Idaho Term Nonparticipating Royalty Deed from Mineral Owner

Description

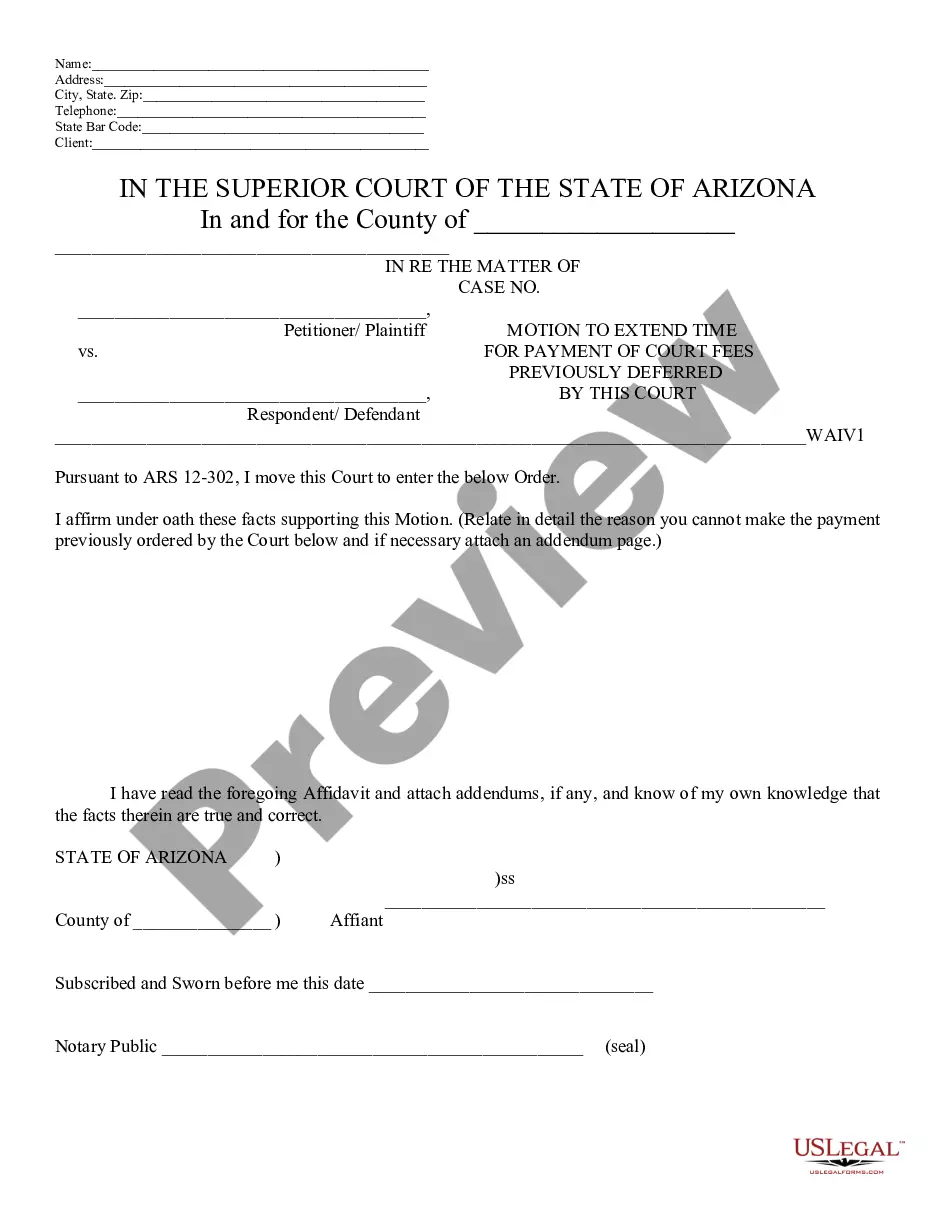

How to fill out Term Nonparticipating Royalty Deed From Mineral Owner?

You may devote several hours on-line attempting to find the legitimate papers template which fits the federal and state needs you need. US Legal Forms offers thousands of legitimate varieties that happen to be analyzed by pros. You can actually down load or print the Idaho Term Nonparticipating Royalty Deed from Mineral Owner from the services.

If you already have a US Legal Forms account, you are able to log in and then click the Obtain key. Next, you are able to total, modify, print, or indicator the Idaho Term Nonparticipating Royalty Deed from Mineral Owner. Each legitimate papers template you buy is your own forever. To acquire yet another copy of any bought develop, go to the My Forms tab and then click the corresponding key.

If you are using the US Legal Forms website the first time, adhere to the basic recommendations beneath:

- Very first, be sure that you have selected the right papers template for the region/metropolis of your liking. Browse the develop explanation to make sure you have picked the appropriate develop. If accessible, use the Preview key to check throughout the papers template as well.

- If you want to find yet another version in the develop, use the Lookup industry to get the template that suits you and needs.

- Once you have located the template you need, click on Buy now to move forward.

- Select the pricing strategy you need, enter your qualifications, and register for an account on US Legal Forms.

- Total the purchase. You can utilize your Visa or Mastercard or PayPal account to purchase the legitimate develop.

- Select the file format in the papers and down load it to your product.

- Make alterations to your papers if needed. You may total, modify and indicator and print Idaho Term Nonparticipating Royalty Deed from Mineral Owner.

Obtain and print thousands of papers layouts utilizing the US Legal Forms web site, which provides the biggest assortment of legitimate varieties. Use specialist and condition-certain layouts to tackle your small business or individual requires.

Form popularity

FAQ

The formula to calculate NPRI without proportionate share reduction is LRR ? RI = NPRI. As an example, reducing your revenue interest from 25% LRR results in 1/16 NPRI, leaving 75% NRI for working interest owners.

Royalty Interest (RI) ? this type of mineral interest is obtained when an owner decides to lease their mineral interest to a company that plans to drill and operate a well on the land.

Participating Royalty Interest (NPRI) is an interest in oil and gas production which is created from the mineral estate. Like the plain ?royalty interest? it is expensefree, bearing no operational costs of production.

Mineral rights deeds are not the same as royalty deeds. Royalty deeds do not allow for surface access, or for the initiation of the extraction and sale of minerals. A royalty owner will only benefit economically if the mineral owner decides to produce and sell the minerals.

Royalty interest differs from working or non-operating working interest. Only working interests pay for the costs for drilling, production, and exploration. However, royalty owners are usually not required to pay operating costs.

An NPRI owner also does not have the right to produce the minerals by himself, and they are not responsible for the operational costs associated with production or drilling. An NPRI has fewer rights than a 'regular' mineral rights owner as they do not have the right to make decisions related to the execution of leases.

As ownership of land changes, NPRIs are commonly created and assigned to whoever the owners want. The amount of revenue the mineral and surface rights generate can make present and past owners want to share in the future resources of their royalty payments.

Non-Participating Royalty Interest (NPRI) Unlike a mineral interest owner, the NPRI owner does not have ?executive? rights, meaning they cannot sign an oil and gas lease or participate in the benefits of lease bonus or delay rentals.