Idaho Moving Services Contract - Self-Employed

Description

How to fill out Idaho Moving Services Contract - Self-Employed?

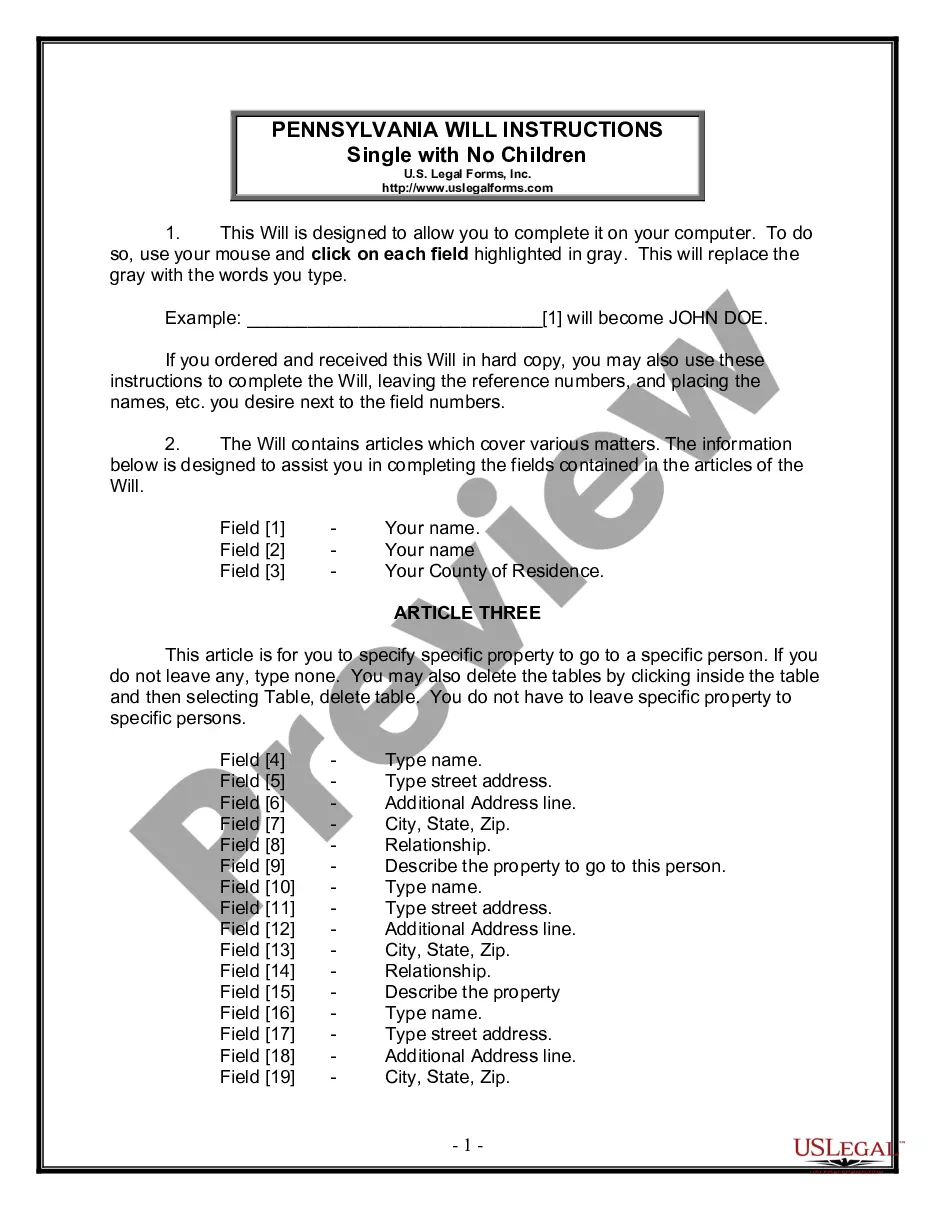

If you have to complete, obtain, or print authorized record layouts, use US Legal Forms, the largest variety of authorized forms, that can be found on the Internet. Use the site`s easy and practical research to find the files you will need. Various layouts for organization and personal reasons are sorted by types and states, or keywords. Use US Legal Forms to find the Idaho Moving Services Contract - Self-Employed in a handful of click throughs.

If you are presently a US Legal Forms consumer, log in to your account and then click the Down load button to have the Idaho Moving Services Contract - Self-Employed. You may also accessibility forms you formerly acquired within the My Forms tab of your respective account.

If you work with US Legal Forms initially, follow the instructions below:

- Step 1. Be sure you have chosen the shape for that appropriate metropolis/land.

- Step 2. Utilize the Review method to check out the form`s content. Do not overlook to learn the explanation.

- Step 3. If you are unsatisfied using the type, use the Research field on top of the display screen to get other variations of your authorized type template.

- Step 4. Upon having found the shape you will need, click the Get now button. Select the rates plan you like and add your references to register to have an account.

- Step 5. Process the deal. You may use your Мisa or Ьastercard or PayPal account to finish the deal.

- Step 6. Find the file format of your authorized type and obtain it on the product.

- Step 7. Full, revise and print or sign the Idaho Moving Services Contract - Self-Employed.

Each and every authorized record template you purchase is yours permanently. You possess acces to every type you acquired in your acccount. Select the My Forms portion and decide on a type to print or obtain again.

Contend and obtain, and print the Idaho Moving Services Contract - Self-Employed with US Legal Forms. There are thousands of professional and state-particular forms you may use for the organization or personal demands.

Form popularity

FAQ

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.

If your independent contractor agreement contains a provision that allows the parties to terminate the relationship at any time, revise the agreement to include a notice provision with at least some kind of a notice period required for termination of the contract.

Remember that an independent contractor is considered to be self-employed, so in effect, you are running your own one-person business. Any income that you earn as an independent contractor must be reported on Schedule C. You'll then pay income taxes on the total profit.

Contractors (sometimes called consultants) are self-employed people engaged for a specific task at an agreed price and with a specific goal in mind, often over a set period of time.

No, Oregon does not issue an independent contractor license. Although various trades and professional occupations may have licensure requirements, merely holding such a license does not make anyone into an independent contractor.

The most common business organizations for Independent Contractors include C-corporation, S-Corporation, Partnership, Limited Partnership (LP), Limited Liability Partnership (LLP), Limited Liability Company (LLC), and Sole Proprietorship.

Every independent contractor is a business owner. You run a business even if you are your only employee and you don't have a company name. There are significant differences, however, between a business that's just you as an independent contractor and running a company with employees and a registered name.

All contractors are required by Idaho law to be registered with the Idaho Contractors Board, which is a division of the State of Idaho, Bureau of Occupational Licenses.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

There are several types of business bank accounts to consider for your independent contracting business. You can consider an account with a local bank as well as an online business bank account. You may prefer mobile banking if you don't need to go into a physical branch and don't need to deposit cash.