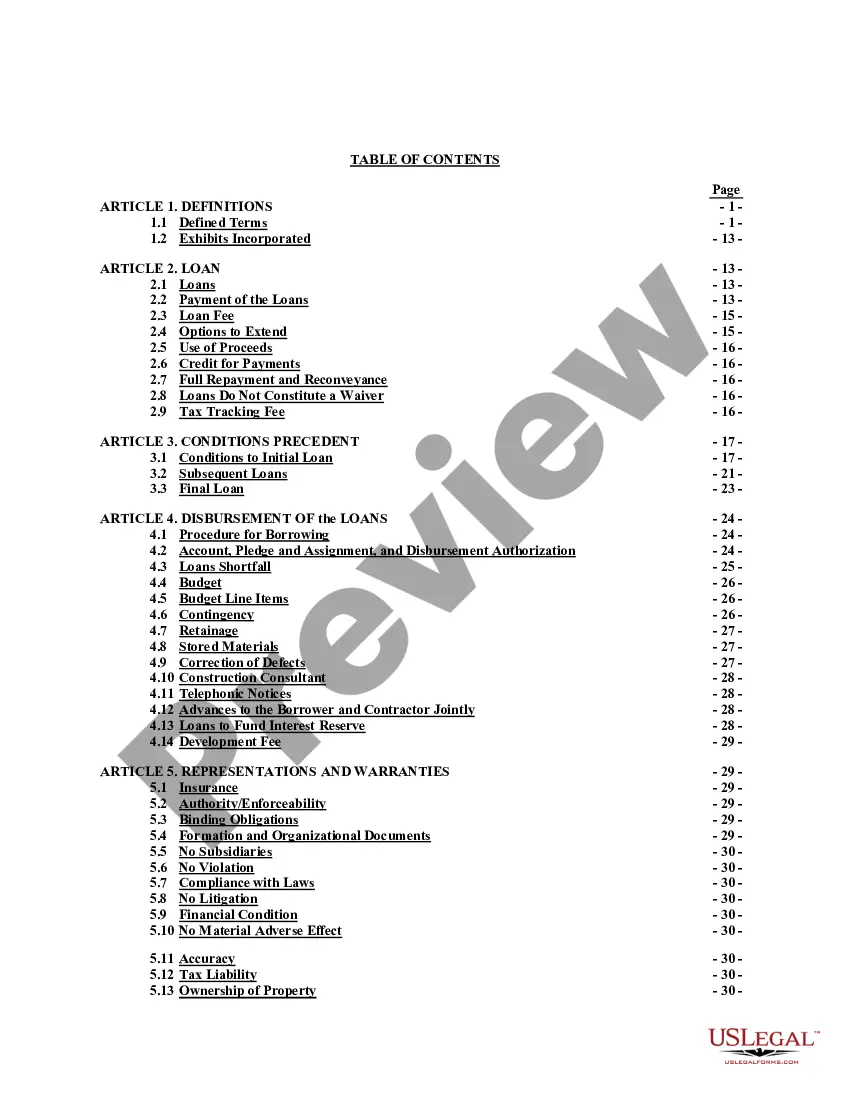

Idaho Construction Loan Agreement

Description

A Loan Agreement is a document between a borrower and lender that details the loan repayment schedule.

The Loan Agreement protects the lender by enforcing the borrower's pledge to repay the loan; payment via regular payments or lump sums. The borrower may also find the loan contract useful because it records the details of the loan for their records and helps keep track of payments.

Loan agreements generally include information about:

* The location.

* The loan amount.

* Interest and late fees.

* Repayment method.

* Collateral and insurance."

How to fill out Construction Loan Agreement?

If you have to total, download, or print out authorized record templates, use US Legal Forms, the greatest variety of authorized varieties, that can be found on-line. Make use of the site`s basic and practical look for to obtain the papers you will need. A variety of templates for enterprise and personal functions are categorized by types and claims, or keywords. Use US Legal Forms to obtain the Idaho Construction Loan Agreement with a couple of click throughs.

When you are previously a US Legal Forms customer, log in to the profile and click the Obtain button to find the Idaho Construction Loan Agreement. Also you can accessibility varieties you earlier saved inside the My Forms tab of your profile.

If you are using US Legal Forms the very first time, refer to the instructions listed below:

- Step 1. Ensure you have selected the shape for your proper area/region.

- Step 2. Make use of the Review option to look over the form`s information. Don`t neglect to see the outline.

- Step 3. When you are not satisfied using the type, take advantage of the Lookup field at the top of the monitor to find other models in the authorized type template.

- Step 4. Upon having located the shape you will need, select the Acquire now button. Select the pricing program you like and add your qualifications to sign up for the profile.

- Step 5. Procedure the deal. You can utilize your Мisa or Ьastercard or PayPal profile to finish the deal.

- Step 6. Find the format in the authorized type and download it on your gadget.

- Step 7. Comprehensive, modify and print out or indication the Idaho Construction Loan Agreement.

Each authorized record template you buy is your own property permanently. You might have acces to every single type you saved in your acccount. Click the My Forms portion and decide on a type to print out or download once again.

Contend and download, and print out the Idaho Construction Loan Agreement with US Legal Forms. There are millions of skilled and condition-specific varieties you can use for the enterprise or personal requires.

Form popularity

FAQ

Construction loans have much shorter terms than conventional mortgages. A 30-year loan may be the most common, but homebuyers have the option of selecting shorter terms depending on their bank, such as 20 or 15 years. A construction loan has a term of one year or less. The rates tend to be much higher, too.

What to include in your loan agreement? The amount of the loan, also known as the principal amount. The date of the creation of the loan agreement. The name, address, and contact information of the borrower. The name, address, and contact information of the lender.

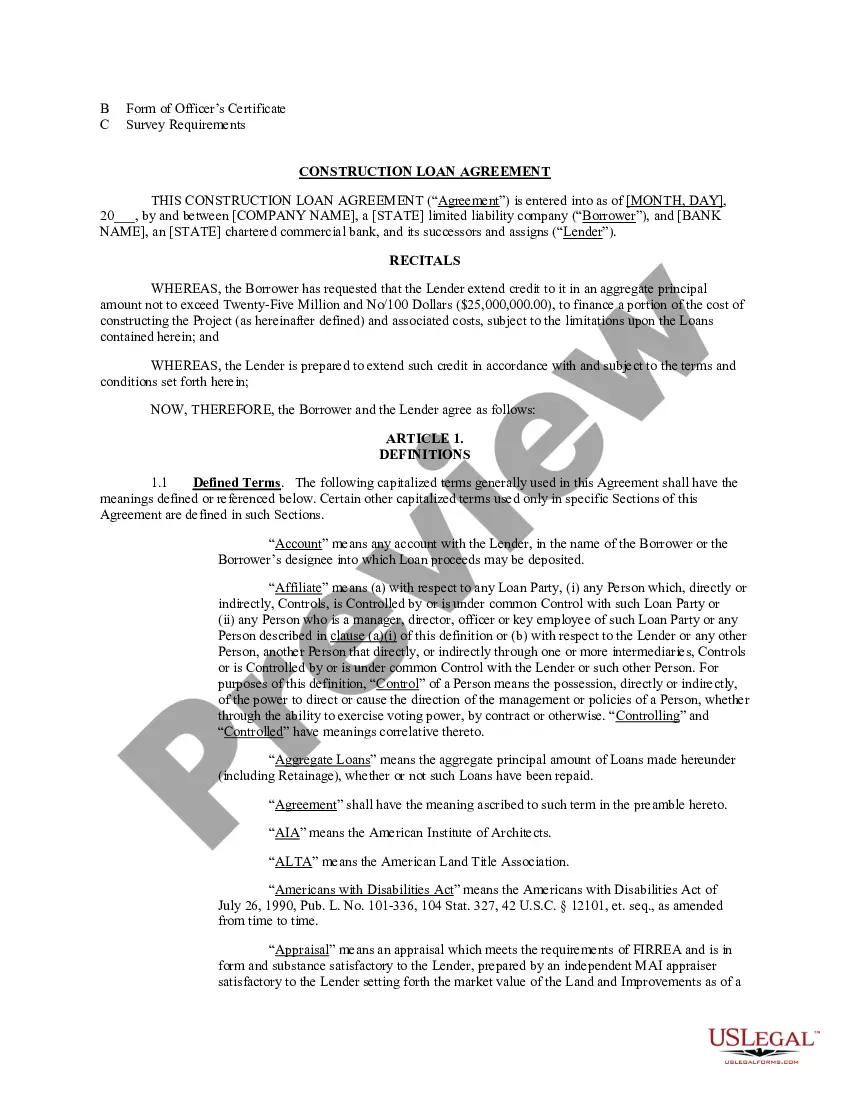

A building loan agreement is a legal contract between a borrower and a lender that outlines the terms of a mortgage. For example, suppose this agreement requires a borrower to pay interest on the full amount of their loan for its duration instead of just interest on any outstanding balance after each payment is made.

A construction loan agreement is a legally binding contract between the lender and the borrower, detailing the promises and commitments both parties have to uphold through successful project completion.

A loan agreement should be structured to include information about the borrower and the lender, the loan amount, and repayment terms, including interest charges and a timeline for repaying the loan. It should also spell out penalties for late payments or default and should be clear about expectations between parties.

A construction loan (also known as a ?self-build loan") is a short-term loan used to finance the building of a home or another real estate project. The builder or home buyer takes out a construction loan to cover the costs of the project before obtaining long-term funding.

For loans by a commercial lender, the lender will provide the agreement. But for loans between friends or relatives, you will need to create your own loan agreement.

Cons to doing a construction loan would be that payments on the construction loan begin once funds start being disbursed to the builder. With a traditional mortgage, payments don't begin until settlement. Another con is that the interest rates on construction loans are typically higher than on traditional mortgages.