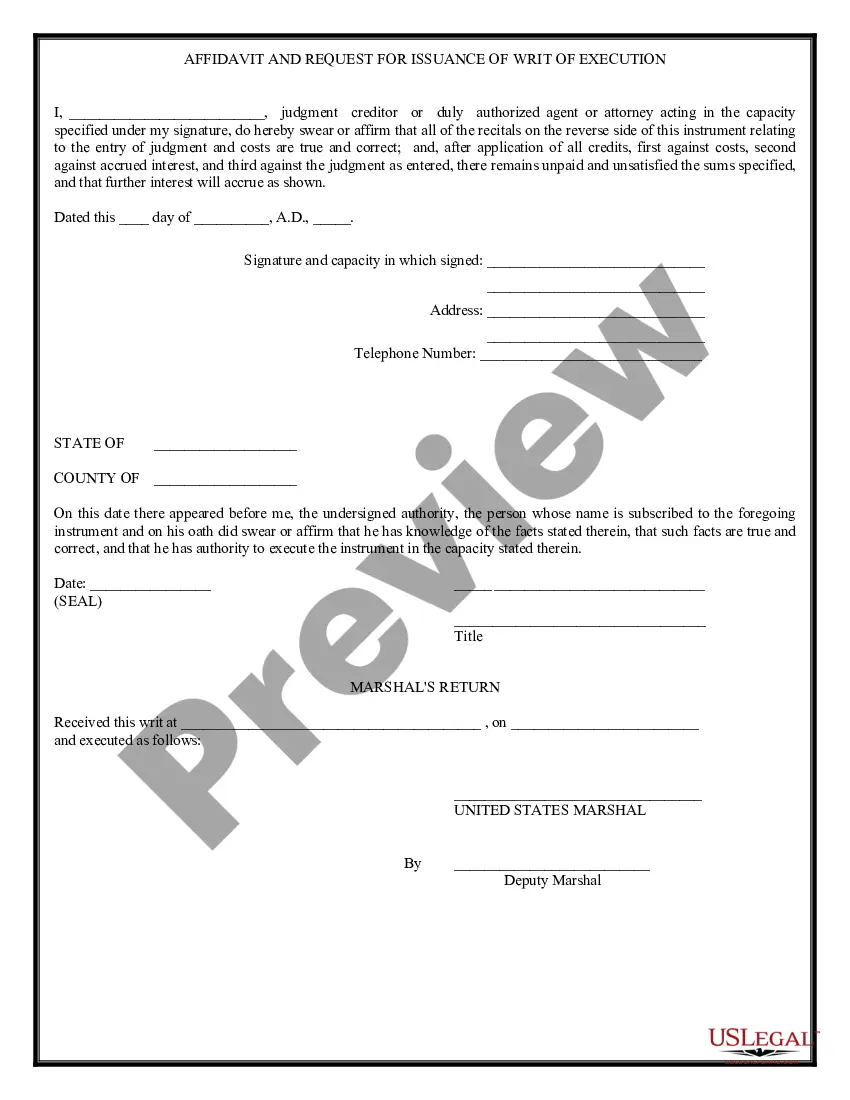

Idaho Writ of Execution

Description

How to fill out Writ Of Execution?

Choosing the right authorized papers template can be quite a battle. Of course, there are plenty of web templates available on the net, but how do you get the authorized type you require? Take advantage of the US Legal Forms internet site. The assistance delivers a huge number of web templates, like the Idaho Writ of Execution, that can be used for enterprise and private demands. All of the forms are checked by professionals and satisfy state and federal needs.

In case you are previously authorized, log in in your account and click on the Download option to get the Idaho Writ of Execution. Use your account to check from the authorized forms you might have acquired earlier. Visit the My Forms tab of the account and have yet another copy in the papers you require.

In case you are a whole new end user of US Legal Forms, allow me to share basic recommendations so that you can follow:

- Initially, be sure you have chosen the appropriate type for your city/state. It is possible to look over the form using the Preview option and study the form description to make sure it will be the right one for you.

- In the event the type fails to satisfy your preferences, take advantage of the Seach field to discover the right type.

- When you are sure that the form is acceptable, click the Get now option to get the type.

- Opt for the pricing program you want and enter in the essential information and facts. Build your account and pay for the transaction with your PayPal account or Visa or Mastercard.

- Opt for the document format and down load the authorized papers template in your gadget.

- Full, edit and print out and indication the attained Idaho Writ of Execution.

US Legal Forms may be the largest collection of authorized forms for which you can discover various papers web templates. Take advantage of the company to down load skillfully-manufactured documents that follow status needs.

Form popularity

FAQ

A writ of execution is a process issued by the court directing the U.S. Marshal to enforce and satisfy a judgment for payment of money. (Federal Rules of Civil Procedure 69). Writ of Execution - U.S. Marshals Service usmarshals.gov ? what-we-do ? civil-process usmarshals.gov ? what-we-do ? civil-process

A Writ of Execution is a court order that commands the Sheriff to levy on the property of a debtor for the satisfaction of a debt. You must give the Sheriff's Office a letter of instruction describing the property to be seized or the action to be taken. You must provide the service information. Civil Process Services & Documents - Ada County Sheriff Ada County (.gov) ? ... ? Civil Division Ada County (.gov) ? ... ? Civil Division

What's next? After you have a Writ of Execution, you will send it with more instructions to the sheriff so they can try to collect the money owed. How to get a Writ of Execution | California Courts | Self Help Guide ca.gov ? after-trial ? collect-money ca.gov ? after-trial ? collect-money

Generally, cases for any other felony must be started within 5 years of the crime. But cases for ritualized abuse of a child or female genital mutilation of a child must be started within 3 years after the victim notifies law enforcement of the crime. Generally, cases for misdemeanors must be started within 1 year.

For collection of a debt on an account, where there is an agreement in writing, the statute of limitations is five years. (Refer to §5-216.) For collection of a debt on an account, where there is an oral agreement, the statute of limitations is four years. (Refer to §5-217.)

A creditor must collect on the debt within five years after a court issues a judgment, although a creditor can renew a judgment for additional five year periods. If the creditor does not collect on or renew the judgment within the five year period, they cannot force the debtor to pay...

While states are free to impose stricter limits, Idaho law is the same as federal law. On a weekly basis, the garnishment can't exceed the lesser of: 25% of your disposable earnings for that week, or. the amount by which your disposable earnings for that week surpasses 30 times the federal minimum hourly wage.

A creditor must collect on the debt within five years after a court issues a judgment, although a creditor can renew a judgment for additional five year periods. If the creditor does not collect on or renew the judgment within the five year period, they cannot force the debtor to pay... Garnishments and Exemptions from Judgments Idaho Legal Aid ? node ? garnishments-... Idaho Legal Aid ? node ? garnishments-...