Idaho Self-Employed Independent Contractor Construction Worker Contract

Description

How to fill out Idaho Self-Employed Independent Contractor Construction Worker Contract?

You can spend hours on the Internet looking for the lawful document web template that fits the state and federal requirements you need. US Legal Forms gives a huge number of lawful forms that are examined by specialists. It is possible to acquire or print out the Idaho Self-Employed Independent Contractor Construction Worker Contract from my assistance.

If you have a US Legal Forms account, you can log in and click on the Download switch. Next, you can total, change, print out, or indicator the Idaho Self-Employed Independent Contractor Construction Worker Contract. Each and every lawful document web template you buy is yours for a long time. To have an additional version of the bought form, proceed to the My Forms tab and click on the corresponding switch.

If you use the US Legal Forms site the very first time, stick to the straightforward recommendations below:

- Very first, make sure that you have selected the right document web template for your state/city that you pick. Browse the form explanation to make sure you have chosen the appropriate form. If accessible, take advantage of the Preview switch to search with the document web template also.

- If you want to discover an additional version of your form, take advantage of the Look for field to find the web template that fits your needs and requirements.

- When you have located the web template you want, click Get now to move forward.

- Pick the pricing program you want, enter your accreditations, and register for a free account on US Legal Forms.

- Full the transaction. You can use your charge card or PayPal account to fund the lawful form.

- Pick the file format of your document and acquire it to the product.

- Make changes to the document if necessary. You can total, change and indicator and print out Idaho Self-Employed Independent Contractor Construction Worker Contract.

Download and print out a huge number of document themes utilizing the US Legal Forms web site, which offers the biggest variety of lawful forms. Use specialist and condition-distinct themes to take on your organization or person requires.

Form popularity

FAQ

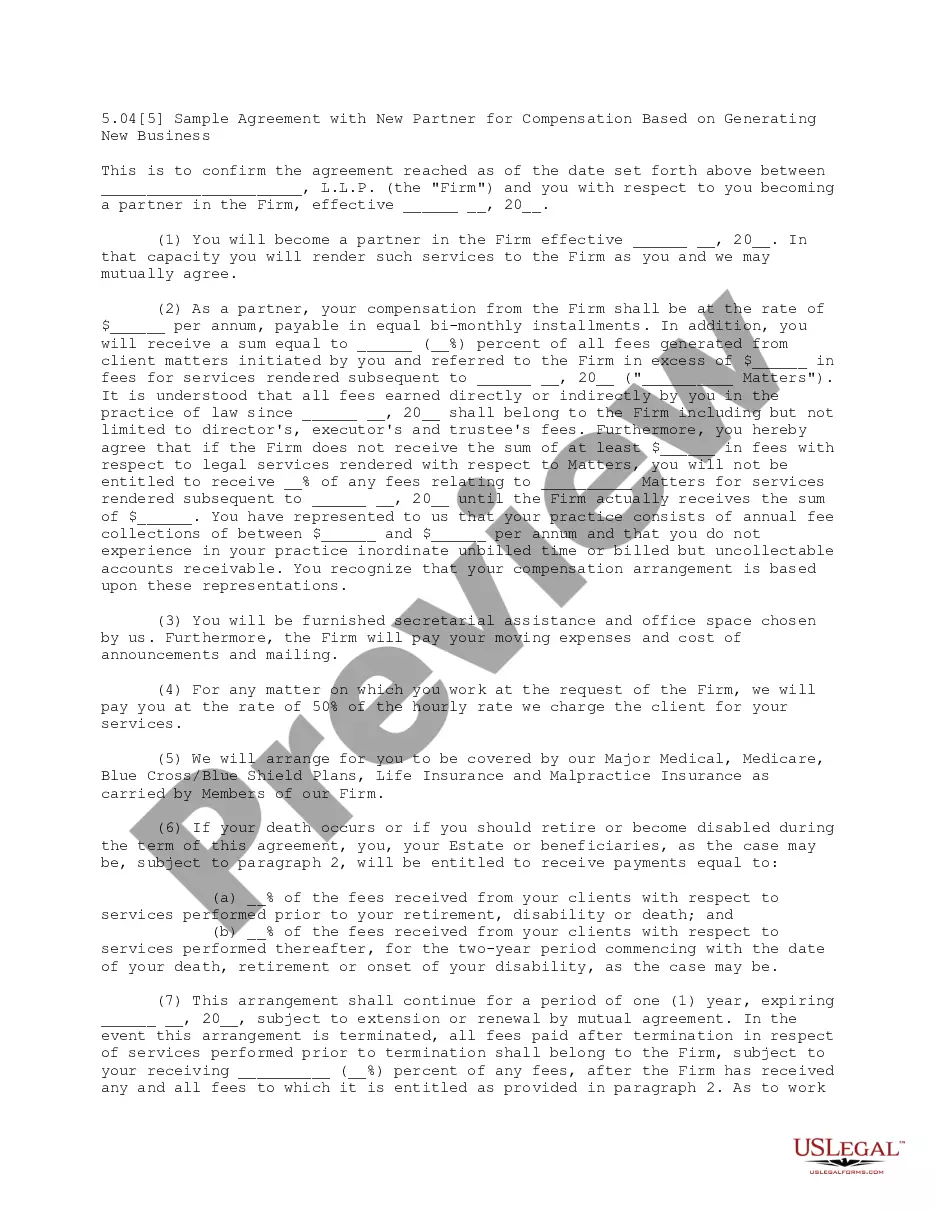

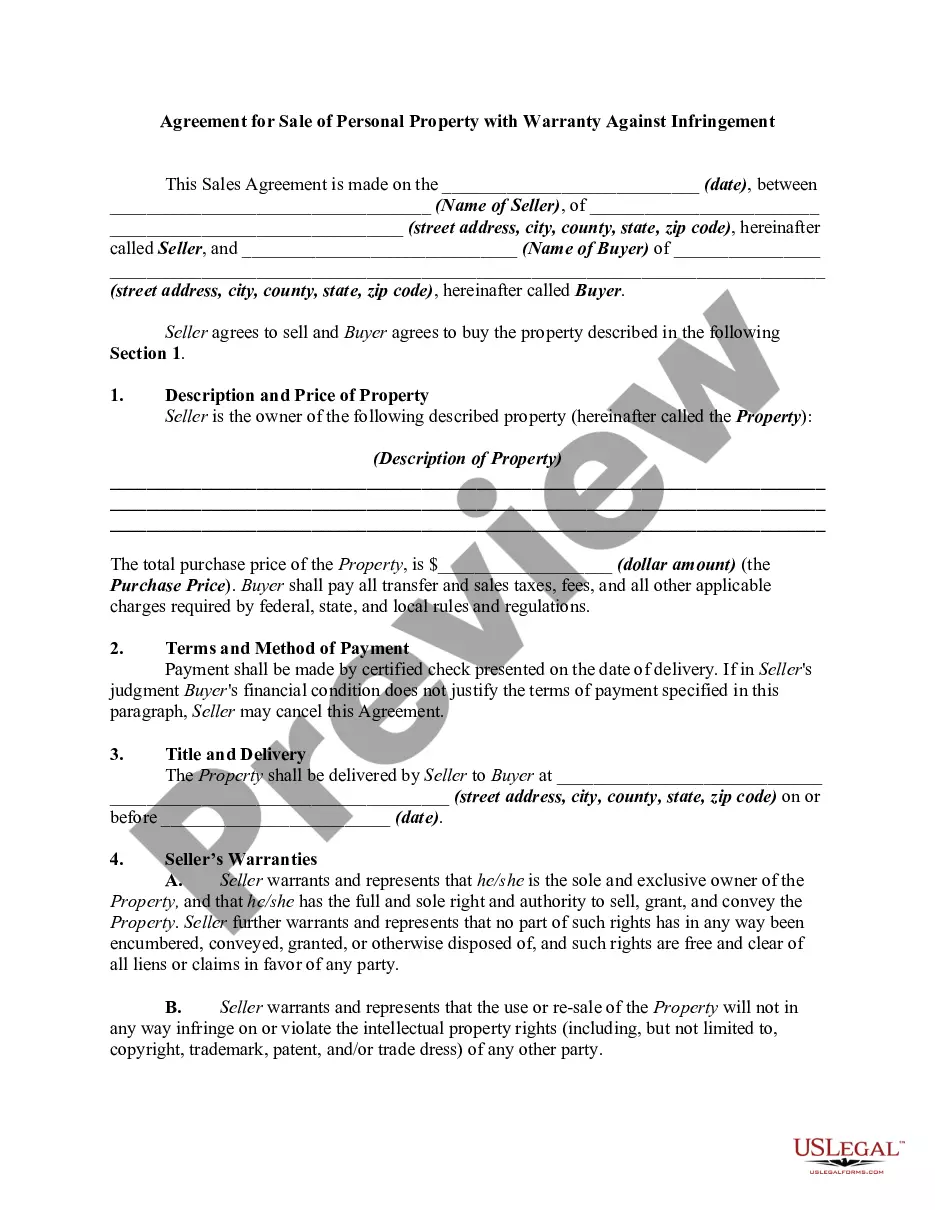

An independent contractor agreement is a contract between a freelancer and a company or client outlining the specifics of their work together. This legal contract usually includes information regarding the scope of the work, payment, and deadlines.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees. In contrast, actual company employees are considered W-2 employees.

Self-employed people are those who own their own businesses and work for themselves. According to the IRS, you are self-employed if you act as a sole proprietor or independent contractor, or if you own an unincorporated business.

An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.

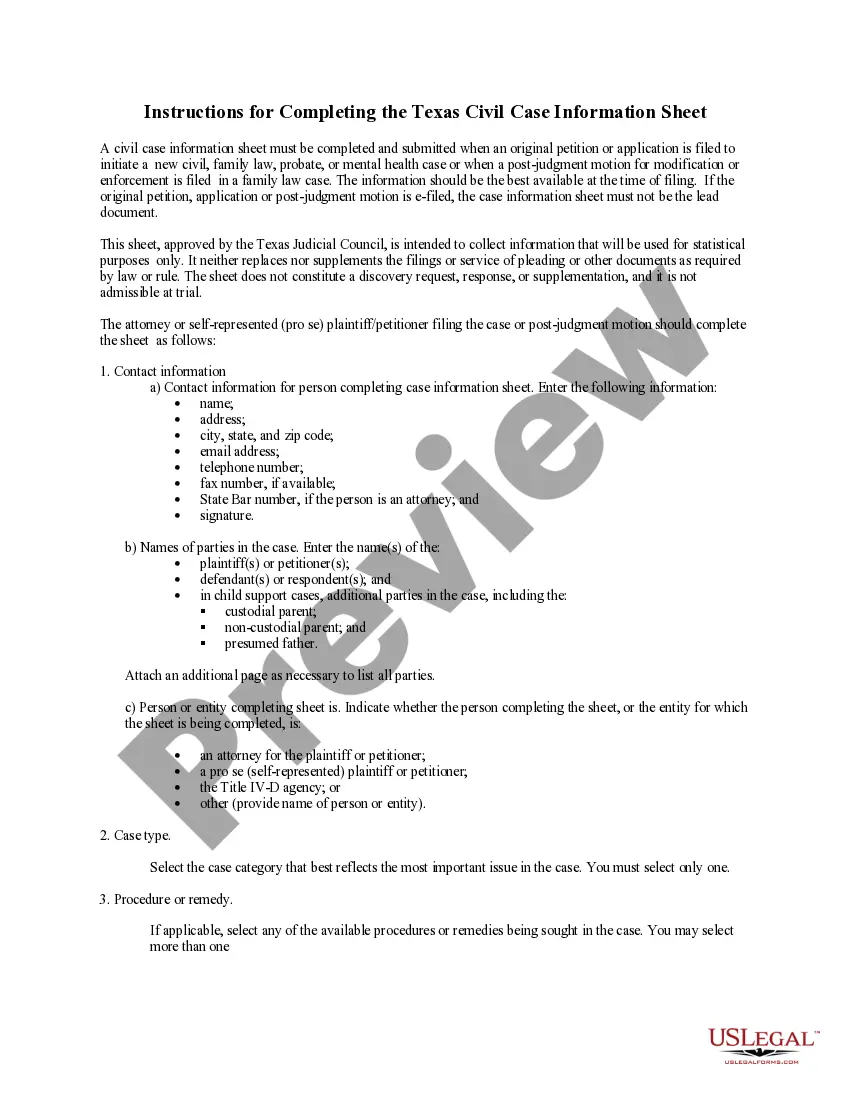

All contractors are required by Idaho law to be registered with the Idaho Contractors Board, which is a division of the State of Idaho, Bureau of Occupational Licenses.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.