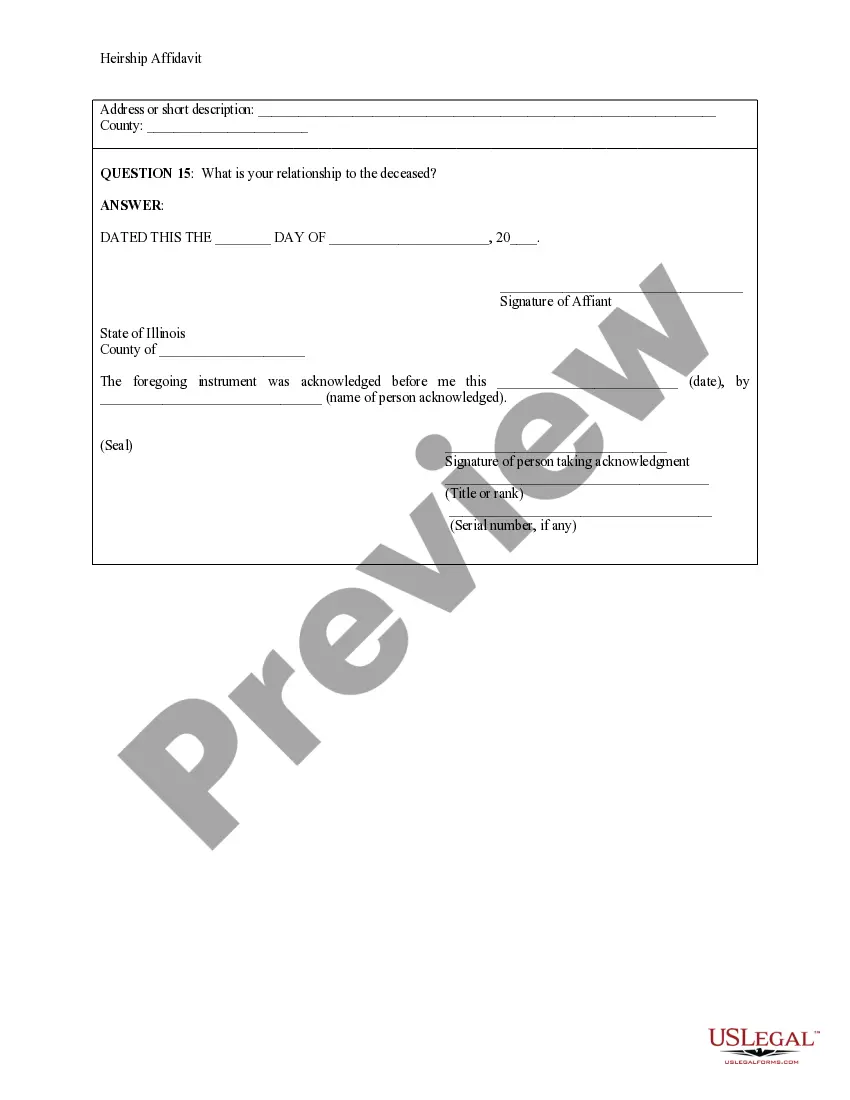

Illinois Heirship Affidavit - Descent

Description Il Affidavit Document

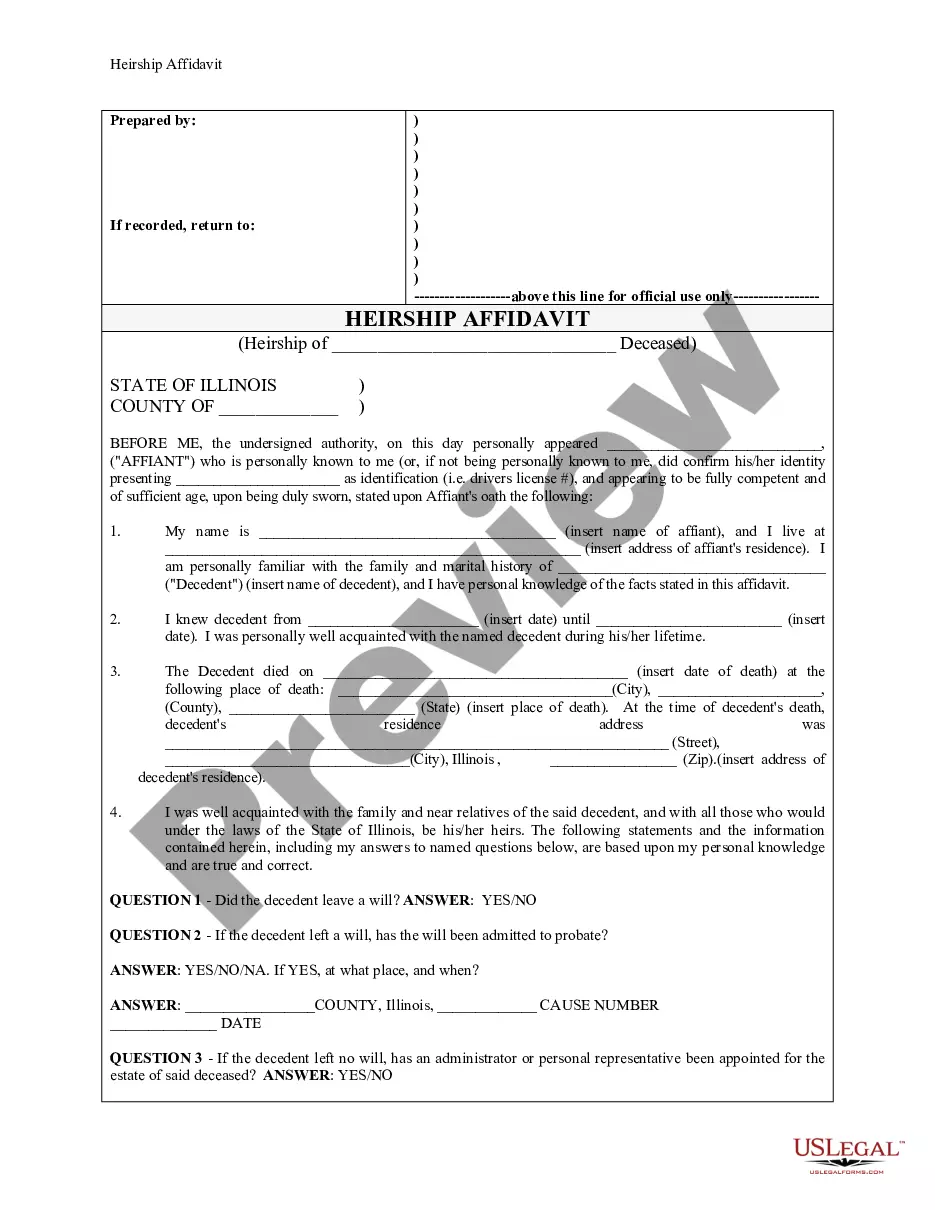

How to fill out Heirship Affidavit Illinois?

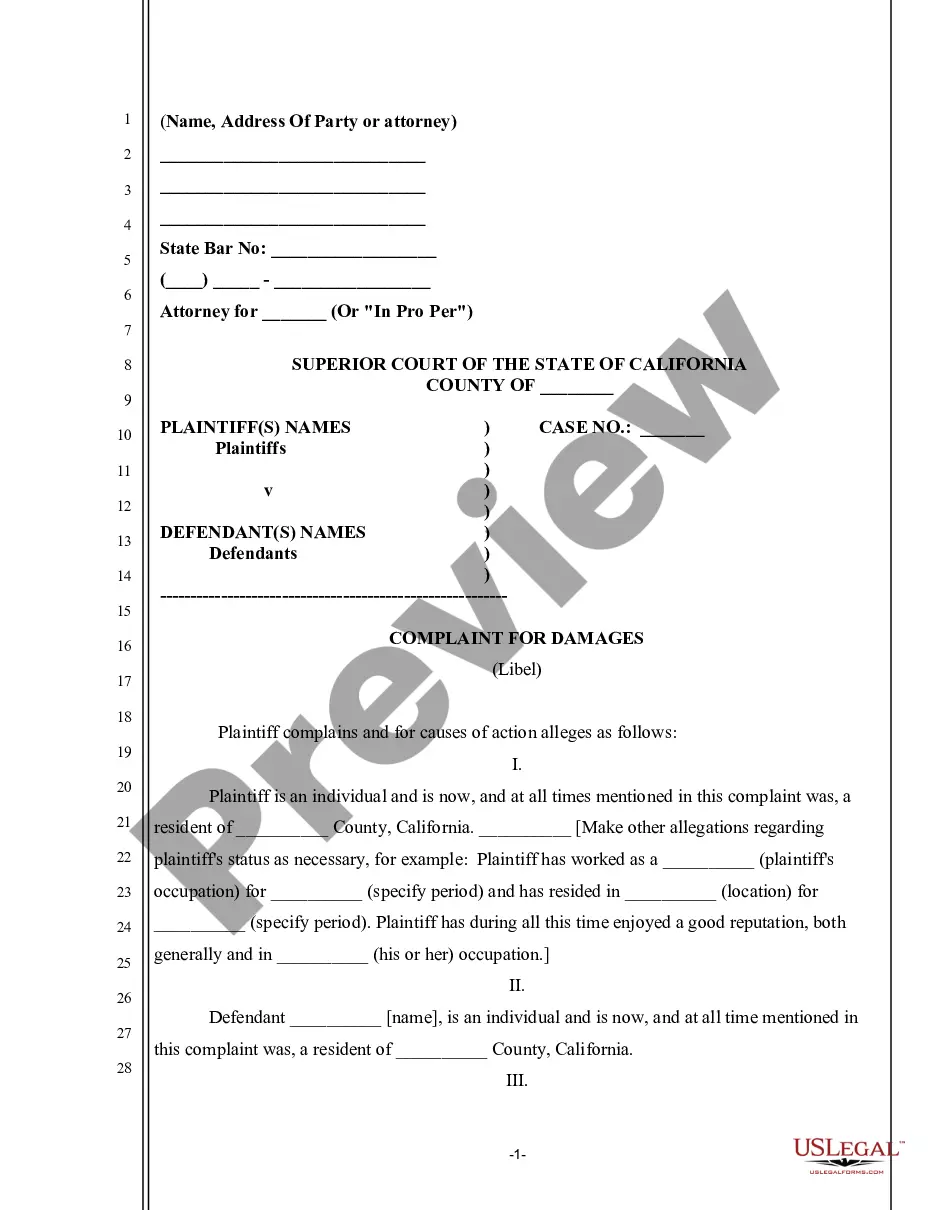

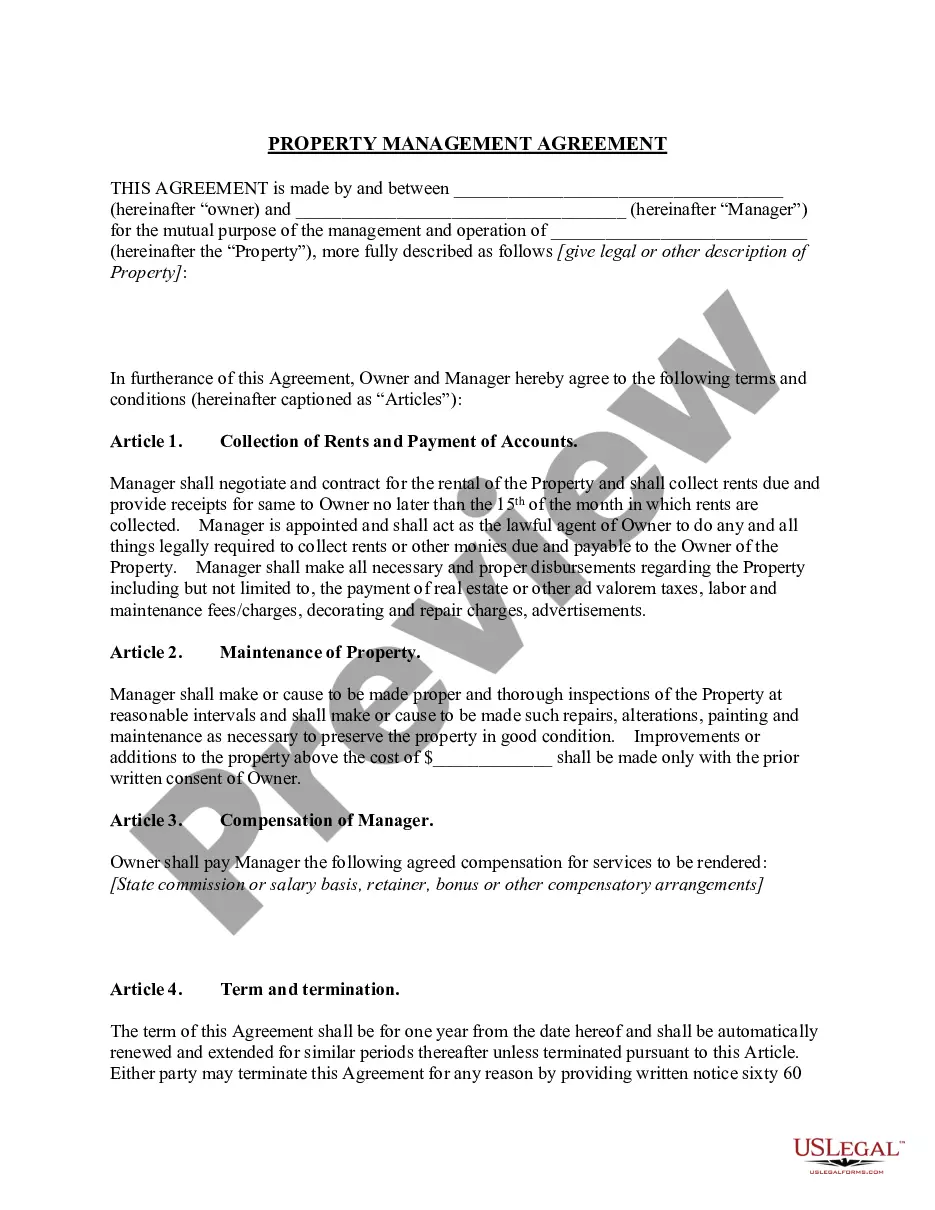

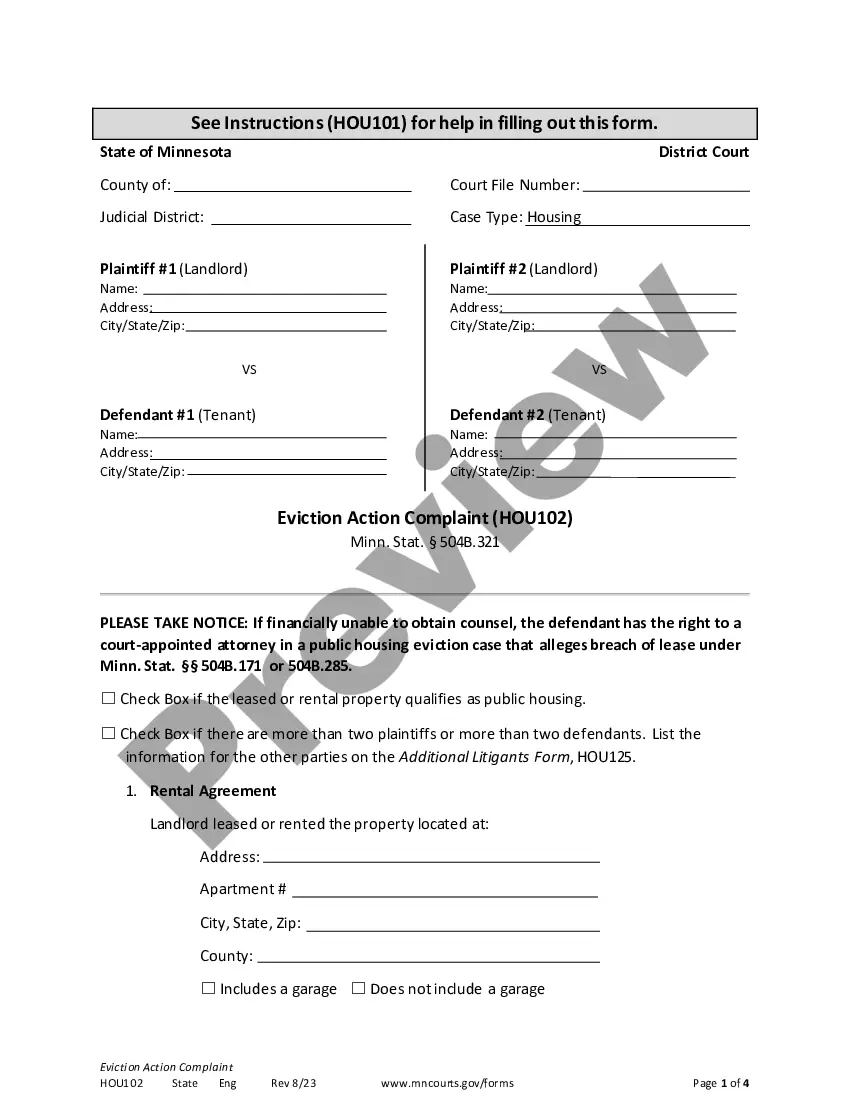

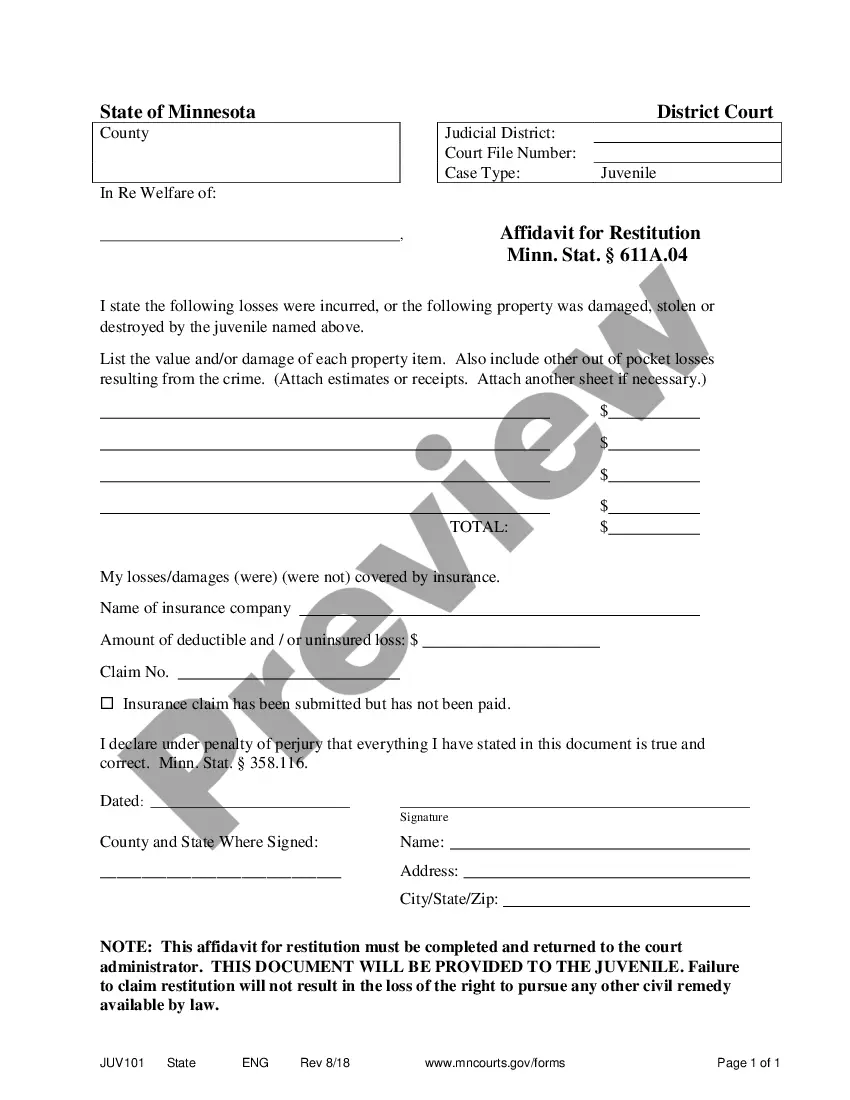

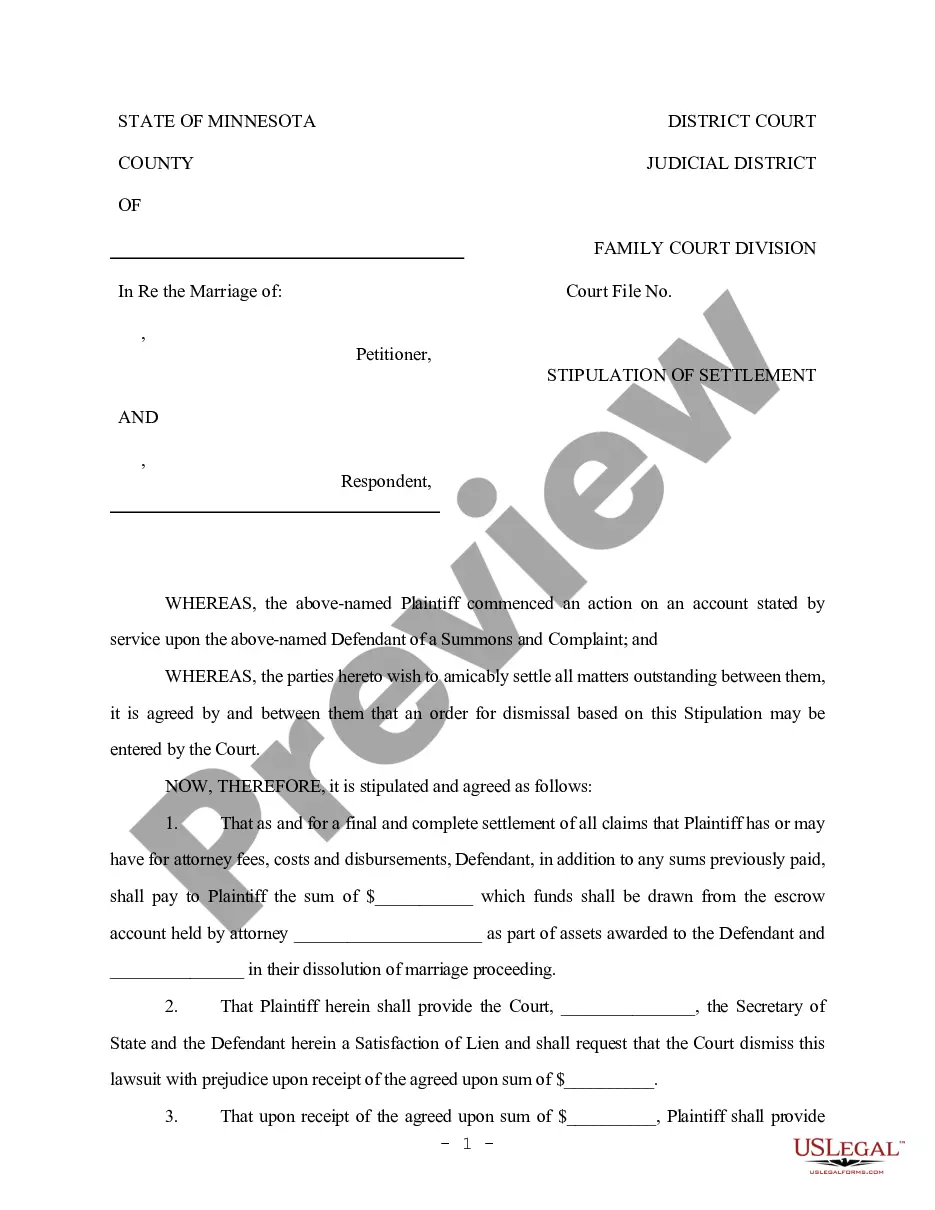

Trying to find Illinois Heirship Affidavit - Descent templates and completing them could be a challenge. To save time, costs and effort, use US Legal Forms and choose the right template specifically for your state in a couple of clicks. Our lawyers draw up each and every document, so you simply need to fill them out. It really is so simple.

Log in to your account and come back to the form's page and download the document. All of your saved templates are kept in My Forms and they are accessible always for further use later. If you haven’t subscribed yet, you should sign up.

Have a look at our detailed guidelines concerning how to get the Illinois Heirship Affidavit - Descent template in a few minutes:

- To get an qualified sample, check out its applicability for your state.

- Check out the example using the Preview option (if it’s offered).

- If there's a description, go through it to understand the important points.

- Click Buy Now if you identified what you're searching for.

- Pick your plan on the pricing page and make an account.

- Pick how you wish to pay by a credit card or by PayPal.

- Download the sample in the favored format.

You can print out the Illinois Heirship Affidavit - Descent form or fill it out utilizing any web-based editor. No need to concern yourself with making typos because your sample may be utilized and sent, and published as many times as you want. Try out US Legal Forms and get access to around 85,000 state-specific legal and tax documents.

Heirship File Form popularity

Heirship Illinois Other Form Names

Il Heirship Affidavit Pdf FAQ

Merriam-Webster defines heir as "one who inherits or is entitled to inherit property" and legatee as "someone who receives money or property from a person who has died."

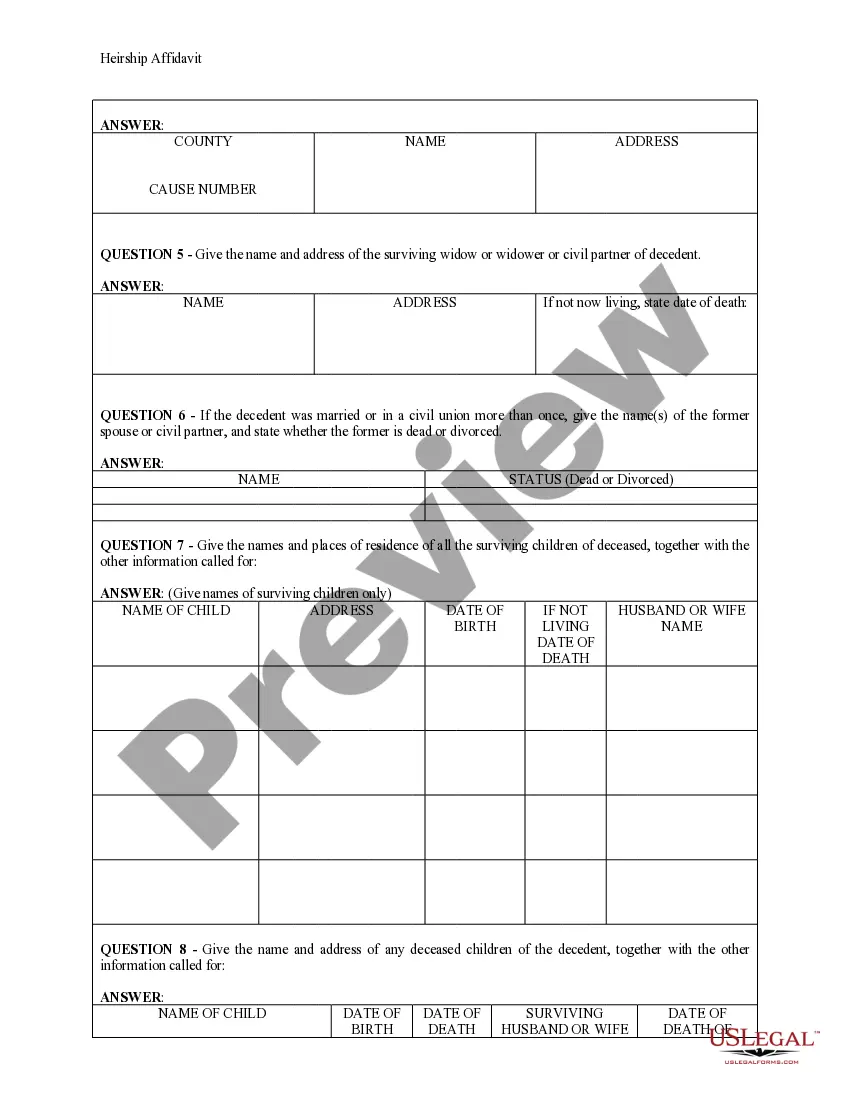

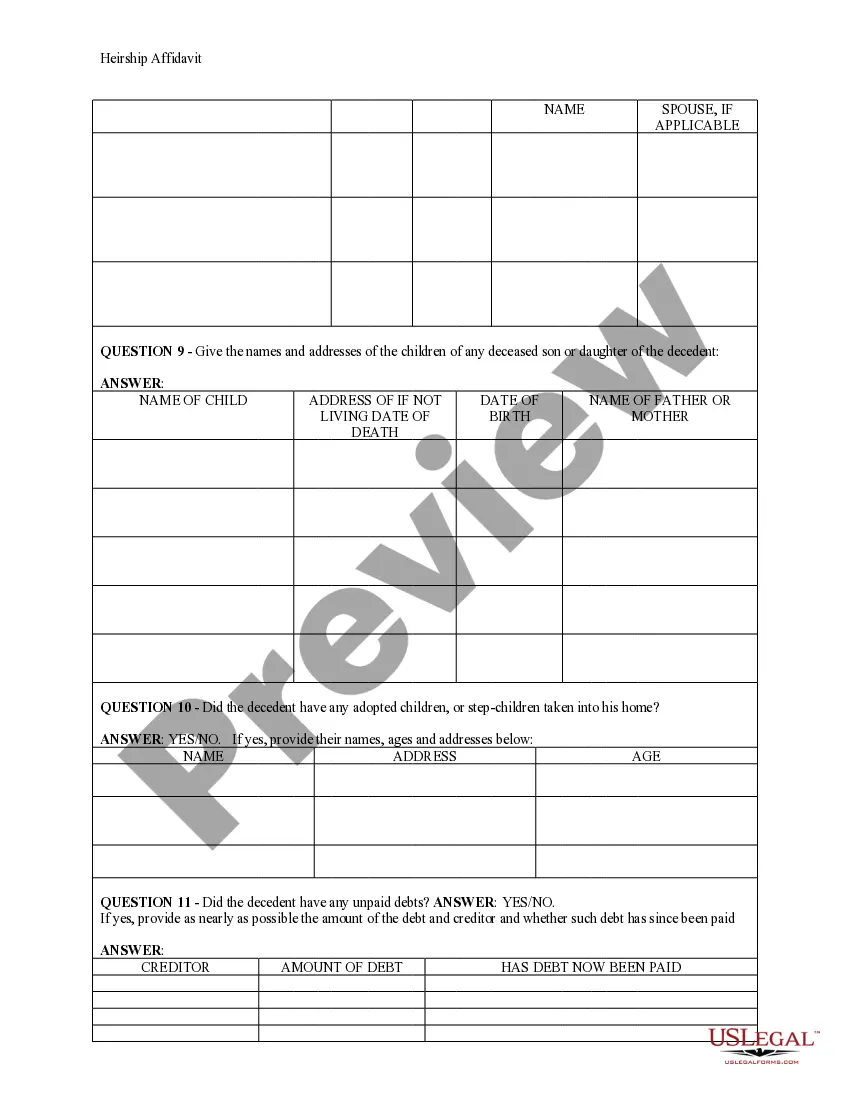

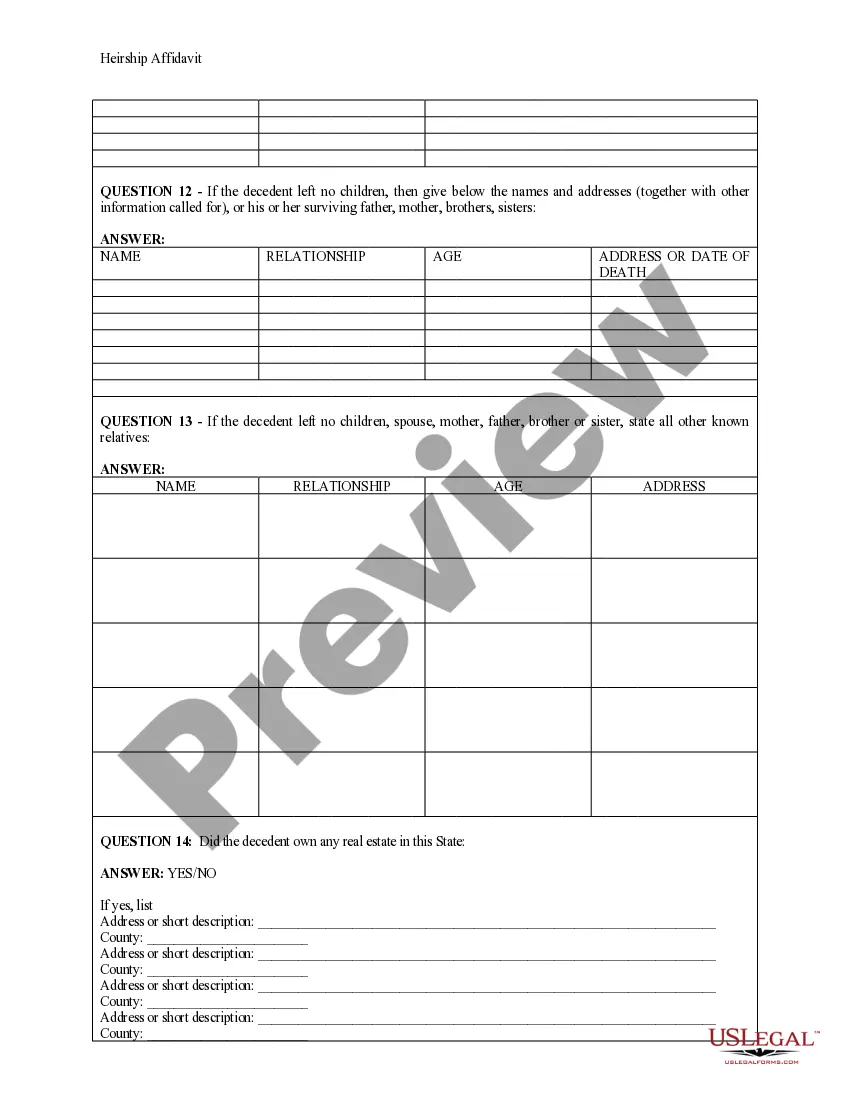

When a person who owns real property dies intestate, and there is no survivor mentioned in the deed, the heirs of the decedent, must file an affidavit of descent to establish their chain of title to the property. This affidavit, is known as an affidavit of descent.

In Illinois, Per Stirpes is the default method of dividing up a deceased person's estate if the deceased dies without having a will.The other two surviving children of the father will again each get an equal amount of money, this time just a third of the estate.

Meaning differences. Merriam-Webster defines heir as "one who inherits or is entitled to inherit property" and legatee as "someone who receives money or property from a person who has died."

(A judgment in this case is a court order, in writing, reciting that the deceased person is dead, the date of death and a list of who are the heirs.) Proof. Once the judgment is issued, copies of the judgment can be used to show proof as to who is entitled to estate assets.

An affidavit of heirship is needed to transfer a deceased person's interest in real or personal property to his or her heirs when the decedent dies without leaving a last will and testament or without disposing of all of his or her property in a will.

A fee of $15 for the first page and $4 for each additional page is common. Ask if you can file the two affidavits of heirship as one document. Some counties let you file the two affidavits of heirship as one document if the decedent and property descriptions are the same.

An heir is the person who legally stands to inherit assets in the absence of direction from the decedent. Whereas a legatee is someone the decedent has directed shall receive assets. So if a decedent had a will leaving money to a nephew, the nephew is a legatee.

The heirship of a deceased person is determined through a document called an Affidavit of Heirship. This is a form that gives a detailed explanation of the heirs at law of the deceased person at the time of his/her death.The deceased, DOROTHY, died at Anytown, Illinois on January 1, 2015.