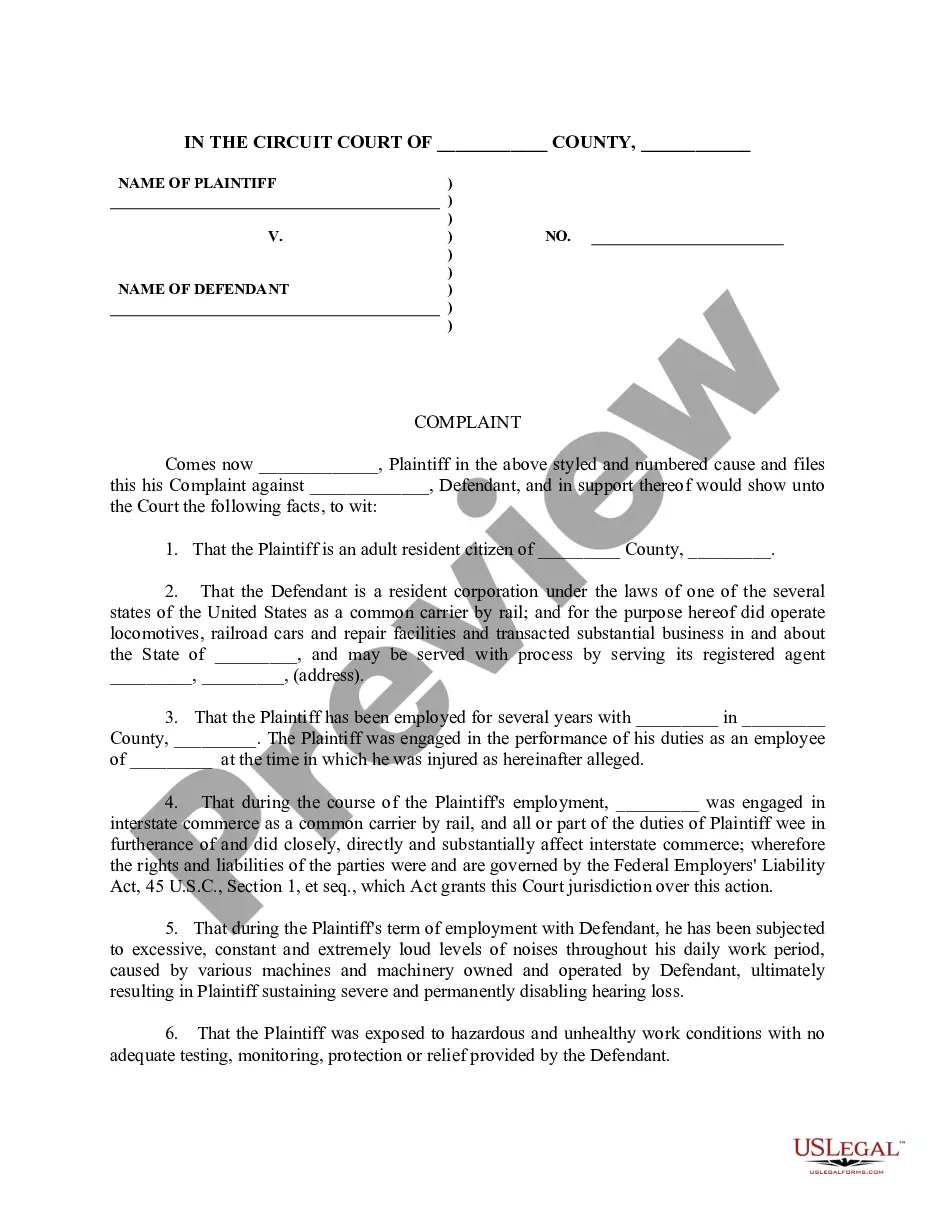

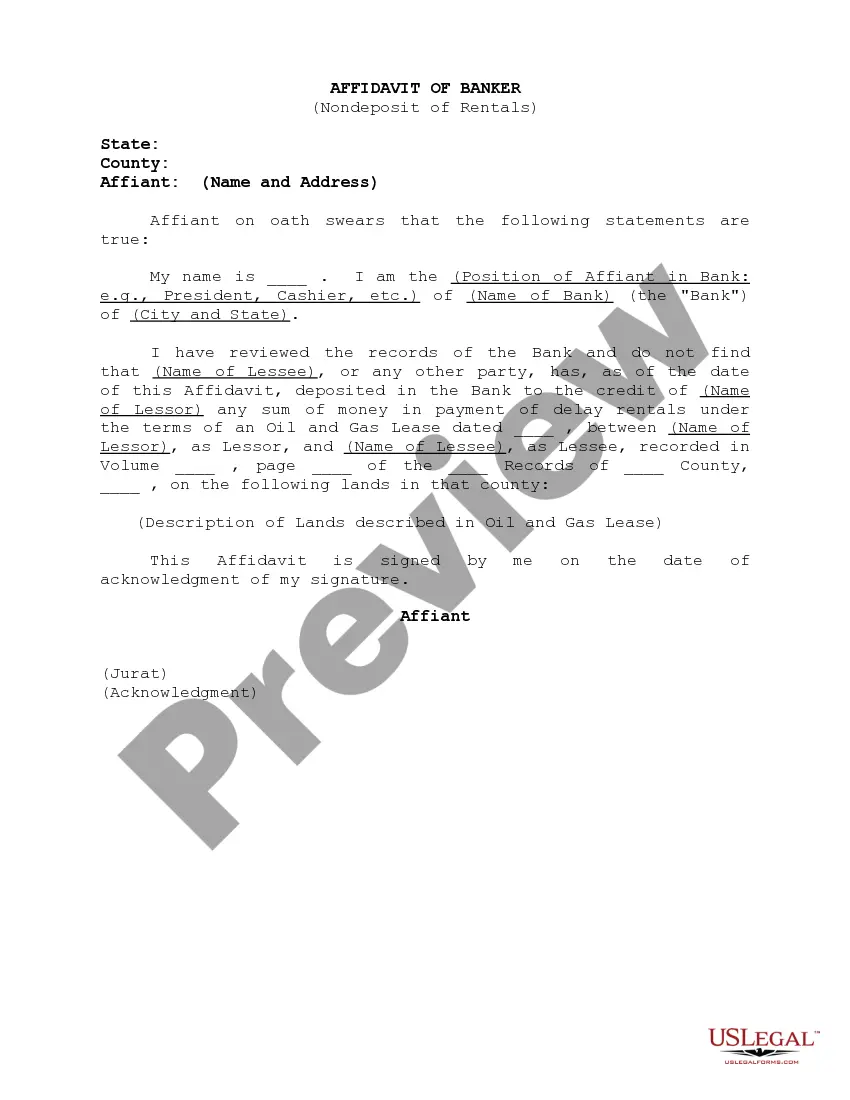

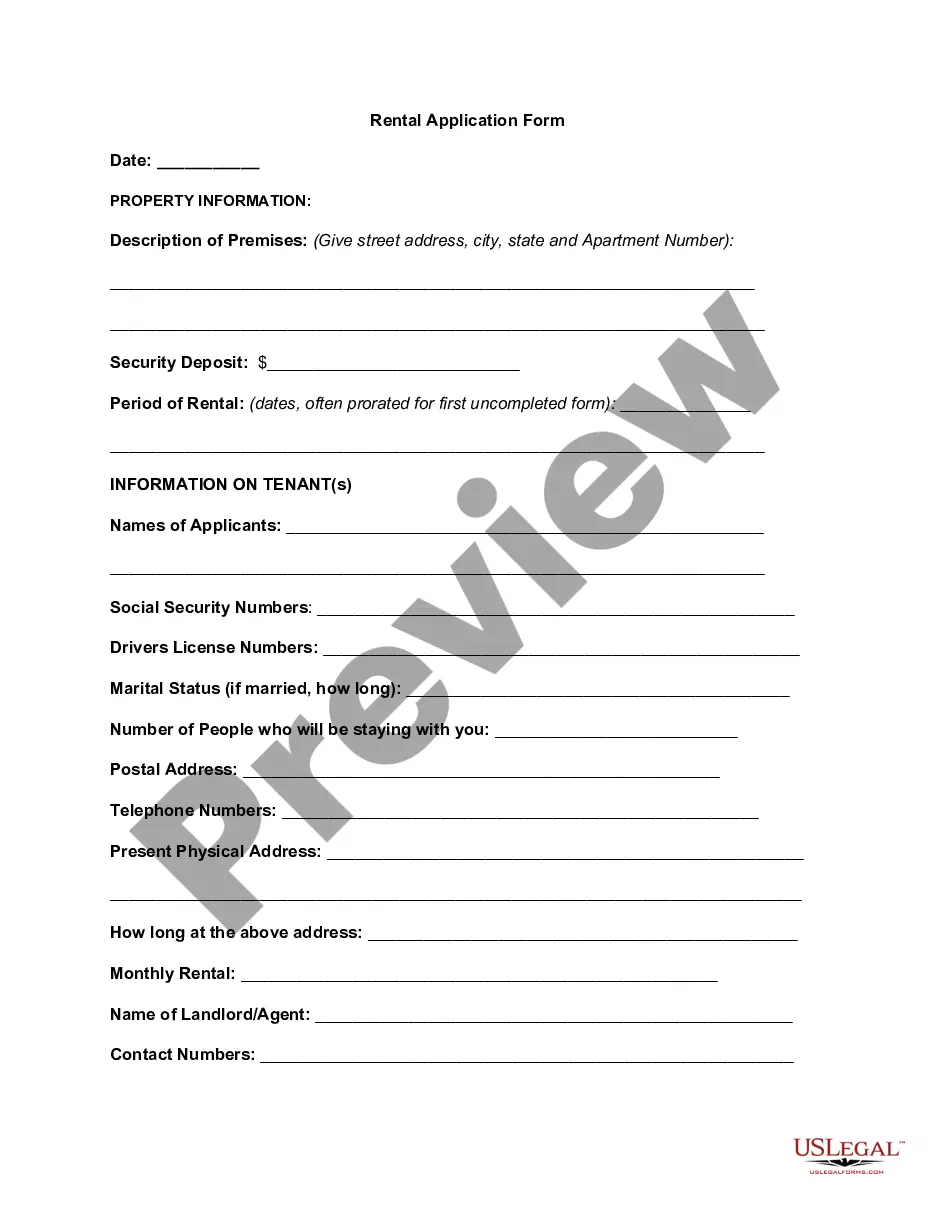

Idaho Accounting Agreement — Self-Employed Independent Contractor: A Comprehensive Guide Introduction: The Idaho Accounting Agreement — Self-Employed Independent Contractor is a legally binding contract that outlines the terms and conditions for accounting services provided by self-employed individuals in the state of Idaho. This agreement is crucial for establishing a professional relationship between the accounting service provider and their clients, ensuring a clear understanding of responsibilities, compensation, and other important aspects of the services rendered. Key Elements: 1. Scope of Services: The Idaho Accounting Agreement defines the specific accounting services to be provided by the self-employed independent contractor. This may include bookkeeping, tax preparation, financial analysis, payroll management, or any other relevant service. 2. Compensation: The agreement outlines the compensation structure, including hourly rates, flat fees, or any alternative payment arrangements. It may also include details about invoicing, payment terms, and penalties for late payments. 3. Contract Duration: This section clarifies the duration of the agreement, specifying the start and end dates, or indicating that the agreement is ongoing until either party terminates it with notice. 4. Independent Contractor Status: The agreement reaffirms the self-employed independent contractor status of the accounting service provider, emphasizing that no employee-employer relationship exists between the parties involved. This is important for tax and legal purposes, ensuring compliance with relevant Idaho laws and regulations. 5. Confidentiality: Confidentiality clauses are included to protect the sensitive financial information shared by clients with the accounting service provider. It outlines the duty of the contractor to maintain the confidentiality of client data and restrict its use to the agreed-upon services. 6. Intellectual Property: If the accounting service provider creates any original intellectual property, such as customized software or templates, the agreement specifies ownership rights and usage permissions. Different Types of Idaho Accounting Agreement — Self-Employed Independent Contractor: 1. Basic Accounting Services Agreement: This agreement covers general accounting services like bookkeeping, tax preparation, and financial statement preparation. 2. Payroll Management Agreement: This agreement specifically focuses on payroll management services, including payroll processing, tax withholding, and payroll reporting. 3. Tax Consulting Agreement: This agreement is tailored for tax consulting services, such as tax planning, compliance assistance, and representation before tax authorities. 4. Financial Analysis Agreement: Ideal for businesses seeking in-depth financial analysis and reporting services, this agreement defines the scope of financial analysis, forecasting, and budgeting services to be provided. Conclusion: The Idaho Accounting Agreement — Self-Employed Independent Contractor serves as a valuable tool for establishing a professional relationship between accounting service providers and their clients. By clearly defining the scope of services, compensation, confidentiality, and other crucial aspects, this agreement ensures both parties have a comprehensive understanding of their rights and obligations. It is important for self-employed individuals in the accounting profession to choose the appropriate type of agreement based on the specific services they offer to ensure optimum clarity and legal protection.

Idaho Accounting Agreement - Self-Employed Independent Contractor

Description

How to fill out Idaho Accounting Agreement - Self-Employed Independent Contractor?

Choosing the right legal document template can be a battle. Obviously, there are tons of layouts available on the Internet, but how can you get the legal form you require? Take advantage of the US Legal Forms site. The support offers a huge number of layouts, like the Idaho Accounting Agreement - Self-Employed Independent Contractor, which you can use for business and personal requirements. Each of the types are checked out by experts and satisfy federal and state specifications.

If you are presently registered, log in to your accounts and click the Obtain key to obtain the Idaho Accounting Agreement - Self-Employed Independent Contractor. Make use of your accounts to look through the legal types you possess purchased formerly. Check out the My Forms tab of your own accounts and obtain yet another backup from the document you require.

If you are a brand new end user of US Legal Forms, here are simple instructions so that you can stick to:

- Initial, be sure you have chosen the appropriate form for your personal town/county. It is possible to look through the shape using the Preview key and study the shape outline to make certain it will be the best for you.

- If the form fails to satisfy your needs, take advantage of the Seach field to get the appropriate form.

- When you are certain the shape is acceptable, select the Purchase now key to obtain the form.

- Select the rates plan you need and enter the necessary details. Build your accounts and pay money for the order utilizing your PayPal accounts or charge card.

- Opt for the file formatting and down load the legal document template to your device.

- Full, modify and print out and sign the obtained Idaho Accounting Agreement - Self-Employed Independent Contractor.

US Legal Forms is the most significant collection of legal types where you will find different document layouts. Take advantage of the service to down load expertly-manufactured files that stick to state specifications.

Form popularity

FAQ

Every independent contractor is a business owner. You run a business even if you are your only employee and you don't have a company name. There are significant differences, however, between a business that's just you as an independent contractor and running a company with employees and a registered name.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

No, Oregon does not issue an independent contractor license. Although various trades and professional occupations may have licensure requirements, merely holding such a license does not make anyone into an independent contractor.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Here are some steps you may use to guide you when you write an employment contract:Title the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.Employment.More items...?

There are several types of business bank accounts to consider for your independent contracting business. You can consider an account with a local bank as well as an online business bank account. You may prefer mobile banking if you don't need to go into a physical branch and don't need to deposit cash.

All contractors are required by Idaho law to be registered with the Idaho Contractors Board, which is a division of the State of Idaho, Bureau of Occupational Licenses.

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.

The most common business organizations for Independent Contractors include C-corporation, S-Corporation, Partnership, Limited Partnership (LP), Limited Liability Partnership (LLP), Limited Liability Company (LLC), and Sole Proprietorship.

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...