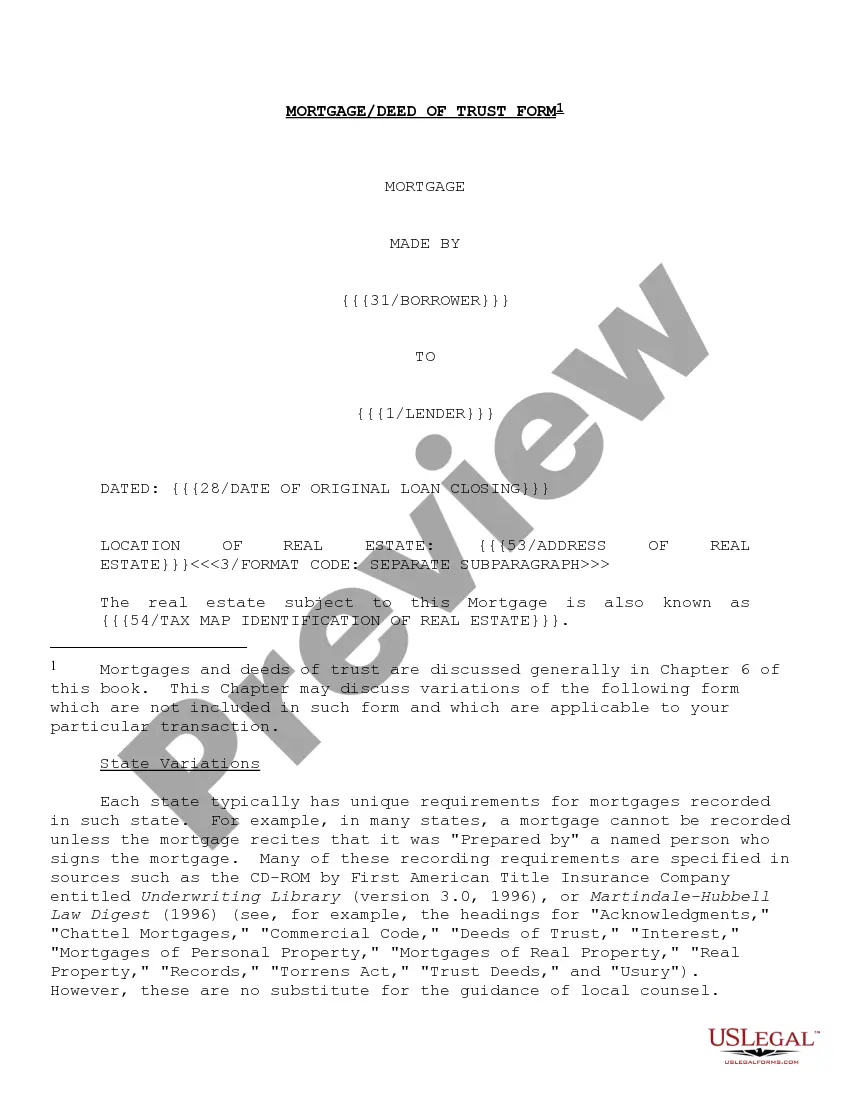

"Form of Mortgage Deed of Trust and Variations" is an American Lawyer Media form. The following form is for a mortgage deed of trust with variations.

Idaho Form of Mortgage Deed of Trust and Variations

Description

How to fill out Form Of Mortgage Deed Of Trust And Variations?

US Legal Forms - among the most significant libraries of legal types in the United States - provides a wide range of legal file templates you can down load or printing. Using the internet site, you will get thousands of types for organization and personal functions, categorized by types, says, or keywords.You will find the most up-to-date variations of types such as the Idaho Form of Mortgage Deed of Trust and Variations within minutes.

If you have a membership, log in and down load Idaho Form of Mortgage Deed of Trust and Variations in the US Legal Forms catalogue. The Down load switch can look on every type you look at. You have access to all in the past acquired types in the My Forms tab of the bank account.

In order to use US Legal Forms initially, listed here are basic directions to help you began:

- Be sure you have picked the right type for your personal city/area. Click the Review switch to analyze the form`s content. See the type outline to actually have selected the appropriate type.

- If the type doesn`t match your specifications, take advantage of the Research discipline near the top of the monitor to discover the one who does.

- If you are happy with the form, affirm your choice by clicking the Purchase now switch. Then, select the costs strategy you want and provide your references to sign up for the bank account.

- Process the deal. Make use of credit card or PayPal bank account to accomplish the deal.

- Pick the structure and down load the form in your device.

- Make changes. Load, edit and printing and signal the acquired Idaho Form of Mortgage Deed of Trust and Variations.

Each and every format you put into your bank account lacks an expiry day which is your own property permanently. So, if you would like down load or printing an additional duplicate, just go to the My Forms area and then click about the type you need.

Obtain access to the Idaho Form of Mortgage Deed of Trust and Variations with US Legal Forms, by far the most comprehensive catalogue of legal file templates. Use thousands of professional and state-specific templates that fulfill your small business or personal needs and specifications.

Form popularity

FAQ

If the Trustee can persuade creditors in your favour, and provide sufficient evidence that you are able to meet the monthly repayments, a second trust deed will operate in the same way as the first.

This Deed of Trust (the ?Trust Deed?) sets out the terms and conditions upon which: [Settlor Name] (the ?Settlor?), of [Settlor Address], settles that property set out in Schedule A (the ?Property?) upon [Trustee Name] (the ?Trustee?), being a Company duly registered under the laws of [state] with registered number [ ...

A deed of variation is a legal document that is used to change the details of an existing trust. In most circumstances, in order to properly execute a Deed of Variation, it is important that the Appointor (sometimes referred to as a Principal or Guardian) along with Trustee consents to the proposed change.

Can a trust deed be amended? Once executed, a deed cannot be amended. However, you can have the deed amended or redrafted as many times as you like before you sign it, as long as you are willing to pay the solicitor for the extra work.

Although about 60% of the US states are mortgage states, Idaho is considered a deed state. A deed of trust is an agreement between a beneficiary, grantor, and trustee. A deed is signed to a trustee as a form of security to ensure that the performance of obligation is fulfilled.

Deeds of trust usually reference promissory notes. A promissory note is a negotiable instrument evidencing the borrower's promise to pay the underlying debt. The deed of trust creates a lien against realty being pledged as collateral to help ensure the repayment of the debt.

The parties would need to apply to the court for an order to rectify the trust deed and satisfy the court that there was a genuine mistake. This is easier in relation to lifetime trusts where the parties agree to the rectification but can be much harder in cases where the Settlor has died.

The trustee, by a deed of amendment, varies the terms of the trust deed to convert the discretionary trust to a fixed unit trust so that each beneficiary had a fixed entitlement in the trust.