Idaho PUD Worksheet is a comprehensive tool used for calculating and reporting income tax information for individuals or businesses in the state of Idaho. This worksheet is specifically designed to assist taxpayers in determining their income tax liability and ensuring compliance with Idaho tax laws. The Idaho PUD Worksheet covers various aspects of income tax calculations, including deductions, exemptions, credits, and tax liabilities. It provides a step-by-step process to help taxpayers accurately calculate their tax obligations. The worksheet takes into account various sources of income, such as wages, self-employment income, interest, dividends, and rental properties, among others. One type of Idaho PUD Worksheet is the Individual Income Tax Worksheet. This particular version is utilized by individual taxpayers to calculate their personal income tax liability. It incorporates forms and instructions for reporting income, deductions, exemptions, and applicable tax credits. Additionally, it considers factors like the taxpayer's filing status, dependents, and other relevant personal details. Another type of Idaho PUD Worksheet is the Business Income Tax Worksheet. This version is tailored for businesses operating in Idaho, enabling them to compute their corporate or partnership income tax liability. The worksheet accounts for various business income sources, deductions, allowable business expenses, and credits. It also considers unique aspects such as depreciation, net operating losses, and estimated tax payments. Using the Idaho PUD Worksheet helps individuals and businesses simplify the complex process of calculating Idaho state income taxes. It ensures accurate reporting, reduces the risk of errors, and assists in maximizing eligible deductions and credits. By following the detailed instructions and utilizing the relevant keywords like "Idaho PUD Worksheet," taxpayers can confidently navigate their tax obligations and fulfill their responsibilities in accordance with Idaho tax laws.

Idaho Pud Worksheet

Description

How to fill out Idaho Pud Worksheet?

If you wish to total, download, or print out legal papers themes, use US Legal Forms, the biggest assortment of legal forms, that can be found online. Take advantage of the site`s simple and practical look for to get the papers you want. Various themes for enterprise and individual uses are sorted by categories and claims, or keywords. Use US Legal Forms to get the Idaho Pud Worksheet in a couple of clicks.

Should you be already a US Legal Forms client, log in in your account and click the Down load key to get the Idaho Pud Worksheet. Also you can access forms you formerly downloaded from the My Forms tab of your account.

If you are using US Legal Forms the first time, follow the instructions beneath:

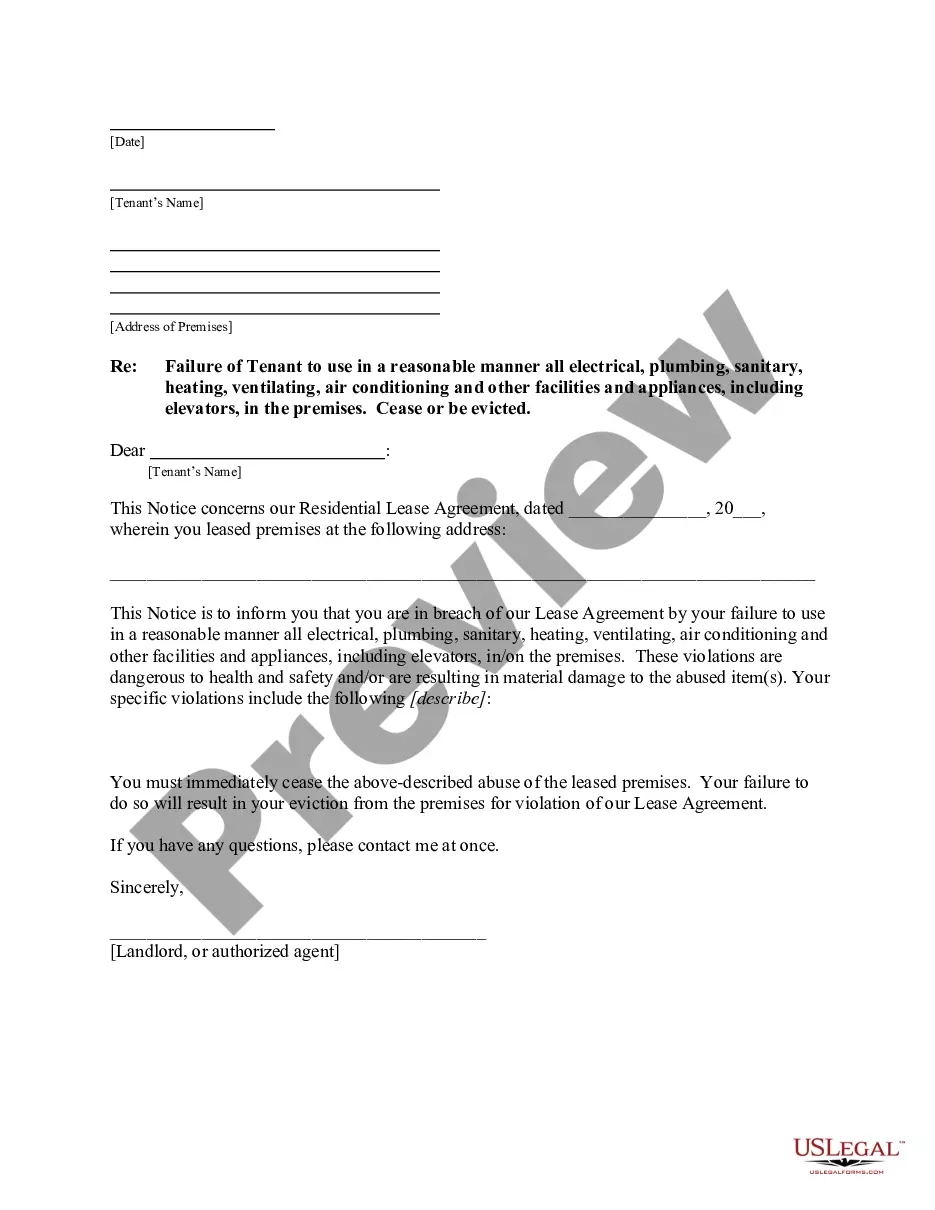

- Step 1. Be sure you have selected the form for your proper town/region.

- Step 2. Use the Review method to examine the form`s content. Don`t neglect to see the description.

- Step 3. Should you be unsatisfied with all the form, use the Research field on top of the display screen to discover other types of the legal form template.

- Step 4. Once you have found the form you want, click on the Get now key. Pick the pricing strategy you choose and add your credentials to sign up on an account.

- Step 5. Approach the purchase. You can use your credit card or PayPal account to accomplish the purchase.

- Step 6. Pick the file format of the legal form and download it in your system.

- Step 7. Full, revise and print out or sign the Idaho Pud Worksheet.

Each legal papers template you purchase is your own for a long time. You may have acces to each form you downloaded in your acccount. Click the My Forms segment and choose a form to print out or download once again.

Compete and download, and print out the Idaho Pud Worksheet with US Legal Forms. There are thousands of specialist and condition-distinct forms you may use for the enterprise or individual requirements.