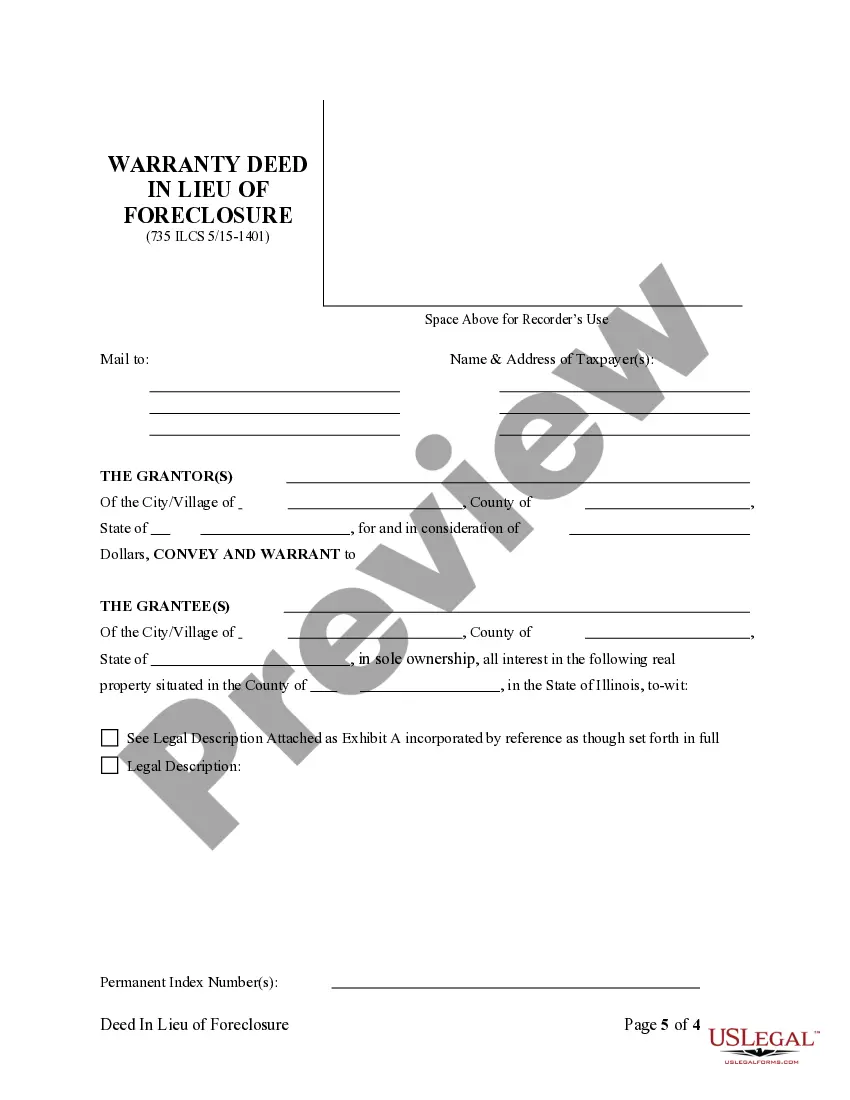

This form is a Warranty Deed where the grantor(s) transfer all interest in the real property to the grantee(s) in lieu or in place of foreclosure. This deed complies with all state statutory laws.

Illinois Warranty Deed in Lieu of Foreclosure

Description Deed Foreclosure Form

How to fill out Deed Real Estate Uslegal?

Looking for Illinois Warranty Deed in Lieu of Foreclosure templates and completing them can be a problem. In order to save time, costs and effort, use US Legal Forms and find the right example specifically for your state in a few clicks. Our lawyers draft every document, so you simply need to fill them out. It is really so simple.

Log in to your account and return to the form's web page and save the document. Your saved examples are kept in My Forms and are accessible all the time for further use later. If you haven’t subscribed yet, you should register.

Look at our comprehensive instructions concerning how to get your Illinois Warranty Deed in Lieu of Foreclosure template in a few minutes:

- To get an qualified form, check its applicability for your state.

- Have a look at the example making use of the Preview option (if it’s offered).

- If there's a description, read it to learn the important points.

- Click on Buy Now button if you found what you're seeking.

- Choose your plan on the pricing page and make your account.

- Select you want to pay out by a credit card or by PayPal.

- Save the file in the favored file format.

You can print out the Illinois Warranty Deed in Lieu of Foreclosure form or fill it out making use of any online editor. No need to worry about making typos because your template may be employed and sent, and printed out as many times as you want. Check out US Legal Forms and get access to over 85,000 state-specific legal and tax files.

Illinois Deed Lieu Foreclosure Document Form popularity

Deed Lieu Foreclosure Other Form Names

Lieu Foreclosure FAQ

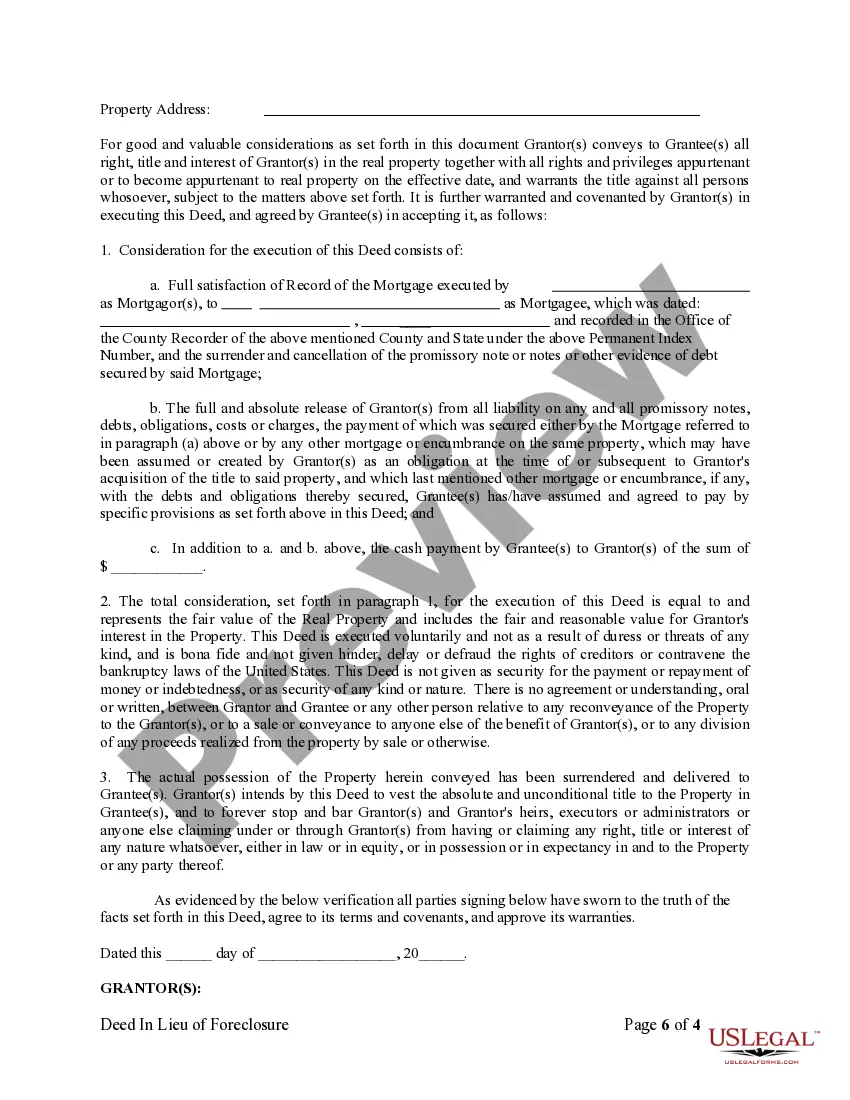

The deed in lieu of foreclosure offers several advantages to both the borrower and the lender. The principal advantage to the borrower is that it immediately releases him/her from most or all of the personal indebtedness associated with the defaulted loan.

Final Thoughts On Deed In Lieu Of Foreclosure When you take a deed in lieu agreement, you transfer your home's deed to your lender voluntarily. In exchange, the lender agrees to forgive the amount left on your loan. A deed in lieu agreement won't stay on your credit report if a foreclosure will.

A deed in lieu of foreclosure is different from a short sale because it transfers the property to the lender instead of selling it to a new buyer.Similar to a short sale, a deed in lieu of foreclosure likely will not damage your credit as severely as a foreclosure or a bankruptcy.

A deed in lieu of foreclosure is a document that transfers the title of a property from the property owner to their lender in exchange for being relieved of the mortgage debt.

First, approach your lender with sufficient proof of inability to repay your mortgage, and then offer a deed in lieu of foreclosure. Second, negotiate the terms of any reports to credit bureaus your lender may make after it accepts your deed in lieu.

If your lender agrees to a short sale or to accept a deed in lieu of foreclosure, you might owe federal income tax on any forgiven deficiency. The IRS learns of the deficiency when the lender sends it a Form 1099-C, which reports the forgiven debt as income to you.

A hardship letter should Start by stating the purpose of the letter whether it is a loan modification or a short sale so the lender knows what homeowners want. It should say something like I need to restructure my mortgage and obtain a lower, fixed interest rate2026, in a way that force them to find out why.

Disadvantages of a Deed in Lieu of Foreclosure. Perhaps the biggest disadvantage of a deed in lieu is that the Lender takes subject to all other encumbrances and interests in the Property. Therefore if there is a second mortgage, for example, a deed in lieu would likely not be a viable strategy.

Rather than deal with the foreclosure process, I would like to give you the deed to my home, in exchange for forgiveness on the loan. I do not have a second mortgage, and there are no other liens on the property. I have attached all relevant documents for the house and for my current economic situation.