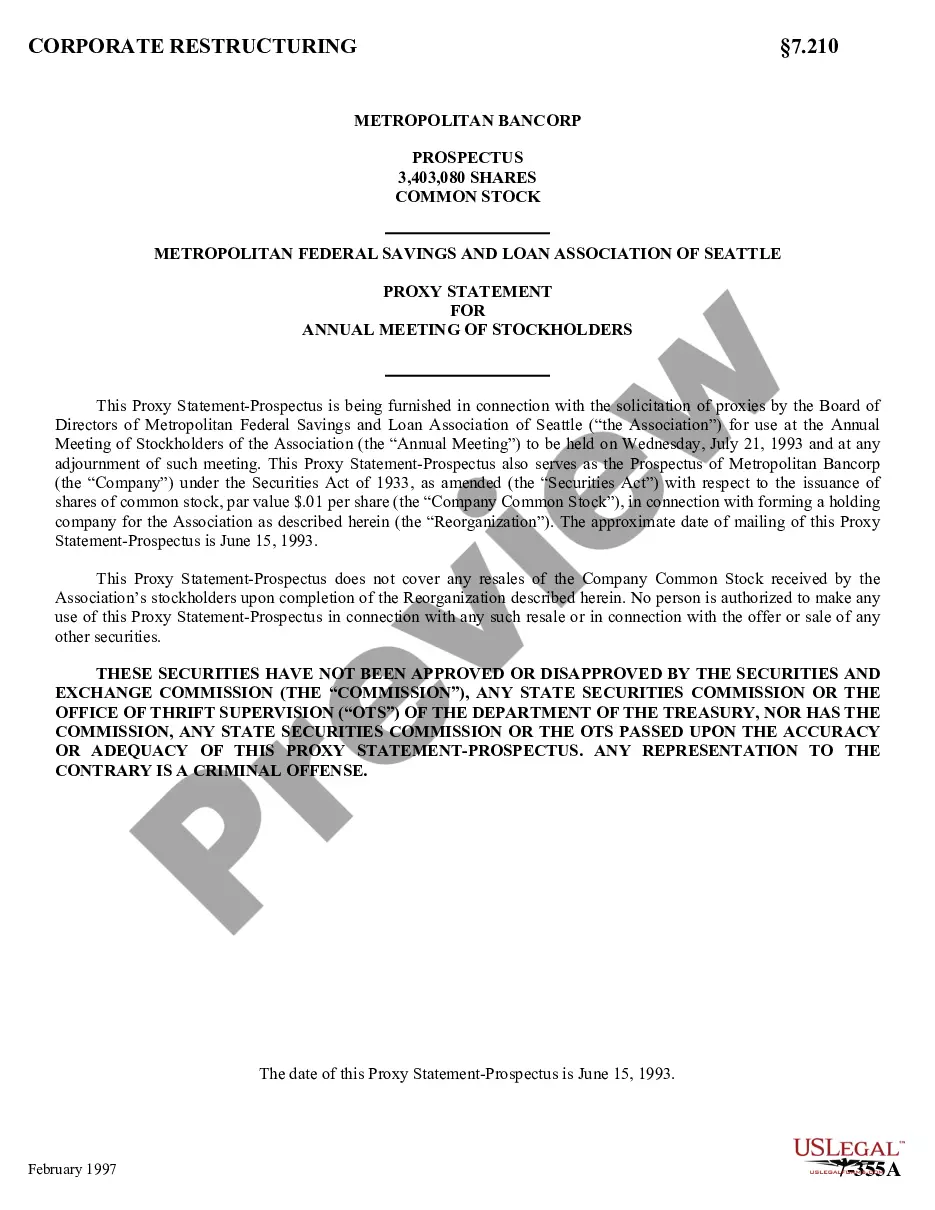

This office lease form is regarding the renewal or other extension of the lease as it relates to the "Base Year Taxes" and the "Base Year for Operating Expenses".

Idaho Option to Renew that Updates the Tenant Operating Expense and Tax Basis

Description

How to fill out Option To Renew That Updates The Tenant Operating Expense And Tax Basis?

Are you currently inside a situation that you require papers for both organization or specific purposes virtually every working day? There are plenty of authorized document themes available online, but locating kinds you can depend on isn`t effortless. US Legal Forms delivers a large number of kind themes, just like the Idaho Option to Renew that Updates the Tenant Operating Expense and Tax Basis, that are composed to satisfy state and federal requirements.

If you are previously acquainted with US Legal Forms internet site and also have your account, just log in. Next, it is possible to acquire the Idaho Option to Renew that Updates the Tenant Operating Expense and Tax Basis design.

Unless you have an profile and want to start using US Legal Forms, follow these steps:

- Discover the kind you want and make sure it is for your correct area/region.

- Make use of the Review switch to examine the shape.

- Look at the outline to actually have chosen the correct kind.

- When the kind isn`t what you`re seeking, utilize the Look for field to discover the kind that meets your requirements and requirements.

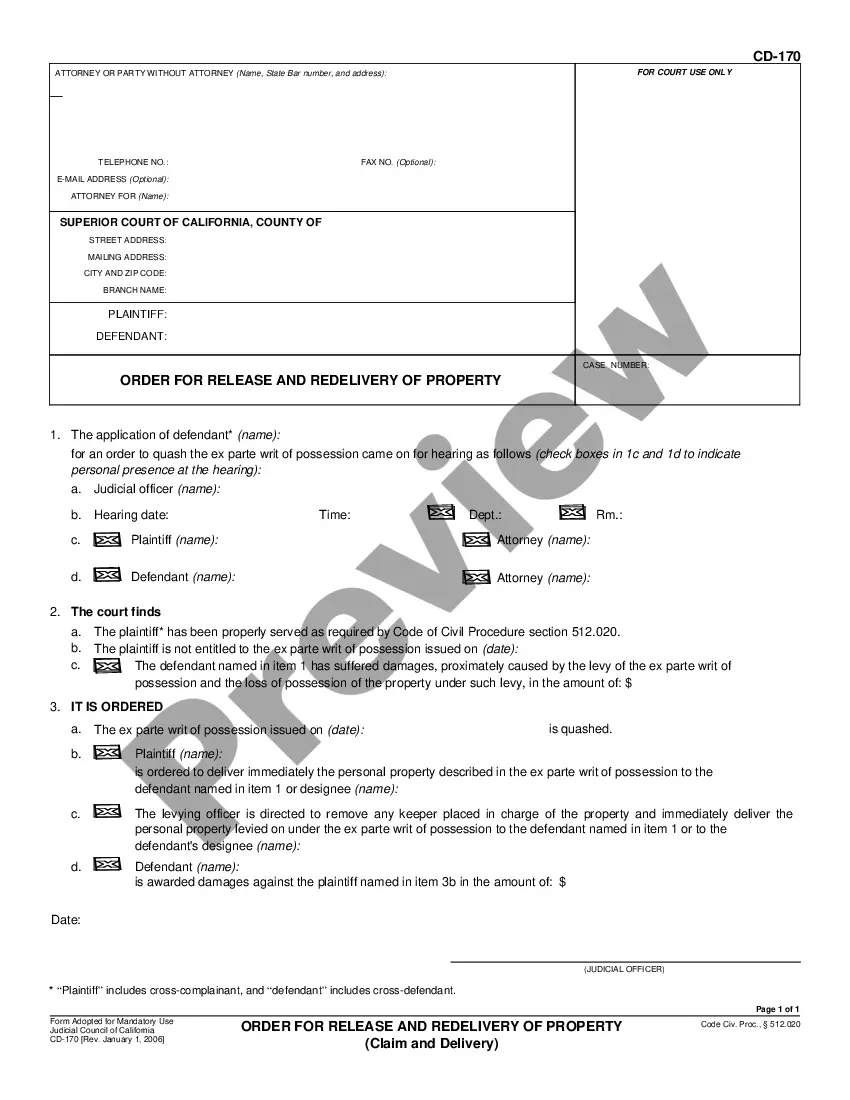

- If you discover the correct kind, simply click Purchase now.

- Select the pricing program you would like, complete the specified info to generate your money, and buy your order using your PayPal or credit card.

- Pick a handy document format and acquire your version.

Get all the document themes you possess purchased in the My Forms menu. You can obtain a additional version of Idaho Option to Renew that Updates the Tenant Operating Expense and Tax Basis any time, if necessary. Just select the needed kind to acquire or produce the document design.

Use US Legal Forms, by far the most extensive assortment of authorized types, to save time as well as avoid errors. The support delivers expertly created authorized document themes which you can use for a selection of purposes. Produce your account on US Legal Forms and initiate making your lifestyle easier.

Form popularity

FAQ

up business may, for example, rent an office space for three years. A renewal option would allow the business to renew or extend the lease to remain in the office space beyond the threeyear lease term.

When a lease expires, both the lessor and the lessee have a few options available. The lessee can vacate or give up access to the property, or the two parties can agree to a lease renewal. This option may require some renegotiation of the terms of the new lease. The final option is to extend the lease.

An option to renew confers on the tenant a right to continue to rent the property for a fresh term after the expiry of the current term, i.e. to renew the existing tenancy. With an option to renew, the tenant obtains another term of tenancy and the landlord is somewhat secured with rental income as agreed beforehand.

An option to renew confers on the tenant a right to continue to rent the property for a fresh term after the expiry of the current term, i.e. to renew the existing tenancy. With an option to renew, the tenant obtains another term of tenancy and the landlord is somewhat secured with rental income as agreed beforehand.

Note: Difference between option to renew and extend ? where the parties agree to ?extend? the existing lease is continued, where the parties ?renew? this creates a new lease.

A landlord may choose the path of least resistance by allowing a tenant to remain on a month-to-month lease and pay the rent. Negotiate a new lease with the tenant. In some cases, a landlord may have simply forgotten that the lease had expired.

The fact that the terms of the lease has come to an end does not mean that you have to leave the property. Unless you or your landlord takes specific steps to end the agreement under the lease, it will simply continue on exactly the same terms. You do not need do anything unless you receive a notice from your landlord.

In commercial real estate, a holdover clause states that, should a tenant remain in the space beyond the lease's expiration date, they must then pay an increased rental rent until they leave the premises.