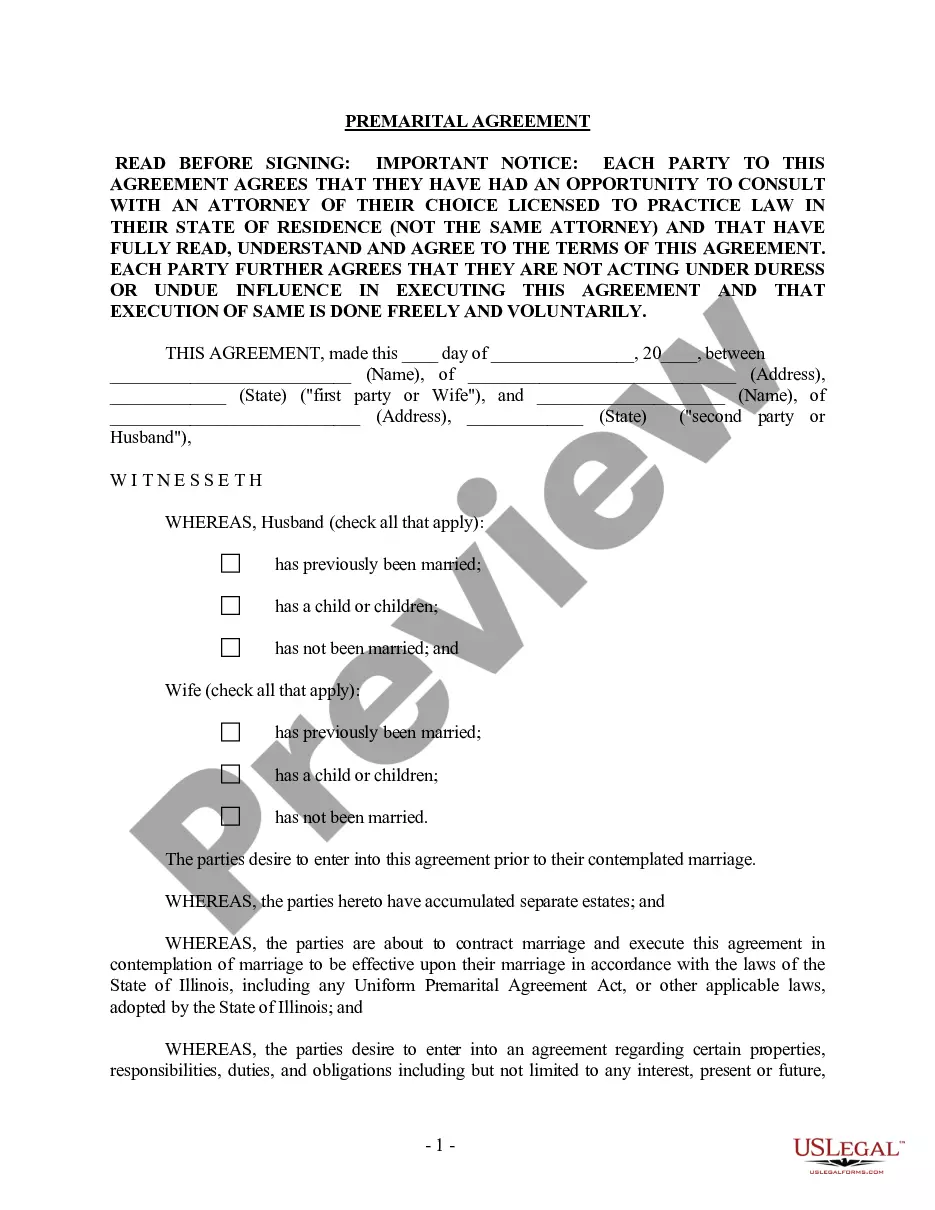

Illinois Prenuptial Premarital Agreement with Financial Statements

Description

How to fill out Illinois Prenuptial Premarital Agreement With Financial Statements?

Searching for Illinois Prenuptial Premarital Agreement with Financial Statements forms and filling out them can be a problem. To save lots of time, costs and effort, use US Legal Forms and find the right sample specially for your state in a few clicks. Our attorneys draft all documents, so you simply need to fill them out. It is really so easy.

Log in to your account and come back to the form's web page and download the document. All of your downloaded examples are stored in My Forms and therefore are available all the time for further use later. If you haven’t subscribed yet, you should register.

Take a look at our detailed recommendations regarding how to get the Illinois Prenuptial Premarital Agreement with Financial Statements sample in a few minutes:

- To get an qualified form, check out its applicability for your state.

- Take a look at the example utilizing the Preview option (if it’s accessible).

- If there's a description, read through it to learn the important points.

- Click on Buy Now button if you identified what you're searching for.

- Choose your plan on the pricing page and create an account.

- Choose you want to pay by a card or by PayPal.

- Save the sample in the favored format.

You can print the Illinois Prenuptial Premarital Agreement with Financial Statements template or fill it out utilizing any web-based editor. No need to concern yourself with making typos because your template may be used and sent away, and published as many times as you would like. Check out US Legal Forms and get access to more than 85,000 state-specific legal and tax files.

Form popularity

FAQ

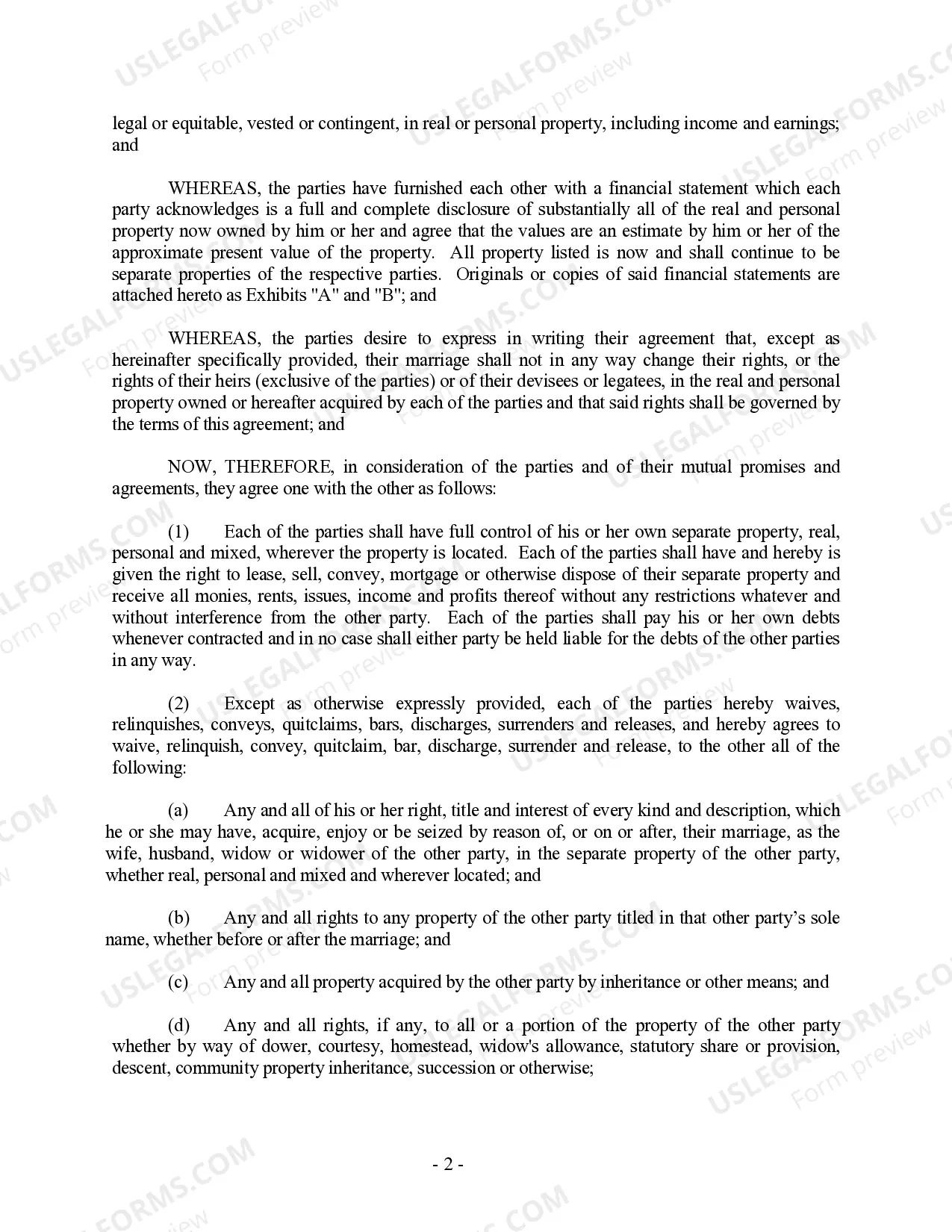

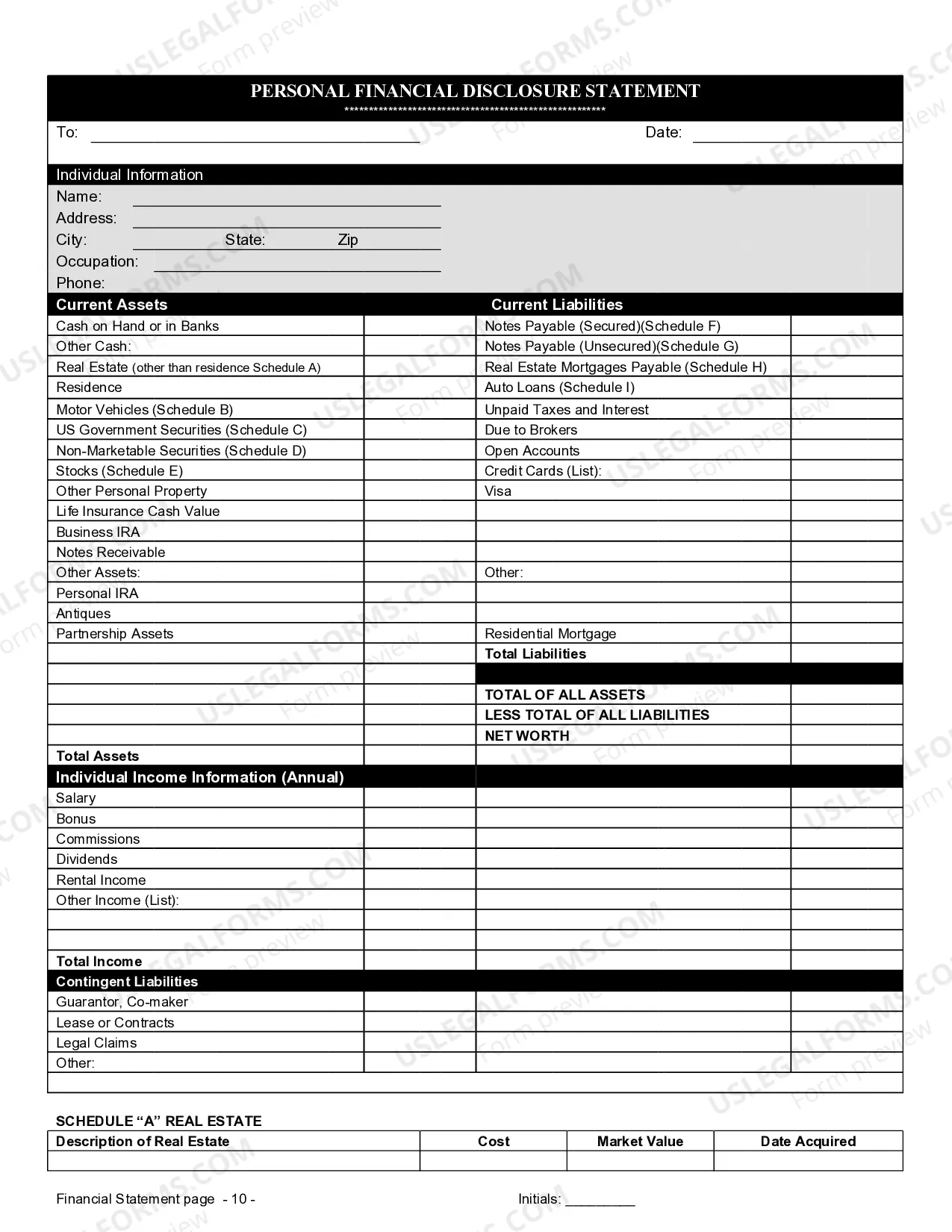

One formality that many do not realize the importance of is a full and fair disclosure of assets and debts prior to the prenuptial agreement being signed. In other words, both parties are supposed to disclosure all the assets and debts that they are bringing into the marriage.

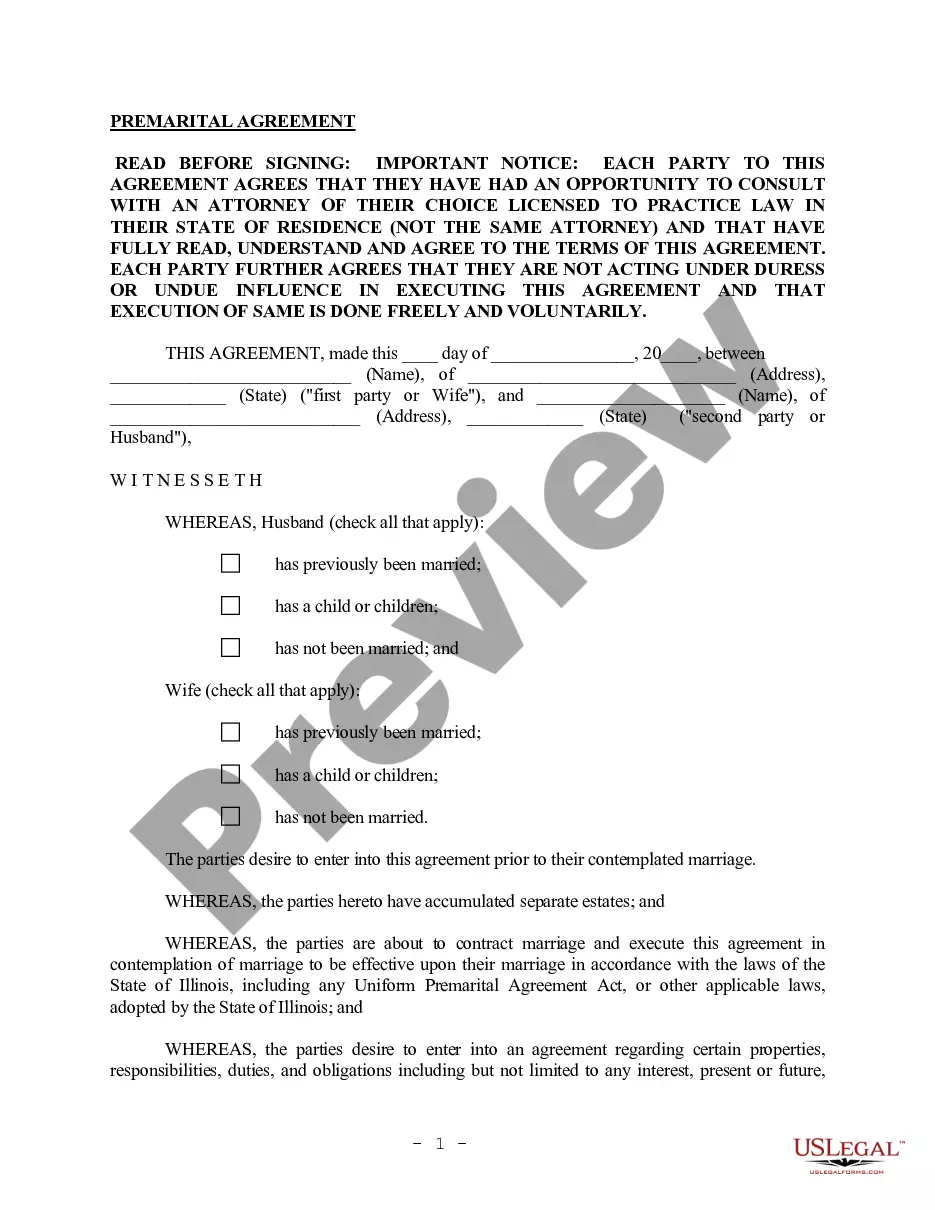

Here are the top 10 reasons why a prenup could be invalid: There Isn't A Written Agreement: Premarital agreements are required to be in writing to be enforced. Not Correctly Executed: Each party is required to sign a premarital agreement prior to the wedding for the agreement to be deemed valid.

Just as a future asset can be protected by a prenup if adequately described, future income can also be treated as belonging to one partner but not both.

Rather, "it's when there are unequal amounts coming in from the marriage." In other words, if one member of the couple has a much higher income or significantly more assets than the other, it's worth considering a prenup. "When one person has way more than the other, that's where it gets a little dicey," says Holeman.

Despite the fact that a prenup is arranged before a marriage, you can still sign one after exchanging "I do's." This contract, known as a post-nuptial agreement, is drafted after marriage by those who are still married and either are contemplating separation or divorce or simply want to protect themselves from the

In the event of divorce, a prenup can protect a spouse from being liable for any debt the other spouse brought into the marriage.A prenup can also protect any income or assets you earn during the marriage, as well as unearned income from a bequest or a trust distribution.

2. Prenups make you think less of your spouse. And at their root, prenups show a lack of commitment to the marriage and a lack of faith in the partnership.Ironically, the marriage becomes more concerned with money after a prenup than it would have been without the prenup.

Prenups aren't just for the rich or famous more millennials are signing them before getting married, and you probably should too.Prenups set expectations for a division of assets and finances in the event of divorce. They may not be romantic to bring up, but most couples will benefit from having one.

Putting the Agreement in Writing. Identify the parties and the document. After titling the document something like Premarital Agreement, you want to identify the two parties by full, legal names and state that they are both willingly entering into the agreement. State the intent of marriage.