A judicial foreclosure is a foreclosure which results from a court action rather than from the power of sale given to a trustee. It is a type of foreclosure proceeding used in some states that is handled as a civil lawsuit and conducted under the auspices of a court. Judicial foreclosures occur when a trust deed or mortgage deed does not have a power of sale clause, thus compelling the lender to take the borrower to court. This is in contrast to a non-judicial foreclosure, in which a foreclosure can be completed outside the court system.

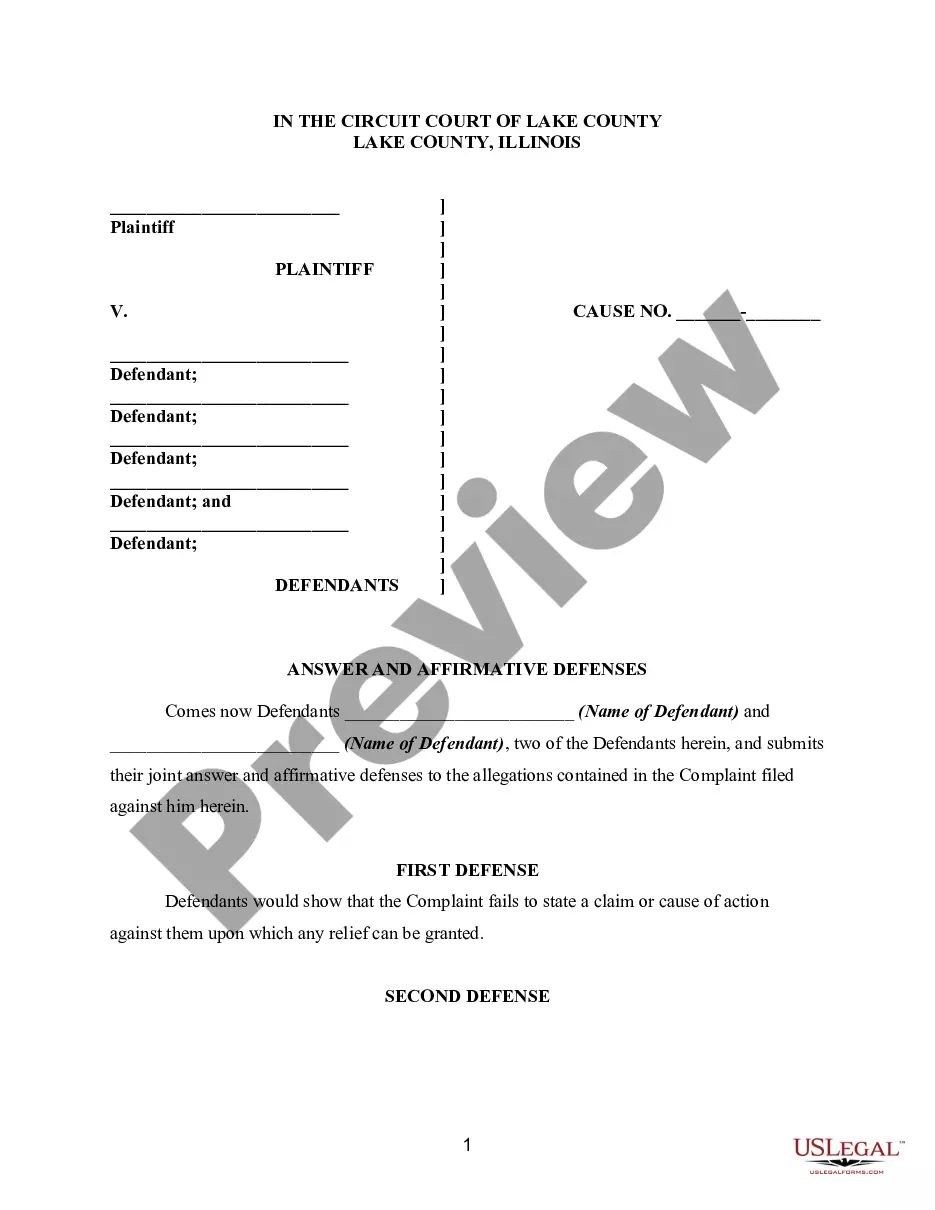

Illinois Answer to Complaint for Judicial Foreclosure

Description Illinois Foreclosure Blank

How to fill out Answer Complaint Judicial?

Searching for Illinois Answer to Complaint for Judicial Foreclosure forms and filling out them could be a challenge. To save time, costs and energy, use US Legal Forms and find the correct sample specially for your state within a couple of clicks. Our attorneys draft all documents, so you just have to fill them out. It is really so simple.

Log in to your account and return to the form's page and save the document. Your saved templates are saved in My Forms and are available at all times for further use later. If you haven’t subscribed yet, you have to sign up.

Check out our detailed recommendations concerning how to get your Illinois Answer to Complaint for Judicial Foreclosure template in a couple of minutes:

- To get an qualified form, check out its applicability for your state.

- Check out the form utilizing the Preview option (if it’s offered).

- If there's a description, read through it to know the specifics.

- Click Buy Now if you found what you're trying to find.

- Pick your plan on the pricing page and make an account.

- Pick how you would like to pay out by way of a credit card or by PayPal.

- Save the file in the preferred file format.

You can print the Illinois Answer to Complaint for Judicial Foreclosure form or fill it out utilizing any web-based editor. No need to concern yourself with making typos because your form can be applied and sent, and printed as many times as you want. Check out US Legal Forms and get access to above 85,000 state-specific legal and tax documents.

Answer Complaint Foreclosure Sample Form popularity

Answer Foreclosure Fill Other Form Names

Sample Answer To Foreclosure Complaint Ohio FAQ

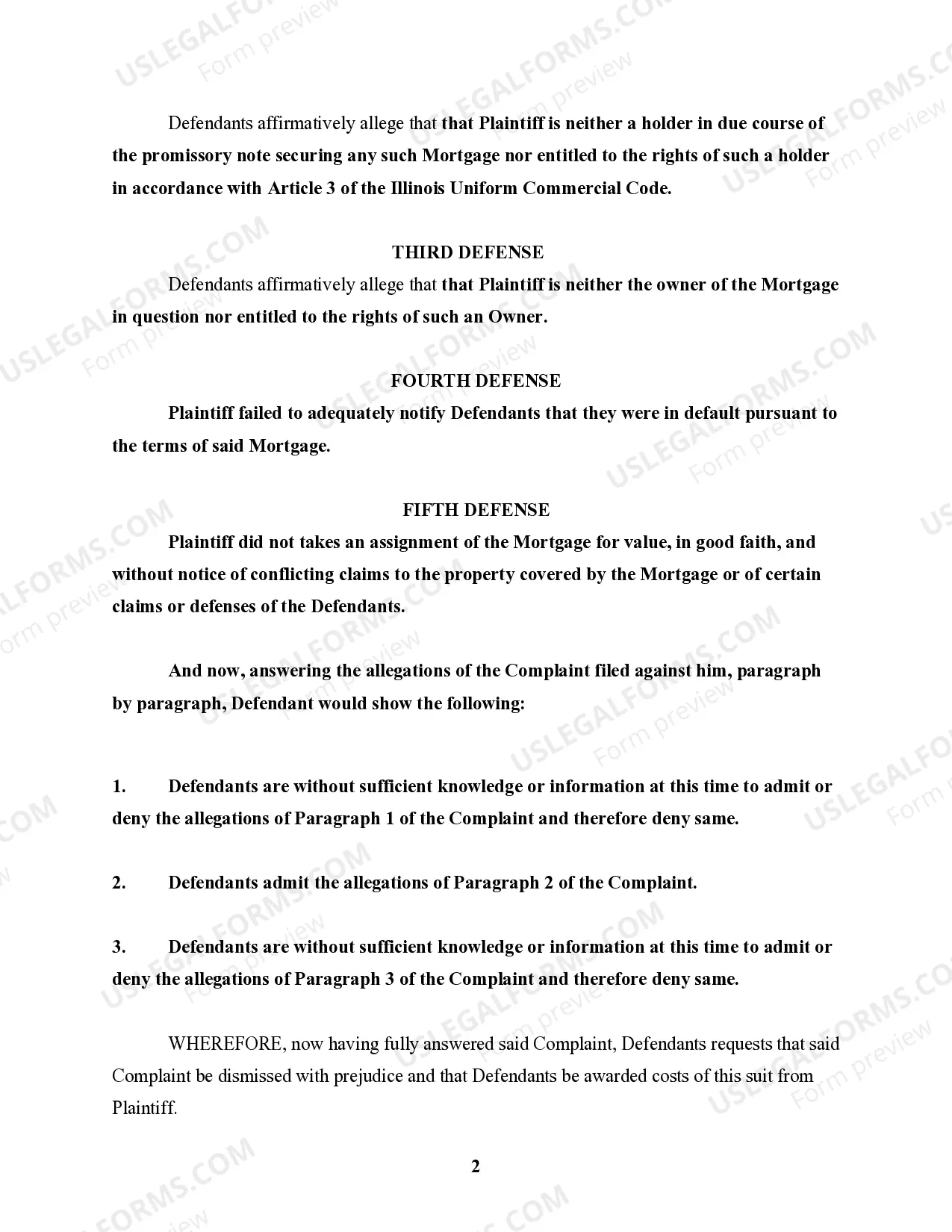

To contest a judicial foreclosure, you have to file a written answer to the complaint (the lawsuit). You'll need to present your defenses and explain the reasons why the lender shouldn't be able to foreclose. You might need to defend yourself against a motion for summary judgment and at trial.

In situations where a foreclosure has already occurred, the California Supreme Court held that a borrower has standing to sue for wrongful foreclosure based on an allegedly void assignment of his or her mortgage.

Foreclosure proceedings begin with a complaint filed by the lender. The borrower is served a copy of the complaint and a summons, along with a notice of his or her rights during foreclosure. In most cases, the borrower has 30 days to file a response. Failure to respond will result in a default judgment for the lender.

A lender can rescind a foreclosure sale if a borrower requests to reinstate the loan agreements and then makes payment to bring the loan balance current, provided this is done more than five days before the scheduled sale date.

To get the deficiency judgment, the bank has to file an application with the court within three months of the foreclosure sale. The judge will then hold a fair value hearing to determine the property's value.

If the court grants summary judgment in favor of the bank, typically after a hearing, the bank wins the case, and your home will be sold at a foreclosure sale.order the foreclosure sale, or. dismiss the case, usually without prejudice. (Without prejudice means the bank can refile the foreclosure.)

Negotiate With Your Lender. If you are having financial difficulties, the worst thing that you can do is bury your head in the sand. Request a Forbearance. Modify Your Loan. Make a Claim. Get a Housing Counselor. Declare Bankruptcy. Use A Foreclosure Defense Strategy. Make Them Produce The Not.

Proving Wrongful Foreclosure If you wish to sue the bank for wrongful foreclosure, you must prove the following: The lender owed you, the borrower, a legal duty. The lender breached that duty. The breach of duty caused your injury or loss (damages)