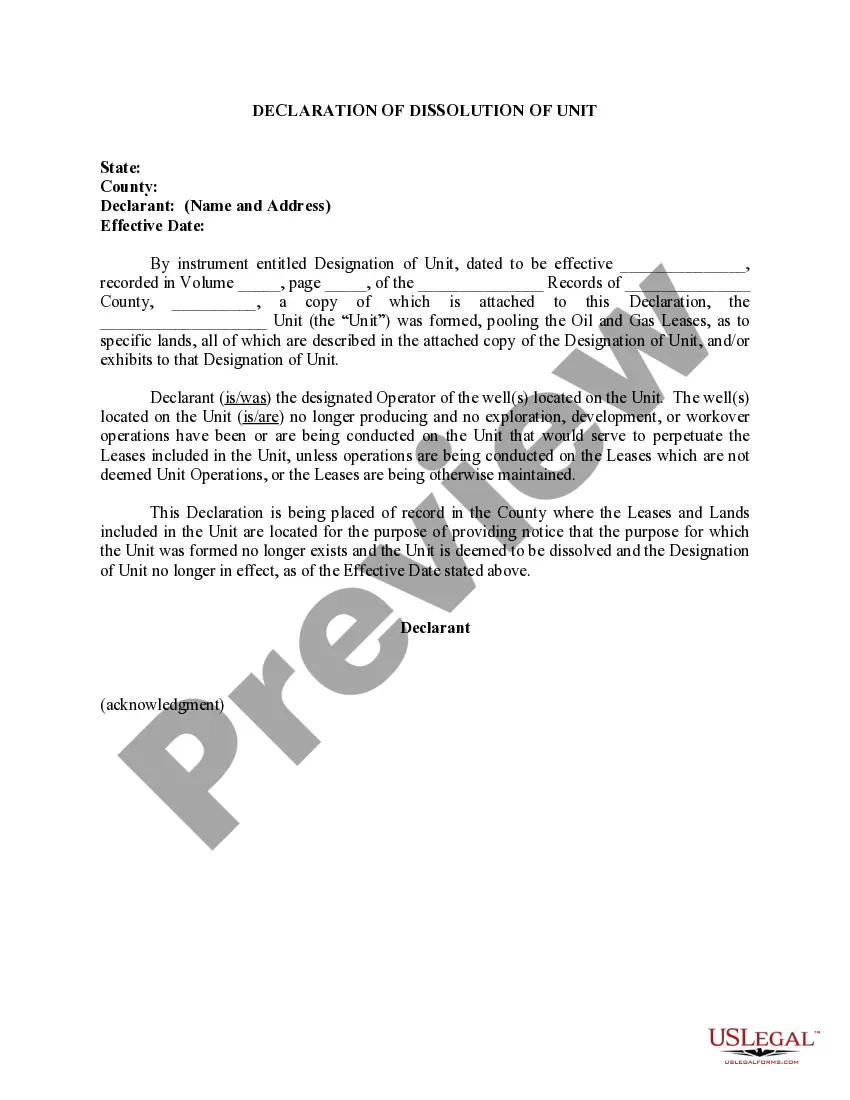

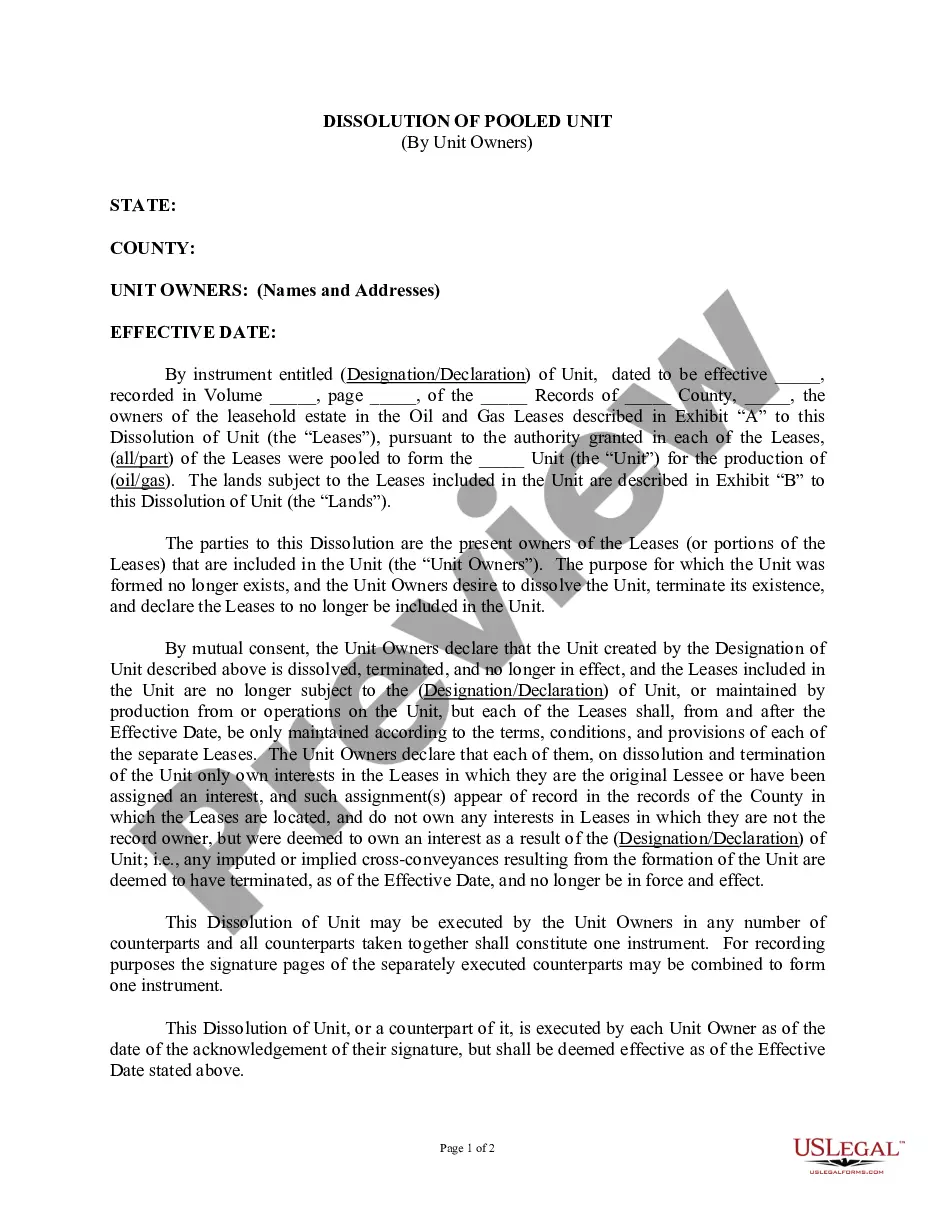

Idaho Dissolution of Unit

Description

How to fill out Dissolution Of Unit?

If you need to comprehensive, acquire, or print authorized papers layouts, use US Legal Forms, the largest collection of authorized forms, that can be found online. Utilize the site`s basic and convenient look for to obtain the papers you will need. Various layouts for company and personal reasons are categorized by classes and claims, or search phrases. Use US Legal Forms to obtain the Idaho Dissolution of Unit with a handful of clicks.

Should you be previously a US Legal Forms consumer, log in in your bank account and then click the Obtain switch to obtain the Idaho Dissolution of Unit. Also you can gain access to forms you earlier saved inside the My Forms tab of the bank account.

If you are using US Legal Forms the first time, follow the instructions beneath:

- Step 1. Be sure you have chosen the shape to the proper town/land.

- Step 2. Take advantage of the Review method to check out the form`s articles. Don`t overlook to read through the outline.

- Step 3. Should you be unsatisfied together with the kind, take advantage of the Lookup industry near the top of the display to find other models of your authorized kind template.

- Step 4. Once you have identified the shape you will need, select the Acquire now switch. Choose the rates plan you like and include your references to register for the bank account.

- Step 5. Procedure the transaction. You can use your bank card or PayPal bank account to finish the transaction.

- Step 6. Choose the file format of your authorized kind and acquire it on your product.

- Step 7. Comprehensive, change and print or signal the Idaho Dissolution of Unit.

Every authorized papers template you purchase is the one you have permanently. You possess acces to each kind you saved within your acccount. Select the My Forms area and choose a kind to print or acquire again.

Remain competitive and acquire, and print the Idaho Dissolution of Unit with US Legal Forms. There are many skilled and status-specific forms you can use for your personal company or personal requirements.

Form popularity

FAQ

After dissolution, a corporation is generally expected to pay all its existing debts and then liquidate its remaining assets to its shareholders. This sometimes becomes difficult, however, where there are unknown claims that may exist against the corporation.

Dissolution is a process by which a solute dissolves into a solvent and forms a solution.

Judicial Dissolution A Court gets involved in determining how the business will be dissolved and how the assets of the business will be distributed between the owners. In a judicial dissolution, the owners of the business have voluntarily given up their ability to dissolve the company on their own.

To dissolve your corporation in Idaho, you can sign in to your SOSBiz account and choose ?terminate business.? Or, you can provide the completed Articles of Dissolution form in duplicate to the Secretary of State by mail or in person, along with the filing fee.

6 Steps to Dissolve a Corporation #1 ? Seek Approval from the Board of Directors and Shareholders. First, hold a meeting with the board of directors. ... #2 ? File Articles of Dissolution. ... #3 ? Finalize Taxes. ... #4 ? Notify Creditors. ... #5 ? Liquidate and Distribute Assets. ... #6 ? Wrap Up Operations.

After your board (and, where applicable, voting members) have approved the dissolution, you'll need to submit articles of dissolution to the Secretary of State (SOS). The articles of dissolution must contain: the name of your nonprofit. the date dissolution was authorized.