Idaho Registered Limited Liability Partnership Application Form is a document designed for entrepreneurs and professionals looking to establish a registered limited liability partnership (LLP) in Idaho. This form serves as an application to register the LLP and provides the necessary information for compliance with the state's regulations. Keywords: Idaho, registered limited liability partnership, LLP, application form, compliance, regulations. There are multiple types of Idaho Registered Limited Liability Partnership Application Forms, each tailored to the specific requirements and circumstances of the applicants. These forms include: 1. Initial Registration Form: This type of application form is intended for new Laps that are registering for the first time in Idaho. It collects basic information about the partnership, such as the names and addresses of the partners, the purpose of the LLP, and its registered office. 2. Amended Registration Form: This application form is used when an existing LLP wants to make changes to its previously submitted registration. It allows partners to update their contact information, modify the LLP's purpose, or alter any other details previously registered with the state. 3. Dissolution Form: When an LLP plans to dissolve or wind up its business operations in Idaho, partners must submit a dissolution form. This form outlines the LLP's decision to cease its activities and includes information regarding the distribution of assets and liabilities among the partners. 4. Conversion Form: If an existing partnership or LLP in Idaho wants to convert its legal structure to a registered LLP, partners must file a conversion form. This form indicates the conversion from the current business structure to the LLP format and provides information about the partnership's existing assets, liabilities, and related details. 5. Annual Report Form: Laps registered in Idaho are required to file an annual report to the Secretary of State. This report ensures that all contact information, partners' details, and other relevant information are up to date. To apply for the Idaho Registered Limited Liability Partnership, applicants should carefully complete the appropriate application form while adhering to the guidelines provided by the Idaho Secretary of State. It is crucial to accurately provide all the required information and fulfill any accompanying filing fees to ensure a smooth and successful registration process.

Idaho Registered Limited Liability Partnership Application Form

Description

How to fill out Idaho Registered Limited Liability Partnership Application Form?

Have you been in the place that you require paperwork for both business or specific functions virtually every day? There are a variety of legal file layouts available on the net, but getting ones you can depend on is not effortless. US Legal Forms provides thousands of type layouts, like the Idaho Registered Limited Liability Partnership Application Form, which can be created in order to meet federal and state needs.

If you are previously informed about US Legal Forms internet site and get a merchant account, simply log in. Following that, you can acquire the Idaho Registered Limited Liability Partnership Application Form web template.

Unless you offer an profile and want to start using US Legal Forms, follow these steps:

- Get the type you will need and ensure it is to the right town/state.

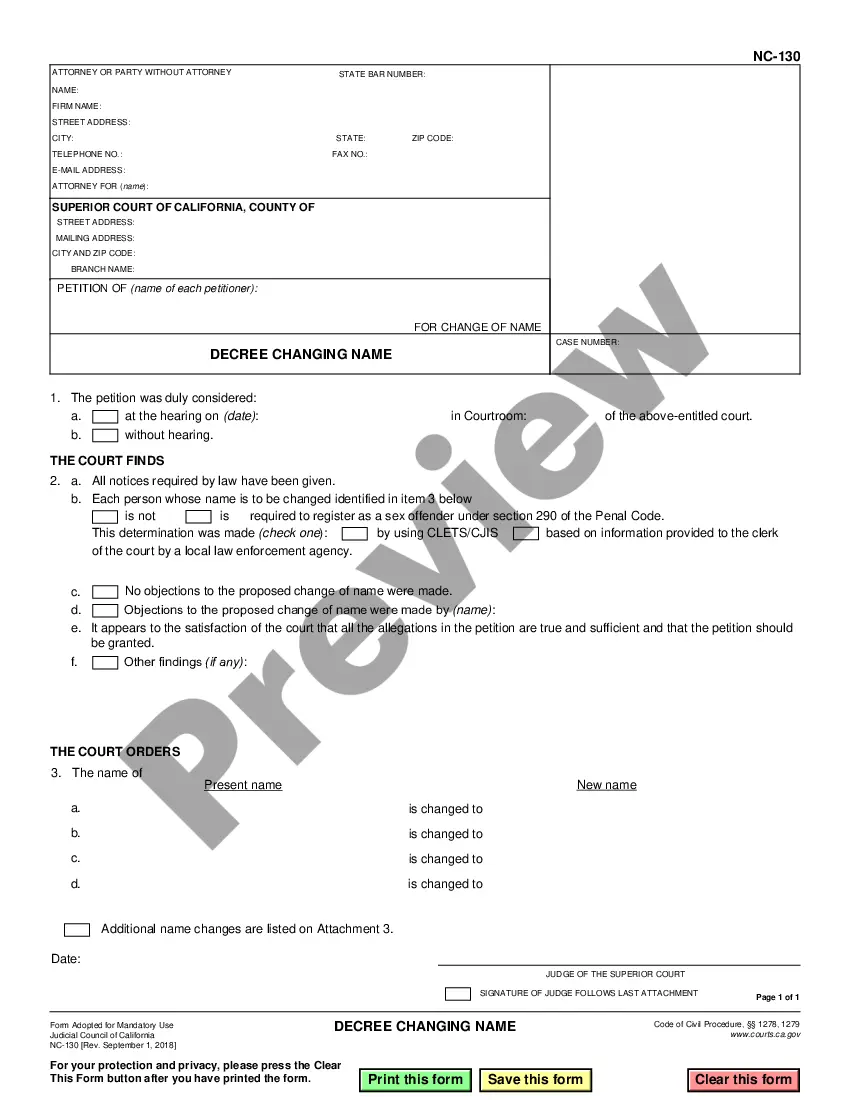

- Utilize the Review key to examine the form.

- See the explanation to actually have chosen the correct type.

- In the event the type is not what you`re seeking, take advantage of the Research field to get the type that suits you and needs.

- Once you find the right type, just click Acquire now.

- Choose the pricing plan you need, fill out the required information and facts to produce your money, and buy your order with your PayPal or credit card.

- Choose a handy file formatting and acquire your version.

Discover all of the file layouts you may have purchased in the My Forms menu. You may get a additional version of Idaho Registered Limited Liability Partnership Application Form at any time, if needed. Just click on the needed type to acquire or printing the file web template.

Use US Legal Forms, probably the most considerable collection of legal kinds, in order to save time and prevent mistakes. The services provides appropriately made legal file layouts which can be used for a selection of functions. Make a merchant account on US Legal Forms and begin creating your life easier.

Form popularity

FAQ

Operates under a legal contract between the owners called an ?Operating Agreement.? All LLCs, including single member ones, need a legal Operating Agreement created by an attorney that conforms with Idaho law.

How to start an Idaho LLC Name your Idaho LLC. Create a business plan. Get a federal employer identification number (EIN) File an Idaho Certificate of Organization. Choose a registered agent in Idaho. Obtain business licenses and permits. Understand Idaho state tax requirements. Prepare an operating agreement.

You can get an LLC in Idaho in 5-7 business days if you file online (or 2-3 weeks if you file by mail). If you need your Idaho LLC faster, you can pay for expedited processing.

Partnerships may be formally organized in Idaho by the filing of a statement of partnership authority. An existing general partnership may be converted into a Limited Liability Partnership if so desired. Idaho Code § 30-24, et seq.

Idaho LLC Formation Filing Fee: $100 The cost to start an Idaho LLC is $100 for online filings, and $120 for paper filings. Forming your LLC involves filing an Idaho Certificate of Organization with the Secretary of State. Filing your certificate officially creates your Idaho LLC.

While a written operating agreement isn't required (per Idaho Statute § 30-25-102), your operating agreement is an essential document for many important aspects of your business, from opening a bank account to handling major events (like fighting lawsuits).

Idaho LLC Formation Filing Fee: $100 The cost to start an Idaho LLC is $100 for online filings, and $120 for paper filings. Forming your LLC involves filing an Idaho Certificate of Organization with the Secretary of State. Filing your certificate officially creates your Idaho LLC.

The only state-wide business license you'll need in Idaho is the Sales and Use Tax license, which allows you to collect the state sales tax of 6%. Registering your business for a Sales and Use Tax license also registers your business for unemployment insurance and tax withholding accounts.