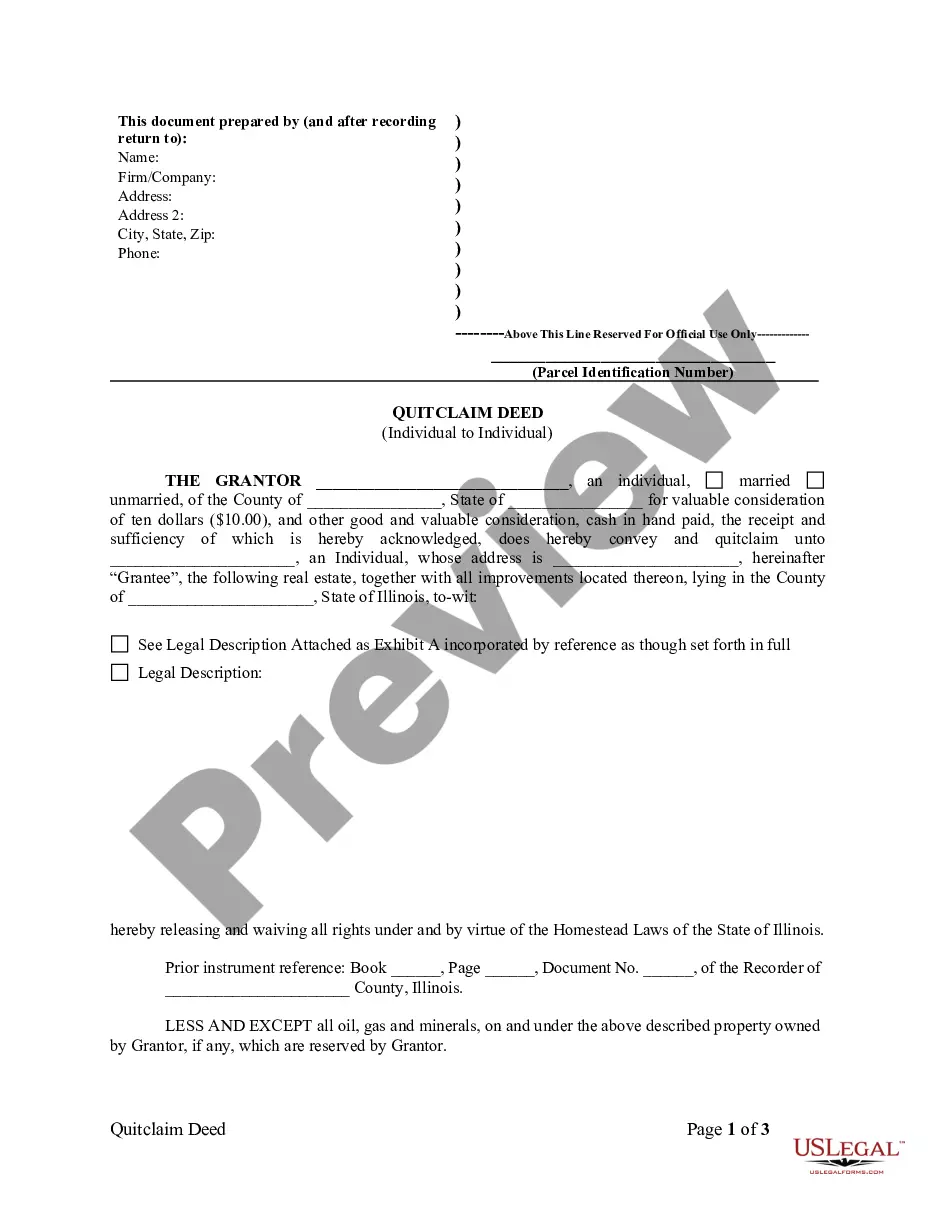

Illinois Quitclaim Deed from Individual to Individual

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

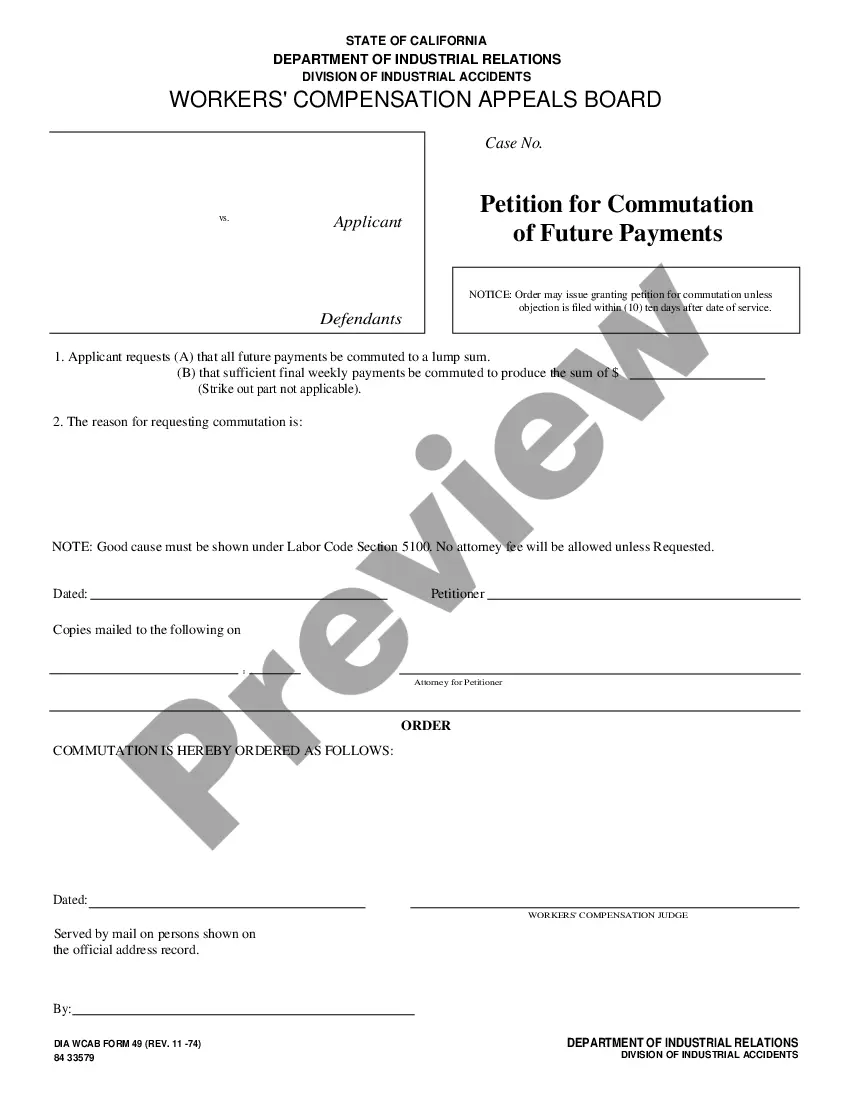

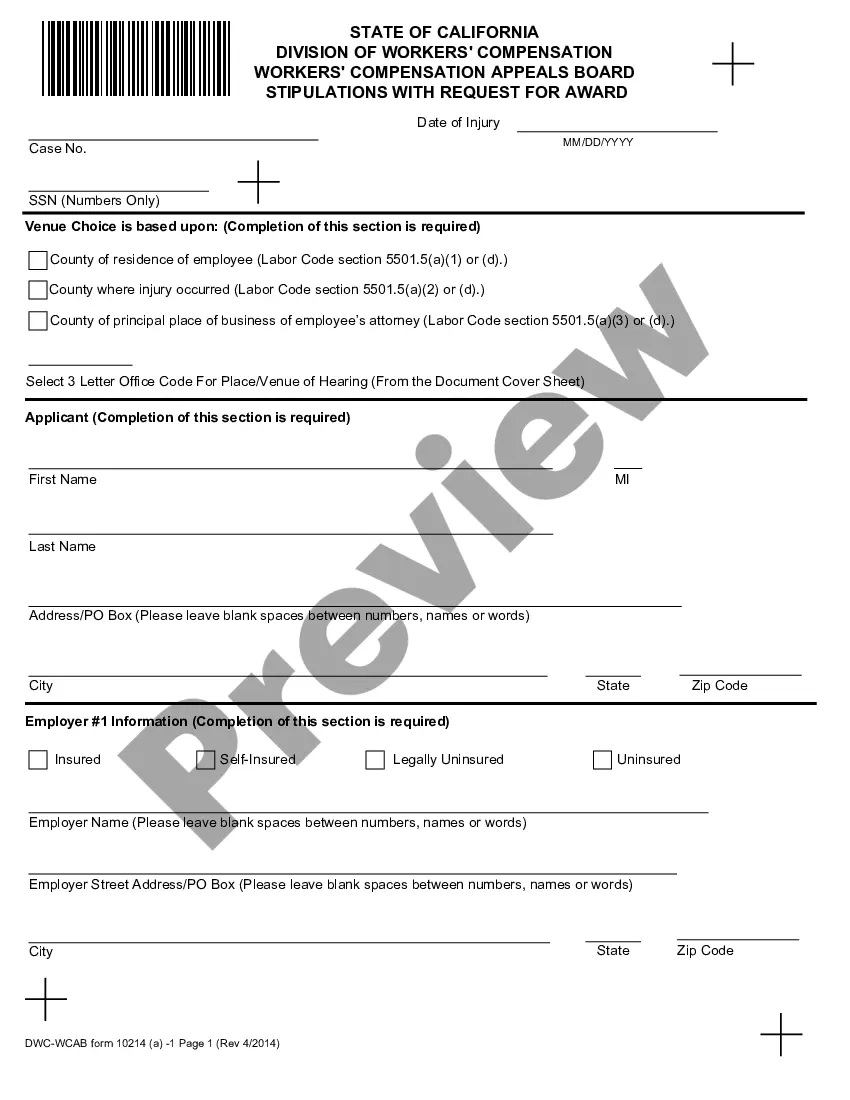

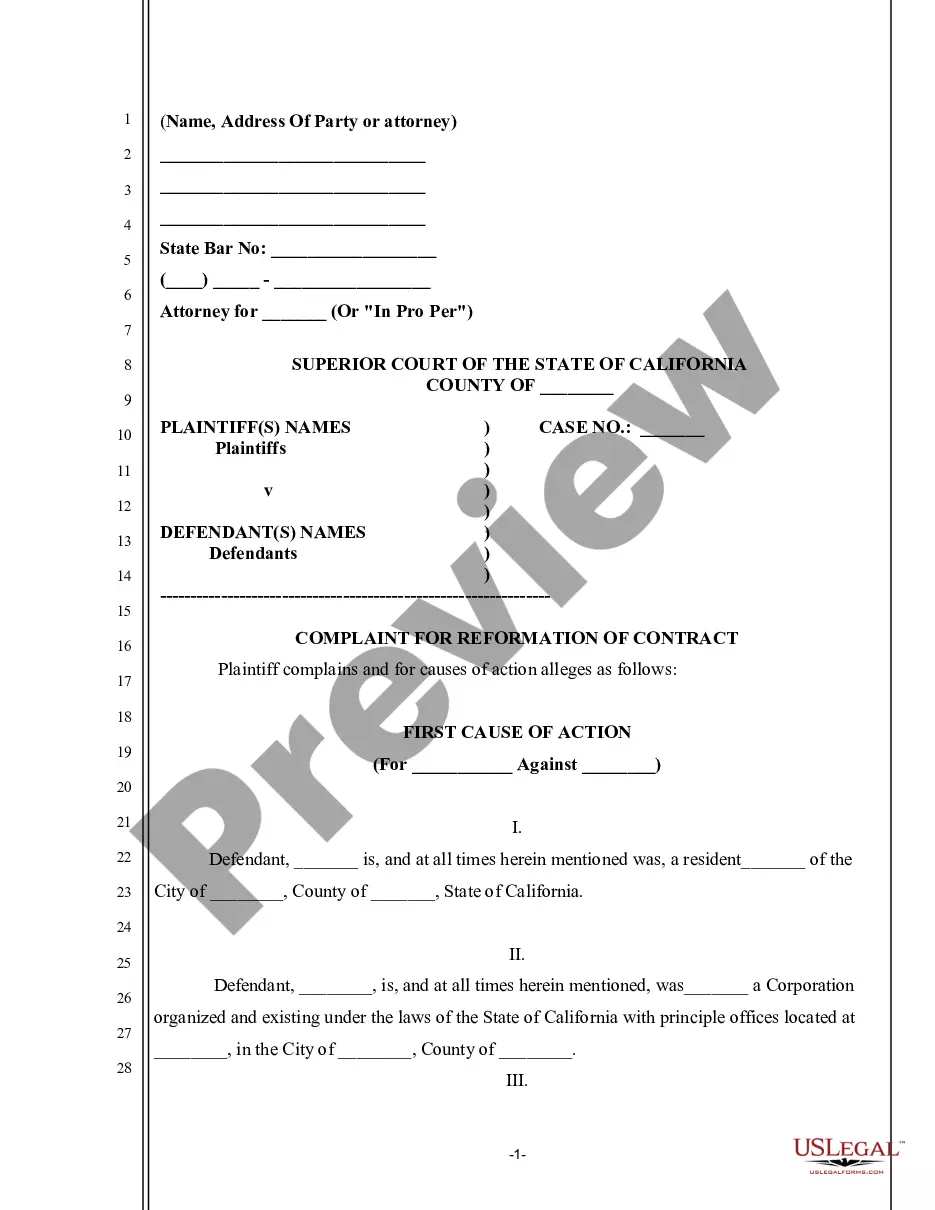

Looking for another form?

How to fill out Illinois Quitclaim Deed From Individual To Individual?

Looking for an Illinois Quitclaim Deed from Individual to Individual example and completing them may pose a challenge.

To conserve time, expenses, and effort, utilize US Legal Forms to locate the appropriate template specifically for your state within a few clicks.

Our lawyers prepare all documents, so all you need to do is complete them.

You can print the Illinois Quitclaim Deed from Individual to Individual template or complete it using any online editor. There's no need to worry about making errors, as your form can be utilized and submitted, and printed as often as you wish. Try US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account to return to the form's webpage and save the document.

- All your downloaded samples are stored in My documents and are accessible at any time for later use.

- If you haven’t subscribed yet, you will need to register.

- Review our detailed instructions on how to obtain your Illinois Quitclaim Deed from Individual to Individual template in mere minutes.

- To acquire a titled template, verify its validity for your state.

- Examine the form using the Preview feature (if it's available).

- If a description exists, read it to understand the details.

- Click Buy Now if you found what you were looking for.

- Select your plan on the pricing page and create an account.

- Choose whether you wish to pay with a card or via PayPal.

- Download the file in your preferred format.

Form popularity

FAQ

If you own your own home, you are free to gift or sell an interest in the real property to someone else.You'll need to transfer an interest by writing up another deed with the person's name on it. In California, you can use either a grant deed, a quitclaim deed or an interspousal deed, depending on your circumstances.

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.

The drawback, quite simply, is that quitclaim deeds offer the grantee/recipient no protection or guarantees whatsoever about the property or their ownership of it. Maybe the grantor did not own the property at all, or maybe they only had partial ownership.

A quitclaim deed transfers the owner's entire interest in the property to the person receiving the property but it only transfers what he actually owns, so if two people jointly own the property and one of them quitclaims his interest to his brother, he can only transfer his half of the ownership.

Yes, you can use a Quitclaim Deed to transfer a gift of property to someone. You must still include consideration when filing your Quitclaim Deed with the County Recorder's Office to show that title has been transferred, so you would use $10.00 as the consideration for the property.

Quitclaim deeds are most often used to transfer property between family members.Examples include when an owner gets married and wants to add a spouse's name to the title or deed, or when the owners divorce and one spouse's name is removed from the title or deed.

Quitclaim deeds are most often used to transfer property between family members. Examples include when an owner gets married and wants to add a spouse's name to the title or deed, or when the owners get divorced and one spouse's name is removed from the title or deed.

Once you sign a quitclaim deed and it has been filed and recorded with the County Clerks Office, the title has been officially transferred and cannot be easily reversed. In order to reverse this type of transfer, it would require your spouse to cooperate and assist in adding your name back to the title.

A person who signs a quitclaim deed to transfer property they do not own results in no title at all being transferred since there is no actual ownership interest. The quitclaim deed only transfers the type of title you own.