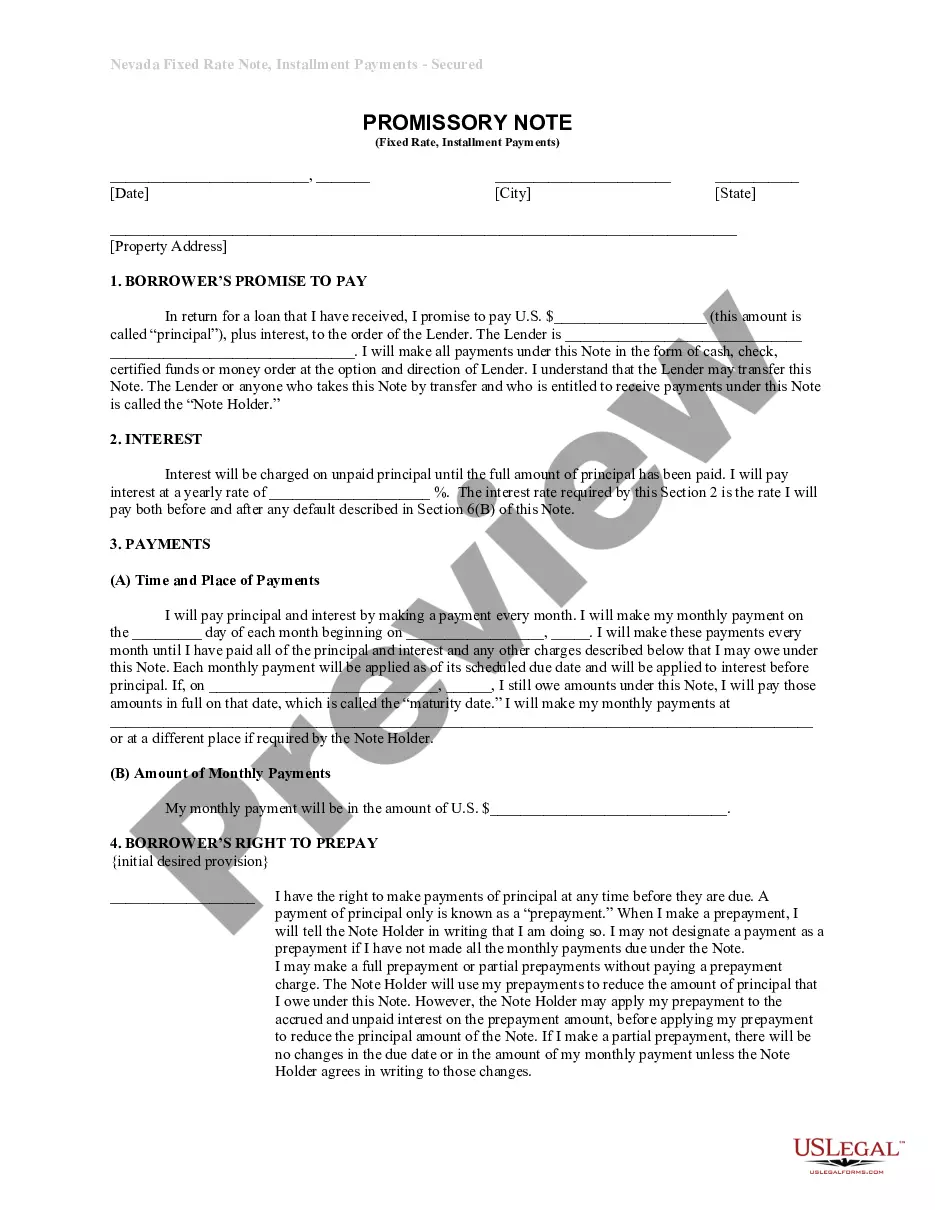

Idaho Lien and Tax Search Checklist: In Idaho, a lien and tax search checklist is a vital tool used by individuals, businesses, and real estate professionals to conduct comprehensive due diligence regarding any outstanding liens or taxes on a property. This detailed checklist helps ensure a smooth transaction process, whether buying, selling, or refinancing a property within the state. Keywords: Idaho, lien search, tax search, checklist, due diligence, property, transaction, outstanding liens, outstanding taxes, buying, selling, refinancing, real estate. Different Types of Idaho Lien and Tax Search Checklist: 1. Real Estate Lien and Tax Search Checklist: The primary type of Idaho lien and tax search checklist focuses on real estate transactions. It includes a detailed list of tasks to perform regarding property liens and taxes, such as examining public records, searching for federal, state, and local tax liens, reviewing contractor liens, and uncovering any additional encumbrances that may impact the property's title. 2. Personal Property Lien Search Checklist: This type of Idaho lien search checklist concentrates on personal property, often used when purchasing vehicles, boats, or other assets that can be subject to liens. It involves verifying if there are any existing liens on the personal property by checking relevant records and ensuring clear ownership transfer upon purchase. 3. Business Lien and Tax Search Checklist: For businesses conducting transactions involving commercial properties or assets, an Idaho business lien and tax search checklist is essential. This checklist aids in examining any outstanding federal and state tax liens on the business entity, searching for UCC (Uniform Commercial Code) filings, and analyzing potential liabilities that may affect the business's financial or legal standing. 4. Judgment Lien Search Checklist: Another type of Idaho lien search checklist focuses on identifying any judgment liens against an individual or business. This checklist aims to uncover any court-ordered liens resulting from unpaid debts and ensures a thorough search of public records to determine if any judgments may hinder a property or business transaction. 5. Tax Lien Certificate Search Checklist: This particular Idaho lien search checklist is relevant for investors or individuals interested in purchasing tax lien certificates or participating in tax lien auctions. It involves reviewing tax sale records, researching outstanding property taxes, and understanding the specific requirements and procedures for tax lien investments within Idaho. By utilizing these various types of Idaho lien and tax search checklists, individuals can conduct comprehensive due diligence to ascertain any potential risks or obstacles associated with a property or business transaction within the state. These checklists ensure that all necessary steps are taken to protect the involved parties' interests and facilitate a smooth transaction process.

Idaho Lien and Tax Search Checklist

Description

How to fill out Idaho Lien And Tax Search Checklist?

You may invest several hours online trying to find the legitimate record template that suits the federal and state demands you want. US Legal Forms offers thousands of legitimate forms which can be reviewed by experts. You can actually obtain or print out the Idaho Lien and Tax Search Checklist from our assistance.

If you already have a US Legal Forms bank account, you are able to log in and click on the Acquire button. Afterward, you are able to total, edit, print out, or indicator the Idaho Lien and Tax Search Checklist. Every legitimate record template you acquire is your own property forever. To get an additional copy for any purchased develop, check out the My Forms tab and click on the corresponding button.

Should you use the US Legal Forms internet site the very first time, keep to the basic guidelines under:

- Initial, be sure that you have chosen the correct record template to the region/city of your choosing. Look at the develop information to make sure you have selected the proper develop. If readily available, utilize the Review button to check from the record template too.

- If you would like locate an additional variation of the develop, utilize the Search area to get the template that meets your needs and demands.

- After you have discovered the template you want, click Buy now to move forward.

- Find the prices plan you want, key in your accreditations, and sign up for a merchant account on US Legal Forms.

- Full the transaction. You can use your charge card or PayPal bank account to cover the legitimate develop.

- Find the structure of the record and obtain it in your system.

- Make modifications in your record if necessary. You may total, edit and indicator and print out Idaho Lien and Tax Search Checklist.

Acquire and print out thousands of record templates making use of the US Legal Forms web site, which offers the most important assortment of legitimate forms. Use specialist and condition-distinct templates to take on your business or person needs.