Idaho Direction For Payment of Royalty to Trustee by Royalty Owners

Description

How to fill out Direction For Payment Of Royalty To Trustee By Royalty Owners?

Choosing the best legal file web template might be a struggle. Of course, there are plenty of themes available on the Internet, but how do you discover the legal kind you need? Take advantage of the US Legal Forms internet site. The services provides thousands of themes, like the Idaho Direction For Payment of Royalty to Trustee by Royalty Owners, that can be used for organization and private requirements. Each of the types are checked out by professionals and meet up with federal and state needs.

If you are presently authorized, log in to the account and then click the Acquire key to find the Idaho Direction For Payment of Royalty to Trustee by Royalty Owners. Utilize your account to appear from the legal types you have bought previously. Check out the My Forms tab of your own account and obtain one more copy in the file you need.

If you are a fresh customer of US Legal Forms, here are simple guidelines that you can adhere to:

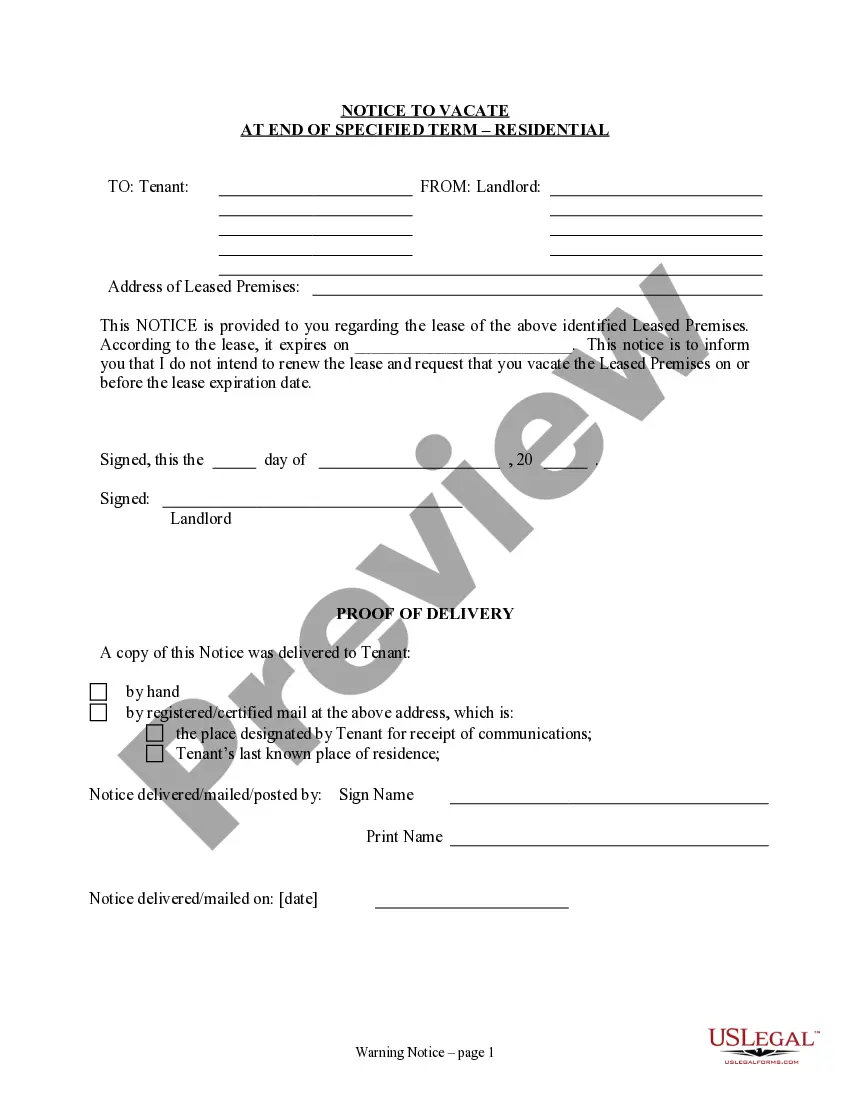

- Initial, ensure you have selected the right kind to your area/region. It is possible to look through the shape while using Review key and look at the shape information to guarantee this is the best for you.

- If the kind fails to meet up with your requirements, take advantage of the Seach industry to get the proper kind.

- Once you are certain that the shape would work, select the Purchase now key to find the kind.

- Opt for the prices strategy you want and type in the needed information and facts. Build your account and purchase an order using your PayPal account or Visa or Mastercard.

- Select the submit structure and acquire the legal file web template to the gadget.

- Full, revise and print and signal the obtained Idaho Direction For Payment of Royalty to Trustee by Royalty Owners.

US Legal Forms is the largest catalogue of legal types for which you will find different file themes. Take advantage of the company to acquire expertly-made paperwork that adhere to state needs.