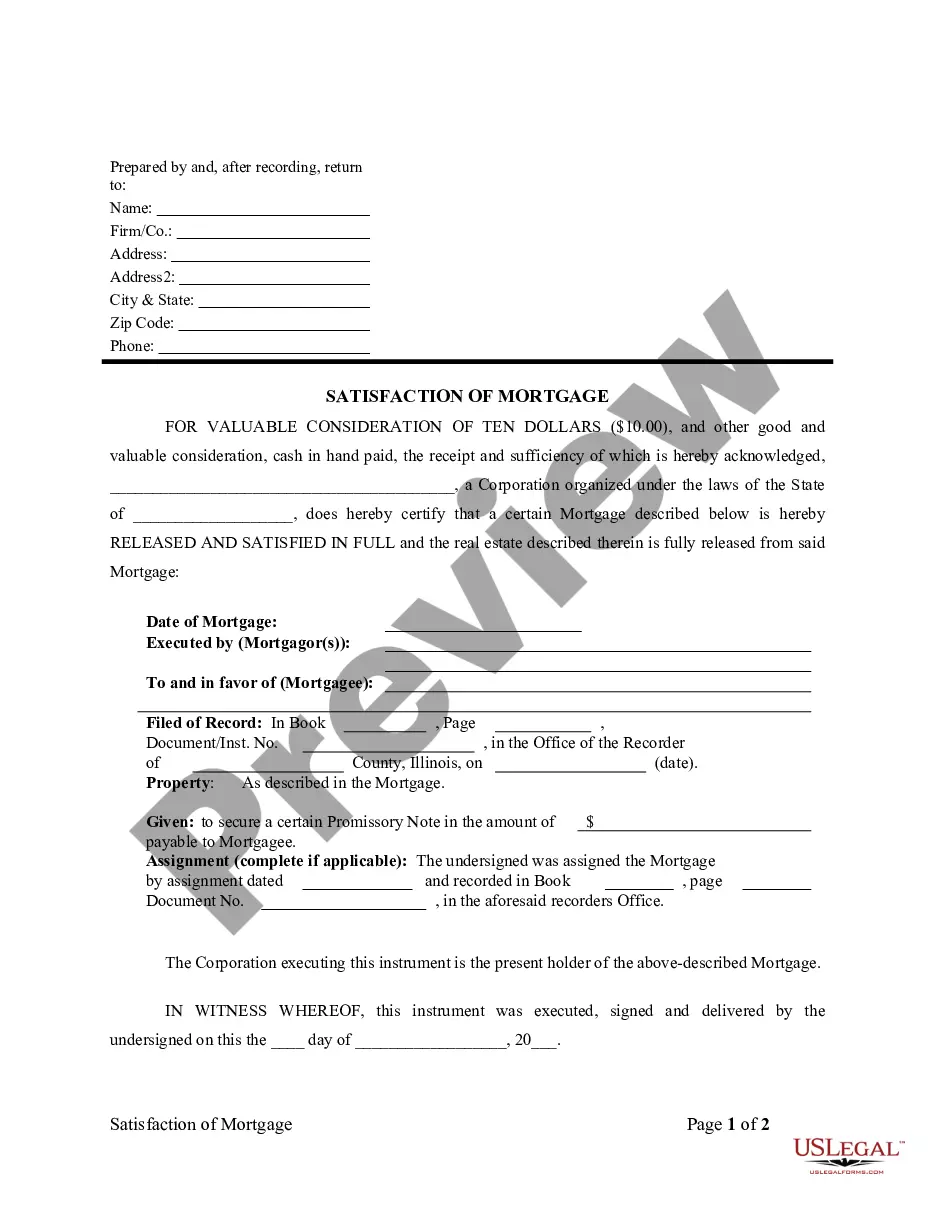

An agreement modifying a loan agreement and mortgage should be signed by both parties to the transaction and recorded in the office of the register of deeds and mortgages where the original mortgage was recorded. Such a modification is contractual in nature and should be supported by consideration.

Illinois Modification of Mortgage Loan in Default to Bring it Current and to Change Variable Rate of Interest to Fixed Rate

Description Modification Mortgage Loan

How to fill out Modification Mortgage Loan Application?

In search of Illinois Modification of Mortgage Loan in Default to Bring it Current and to Change Variable Rate of Interest to Fixed Rate templates and completing them might be a problem. To save time, costs and effort, use US Legal Forms and choose the right template specifically for your state within a couple of clicks. Our attorneys draw up all documents, so you simply need to fill them out. It is really that easy.

Log in to your account and come back to the form's web page and download the sample. Your downloaded samples are kept in My Forms and they are available all the time for further use later. If you haven’t subscribed yet, you need to register.

Look at our comprehensive recommendations concerning how to get your Illinois Modification of Mortgage Loan in Default to Bring it Current and to Change Variable Rate of Interest to Fixed Rate sample in a couple of minutes:

- To get an entitled example, check out its applicability for your state.

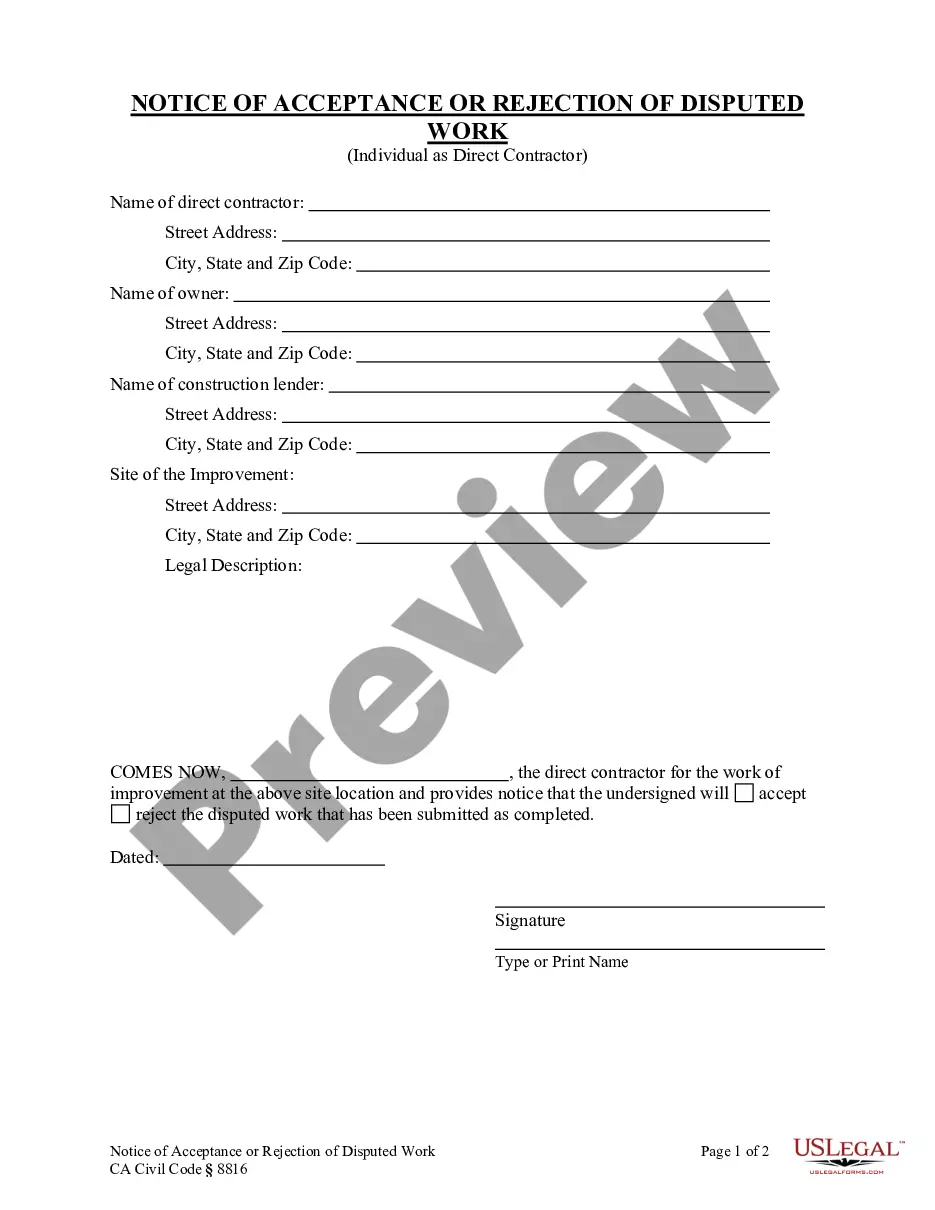

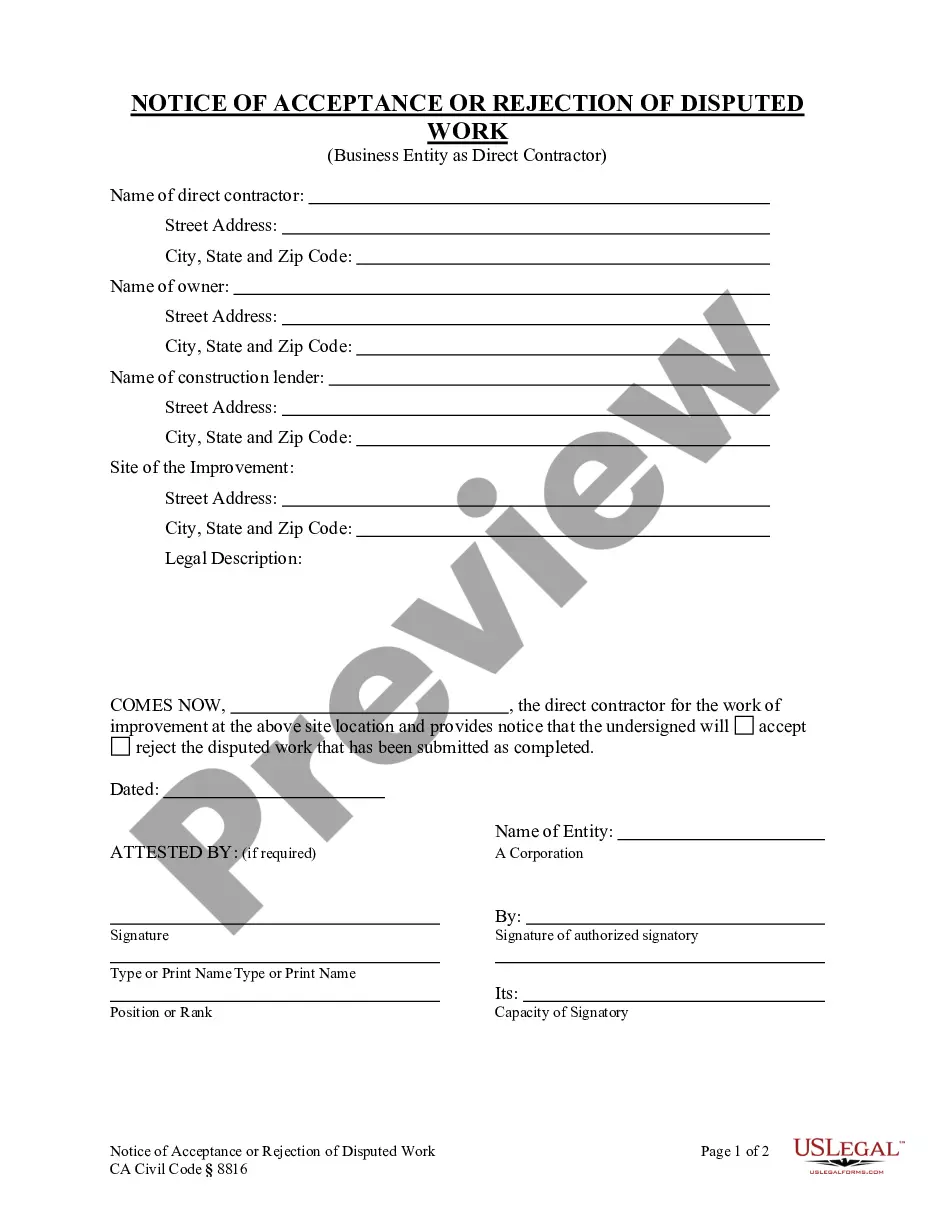

- Check out the form using the Preview option (if it’s available).

- If there's a description, read through it to understand the important points.

- Click Buy Now if you found what you're looking for.

- Select your plan on the pricing page and create an account.

- Select you want to pay by way of a card or by PayPal.

- Save the form in the favored file format.

You can print out the Illinois Modification of Mortgage Loan in Default to Bring it Current and to Change Variable Rate of Interest to Fixed Rate form or fill it out using any online editor. Don’t worry about making typos because your sample can be utilized and sent, and printed out as often as you wish. Try out US Legal Forms and get access to around 85,000 state-specific legal and tax files.

Modification Loan Rate Interest Form popularity

Modification Rate Fixed Other Form Names

Default Current Rate Interest FAQ

If your modification is temporary, you'll likely need to return to the original terms of your mortgage and repay the amount that was deferred before you can qualify for a new purchase or refinance loan.

Homeowners go through the process of a loan modification to stay afloat in times that their mortgage payments are becoming too difficult to maintain. It is possible to refinance the loan again in the future, but do not expect it to come without challenges.

You can refinance a modified home loan depending on your current financial conditions, the terms of the modification and how much time passed since completing the modification. Typically, lenders don't approve modifications unless you stand a better chance of repaying the debt under new modified terms.

Homeowners go through the process of a loan modification to stay afloat in times that their mortgage payments are becoming too difficult to maintain. It is possible to refinance the loan again in the future, but do not expect it to come without challenges.

You can get a mortgage after you have done a loan modification. Loan modifications were quite popular starting in 2009 through 2013.If you went ahead a only lowered the interest rate or converted it to a fixed rate, than you should be able to qualify for a new mortgage right away, no waiting period.

There is a 12-24 month waiting period before you can refinance under most post-loan modification options. To refinance a loan's interest rate and repayment terms, the refinance lender requires you to have stable income and total monthly expenses within 40 percent of your gross monthly income.

If a borrower defaults on a loan modification executed under HAMP (delinquent by the equivalent of three full monthly payments at the end of the month in which the last of the three delinquent payments was due), the loan is no longer considered to be in good standing. Once lost, good standing cannot be restored even

Either way, it stays on your report for seven years.

After your loan modification was completed. There are a couple of lenders that will allow anywhere from 1-2 yrs after a loan modification is completed. Barclay Butler Financial has no minimum time that has to have gone by since the loan modification was completed.