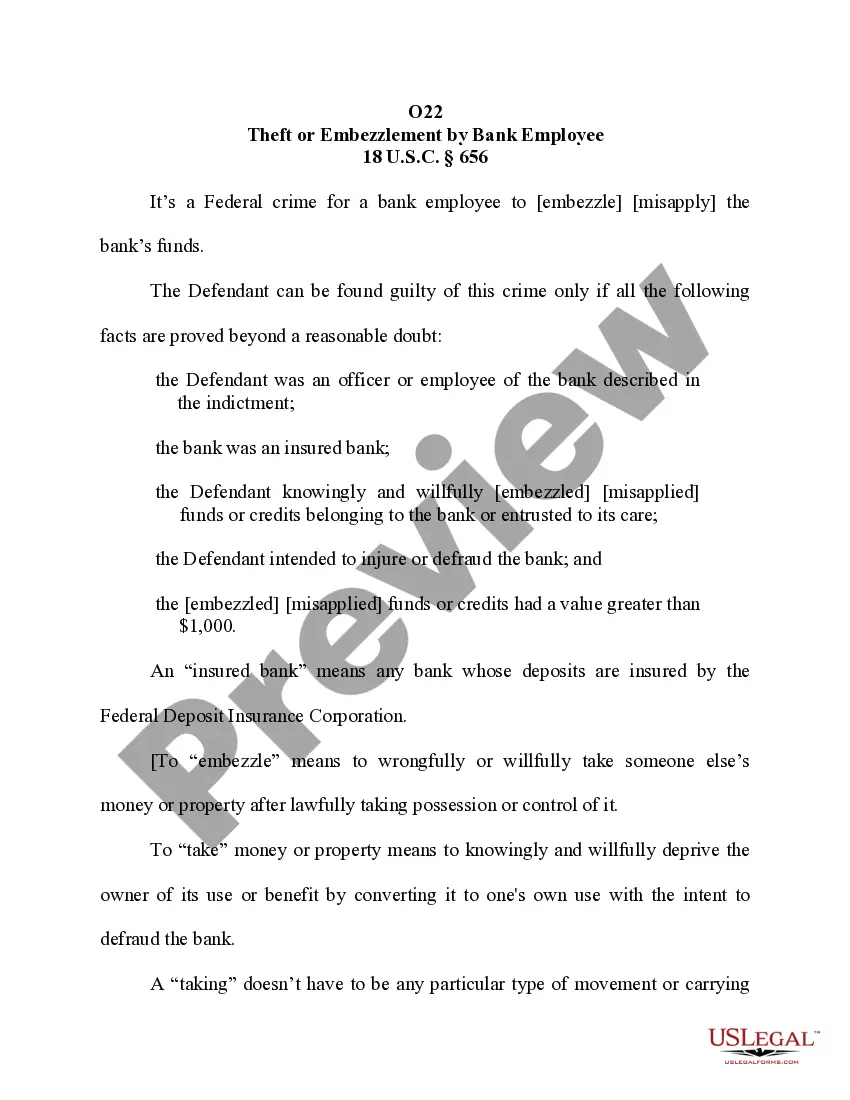

This form provides boilerplate contract clauses that make provision for how transaction costs, both initially and in the event of a dispute or litigation, will be handled under the contract agreement. Several different language options are included to suit individual needs and circumstances.

Idaho Negotiating and Drafting Transaction Cost Provisions

Description

How to fill out Negotiating And Drafting Transaction Cost Provisions?

US Legal Forms - one of the greatest libraries of legal kinds in the USA - offers a variety of legal document themes you can download or produce. Using the internet site, you will get 1000s of kinds for organization and specific functions, sorted by types, states, or keywords.You can find the newest variations of kinds like the Idaho Negotiating and Drafting Transaction Cost Provisions within minutes.

If you currently have a subscription, log in and download Idaho Negotiating and Drafting Transaction Cost Provisions in the US Legal Forms library. The Down load option will show up on each kind you look at. You have access to all formerly acquired kinds inside the My Forms tab of your bank account.

If you would like use US Legal Forms for the first time, listed here are straightforward guidelines to get you began:

- Ensure you have chosen the best kind for the city/area. Click on the Review option to examine the form`s content material. Read the kind description to actually have selected the correct kind.

- In case the kind doesn`t match your requirements, make use of the Look for field towards the top of the display screen to obtain the one who does.

- When you are satisfied with the form, validate your decision by clicking the Acquire now option. Then, opt for the pricing plan you like and provide your credentials to sign up to have an bank account.

- Process the deal. Make use of charge card or PayPal bank account to complete the deal.

- Choose the structure and download the form on your own product.

- Make alterations. Fill out, revise and produce and indication the acquired Idaho Negotiating and Drafting Transaction Cost Provisions.

Every single design you put into your money does not have an expiration particular date and is the one you have forever. So, in order to download or produce another backup, just check out the My Forms portion and then click about the kind you need.

Obtain access to the Idaho Negotiating and Drafting Transaction Cost Provisions with US Legal Forms, the most substantial library of legal document themes. Use 1000s of expert and condition-specific themes that fulfill your small business or specific requirements and requirements.

Form popularity

FAQ

Membership Count as of 9/5/23 StatusNumber of AttorneysActive5475Emeritus17House Counsel25Inactive7793 more rows ?

A conflict of interest exists, however, if there is a significant risk that a lawyer's action on behalf of one client will materially limit the lawyer's effectiveness in representing another client in a different case; for example, when a decision favoring one client will create a precedent likely to seriously weaken ...

Cond. 4.2. In representing a client, a lawyer shall not communicate about the subject of the representation with a person the lawyer knows to be represented by another lawyer in the matter, unless the lawyer has the consent of the other lawyer or is authorized to do so by law or a court order.

Staff DepartmentNameAdministrationNelda AdolfAdministration/Admissions/MCLEMaureen Ryan BraleyAdmissionsBelinda BrownBar CounselJoe Pirtle6 more rows ?