Idaho Agreement for Sales of Data Processing Equipment

Description

How to fill out Idaho Agreement For Sales Of Data Processing Equipment?

Have you been within a situation in which you require papers for sometimes company or person uses virtually every day time? There are tons of lawful papers templates available on the Internet, but getting kinds you can rely on isn`t easy. US Legal Forms delivers a large number of form templates, such as the Idaho Agreement for Sales of Data Processing Equipment, which are created to fulfill federal and state needs.

If you are currently knowledgeable about US Legal Forms website and get a merchant account, simply log in. After that, you may download the Idaho Agreement for Sales of Data Processing Equipment template.

If you do not have an bank account and would like to begin to use US Legal Forms, abide by these steps:

- Obtain the form you will need and ensure it is for that appropriate town/state.

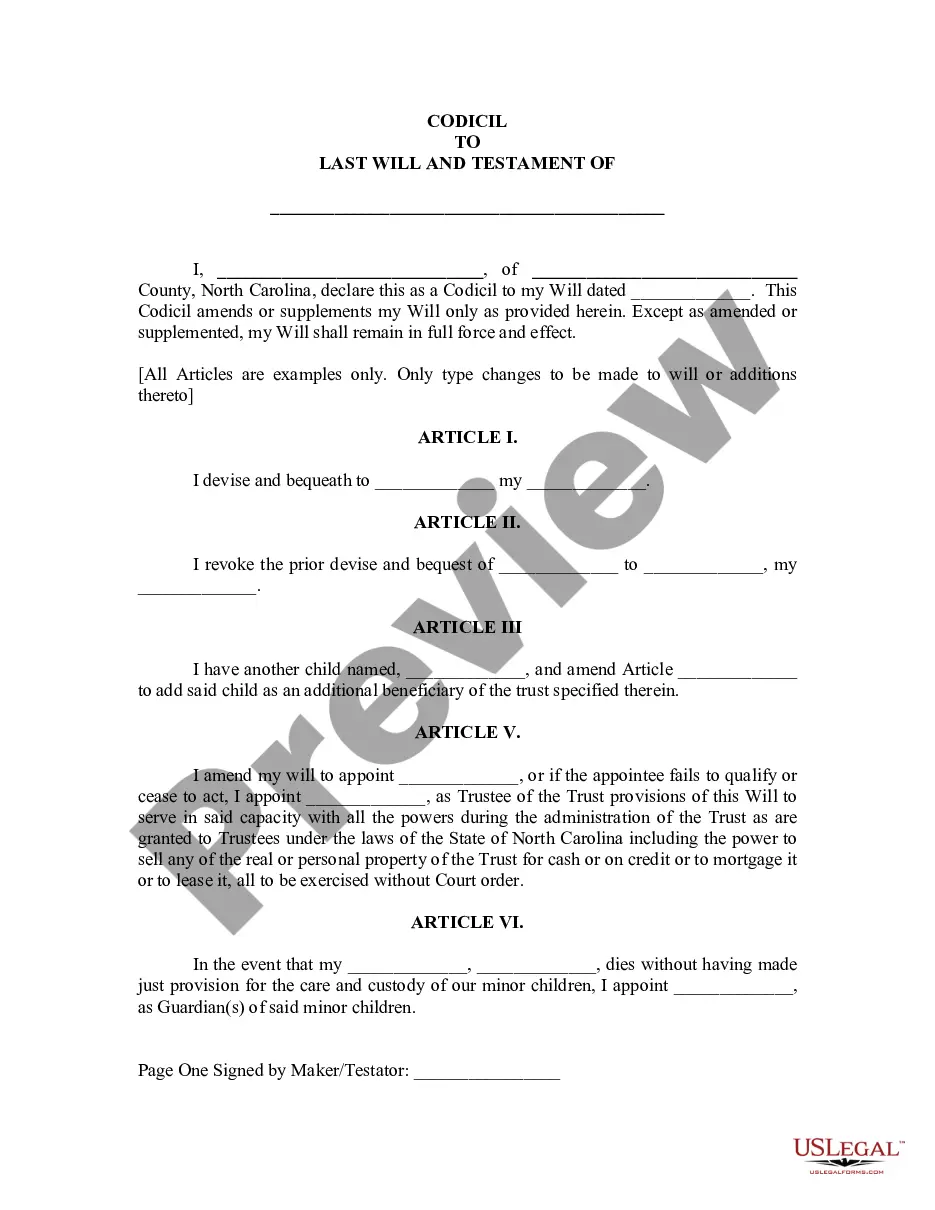

- Take advantage of the Review key to check the shape.

- See the description to actually have chosen the proper form.

- If the form isn`t what you are trying to find, take advantage of the Lookup discipline to discover the form that meets your requirements and needs.

- Whenever you find the appropriate form, click on Purchase now.

- Select the rates prepare you need, submit the specified details to make your bank account, and pay for an order using your PayPal or bank card.

- Select a hassle-free document formatting and download your copy.

Find all of the papers templates you may have bought in the My Forms menu. You can get a more copy of Idaho Agreement for Sales of Data Processing Equipment any time, if required. Just go through the needed form to download or print the papers template.

Use US Legal Forms, probably the most extensive variety of lawful forms, in order to save efforts and steer clear of mistakes. The support delivers skillfully made lawful papers templates which can be used for a variety of uses. Produce a merchant account on US Legal Forms and commence making your daily life a little easier.

Form popularity

FAQ

Sales Tax Exemptions in Idaho Several examples of exemptions are prescription drugs, some groceries, truck campers, office trailers, and transport trailers. These categories may have some further qualifications before the special rate applies, such as a price cap on clothing items.

Services in Idaho are generally not taxable. However if the service you provide includes creating or manufacturing a product, you may have to deal with the sales tax on products. Tangible products are taxable in Idaho, with a few exceptions such as prescription drugs.

If the warranty or service agreement is optional to the purchaser, no sales tax shall be charged on the sale of the warranty or service agreement. A taxable transaction does occur with regard to the seller of the warranty or service agreement upon performance of the repair2026. b.

Service fees for the installation of software are subject to sales tax. Moreover, charges for software maintenance services including delivery of updates for prewritten software are generally taxable. However, maintenance contracts that only provide support services for canned software are not taxable.

In the state of Idaho, sales tax is legally required to be collected from all tangible, physical products being sold to a consumer. An example of an exemption to the state's sales tax is certain prescription medications.

Services in Idaho are generally not taxable. However if the service you provide includes creating or manufacturing a product, you may have to deal with the sales tax on products. Tangible products are taxable in Idaho, with a few exceptions such as prescription drugs.

Idaho generally does not require sales tax on Software-as-a-Service.

Idaho generally does not require sales tax on Software-as-a-Service.

Several examples of exemptions are prescription drugs, some groceries, truck campers, office trailers, and transport trailers. These categories may have some further qualifications before the special rate applies, such as a price cap on clothing items.