This form is a Warranty Deed where the grantor is a corporation and the grantee is a corporation. Grantor conveys and warrants the described property to the grantee. This deed complies with all state statutory laws.

Illinois Warranty Deed - Corporation to Trust

Description

How to fill out Illinois Warranty Deed - Corporation To Trust?

In search of Illinois Warranty Deed - Corporation to Trust forms and completing them could be a challenge. To save lots of time, costs and energy, use US Legal Forms and find the correct sample specifically for your state within a couple of clicks. Our attorneys draft all documents, so you just have to fill them out. It truly is that easy.

Log in to your account and return to the form's page and download the sample. All of your downloaded samples are saved in My Forms and therefore are available at all times for further use later. If you haven’t subscribed yet, you have to register.

Have a look at our detailed instructions regarding how to get the Illinois Warranty Deed - Corporation to Trust sample in a few minutes:

- To get an qualified form, check out its applicability for your state.

- Take a look at the example utilizing the Preview function (if it’s accessible).

- If there's a description, go through it to learn the details.

- Click on Buy Now button if you identified what you're searching for.

- Select your plan on the pricing page and create your account.

- Select you would like to pay with a credit card or by PayPal.

- Download the file in the favored format.

Now you can print the Illinois Warranty Deed - Corporation to Trust form or fill it out utilizing any online editor. No need to concern yourself with making typos because your form can be employed and sent, and published as many times as you wish. Try out US Legal Forms and get access to over 85,000 state-specific legal and tax files.

Form popularity

FAQ

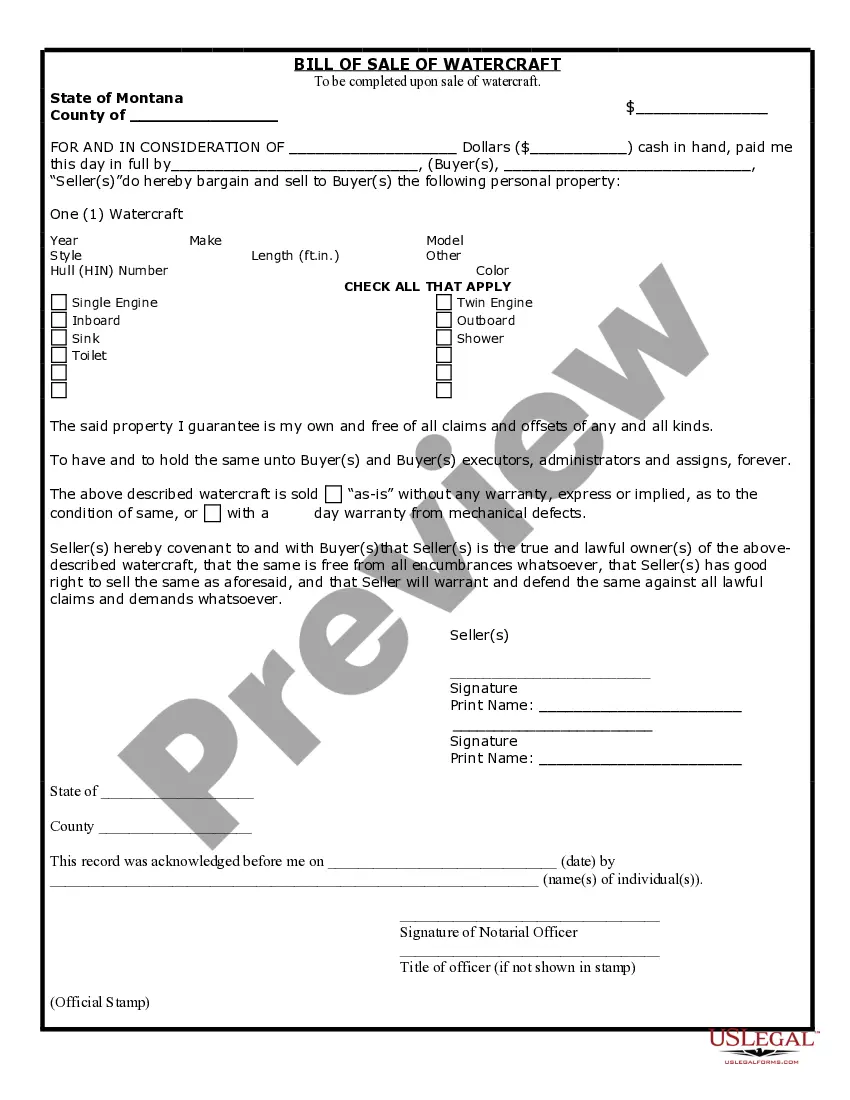

Locate your current deed. Use the proper deed. Check with your title insurance company and lender. Prepare a new deed. Sign in the presence of a notary. Record the deed in the county clerk's office. Locate the deed that's in trust. Use the proper deed.

Warranty Deed Vs Deed of Trust. Both a warranty deed and deed of trust are used to transfer the title of a property from one person to another.As you now know, a deed of trust protects the beneficiary (lender). A warranty deed, on the other hand, protects the property owner.

It's important to note that a warranty deed does not actually prove the grantor has ownership (a title search is the best way to prove that), but it is a promise by the grantor that they are transferring ownership and if it turns out they don't actually own the property, the grantor will be responsible for compensating

A trustee deed offers no such warranties about the title.

A warranty deed protects property owners from future claims that someone else actually owns a portion (or all) of their property, while trustee deeds protect lenders when borrowers default on their mortgage loans.

Quitclaim Deed. Deed of Trust. Warranty Deed. Grant Deed. Bargain and Sale Deed. Mortgage Deed.

A deed conveys ownership; a deed of trust secures a loan.

Let's start with the definition of a deed: DEED: A written instrument by which one party, the Grantor, conveys the title of ownership in property to another party, the Grantee. A Warranty Deed contains promises, called covenants, that the Grantor makes to the Grantee.

Yes, there are key differences between the two. With a deed, you transfer the ownership of the property to one party. In contrast, a deed of trust does not mean the holder owns the property. In an arrangement involving a deed of trust, the borrower signs a contract with the lender with details regarding the loan.